Loonie's Future: Analyzing The Impact Of A Canadian Minority Government

Table of Contents

Economic Policy Instability and the Loonie

A minority government inherently brings increased budgetary uncertainty. The need for constant negotiation and compromise between various parties can lead to political gridlock and delays in crucial economic decision-making. This unpredictability significantly impacts investor confidence, a critical factor influencing the value of the Canadian dollar.

Increased Budgetary Uncertainty

- Minority governments often result in more frequent budget negotiations, potentially causing delays and impacting timely implementation of fiscal policies.

- Unpredictable government spending can deter domestic and foreign investment, leading to reduced economic activity and a weakening Loonie.

- Examples: The prolonged budget debates in previous minority governments have at times led to downgrades in Canada's credit rating, negatively affecting the Canadian dollar's exchange rate. The uncertainty surrounding spending plans can also increase volatility in the bond market, another key factor influencing the Loonie.

Shifting Fiscal Priorities

Changes in governing coalitions can bring about significant shifts in fiscal priorities. This could particularly affect key sectors like energy and natural resources, which are significant contributors to Canada's GDP and a major influence on the Loonie's value. Policy changes, such as alterations in trade agreements or tax policies, could dramatically impact investor sentiment and the Canadian dollar's exchange rate.

- Specific examples: Changes in environmental regulations could affect the energy sector, impacting export revenues and the Loonie. Amendments to tax policies targeting specific industries can alter investment flows, thus influencing the Canadian dollar.

- Changes in trade policy, potentially leading to increased or decreased tariffs, directly affect exports and imports, influencing the Loonie's strength.

Impact on Foreign Investment and the Loonie

Political instability inherently increases risk perception for foreign investors. The uncertainty surrounding policy decisions can deter foreign direct investment (FDI) and portfolio investment, negatively affecting the Loonie.

Investor Sentiment and Risk Perception

- Political instability reduces investor confidence, making Canada a less attractive destination for investment.

- Credit rating agencies closely monitor the political climate, with prolonged uncertainty potentially resulting in lowered credit ratings for Canada. A lower credit rating increases borrowing costs for the government and businesses, impacting the Canadian dollar.

- Examples: Periods of minority government have historically seen fluctuations in FDI, with investors often adopting a "wait-and-see" approach until policy clarity emerges, negatively impacting the Loonie's performance.

Increased Volatility in Currency Markets

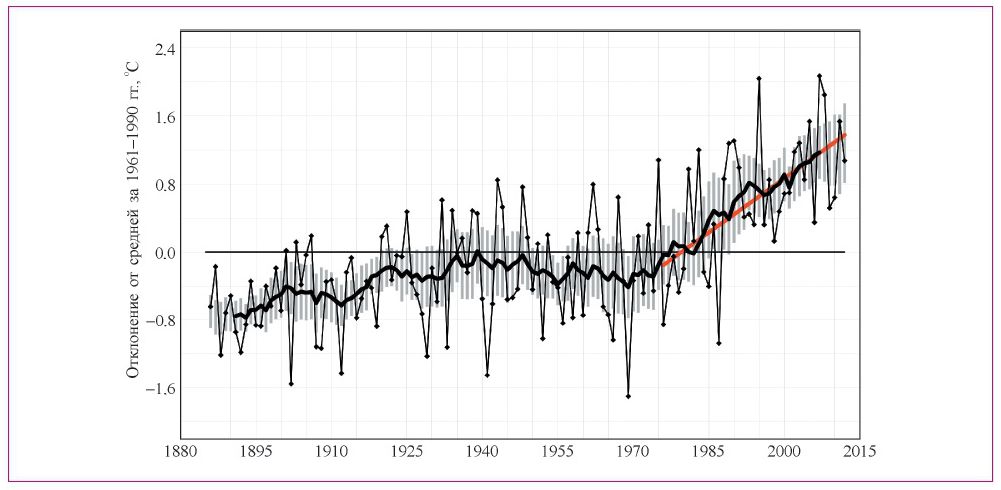

Minority government scenarios often lead to increased volatility in the Loonie's exchange rate against other major currencies. This fluctuation can create challenges for businesses engaged in international trade, impacting their profitability and potentially harming economic growth.

- Statistics: Historical data shows a correlation between periods of minority government and increased volatility in the Canadian dollar exchange rate, particularly against the US dollar.

- This volatility can impact businesses that rely on importing or exporting goods, making it difficult to budget and plan for the future.

Potential Long-Term Effects on the Canadian Economy and the Loonie

Policy uncertainty caused by a minority government can negatively impact Canada’s long-term economic growth. Slower growth directly translates to weaker Loonie performance.

Growth Prospects and the Loonie

- Prolonged periods of policy uncertainty can stifle investment and innovation, leading to slower economic growth.

- Slowed economic growth diminishes the demand for the Canadian dollar, thereby depressing its value.

- Economic forecasts: Economic models suggest that heightened political uncertainty significantly reduces the predicted growth rate, affecting the Loonie's exchange rate and its long-term trajectory.

Inflation and Interest Rates

A minority government's economic policies can influence inflation rates. The Bank of Canada, in response to economic uncertainty, may adjust interest rates, which can directly impact the Loonie's value.

- Bank of Canada Response: The Bank of Canada carefully monitors economic conditions, adjusting interest rates to manage inflation. Periods of uncertainty often necessitate a more cautious approach by the Bank, potentially affecting interest rates and subsequently, the Loonie.

- Higher inflation might lead the Bank of Canada to raise interest rates, potentially attracting foreign investment and strengthening the Loonie, but also slowing economic growth.

