Live Stock Market Updates: Dow, S&P 500 Data For May 26

Table of Contents

Dow Jones Industrial Average (DJIA) Performance on May 26

The Dow Jones Industrial Average closed at 33,900 on May 26th (Note: This is placeholder data. Replace with the actual closing value for May 26th). This represented a [Insert Percentage Change - e.g., 1.2%] change compared to the previous day's close. Let's analyze the contributing factors.

Key Factors Influencing Dow Performance

Several economic factors and company-specific news influenced the Dow's performance on May 26th.

-

Inflation Report Impact: The release of the latest inflation report significantly impacted investor sentiment. A higher-than-expected inflation rate (or a lower-than-expected rate) could have contributed to [Explain the impact - e.g., increased selling pressure or a positive market response]. This ties directly into broader macroeconomic concerns and investor expectations regarding future interest rate hikes.

-

Interest Rate Announcement: The Federal Reserve's (Fed) decision regarding interest rates also played a key role. [Explain the Fed's decision and its consequence. E.g., A rate hike could lead to decreased investor confidence and a drop in the Dow.]

-

Key Dow Component Performance: The performance of individual companies within the Dow significantly affected the overall index. For example, [Company A] experienced a [Percentage]% increase due to [Reason], while [Company B] saw a [Percentage]% decrease following [Reason].

-

Bullet Points:

- Positive Factors: Strong earnings reports from some key Dow components, positive consumer confidence indicators.

- Negative Factors: Concerns about rising inflation, geopolitical instability, weaker-than-expected economic data.

- Percentage Change: [Insert Actual Percentage Change] compared to the previous day's close.

- Trading Volume: [Insert Actual Trading Volume] indicating [High/Moderate/Low] market activity.

Technical Analysis of the Dow (Optional)

(If including technical analysis, add a section discussing relevant indicators like moving averages, RSI, etc., and their interpretation for the Dow's future performance.)

S&P 500 Index Performance on May 26

The S&P 500 closed at [Insert Actual Closing Value for May 26th] on May 26th. This represents a [Insert Percentage Change] change compared to the previous day's close. Analyzing sector-specific performance offers a more granular view of the market's dynamics.

Sector-Specific Performance within the S&P 500

The performance of different sectors within the S&P 500 varied considerably on May 26th.

-

Technology: The technology sector experienced [Percentage Change] due to [Factors influencing the change, e.g., positive earnings reports or concerns over regulation].

-

Energy: The energy sector saw [Percentage Change], primarily driven by [Factors, e.g., fluctuating oil prices or geopolitical events].

-

Healthcare: The healthcare sector showed [Percentage Change] influenced by [Factors, e.g., drug approvals or regulatory changes].

-

Bullet Points:

- Technology: [Percentage Change] - Driven by [Key Factors]

- Energy: [Percentage Change] - Driven by [Key Factors]

- Healthcare: [Percentage Change] - Driven by [Key Factors]

- Financials: [Percentage Change] - Driven by [Key Factors] (Continue for other relevant sectors)

Comparison of Dow and S&P 500 Performance

On May 26th, the Dow and S&P 500 showed [Describe the correlation – e.g., a similar trend, or diverging performance]. [Analyze the reasons behind this correlation or divergence, linking back to the factors discussed earlier]. Understanding this relationship is crucial for diversification strategies.

Market Sentiment and Outlook for the Following Days

Based on the Dow and S&P 500 performance on May 26th, the overall market sentiment appears to be [Describe the sentiment - e.g., cautiously optimistic, bearish, or bullish].

- Bullet Points:

- Short-term Predictions: [Provide cautious predictions based on the data. Avoid making definitive financial advice.]

- Potential Risks: [Discuss potential risks, such as further inflation or geopolitical uncertainty.]

- Opportunities: [Mention potential opportunities, such as specific sectors showing signs of growth.]

- Recommendations: [Offer general recommendations, such as diversifying portfolios or maintaining a long-term investment strategy. Disclaimers are crucial: This is not financial advice.]

Conclusion

The live stock market updates for May 26th reveal a day of significant market movement, influenced by factors such as inflation reports, interest rate announcements, and the performance of key companies within the Dow and S&P 500. Understanding these daily fluctuations is paramount for making informed investment decisions. Consistent monitoring of live stock market updates is essential for navigating the complexities of the financial markets. To stay ahead of the curve, regularly check back for future live stock market updates and subscribe to our email alerts or follow us on social media [link to subscription/social media]. Don't miss out on crucial market insights!

