Land A Private Credit Job: 5 Crucial Do's And Don'ts

Table of Contents

DO: Develop In-Demand Skills for Private Credit Roles

The private credit industry demands a specific skill set. Mastering these crucial areas will significantly boost your candidacy for credit analyst jobs and other private credit career paths.

H3: Master Financial Modeling: Proficiency in financial modeling is paramount for any private credit job. This involves more than just basic Excel skills.

- Excel expertise: Go beyond basic formulas; master advanced functions like VBA (Visual Basic for Applications) for automation and efficiency.

- DCF modeling: Demonstrate a thorough understanding of discounted cash flow analysis, a cornerstone of valuation in private credit.

- LBO modeling: Leveraged buyout modeling is essential for analyzing potential acquisitions and understanding the financial implications of debt financing.

- Comparable company analysis: Learn to identify and analyze comparable companies to assess valuation and risk.

- Software proficiency: Highlight experience with professional-grade software like Bloomberg Terminal or Capital IQ, demonstrating your familiarity with industry-standard tools.

H3: Hone Your Credit Analysis Skills: Beyond financial modeling, a deep understanding of credit analysis principles is crucial.

- Credit ratios: Master the calculation and interpretation of key credit ratios, such as leverage ratios, coverage ratios, and liquidity ratios.

- Financial statement analysis: Demonstrate the ability to critically analyze financial statements (balance sheets, income statements, cash flow statements) to assess a company's financial health.

- Industry research: Show your ability to conduct thorough industry research to understand market trends and competitive dynamics.

- Covenant analysis: Understand the importance of loan covenants and their impact on borrowers.

- Risk assessment: Demonstrate your ability to identify and assess various credit risks, such as default risk, interest rate risk, and liquidity risk. Mention any relevant certifications (CFA, CAIA) or coursework to solidify your expertise.

H3: Build Strong Due Diligence Capabilities: Thorough due diligence is critical in private credit.

- Data analysis: Showcase your proficiency in collecting, cleaning, and analyzing large datasets.

- Valuation techniques: Demonstrate your understanding of various valuation methodologies beyond DCF, such as precedent transactions and asset-based valuations.

- Legal document review: Highlight any experience reviewing legal documents such as loan agreements and security agreements.

- Attention to detail: Emphasize your meticulous approach and commitment to accuracy—essential for preventing costly errors.

DO: Network Strategically within the Private Credit Industry

Networking is key to landing a private credit job. A proactive approach can open doors to unadvertised opportunities.

H3: Attend Industry Events: Conferences and seminars provide invaluable networking opportunities.

- Relevant conferences: Target industry-specific events such as SuperReturn, Infra week, and smaller, niche conferences focusing on specific credit sectors (e.g., real estate debt, infrastructure debt).

- Networking successes: Prepare brief anecdotes about successful networking interactions you’ve had in the past.

H3: Leverage LinkedIn: Optimize your LinkedIn profile to attract recruiters and connect with professionals in the field.

- Keyword optimization: Use relevant keywords like "private credit," "credit analyst," "financial modeling," "due diligence," and "investment banking" throughout your profile.

- Group participation: Join relevant LinkedIn groups focused on private credit, finance, and investment management. Actively participate in discussions and share insightful content.

- Content sharing: Share articles, analyses, and insights related to private credit to showcase your expertise and build your online presence.

H3: Informational Interviews: Reach out to professionals for informational interviews to learn about their experiences and gain insights into the industry.

- Thoughtful questions: Prepare insightful questions about their career path, the industry's current trends, and the challenges they face.

- Genuine interest: Show genuine interest in their experiences and perspectives; this is not just about getting a job, but building relationships.

- Follow-up: Always send a thank-you note after an informational interview.

DO: Prepare Thoroughly for Private Credit Job Interviews

Thorough preparation is crucial for success in private credit job interviews.

H3: Research the Firm: A deep understanding of the firm's investment strategy and portfolio is essential.

- Recent deals: Analyze their recent investment activities to understand their investment thesis and preferences.

- Investment focus: Understand their specific industry focus (e.g., real estate, healthcare, infrastructure) and investment strategy (e.g., senior secured debt, subordinated debt, mezzanine financing).

- Company culture: Research the company culture to ensure it's a good fit for your personality and working style. Look at employee reviews on sites like Glassdoor.

H3: Practice Behavioral Questions: Prepare compelling answers to common behavioral interview questions using the STAR method.

- STAR method: Structure your answers using the STAR method (Situation, Task, Action, Result) to provide clear and concise examples of your skills and accomplishments.

- Teamwork: Prepare examples that highlight your ability to work effectively in a team environment.

