Live Stock Market Updates: Dow Futures, Earnings, And Market Analysis

Table of Contents

Dow Futures: A Window into Market Sentiment

Dow Futures are derivative contracts that obligate the buyer to purchase the Dow Jones Industrial Average (DJIA) at a specific price on a future date. Understanding Dow Futures is key to interpreting market sentiment and predicting potential short-term movements.

Understanding Dow Futures Contracts

- Futures Contracts: These are agreements to buy or sell an asset (in this case, the DJIA) at a predetermined price on a specified future date.

- Relationship to the DJIA: Dow Futures prices closely track the DJIA, offering a glimpse into investor expectations regarding the index's future performance.

- Hedging Tool: Businesses and investors use Dow Futures to hedge against potential losses in the underlying index. For example, a company concerned about a decline in their stock price might use Dow Futures to offset potential losses.

Different types of Dow Futures contracts exist, each with its own expiration date. Understanding these expiration dates is vital for effective trading strategies. For instance, contracts with shorter expiration periods tend to be more volatile than those with longer expirations.

Interpreting Dow Futures Prices

Changes in Dow Futures prices directly reflect investor sentiment and anticipated market direction.

- Relationship between Futures Prices and the Underlying Index: A rise in Dow Futures prices generally suggests a bullish outlook on the DJIA, while a decline indicates bearish sentiment.

- Factors Influencing Futures Prices: Various factors influence Dow Futures prices, including breaking news events (like geopolitical tensions or unexpected economic data releases), upcoming earnings announcements, and changes in interest rates.

For example, a sudden surge in Dow Futures prices following a positive economic report might signal increased investor confidence and a potential upward trend in the broader market. Conversely, a sharp drop in Dow Futures after a disappointing earnings season could indicate a bearish market outlook.

Earnings Season: Key Insights and Impact

Earnings season is a crucial period for investors, as companies release their financial reports, revealing their performance and future outlook. This information profoundly affects stock prices.

Analyzing Corporate Earnings Reports

Analyzing corporate earnings reports involves scrutinizing key metrics to gauge a company's financial health and growth potential.

- Key Metrics: Earnings Per Share (EPS), revenue growth, and future guidance are critical indicators investors use to assess a company’s performance. Positive surprises often lead to stock price increases, while negative surprises can trigger significant declines.

- Impact of Positive and Negative Surprises: When a company exceeds expectations, its stock price often rises. Conversely, falling short of expectations typically leads to a drop in stock price.

For example, a technology company exceeding revenue projections and providing positive guidance for future quarters is likely to see its stock price appreciate. Conversely, a retail company reporting lower-than-expected earnings and reduced future sales might face a significant stock price decline.

Earnings Calendar and Market Reactions

Following the earnings calendar is essential for anticipating market volatility and making informed investment decisions.

- Resources for Finding Earnings Calendars: Many financial news websites, including Yahoo Finance, Google Finance, and Bloomberg, provide comprehensive earnings calendars.

- Market Reactions: The market often reacts strongly to earnings announcements, with periods of increased volatility, particularly for companies with significant market capitalization.

Broad Market Analysis: Macroeconomic Factors and Trends

Analyzing the broader market involves considering macroeconomic factors and trends influencing the overall market performance.

Impact of Macroeconomic Indicators

Macroeconomic indicators, like inflation, interest rates, and economic growth, have a significant influence on stock market performance.

- Relationship between Indicators and Stock Market Performance: High inflation typically puts pressure on stock prices, while low interest rates usually stimulate economic activity and boost stock valuations. Strong economic growth is usually associated with a positive stock market outlook.

For example, unexpectedly high inflation can trigger a sell-off in the stock market as investors worry about reduced corporate profits. Conversely, a cut in interest rates by the central bank might fuel economic growth and boost investor confidence, driving up stock prices.

Identifying Market Trends and Opportunities

Identifying market trends requires applying various analytical techniques.

- Analytical Techniques: Technical analysis focuses on chart patterns and other indicators to predict future price movements. Fundamental analysis evaluates a company's financial health and intrinsic value. Sector-specific analysis focuses on identifying opportunities within specific industry sectors.

- Risk Management and Diversification: Effective investment strategies incorporate robust risk management principles and diversification to mitigate potential losses.

Conclusion

Staying updated on live stock market updates is crucial for successful investing. Understanding Dow Futures provides insight into near-term market sentiment. Analyzing earnings reports allows you to gauge individual company performance and potential impact. Finally, a thorough analysis of macroeconomic factors helps you to understand the broader market trends and opportunities. By combining these elements, investors can develop a more comprehensive strategy for navigating the complexities of the market. Stay ahead of the curve by regularly checking back for live stock market updates. Understanding Dow Futures, analyzing earnings, and conducting thorough market analysis are essential components of a successful investment strategy. [Link to a daily market report or relevant financial news source]

