Live Music Stocks: Friday's Expected Decline

Table of Contents

Macroeconomic Factors Influencing Live Music Stock Performance

Economic Uncertainty and its Impact on Entertainment Spending

Rising inflation is significantly impacting consumer spending, particularly on discretionary items like concert tickets and merchandise. The increased cost of living leaves less disposable income for entertainment, potentially affecting ticket sales and overall revenue for live music companies. Interest rate hikes further exacerbate this situation, making borrowing more expensive for both companies and consumers. This can lead to reduced investment in new productions and tours, ultimately impacting the growth of the sector.

- Rising inflation: The Consumer Price Index (CPI) continues to rise, squeezing consumer budgets.

- Interest rate hikes: Increased borrowing costs impact investment in the entertainment industry.

- Global economic slowdown: Reduced consumer confidence translates to fewer concert attendees and lower merchandise sales.

- GDP growth: Slowing GDP growth negatively affects overall consumer spending, including entertainment.

Geopolitical Events and Their Ripple Effect on Live Music

Geopolitical instability also plays a significant role. Ongoing international conflicts and travel restrictions can disrupt touring schedules, impacting revenue streams for artists and promoters. Uncertainty in the global market affects investor confidence, leading to a more cautious approach towards riskier assets like live music stocks.

- Travel restrictions: International touring remains vulnerable to unexpected border closures and travel advisories.

- Global conflict: Geopolitical instability can create uncertainty and reduce investor confidence.

- Supply chain disruptions: Challenges in sourcing equipment and materials can increase production costs and delay events.

Company-Specific News Affecting Live Music Stocks on Friday

Analyzing Individual Stock Performances – Identifying Key Players

Several key players in the live music industry, including Live Nation and AEG Presents, are facing unique challenges. Recent financial reports may reveal lower-than-expected ticket sales or increased operating costs. Announcements regarding tour cancellations or changes in management can also significantly impact individual stock prices. Analyst predictions and rating downgrades further contribute to the anticipated decline.

- Live Nation's Q[Quarter] earnings: Recent results might show a negative trend in ticket sales or revenue growth.

- AEG Presents' future touring plans: Any announcements of postponed or canceled tours can negatively affect investor sentiment.

- Ticketmaster's operational challenges: Ongoing issues with the ticketing giant could also affect the broader sector.

Assessing Risk Factors for Individual Live Music Companies

Debt levels, intense competition, and the overall vulnerability of the live music industry to economic downturns are significant risk factors. Companies with high debt burdens might struggle to withstand a period of reduced revenue, potentially leading to a decline in their stock price. The competitive landscape also plays a crucial role, as companies fight for market share and artist bookings.

- High debt levels: Companies with substantial debt are more vulnerable to economic downturns.

- Intense competition: The live music industry is highly competitive, requiring companies to constantly innovate and adapt.

- Artist dependency: Reliance on a limited number of major artists can create vulnerability to unforeseen circumstances.

Technical Analysis and Market Predictions for Live Music Stocks

Chart Analysis and Predictions for Friday's Trading Session

Technical indicators, such as moving averages and the Relative Strength Index (RSI), are suggesting a potential downward trend. Many analysts predict a drop in live music stock prices on Friday, citing the macroeconomic factors and company-specific news discussed above. While charts cannot predict the future with certainty, they offer valuable insights into potential market movements. (Include relevant charts and graphs here if possible).

- Moving averages: A downward trend in moving averages suggests bearish momentum.

- RSI: An RSI below 30 indicates the stock might be oversold, but doesn't guarantee a rebound.

- Analyst predictions: Several financial analysts have predicted a decline in live music stock prices.

Investor Sentiment and its Influence on Stock Prices

Current investor sentiment towards the live music industry is cautiously pessimistic. Recent trading volume and volatility reflect this uncertainty. Any significant negative news can trigger a sell-off, exacerbating the anticipated decline. Monitoring investor sentiment through news articles and social media can provide valuable insights into potential market reactions.

- Trading volume: High trading volume coupled with price declines indicates significant selling pressure.

- Volatility: Increased volatility suggests uncertainty and heightened risk within the market.

- News sentiment: Negative news coverage often amplifies selling pressure and intensifies market downturns.

Conclusion: Navigating Friday's Dip in Live Music Stocks – Your Next Steps

Friday's expected decline in live music stocks is influenced by a combination of macroeconomic headwinds, company-specific concerns, and negative technical indicators. Understanding these factors is vital for making informed investment decisions. It’s crucial to carefully analyze live music stock trends and stay informed on live music stock performance. Remember to conduct thorough research and base your investment decisions on your risk tolerance and financial goals. Don't panic sell; instead, make calculated investments in live music stocks based on your own risk assessment. Stay informed and make prudent decisions to navigate this potentially challenging day in the live music market.

Featured Posts

-

Bts Reunion Teaser Comeback Speculation Ignites Army

May 30, 2025

Bts Reunion Teaser Comeback Speculation Ignites Army

May 30, 2025 -

New Us Solar Duties How Hanwha And Oci Plan To Expand Market Share

May 30, 2025

New Us Solar Duties How Hanwha And Oci Plan To Expand Market Share

May 30, 2025 -

Europe 1 Soir Emission Complete Du 19 03 2025

May 30, 2025

Europe 1 Soir Emission Complete Du 19 03 2025

May 30, 2025 -

Senamhi Alerta Por Olas De Frio En Lima Y Recomendaciones

May 30, 2025

Senamhi Alerta Por Olas De Frio En Lima Y Recomendaciones

May 30, 2025 -

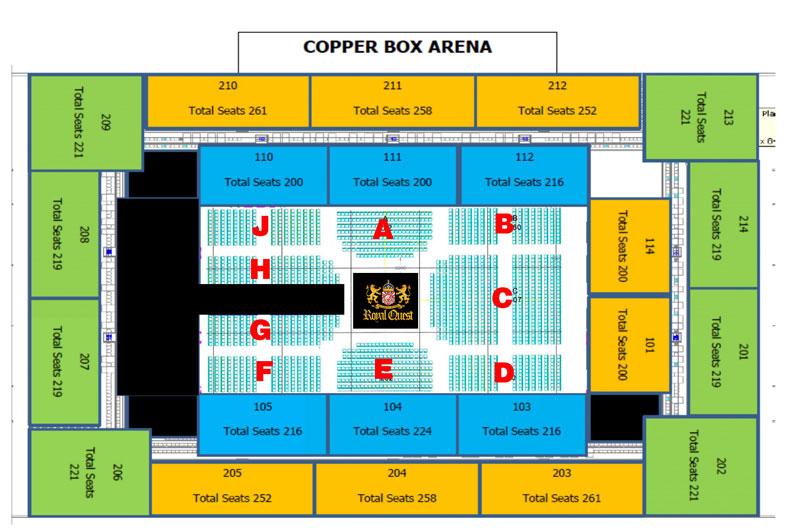

Last Chance Gorillaz Tickets For London Shows At Copper Box Arena

May 30, 2025

Last Chance Gorillaz Tickets For London Shows At Copper Box Arena

May 30, 2025