Land Your Dream Private Credit Job: 5 Essential Dos And Don'ts

Table of Contents

DO: Network Strategically

Building a strong network is paramount in securing a private credit job. The industry thrives on relationships, and strategic networking can open doors you wouldn't find through online applications alone.

Leverage LinkedIn:

Actively engage on LinkedIn. Don't just build connections; cultivate them.

- Example: Comment thoughtfully on industry articles, share insightful posts relevant to private credit strategies and alternative lending, and initiate conversations with recruiters and hiring managers specializing in investment banking or private equity.

- Benefit: Increases your visibility, positions you as a thought leader, and helps build relationships within the private credit community. A strong LinkedIn presence is a powerful tool in your job search.

Attend Industry Events:

Conferences and networking events provide unparalleled opportunities for face-to-face interaction.

- Example: The Private Debt Investor Forum, industry-specific conferences focusing on alternative lending, or even smaller, regional meetups focused on private credit.

- Benefit: Face-to-face networking strengthens connections, allows for personalized interaction, and helps you learn about current trends in private credit and private lending opportunities. You can also gain insights into different firm cultures.

Informational Interviews:

Don't underestimate the power of informational interviews.

- Example: Reach out to professionals working in private credit (credit analysts, portfolio managers, etc.) for a 30-minute chat to learn about their career path and the industry. Show genuine interest in their experiences within private credit.

- Benefit: Demonstrates initiative, provides valuable career advice, and can lead to unexpected job opportunities within private credit. These conversations often lead to referrals.

DON'T: Neglect Your Online Presence

Your online presence is your digital resume. It’s the first impression many potential employers will have of you.

Update Your Resume/CV:

Tailor your resume and CV to each specific private credit job application. Use keywords from the job descriptions.

- Example: Emphasize experience in financial modeling, credit analysis, due diligence, portfolio management, and any experience with alternative lending or distressed debt. Quantify your achievements whenever possible.

- Benefit: Makes your application stand out from the competition by showcasing relevant skills and experience in the language recruiters understand.

Underestimate the Importance of a Professional LinkedIn Profile:

Your LinkedIn profile is your virtual handshake.

- Example: Include a professional headshot, a compelling summary highlighting your skills and experience in private credit, and quantifiable achievements (e.g., "Increased portfolio returns by 15%").

- Benefit: Creates a strong first impression on recruiters and hiring managers, making them more likely to consider your application for private credit jobs.

Ignore Online Reviews:

Research potential employers thoroughly.

- Example: Check sites like Glassdoor, Indeed, and company websites to understand company culture and employee experiences. This research should be done for every company you apply to within the private credit industry.

- Benefit: Helps you make informed decisions, prepare for interviews by understanding the company's values, and potentially avoid a bad fit.

DO: Master the Fundamentals of Private Credit

A deep understanding of private credit principles is non-negotiable.

Understand Different Private Credit Strategies:

Familiarize yourself with various private credit strategies.

- Example: Research direct lending, mezzanine financing, distressed debt, and other alternative lending strategies, understanding their risk/return profiles.

- Benefit: Demonstrates a comprehensive understanding of the industry and its nuances.

Develop Strong Financial Modeling Skills:

Proficiency in financial modeling is crucial.

- Example: Practice building detailed financial models for various investment scenarios, including leveraged buyouts and distressed debt restructuring.

- Benefit: Essential for conducting due diligence and evaluating investment opportunities within private credit.

Stay Updated on Market Trends:

Keep abreast of current events impacting private credit.

- Example: Read industry publications (like Private Equity International), follow financial news, and attend industry events to stay informed about market trends and regulatory changes in private credit and alternative lending.

- Benefit: Demonstrates your commitment to the industry and your ability to adapt to change – essential skills in the dynamic world of finance jobs.

DON'T: Rush the Application Process

Take your time and ensure a polished presentation.

Submit Incomplete or Sloppy Applications:

Proofread everything meticulously.

- Example: Check for grammatical errors, typos, and ensure all required documents are included.

- Benefit: Creates a positive first impression and demonstrates attention to detail – crucial in the finance industry and any private credit job search.

Neglect the Cover Letter:

Craft a compelling cover letter for each application.

- Example: Tailor your cover letter to each specific job application, highlighting how your skills and experience align with the role's requirements.

- Benefit: Provides an opportunity to showcase your personality, enthusiasm, and understanding of the specific firm and its private credit strategies.

Forget to Follow Up:

Send follow-up emails after submitting your application and after interviews.

- Example: Express your continued interest and enthusiasm. A polite follow up demonstrates persistence.

