Land Your Dream Private Credit Role: 5 Crucial Do's And Don'ts

Table of Contents

Do's for Landing Your Dream Private Credit Role

Master Essential Skills

The private credit industry demands a robust skillset. To stand out, you must demonstrate proficiency in several key areas:

-

Financial Modeling Prowess: Become highly proficient in financial modeling using Excel, and ideally expand your skills to include programming languages like Python for advanced analysis and automation. This is crucial for credit analysis, deal valuation, and forecasting. Mastering discounted cash flow (DCF) modeling, leveraged buyout (LBO) modeling, and other relevant techniques is essential.

-

Credit Analysis Expertise: Deeply understand credit analysis principles, including financial statement analysis (ratio analysis, trend analysis), credit risk assessment (using credit scoring models and qualitative factors), and covenant compliance (monitoring loan agreements and ensuring borrowers adhere to conditions).

-

Deal Sourcing and Origination: Develop strong deal sourcing skills. This involves networking, researching potential investment opportunities, and building relationships with potential borrowers and intermediaries. Learning to identify promising deals is a highly valued skill.

-

Software and Database Proficiency: Familiarize yourself with industry-specific software and databases used for deal management, portfolio tracking, and financial analysis. Examples include Bloomberg Terminal, Capital IQ, and Argus.

Network Strategically

Networking is not just beneficial; it's essential for securing a private credit role. A proactive networking strategy can open doors that applications alone cannot.

-

Attend Industry Events: Participate in industry conferences, seminars, and networking events focused on private credit, private debt, and alternative investments. These events offer unparalleled opportunities to meet professionals, learn about new trends, and make valuable connections.

-

Leverage LinkedIn: Optimize your LinkedIn profile to highlight your skills and experience. Actively connect with professionals working in private credit, engage in relevant discussions, and follow industry leaders.

-

Informational Interviews: Schedule informational interviews with professionals in the field. These conversations provide invaluable insights into the industry, specific firms, and the path to career advancement.

-

Targeted Networking: Don't just network broadly; tailor your approach. Research specific firms you're interested in and target your networking efforts toward professionals within those organizations.

Craft a Compelling Resume and Cover Letter

Your resume and cover letter are your first impression. They must effectively showcase your qualifications and make you stand out from the competition.

-

Highlight Relevant Experience: Focus on experiences demonstrating your financial modeling skills, credit analysis experience, and deal sourcing abilities. Quantify your achievements whenever possible (e.g., "Increased portfolio returns by 15%").

-

Tailored Approach: Never send generic applications. Carefully tailor your resume and cover letter to each specific job description, incorporating keywords from the posting.

-

Error-Free and Professional: Ensure your resume and cover letter are flawlessly written, professionally formatted, and free of grammatical errors. A poorly presented application can instantly disqualify you.

Don'ts for Landing Your Dream Private Credit Role

Avoid Common Mistakes

Several common mistakes can significantly hinder your job search. Avoid these pitfalls:

-

Underestimating Networking: Don't underestimate the importance of networking – it's the lifeblood of the private credit industry.

-

Insufficient Firm Research: Don't apply to firms without thoroughly researching their investment strategies, portfolio companies, and culture.

-

Generic Applications: Don't submit generic resumes and cover letters. A personalized approach demonstrates genuine interest and increases your chances of success.

-

Ignoring Soft Skills: Don't overlook the importance of soft skills like communication, teamwork, and problem-solving. These are crucial for success in a collaborative environment.

-

Forgetting Feedback: Don't be afraid to seek feedback on your resume, cover letter, and interview performance. Constructive criticism can help you improve and refine your approach.

Don't Undersell Your Skills

During the application and interview process, effectively highlight your abilities.

-

Articulate Achievements: Clearly articulate your accomplishments and contributions, quantifying your impact whenever possible. Use the STAR method (Situation, Task, Action, Result) to structure your responses.

-

Showcase Skills: Effectively showcase both your technical skills (financial modeling, credit analysis) and soft skills (communication, teamwork).

-

Highlight Your USP: Don't be afraid to highlight your unique selling points—what makes you stand out from other candidates.

Don't Neglect the Interview Process

The interview is your opportunity to shine. Thorough preparation is critical.

-

Prepare Thoroughly: Prepare for both behavioral questions (assessing your personality and work style) and technical questions (testing your knowledge of finance and credit analysis). Practice your responses using the STAR method.

-

Research the Firm and Interviewer: Research the firm's investment strategy, recent deals, and the interviewer's background. This demonstrates your genuine interest and allows you to ask insightful questions.

-

Professionalism: Dress professionally, arrive on time, and maintain a positive and confident demeanor. Ask thoughtful questions to demonstrate your engagement and interest.

Conclusion

Securing your dream private credit role requires a strategic and multifaceted approach. By mastering essential skills, networking effectively, crafting a compelling application, and avoiding common mistakes, you significantly improve your chances of success. Remember, landing a private credit job is a marathon, not a sprint. Start building your private credit career today! Take the first step towards your dream private credit job now!