Featured Posts

-

Workboat Automation Tbs Safetys Collaboration With Nebofleet

May 01, 2025

Workboat Automation Tbs Safetys Collaboration With Nebofleet

May 01, 2025 -

Binh Duong Tu Hao Tien Linh Dai Su Tinh Nguyen Va Tam Guong Sang Cho Gioi Tre

May 01, 2025

Binh Duong Tu Hao Tien Linh Dai Su Tinh Nguyen Va Tam Guong Sang Cho Gioi Tre

May 01, 2025 -

Vinh Danh Quan Quan Giai Bong Da Thanh Nien Thanh Pho Hue Lan Thu Vii

May 01, 2025

Vinh Danh Quan Quan Giai Bong Da Thanh Nien Thanh Pho Hue Lan Thu Vii

May 01, 2025 -

Ely Rda Syd Ka Mwqf Kshmyrywn Ke Hqwq Awr Khte Ka Amn

May 01, 2025

Ely Rda Syd Ka Mwqf Kshmyrywn Ke Hqwq Awr Khte Ka Amn

May 01, 2025 -

F 35 Inventory Management Pentagon Audit Reveals Critical Shortcomings

May 01, 2025

F 35 Inventory Management Pentagon Audit Reveals Critical Shortcomings

May 01, 2025

Latest Posts

-

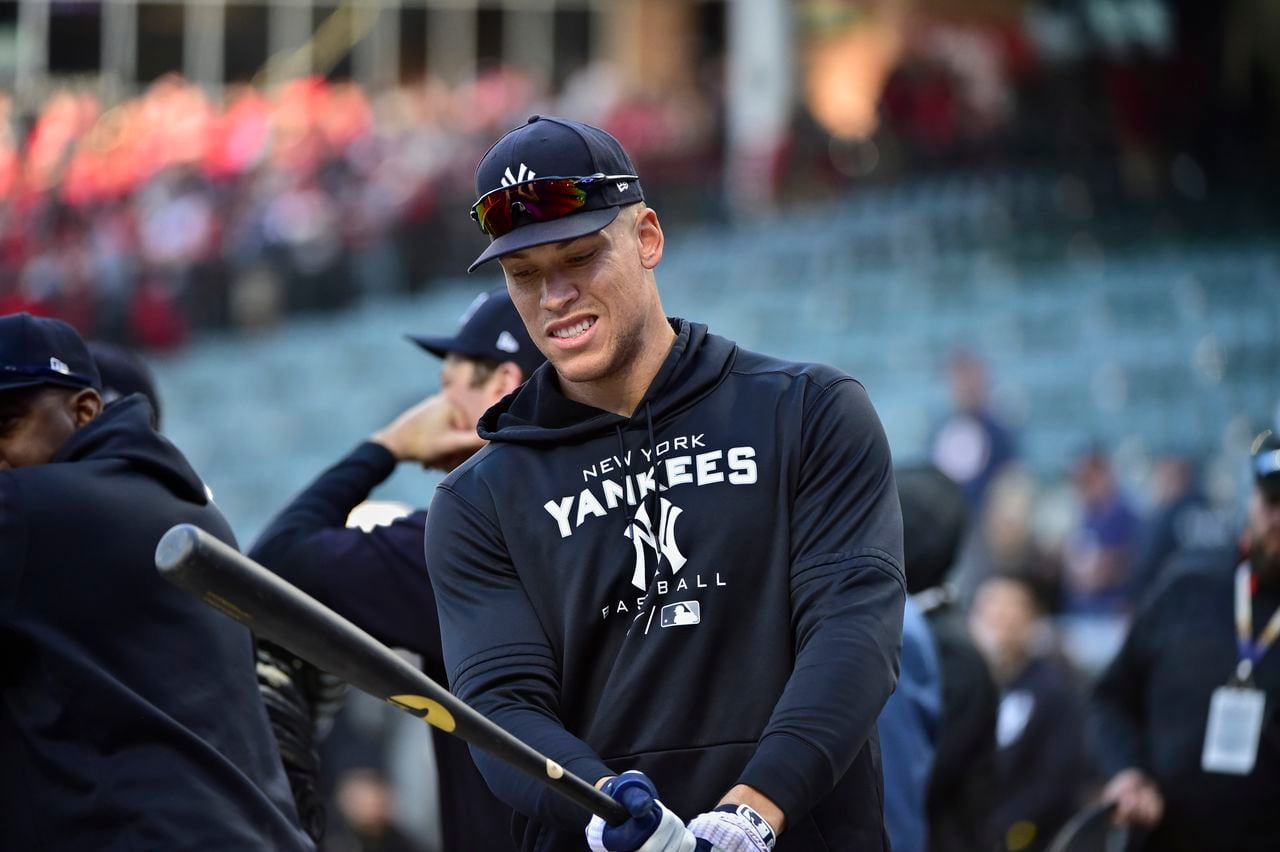

Aaron Judge Paul Goldschmidt Lead Yankees To Crucial Win

May 01, 2025

Aaron Judge Paul Goldschmidt Lead Yankees To Crucial Win

May 01, 2025 -

Essential Wayne Gretzky Fast Facts For Hockey Fans

May 01, 2025

Essential Wayne Gretzky Fast Facts For Hockey Fans

May 01, 2025 -

Judge And Goldschmidts Key Contributions Secure Yankees Victory

May 01, 2025

Judge And Goldschmidts Key Contributions Secure Yankees Victory

May 01, 2025 -

Wayne Gretzky Quick Facts About The Hockey Legend

May 01, 2025

Wayne Gretzky Quick Facts About The Hockey Legend

May 01, 2025 -

Senators Fall To Panthers Despite Tkachuks Efforts

May 01, 2025

Senators Fall To Panthers Despite Tkachuks Efforts

May 01, 2025