- Problem-solving: Showcase your analytical and problem-solving skills using specific examples.

- Leadership: If applicable, prepare examples that demonstrate your leadership abilities.

H3: Prepare Technical Questions: Be ready to answer in-depth questions related to financial modeling and credit analysis.

- Key concepts: Review key concepts in financial modeling, credit analysis, and valuation.

- Case studies: Practice case studies to prepare for scenario-based questions. Use your research of the firm to tailor your answers.

DON'T: Neglect the Importance of Your Resume and Cover Letter

Your resume and cover letter are your first impression.

H3: Tailor Your Resume: Customize your resume for each specific job application, highlighting relevant skills and experiences.

- Keywords: Incorporate keywords from the job description to improve your chances of Applicant Tracking System (ATS) detection.

- Quantifiable achievements: Quantify your accomplishments whenever possible (e.g., "Increased efficiency by 15%," "Managed a portfolio of $X million").

H3: Write a Compelling Cover Letter: Your cover letter should showcase your passion for private credit and highlight your key qualifications.

- Career goals: Clearly state your career goals and how this specific role aligns with your aspirations.

- Skill alignment: Connect your skills and experiences to the specific requirements outlined in the job description.

- Company research: Demonstrate your understanding of the firm's investment strategy and culture.

DON'T: Underestimate the Importance of Fit and Cultural Alignment

Cultural fit is paramount in the private credit industry.

H3: Research Company Culture: Research the firm's values, work environment, and team dynamics.

- Online reviews: Look for employee reviews on platforms like Glassdoor or LinkedIn to gain insights into the company culture.

- Company website: Review the firm's website for information on their values, mission, and team.

H3: Showcase Your Personality: Let your personality shine through during interviews to demonstrate your enthusiasm and fit within the team.

- Confidence: Project confidence and enthusiasm throughout the interview process.

- Authenticity: Be yourself and let your genuine personality shine through.

Conclusion:

Landing a private credit job requires dedication, preparation, and a strategic approach. By following these do's and don'ts – mastering in-demand skills, networking effectively, preparing meticulously for interviews, crafting a strong resume and cover letter, and understanding the company culture – you significantly increase your chances of success. Don't delay your journey to a rewarding private credit career. Start implementing these strategies today and begin your search for your ideal private credit job!