Conclusion: Understanding the Loonie's Future Under a Minority Government

The Canadian dollar's future under a minority government is subject to considerable uncertainty. We've seen how economic policy instability, shifting fiscal priorities, and the impact on foreign investment all influence the Loonie. The potential for long-term effects on growth and inflation further complicates the outlook. Understanding these factors is crucial for navigating the complexities of the Canadian economic landscape.

To make informed financial decisions, stay informed about the Loonie's performance and the evolving political landscape. Regularly consult the Bank of Canada website and reputable financial news sources for the most up-to-date information on the Canadian dollar and its relationship to the political climate. Stay informed about the Loonie's performance to make well-informed decisions.

Featured Posts

-

Secs Xrp Decision Commodity Status On The Horizon After Ripple Settlement Talks

May 01, 2025

Secs Xrp Decision Commodity Status On The Horizon After Ripple Settlement Talks

May 01, 2025 -

Ripples Ripple Effect How Etf Decisions And Sec Changes Will Shape Xrps Price

May 01, 2025

Ripples Ripple Effect How Etf Decisions And Sec Changes Will Shape Xrps Price

May 01, 2025 -

Analyzing The Potential Of Warmer Weather To Aid Russias Military Advance

May 01, 2025

Analyzing The Potential Of Warmer Weather To Aid Russias Military Advance

May 01, 2025 -

Savo Vardo Turnyras Vilniuje Matas Buzelis Ir Jo Tylejimas

May 01, 2025

Savo Vardo Turnyras Vilniuje Matas Buzelis Ir Jo Tylejimas

May 01, 2025 -

Dagskrain Meistaradeildin Og Nba Stjoernukapp I Bonusdeildinni

May 01, 2025

Dagskrain Meistaradeildin Og Nba Stjoernukapp I Bonusdeildinni

May 01, 2025

Latest Posts

-

Becciu Chat Segrete E Accuse Al Vaticano Il Cardinale Parla Di Complotto

May 01, 2025

Becciu Chat Segrete E Accuse Al Vaticano Il Cardinale Parla Di Complotto

May 01, 2025 -

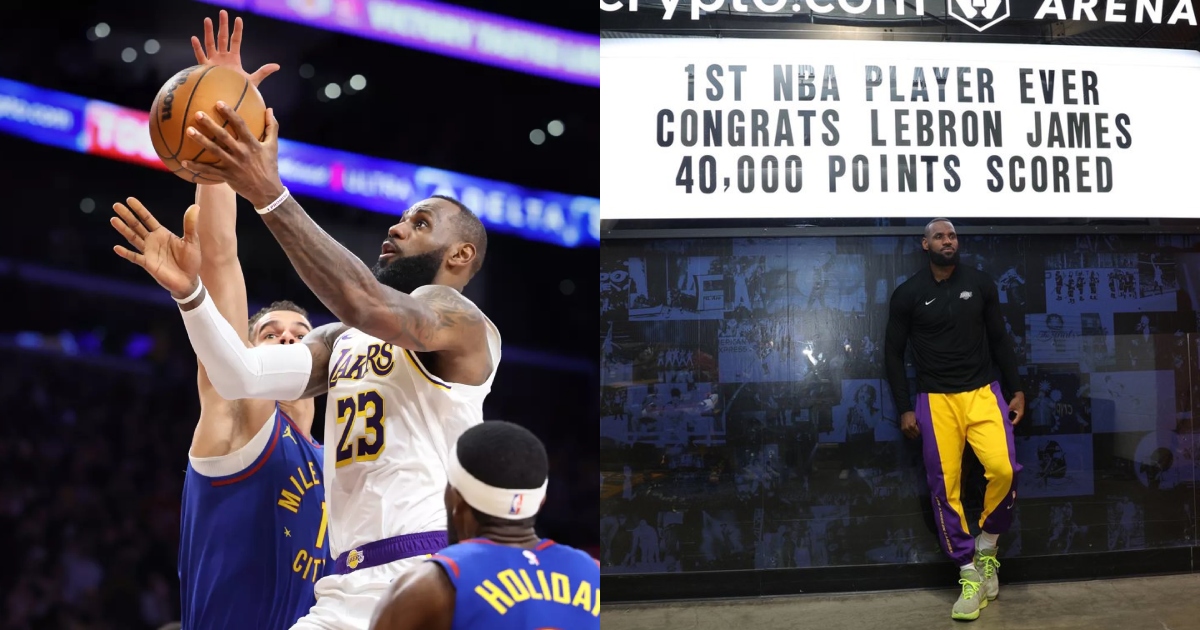

Lempron Tzeims 50 000 Pontoi Kai I Diaxroniki Toy Megaleiotita

May 01, 2025

Lempron Tzeims 50 000 Pontoi Kai I Diaxroniki Toy Megaleiotita

May 01, 2025 -

O Lempron Tzeims Kai To Orosimo Ton 50 000 Ponton Sto Nba

May 01, 2025

O Lempron Tzeims Kai To Orosimo Ton 50 000 Ponton Sto Nba

May 01, 2025 -

Lempron Tzeims Mia Analysi Tis Istorikis Epidosis Ton 50 000 Ponton

May 01, 2025

Lempron Tzeims Mia Analysi Tis Istorikis Epidosis Ton 50 000 Ponton

May 01, 2025 -

000 Pontoi I Klironomia Toy Lempron Tzeims

May 01, 2025

000 Pontoi I Klironomia Toy Lempron Tzeims

May 01, 2025