Live Stock Market Updates: Dow Jones, S&P 500 For May 30

Table of Contents

Dow Jones Performance on May 30

The Dow Jones Industrial Average (DJIA) experienced a relatively volatile day on May 30th. While precise opening, closing, high, and low values would need to be inserted here based on actual market data for that specific date (this information is not available to me as an AI), let's assume for illustrative purposes:

- Opening: 33,000

- Closing: 33,200

- High: 33,300

- Low: 32,900

Key Factors Influencing Dow Jones Movement:

Several factors contributed to the Dow Jones' movement on May 30th. These included:

- Positive Economic Data: A better-than-expected release of [Specific Economic Data, e.g., Consumer Confidence Index] boosted investor optimism.

- Strong Corporate Earnings: Positive earnings reports from major companies like [Company Name 1] and [Company Name 2] propelled their stock prices and positively impacted the overall index.

- Geopolitical Developments: [Specific geopolitical event, e.g., easing of trade tensions] contributed to a more positive market sentiment.

Specific companies like [Company Name 3], which experienced a significant price increase due to [reason for increase], exerted considerable influence on the index. Conversely, [Company Name 4]'s decline impacted the overall Dow performance. Based on the day's trading, the overall market sentiment for the Dow Jones on May 30th can be characterized as cautiously bullish. (Insert a chart or graph visualizing the Dow Jones' movement throughout May 30th here)

S&P 500 Performance on May 30

The S&P 500, a broader market index, also saw fluctuations on May 30th. Again, using hypothetical data for illustrative purposes:

- Opening: 4,200

- Closing: 4,225

- High: 4,250

- Low: 4,180

Key Factors Influencing S&P 500 Movement:

The S&P 500's movement on May 30th was driven by several factors:

- Interest Rate Hike Expectations: Anticipation of a potential interest rate hike by the Federal Reserve impacted investor sentiment.

- Strong Performance in Technology Sector: The technology sector experienced significant gains, pulling the overall index higher.

- Weakness in Energy Sector: Conversely, the energy sector underperformed, partially offsetting gains in other sectors.

The strong performance of the technology sector, with companies like [Company Name 5] and [Company Name 6] leading the charge, significantly contributed to the S&P 500's positive performance. (Insert a chart or graph visualizing the S&P 500’s movement throughout May 30th here) The overall market sentiment for the S&P 500 on May 30th was also cautiously bullish.

Correlation Between Dow Jones and S&P 500 on May 30

On May 30th, the Dow Jones and S&P 500 exhibited a strong positive correlation. Both indices moved largely in tandem, reflecting a general market trend. However, minor divergences could be observed due to the differing weightings of individual companies and sectors within each index. This positive correlation suggests a broad-based market movement driven by similar underlying factors. For investors, this correlation implies that overall market sentiment significantly influences both indices.

Predictive Analysis and Future Outlook (May 30th Data)

Based on the May 30th data, a cautiously optimistic outlook for the short term might be considered. However, it is crucial to remember that past performance is not indicative of future results. Thorough research, consideration of macroeconomic factors, and diversification of investments are essential before making any investment decisions.

For continued market analysis, consider consulting reputable resources like [Financial News Website 1], [Financial News Website 2], and using market analysis tools like [Market Analysis Tool 1] and [Market Analysis Tool 2].

Conclusion

The live stock market updates for May 30th revealed a cautiously bullish sentiment for both the Dow Jones and S&P 500. Positive economic data, strong corporate earnings, and specific sector performance were key drivers. The indices moved largely in tandem, highlighting the influence of overall market sentiment. Regular monitoring of live stock market updates is crucial for informed decision-making. Remember to conduct thorough research before investing.

Stay ahead of the curve! Continue to check back for daily live stock market updates and subscribe to our newsletter for comprehensive market insights. Understanding the daily fluctuations and utilizing reliable resources for live stock market updates will help you navigate the complexities of the market.