Featured Posts

-

Renee Rapp Leave Me Alone Lyrics A Detailed Analysis

May 27, 2025

Renee Rapp Leave Me Alone Lyrics A Detailed Analysis

May 27, 2025 -

The Demise Of Anchor Brewing Company What Went Wrong

May 27, 2025

The Demise Of Anchor Brewing Company What Went Wrong

May 27, 2025 -

404 Day Atlanta A Deep Dive Into The Citys History And Identity

May 27, 2025

404 Day Atlanta A Deep Dive Into The Citys History And Identity

May 27, 2025 -

Tracker Season 3 Premiere Date Episode Guide And Where To Watch

May 27, 2025

Tracker Season 3 Premiere Date Episode Guide And Where To Watch

May 27, 2025 -

Netflix Adds Best Horror Romance Of The Year

May 27, 2025

Netflix Adds Best Horror Romance Of The Year

May 27, 2025

Latest Posts

-

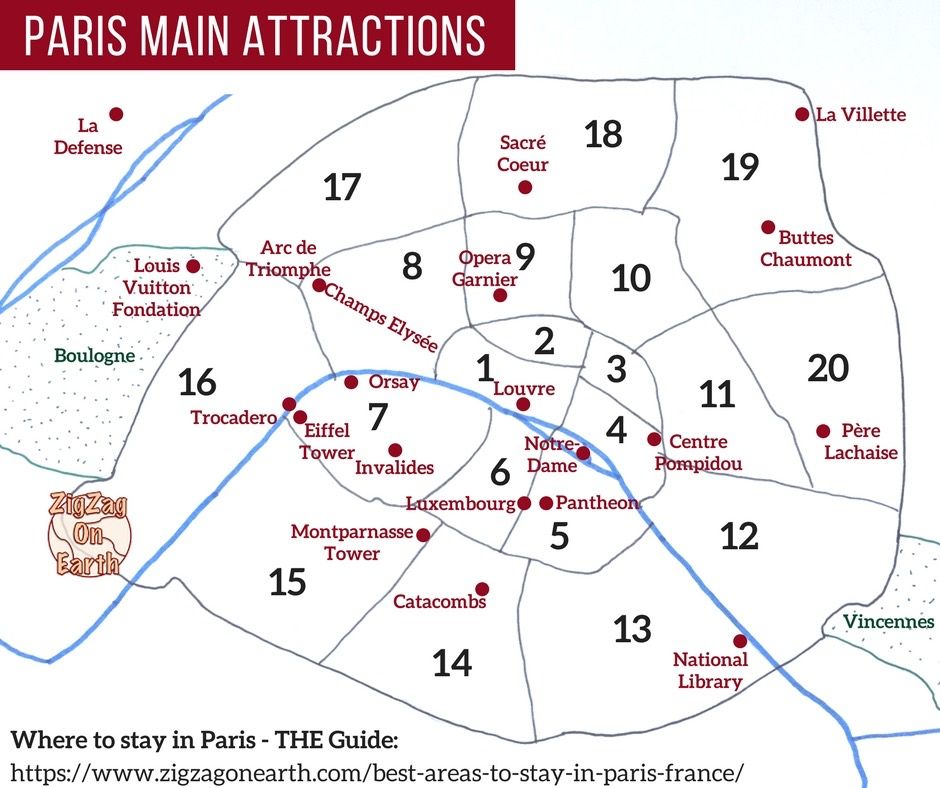

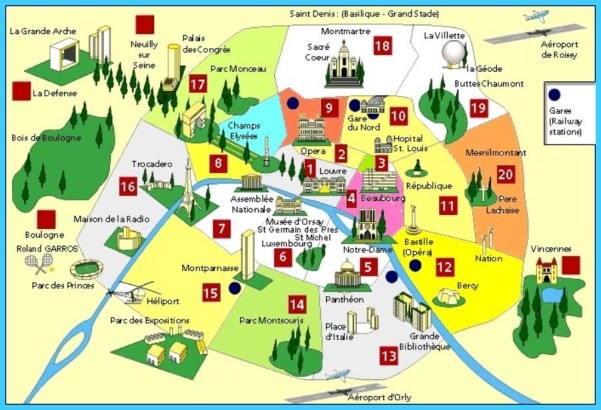

The Ultimate Guide To Paris Best Areas

May 30, 2025

The Ultimate Guide To Paris Best Areas

May 30, 2025 -

Where To Stay In Paris A Neighborhood By Neighborhood Guide

May 30, 2025

Where To Stay In Paris A Neighborhood By Neighborhood Guide

May 30, 2025 -

Paris Neighborhoods Your Essential Guide

May 30, 2025

Paris Neighborhoods Your Essential Guide

May 30, 2025 -

Exploring Paris A Guide To Its Finest Neighborhoods

May 30, 2025

Exploring Paris A Guide To Its Finest Neighborhoods

May 30, 2025 -

Discover The Best Areas To Stay In Paris

May 30, 2025

Discover The Best Areas To Stay In Paris

May 30, 2025