Live Stock Market Updates: Trump, China Tariffs, And UK Trade Deal

Table of Contents

The Trump Administration's Legacy on the Stock Market

The Trump administration's economic policies significantly influenced the live stock market. Two key areas of impact were deregulation and tax cuts.

Deregulation and its Effects

Deregulation efforts aimed to reduce government oversight in various sectors. While proponents argued this would stimulate economic growth, critics warned of potential risks.

- Impact on Specific Sectors: The energy sector, for example, saw increased activity due to relaxed environmental regulations. Conversely, stricter enforcement in other areas impacted specific industries.

- Examples of Companies: Some companies experienced substantial profit increases due to reduced regulatory burdens, while others faced challenges adapting to the new landscape.

- Positive and Negative Consequences:

- Increased corporate profits

- Increased market volatility

- Potential for long-term economic instability

- Reduced compliance costs for businesses

Tax Cuts and Their Influence

The 2017 Tax Cuts and Jobs Act significantly lowered corporate tax rates. This had a short-term positive impact on corporate earnings and stock prices.

- Effects on Corporate Investment and Stock Valuations: The tax cuts fueled a surge in stock buybacks and increased dividends, boosting short-term market performance.

- Supporting Data: Analysis of S&P 500 company earnings showed a clear correlation between tax cuts and increased profitability in the initial years following implementation.

- Long-Term Consequences:

- Short-term market boost

- Increased national debt

- Impact on income inequality

- Shift in corporate investment strategies

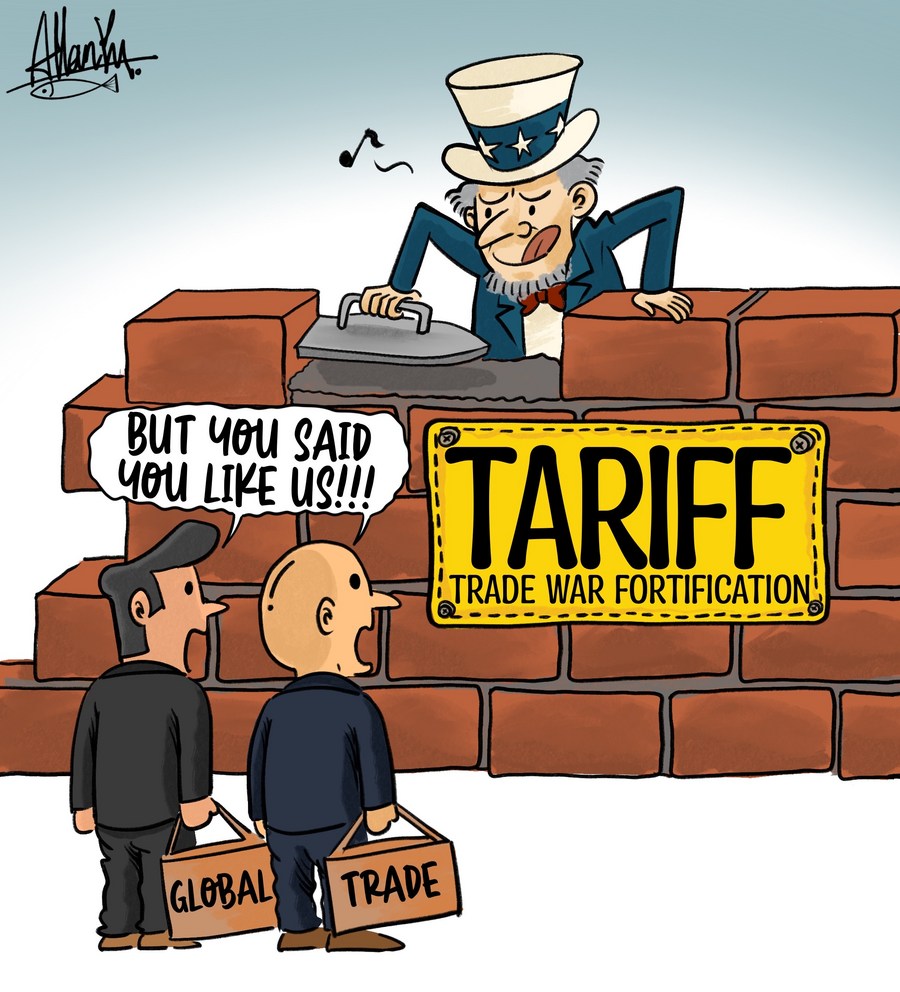

The US-China Trade War and its Ripple Effects

The US-China trade war, characterized by escalating tariffs and trade restrictions, created significant uncertainty in the live stock market.