Featured Posts

-

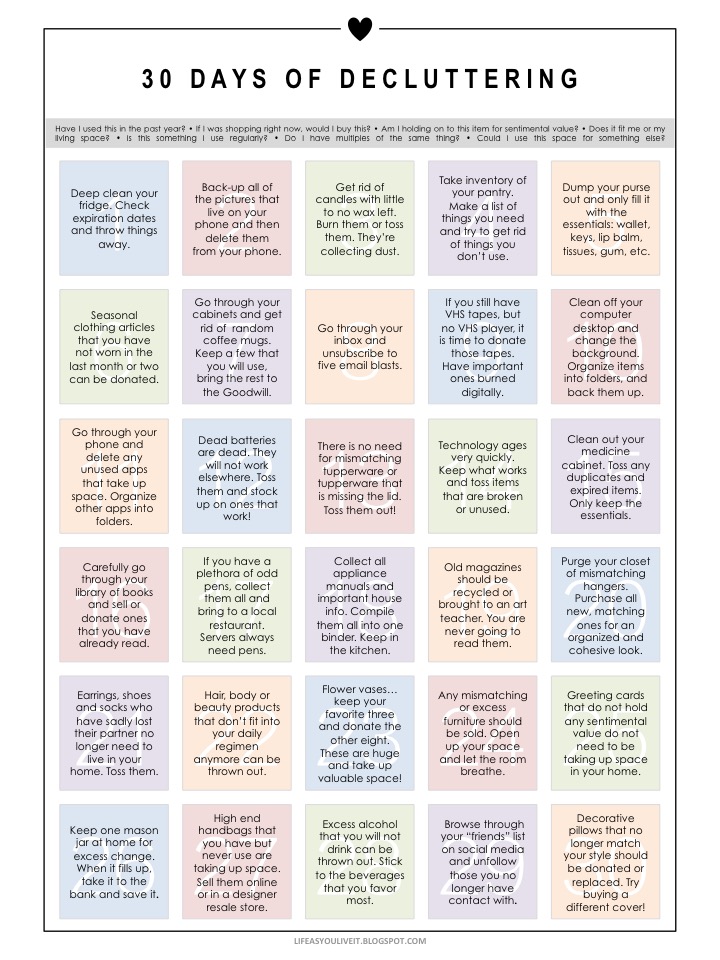

30 Days To Minimalism A Practical Guide To Decluttering Your Life

May 31, 2025

30 Days To Minimalism A Practical Guide To Decluttering Your Life

May 31, 2025 -

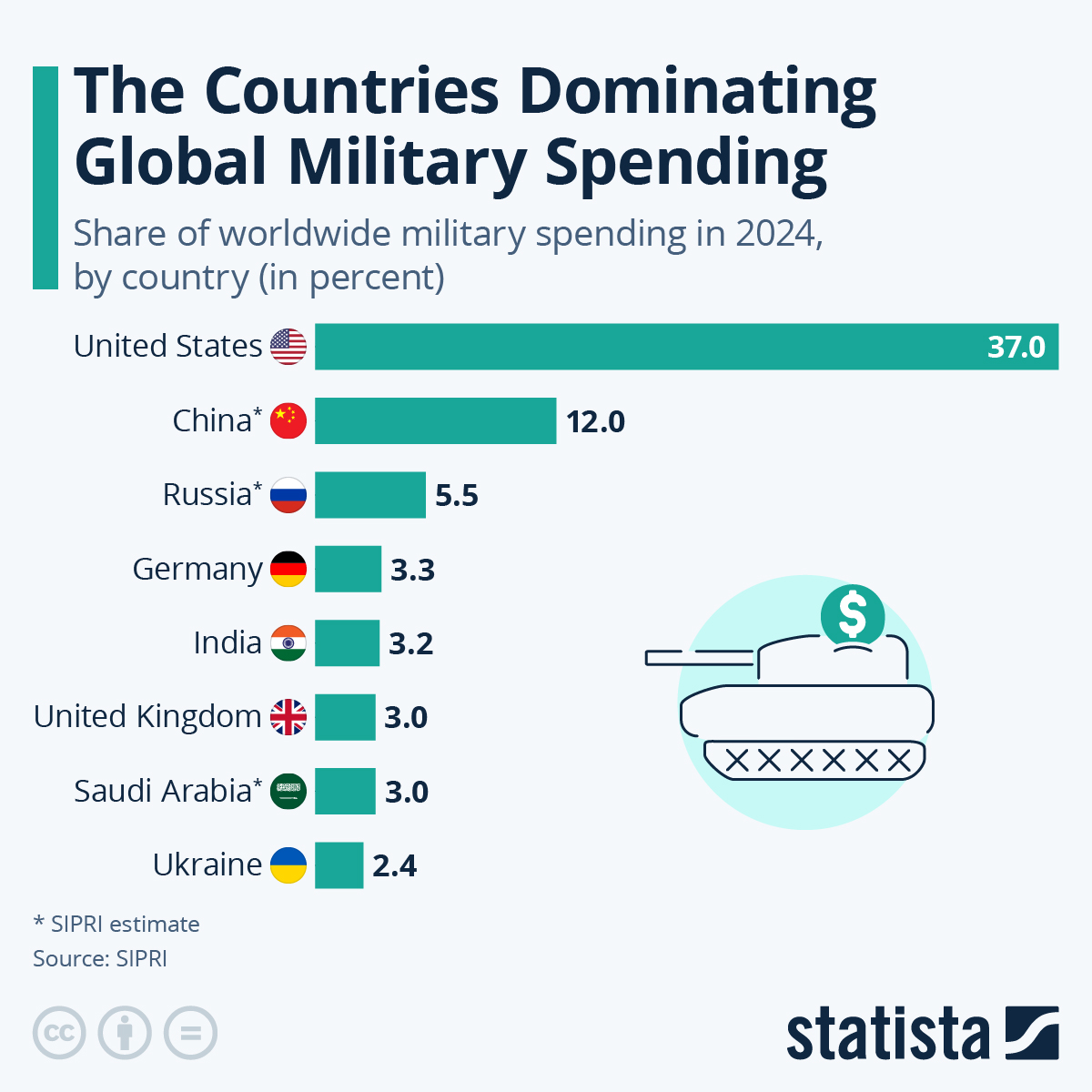

The Future Of Global Military Power A Us China Perspective

May 31, 2025

The Future Of Global Military Power A Us China Perspective

May 31, 2025 -

Empanadas De Jamon Y Queso Receta Sencilla Sin Horno

May 31, 2025

Empanadas De Jamon Y Queso Receta Sencilla Sin Horno

May 31, 2025 -

The Versatile Uses Of Rosemary And Thyme In Cooking

May 31, 2025

The Versatile Uses Of Rosemary And Thyme In Cooking

May 31, 2025 -

Pflegekonferenz Bodenseekreis Wichtige Informationen Fuer Pflegekraefte

May 31, 2025

Pflegekonferenz Bodenseekreis Wichtige Informationen Fuer Pflegekraefte

May 31, 2025