Lingering Inflation: The ECB Links Post-Pandemic Fiscal Support

Table of Contents

The ECB's Response to the Pandemic

The COVID-19 pandemic triggered an unprecedented economic crisis, prompting the ECB to deploy a range of emergency measures to mitigate its impact and support the Eurozone economy.

Unprecedented Fiscal Stimulus

The ECB's response was swift and substantial, encompassing a multifaceted approach aimed at preventing a collapse of the financial system and stimulating economic activity.

- Quantitative Easing (QE): The ECB engaged in large-scale asset purchases, injecting trillions of euros into the financial system. This involved purchasing government bonds, corporate bonds, and other assets to lower long-term interest rates and increase liquidity.

- Targeted Longer-Term Refinancing Operations (TLTROs): These offered banks very cheap loans, encouraging them to lend more to businesses and households, thereby boosting lending and investment.

- Pandemic Emergency Purchase Programme (PEPP): A temporary asset purchase program designed to counter the negative effects of the pandemic on financing conditions.

The rationale behind these actions was clear: to prevent a credit crunch, support businesses struggling with lockdowns, and stimulate aggregate demand to prevent a deeper recession. The sheer scale of these interventions was unprecedented in the ECB's history.

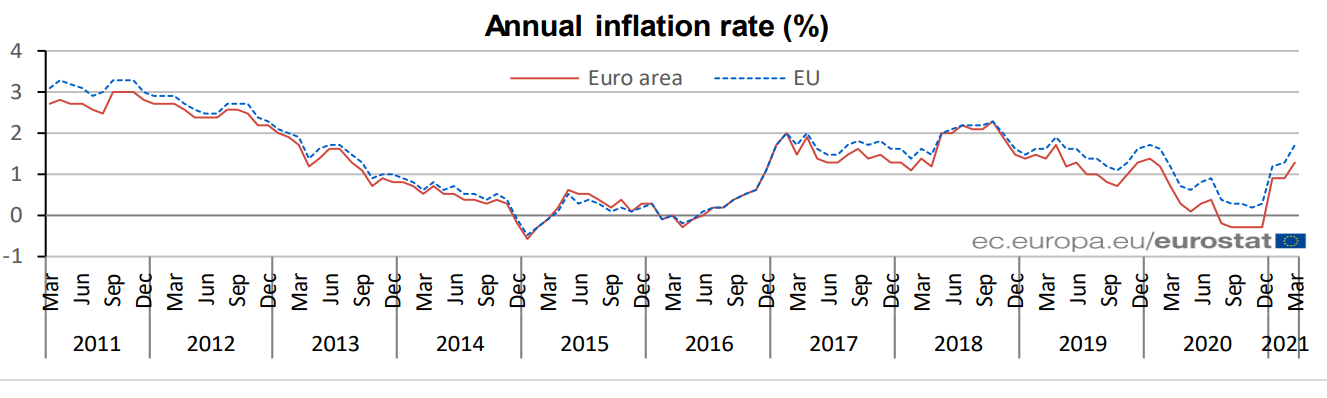

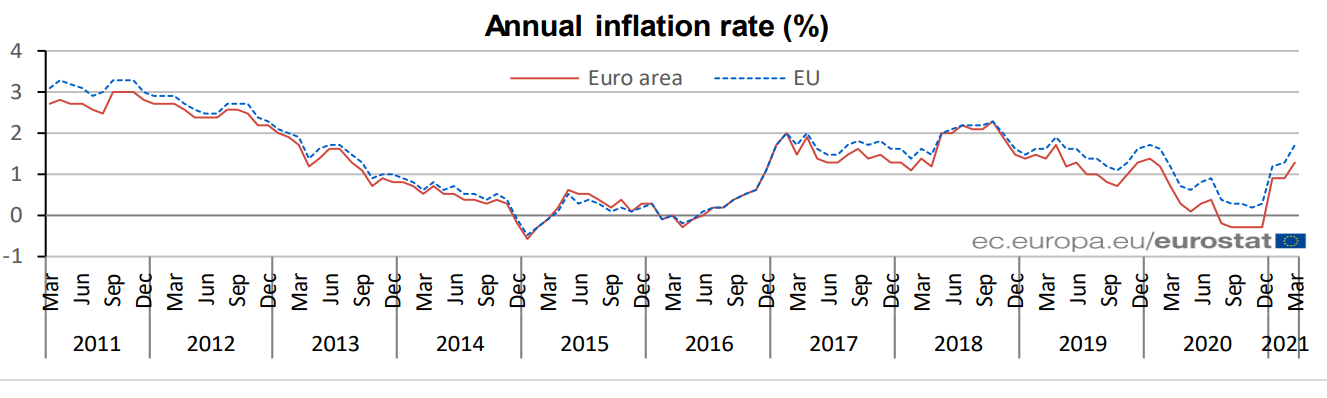

Impact on Money Supply and Aggregate Demand

The massive injection of liquidity through QE and TLTROs significantly increased the money supply within the Eurozone. This increased money supply, combined with the fiscal stimulus packages implemented by individual Eurozone governments, fueled aggregate demand. Increased consumer spending and investment put upward pressure on prices, contributing to demand-pull inflation.

- Increased Money Supply: The expansion of the money supply exceeded the growth of the real economy, leading to a surge in purchasing power.

- Consumer Spending Surge: Consumers, with more disposable income and easier access to credit, increased their spending, further fueling demand.