Featured Posts

-

Cbc Projects Poilievre Defeat Impact On Canadian Conservative Party

Apr 30, 2025

Cbc Projects Poilievre Defeat Impact On Canadian Conservative Party

Apr 30, 2025 -

Channel 4s Trespasses First Look At New Dramas Teaser Images

Apr 30, 2025

Channel 4s Trespasses First Look At New Dramas Teaser Images

Apr 30, 2025 -

Trump Country Faces Economic Hardship From Federal Funding Cuts

Apr 30, 2025

Trump Country Faces Economic Hardship From Federal Funding Cuts

Apr 30, 2025 -

Beyonce Shkelqen Ne Fushaten E Levi S Ja Pamjet Qe Te Lene Pa Fryme

Apr 30, 2025

Beyonce Shkelqen Ne Fushaten E Levi S Ja Pamjet Qe Te Lene Pa Fryme

Apr 30, 2025 -

Tanner Bibees First Pitch Homer Guardians Comeback Win Over Yankees

Apr 30, 2025

Tanner Bibees First Pitch Homer Guardians Comeback Win Over Yankees

Apr 30, 2025

Latest Posts

-

Rugby World Cup Duponts 11 Point Performance Leads France To Victory

May 01, 2025

Rugby World Cup Duponts 11 Point Performance Leads France To Victory

May 01, 2025 -

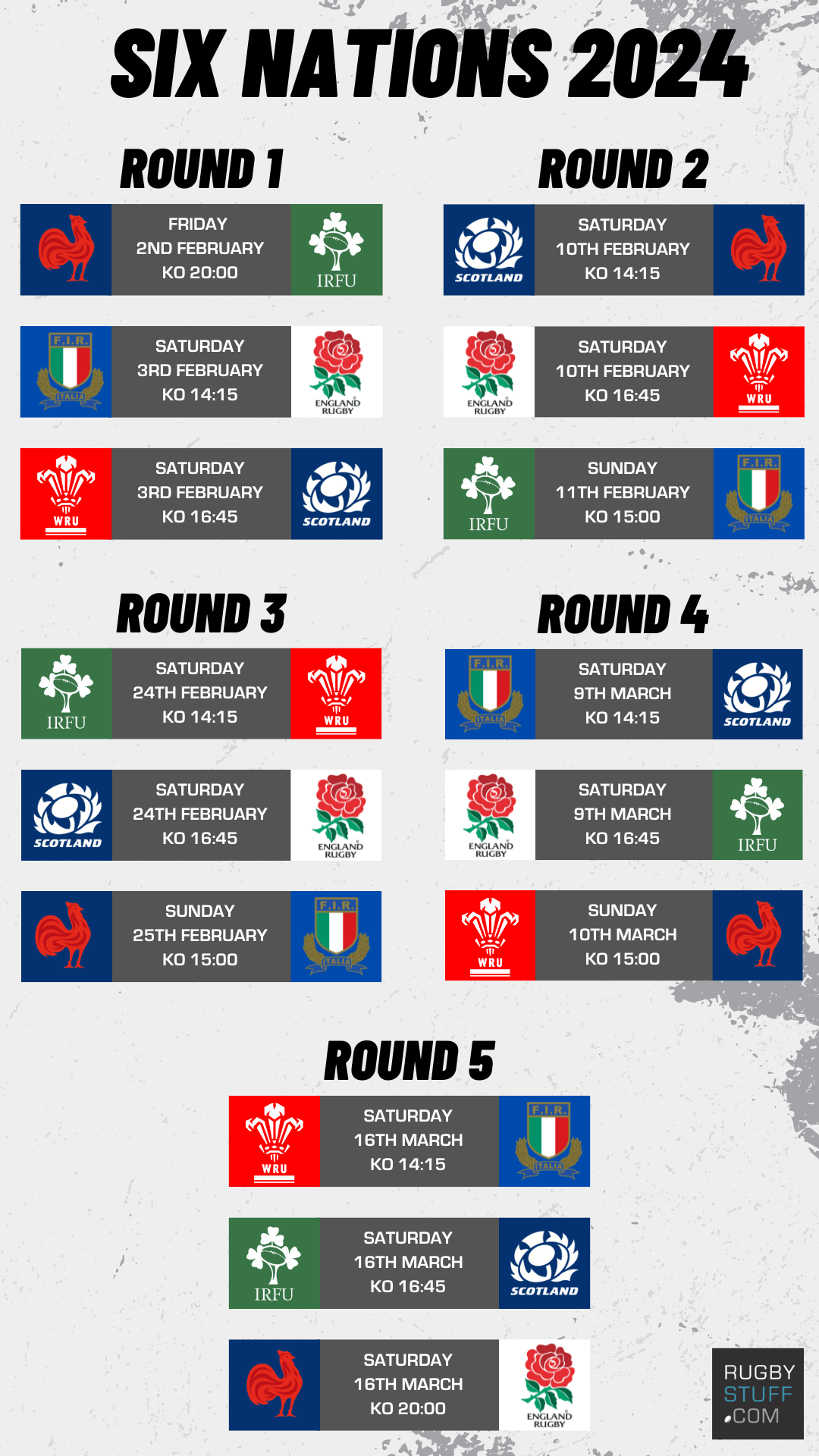

Six Nations 2025 Frances Rugby Renaissance

May 01, 2025

Six Nations 2025 Frances Rugby Renaissance

May 01, 2025 -

Duponts 11 Point Masterclass Secures Frances Win Against Italy

May 01, 2025

Duponts 11 Point Masterclass Secures Frances Win Against Italy

May 01, 2025 -

Frances Rugby Triumph Duponts 11 Point Masterclass Against Italy

May 01, 2025

Frances Rugby Triumph Duponts 11 Point Masterclass Against Italy

May 01, 2025 -

Rugby World Cup Dupont Leads France To Victory Against Italy

May 01, 2025

Rugby World Cup Dupont Leads France To Victory Against Italy

May 01, 2025