- Benefit: Shows persistence and keeps your application top-of-mind, improving your chances of securing the private credit job.

DO: Prepare for Behavioral and Technical Interviews

Thorough preparation is key to success.

Practice Answering Common Interview Questions:

Prepare for behavioral and technical questions.

- Example: Use the STAR method (Situation, Task, Action, Result) to structure your responses, providing concrete examples.

- Benefit: Helps you feel confident and articulate during the interview, showcasing your skills and experience in a clear and concise manner.

Demonstrate Your Knowledge of Private Credit:

Be prepared to discuss your understanding of the industry.

- Example: Showcase your knowledge through specific examples and case studies, demonstrating your understanding of private credit strategies, market trends, and relevant regulations.

- Benefit: Demonstrates your expertise and passion for the industry, solidifying your position as a strong candidate.

Ask Thoughtful Questions:

Prepare insightful questions to ask the interviewer.

- Example: Ask about the company's culture, investment strategy, team dynamics, and future plans within the private credit space.

- Benefit: Shows initiative, engagement, and allows you to gain valuable information to assess the fit for your private credit career.

Conclusion:

Securing your dream job in private credit requires a strategic and well-planned approach. By following these essential dos and don’ts – focusing on networking, mastering the fundamentals, and presenting yourself professionally – you significantly increase your chances of success. Remember to consistently refine your skills, stay updated on industry trends, and remain persistent in your job search. Don't delay – start implementing these tips today and land your dream private credit job!

Featured Posts

-

Watch Warriors Vs Trail Blazers Live Game Time And Streaming Details For April 11th

May 07, 2025

Watch Warriors Vs Trail Blazers Live Game Time And Streaming Details For April 11th

May 07, 2025 -

The Cobra Kai Stars Secret To Marital Success Staying Out Of Hollywood

May 07, 2025

The Cobra Kai Stars Secret To Marital Success Staying Out Of Hollywood

May 07, 2025 -

Why Middle Managers Are Essential For Company Success

May 07, 2025

Why Middle Managers Are Essential For Company Success

May 07, 2025 -

Warriors Blowout Loss A Historical Look At Resilience

May 07, 2025

Warriors Blowout Loss A Historical Look At Resilience

May 07, 2025 -

Rihannas Savage X Fenty The Bridal Collection Thats Redefining Romance

May 07, 2025

Rihannas Savage X Fenty The Bridal Collection Thats Redefining Romance

May 07, 2025

Latest Posts

-

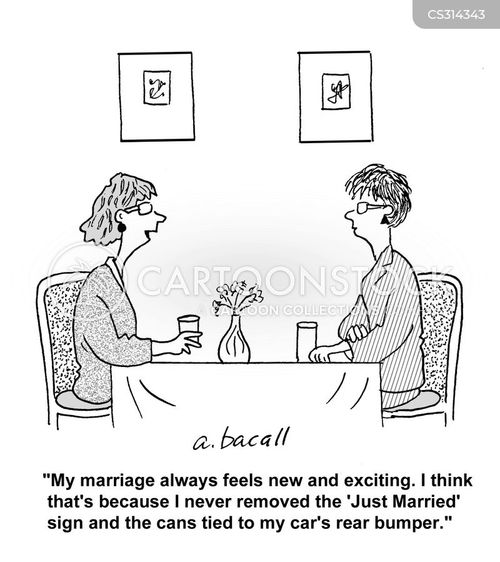

The Celebrity Who Wants To Be A Millionaire Special Format Rules And Notable Moments

May 07, 2025

The Celebrity Who Wants To Be A Millionaire Special Format Rules And Notable Moments

May 07, 2025 -

Who Wants To Be A Millionaire Celebrity Special Strategies And Surprises From Famous Contestants

May 07, 2025

Who Wants To Be A Millionaire Celebrity Special Strategies And Surprises From Famous Contestants

May 07, 2025 -

Can You Beat This Millionaire Player A Ridiculously Easy Question And Three Lifelines

May 07, 2025

Can You Beat This Millionaire Player A Ridiculously Easy Question And Three Lifelines

May 07, 2025 -

Dame Laura Kennys Post Olympic Career Advice Gold Medals And New Beginnings

May 07, 2025

Dame Laura Kennys Post Olympic Career Advice Gold Medals And New Beginnings

May 07, 2025 -

Who Wants To Be A Millionaire Celebrity Special A Look At The Format And Its Evolution

May 07, 2025

Who Wants To Be A Millionaire Celebrity Special A Look At The Format And Its Evolution

May 07, 2025