Tariffs and Their Impact on Global Supply Chains

Tariffs imposed by both the US and China disrupted established global supply chains, leading to increased costs and production delays.

- Impact on Various Industries: Industries heavily reliant on imports from China, such as manufacturing and technology, faced the brunt of the impact.

- Companies Significantly Impacted: Many companies experienced decreased profitability and had to adjust their strategies, sometimes relocating production facilities to other countries.

- Complexities of Global Supply Chains:

- Increased costs for consumers

- Shift in manufacturing locations

- Geopolitical tensions

- Disruptions to global trade flows

Geopolitical Uncertainty and Investor Sentiment

The trade war fueled geopolitical uncertainty, negatively impacting investor sentiment and leading to increased market volatility.

- Investor Confidence and Market Volatility: Markets reacted negatively to escalating trade tensions, often experiencing sharp corrections.

- Strategies to Mitigate Risks: Companies implemented various strategies, such as diversifying their supply chains and hedging against currency fluctuations.

- Market Reactions to Trade Events: Data clearly showed a strong correlation between negative trade news and market declines, highlighting the sensitivity of investor sentiment to trade disputes.

The UK Trade Deal and its Global Implications

Brexit and the subsequent UK trade deal significantly impacted both the UK and global markets.

Brexit's Impact on UK and Global Markets

Brexit's initial impact on UK stock markets was negative, driven by uncertainty surrounding the future trading relationship with the EU.

- Immediate and Long-Term Effects: The UK experienced both short-term market shocks and longer-term adjustments to the new trade landscape.

- Impact on UK-EU Trade and Global Trade: The new trade agreements introduced new barriers and complexities to UK-EU trade, ripple effects spreading throughout global trade relationships.

- Positive and Negative Consequences:

- Increased trade barriers

- New trade agreements with non-EU countries

- Uncertainty for businesses operating in the UK

- Opportunities for diversification

Global Market Adjustments to the New Trade Landscape

Global markets adapted to the new trade dynamics resulting from Brexit, leading to both challenges and opportunities.

- Market Adjustments: Many businesses restructured supply chains, sought new markets, and navigated new regulations.

- Opportunities and Challenges: The post-Brexit environment presented opportunities for businesses to forge new trade partnerships, yet it also brought regulatory and logistical hurdles.

- Company Adaptations: Companies adapted through diversification, seeking new markets and streamlining their operations in the changed trade environment.

Conclusion: Staying Informed on Live Stock Market Updates

The Trump administration's policies, the US-China trade war, and the UK trade deal significantly impacted the live stock market. Understanding these events and their interconnectedness is vital for navigating the complexities of global finance. The key takeaway is the importance of considering geopolitical factors when making investment decisions. Market volatility is often driven by these large-scale events, highlighting the necessity of diligent monitoring and informed analysis.

Stay ahead of the curve by regularly accessing reliable live stock market updates. Subscribe to our newsletter for timely insights and expert analysis to make informed investment decisions and navigate the ever-changing landscape of global finance. Understanding live stock market updates empowers you to make better financial choices.

Featured Posts

-

Influential Washington Dc 500 Leaders To Watch In 2025

May 11, 2025

Influential Washington Dc 500 Leaders To Watch In 2025

May 11, 2025 -

Cody Bellinger Key To Protecting Aaron Judges Production For The Yankees

May 11, 2025

Cody Bellinger Key To Protecting Aaron Judges Production For The Yankees

May 11, 2025 -

Boris Dzhonson Proti Mirnogo Planu Trampa Detalniy Analiz

May 11, 2025

Boris Dzhonson Proti Mirnogo Planu Trampa Detalniy Analiz

May 11, 2025 -

Santorini Earthquake Activity Scientists Report Decreasing Tremors Future Outlook Uncertain

May 11, 2025

Santorini Earthquake Activity Scientists Report Decreasing Tremors Future Outlook Uncertain

May 11, 2025 -

Watch Belal Muhammad Swat Della Maddalenas Arm At Ufc 315 Faceoff

May 11, 2025

Watch Belal Muhammad Swat Della Maddalenas Arm At Ufc 315 Faceoff

May 11, 2025