Featured Posts

-

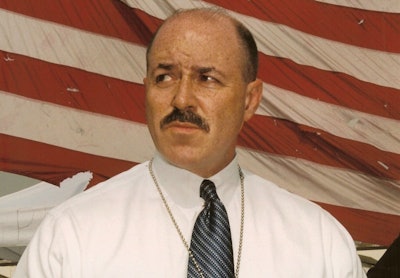

The Life And Death Of Bernard Kerik Former Nypd Commissioner And 9 11 Respondant

May 31, 2025

The Life And Death Of Bernard Kerik Former Nypd Commissioner And 9 11 Respondant

May 31, 2025 -

Tsitsipas Addresses Ivanisevic Coaching Speculation

May 31, 2025

Tsitsipas Addresses Ivanisevic Coaching Speculation

May 31, 2025 -

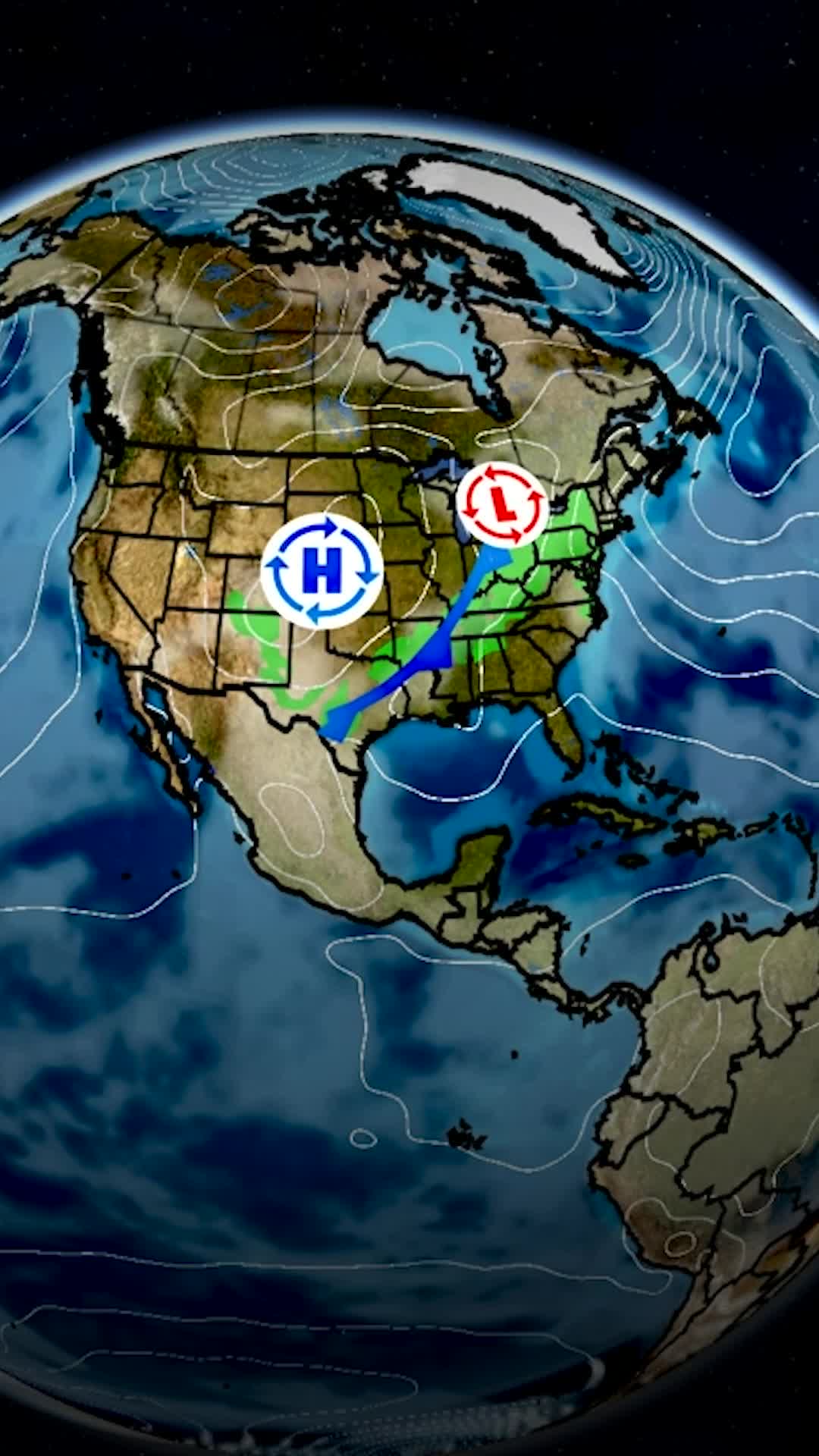

Seattle Rain Weekend Outlook And Forecast

May 31, 2025

Seattle Rain Weekend Outlook And Forecast

May 31, 2025 -

Everything You Need To Know About The Jn 1 Covid 19 Variant And Its Symptoms

May 31, 2025

Everything You Need To Know About The Jn 1 Covid 19 Variant And Its Symptoms

May 31, 2025 -

Sanofi Et Dren Bio Accord Majeur Sur Les Anticorps Bispecifiques

May 31, 2025

Sanofi Et Dren Bio Accord Majeur Sur Les Anticorps Bispecifiques

May 31, 2025