- Demand-Pull Inflation: This surge in demand outpaced the capacity of the economy to produce goods and services, leading to price increases. This is a classic example of demand-pull inflation, where excessive demand chases a limited supply.

Supply Chain Disruptions and Inflationary Pressures

While the ECB's actions undoubtedly played a role in the current inflationary environment, it's crucial to acknowledge the significant impact of other factors, notably supply-side disruptions.

The Role of Supply-Side Bottlenecks

The pandemic severely disrupted global supply chains, leading to widespread shortages of goods and raw materials. These bottlenecks exacerbated inflationary pressures, regardless of the monetary policy stance adopted by the ECB.

- Semiconductor Shortages: The global shortage of semiconductors impacted various industries, from automobiles to electronics, leading to higher production costs and prices.

- Shipping Delays and Container Shortages: Port congestion and a lack of shipping containers significantly increased transportation costs, adding to the price of imported goods.

- Raw Material Scarcity: Disruptions to global supply chains led to shortages of various raw materials, increasing their prices and impacting the cost of production for numerous goods.

These supply-side bottlenecks contributed to cost-push inflation, where increased production costs are passed on to consumers in the form of higher prices. This cost-push inflation interacted with the demand-pull inflation caused by the ECB’s expansive monetary policy, creating a potent inflationary cocktail.

Energy Prices and Inflation

The sharp increase in energy prices, particularly oil and natural gas, played a significant role in driving up inflation across the Eurozone. This was largely independent of the ECB’s monetary policy actions.

- Geopolitical Factors: The war in Ukraine significantly disrupted energy supplies, leading to a sharp rise in energy prices.

- Increased Demand: Stronger-than-expected post-pandemic economic recovery in many parts of the world also fueled demand for energy, putting upward pressure on prices.

- Energy Price Impact on Inflation: Rising energy costs permeate the entire economy, affecting transportation, manufacturing, and household expenses, contributing significantly to the overall inflation rate.

The ECB's Current Monetary Policy Strategy

Faced with persistent lingering inflation, the ECB has shifted its monetary policy stance, moving away from the expansive policies adopted during the pandemic.

Combating Lingering Inflation

To combat the elevated inflation rate, the ECB has implemented a series of measures aimed at curbing demand and cooling down the economy.

- Interest Rate Hikes: The ECB has raised its key interest rates multiple times, making borrowing more expensive for banks, businesses, and consumers, thereby reducing demand.

- Quantitative Tightening (QT): The ECB has begun reducing its balance sheet by allowing some of its holdings of government and corporate bonds to mature without reinvestment, further tightening monetary conditions.

- Forward Guidance: The ECB has provided forward guidance indicating its intention to continue its tightening cycle until inflation returns to its 2% target.

These measures are designed to reduce the money supply and cool down overheated demand, thus bringing inflation back to the ECB’s target.

Balancing Economic Growth and Price Stability

The ECB faces the complex challenge of balancing its commitment to price stability with the need to avoid triggering a sharp economic slowdown or recession. Aggressive monetary tightening carries the risk of stifling economic growth and increasing unemployment.

- Risk of Recession: Rapid interest rate hikes can lead to a sharp decline in investment and consumer spending, potentially pushing the Eurozone into a recession.

- Trade-offs: The ECB must carefully weigh the risks of allowing inflation to remain high against the risks of triggering a recession through overly aggressive monetary tightening.

- Navigating Uncertainty: The ECB's policy decisions are made in an environment of considerable uncertainty about the future trajectory of inflation and the economy.

Conclusion:

Lingering inflation in the Eurozone is a complex phenomenon with multiple contributing factors. While the ECB's post-pandemic fiscal support measures were crucial in preventing a deeper economic crisis, they also contributed to inflationary pressures by boosting aggregate demand and increasing the money supply. Simultaneously, supply-side bottlenecks and soaring energy prices played a significant independent role in driving up inflation. The ECB’s current strategy of raising interest rates and engaging in quantitative tightening aims to bring inflation back to its target, but this requires a delicate balancing act between controlling inflation and maintaining economic growth. Understanding the intricate connection between lingering inflation and the ECB's response is crucial for navigating the challenges of maintaining price stability in the Eurozone. Continue to follow the ECB's monetary policy decisions and their impact on the Eurozone economy to better understand the dynamics of lingering inflation and the challenges of maintaining price stability.

Featured Posts

-

The Uks Legal Definition Of Woman Implications For Transgender Individuals And Sex Based Rights

Apr 29, 2025

The Uks Legal Definition Of Woman Implications For Transgender Individuals And Sex Based Rights

Apr 29, 2025 -

Fhi Rapport Medisinens Effekt Pa Skoleprestasjoner Hos Barn Med Adhd

Apr 29, 2025

Fhi Rapport Medisinens Effekt Pa Skoleprestasjoner Hos Barn Med Adhd

Apr 29, 2025 -

How You Tube Caters To The Needs Of Older Viewers

Apr 29, 2025

How You Tube Caters To The Needs Of Older Viewers

Apr 29, 2025 -

Finding Capital Summertime Ball 2025 Tickets A Practical Approach

Apr 29, 2025

Finding Capital Summertime Ball 2025 Tickets A Practical Approach

Apr 29, 2025 -

Urgent Evacuation Israeli Airstrike Rocks Southern Beirut

Apr 29, 2025

Urgent Evacuation Israeli Airstrike Rocks Southern Beirut

Apr 29, 2025