Lagarde's Strategy: Elevating The Euro's Global Standing Through EUR/USD

Table of Contents

Interest Rate Hikes and Their Impact on EUR/USD

The ECB's interest rate policy under Lagarde has been a cornerstone of her strategy to strengthen the Euro. Facing persistent inflation, the ECB, under Lagarde's leadership, has implemented a series of interest rate hikes, aiming to curb inflationary pressures and boost the Euro. This directly impacts the EUR/USD exchange rate because higher interest rates generally attract foreign investment, increasing demand for the Euro and strengthening its value against the US dollar.

- Impact on inflation control: Higher interest rates make borrowing more expensive, reducing consumer spending and investment, thereby cooling down inflation. This is a key objective of Lagarde's monetary policy.

- Attraction of foreign investment: Higher interest rates on Euro-denominated assets make them more attractive to international investors seeking higher returns, increasing demand for the Euro and pushing up the EUR/USD rate.

- Effect on Eurozone borrowing costs: While beneficial for inflation control, higher interest rates also increase borrowing costs for governments and businesses within the Eurozone. This can potentially stifle economic growth if not managed carefully.

- Potential downsides of aggressive rate hikes: Overly aggressive rate hikes risk triggering a recession by significantly slowing down economic activity. Finding the right balance is a delicate act for the ECB.

Communication Strategy and Market Sentiment

Lagarde's communication style plays a significant role in shaping market expectations and influencing the EUR/USD exchange rate. Clear, consistent, and transparent communication helps manage market volatility and build confidence in the ECB's policies. This is a critical component of Lagarde's EUR/USD strategy.

- The importance of forward guidance: Providing clear guidance on the future path of interest rates allows market participants to anticipate ECB actions, reducing uncertainty and market volatility.

- Managing market volatility through transparency: Open and honest communication about the ECB's assessment of the economic situation and its policy intentions builds trust and helps stabilize the EUR/USD.

- The role of press conferences and statements: Lagarde's press conferences and public statements are closely scrutinized by markets. Her tone, choice of words, and emphasis on specific issues can significantly influence investor sentiment and the EUR/USD.

- Impact of unexpected announcements on EUR/USD: Any unexpected announcements or policy shifts from the ECB can cause significant short-term volatility in the EUR/USD exchange rate, highlighting the importance of clear and consistent communication.

Geopolitical Factors and Their Influence on the EUR/USD

Geopolitical events significantly impact the Euro and the EUR/USD exchange rate. The war in Ukraine, the ongoing energy crisis, and other global uncertainties create headwinds for the Eurozone economy and directly affect Lagarde's ability to manage the EUR/USD.

- Energy dependence and its effect on the Eurozone economy: The Eurozone's reliance on Russian energy has made it vulnerable to energy price shocks, impacting inflation and economic growth, and consequently, the EUR/USD.

- Sanctions and their impact on trade: Sanctions imposed on Russia have disrupted trade flows and supply chains, affecting the Eurozone economy and putting downward pressure on the EUR/USD.

- Geopolitical risks and their influence on investor confidence: Geopolitical uncertainty generally reduces investor confidence, leading to capital outflows and a weaker Euro.

- Lagarde's response to external shocks: Lagarde's response to external shocks, such as the war in Ukraine, is crucial in mitigating their impact on the Eurozone economy and stabilizing the EUR/USD. Her communication and policy decisions during such times are carefully observed by markets.

Quantitative Tightening (QT) and its Role in EUR/USD

The ECB's quantitative tightening (QT) policies, implemented under Lagarde's leadership, aim to reduce the ECB's balance sheet by gradually unwinding its asset purchase programs. This affects liquidity in the market and influences the EUR/USD exchange rate.

- Reduction of the ECB's balance sheet: By reducing its holdings of government bonds and other assets, the ECB aims to remove excess liquidity from the market, potentially reducing inflationary pressures.

- Impact on bond yields and interest rates: QT can lead to higher bond yields and interest rates, making Euro-denominated assets more attractive to investors and strengthening the EUR/USD.

- Effects on money supply and inflation: Reducing the money supply through QT can help control inflation, a key objective of the ECB's monetary policy.

- Comparison with other central banks' QT strategies: The ECB's QT strategy is compared to that of other central banks, such as the Federal Reserve, to assess its effectiveness and impact on the EUR/USD exchange rate relative to other major currencies.

Conclusion

Lagarde's strategy to elevate the Euro's global standing through managing the EUR/USD exchange rate is multi-faceted, involving interest rate adjustments, strategic communication, navigating geopolitical complexities, and implementing quantitative tightening measures. While challenges remain, her approach demonstrates a commitment to strengthening the Eurozone economy and enhancing the Euro's international competitiveness. To stay updated on the evolving dynamics of Lagarde's EUR/USD strategy and its implications for the global financial landscape, continue to follow reputable financial news sources and analyses. Understanding Lagarde's EUR/USD strategy is crucial for anyone invested in the Eurozone economy or involved in foreign exchange markets.

Featured Posts

-

Peran Kodam Udayana Dalam Gerakan Bali Bersih Sampah

May 28, 2025

Peran Kodam Udayana Dalam Gerakan Bali Bersih Sampah

May 28, 2025 -

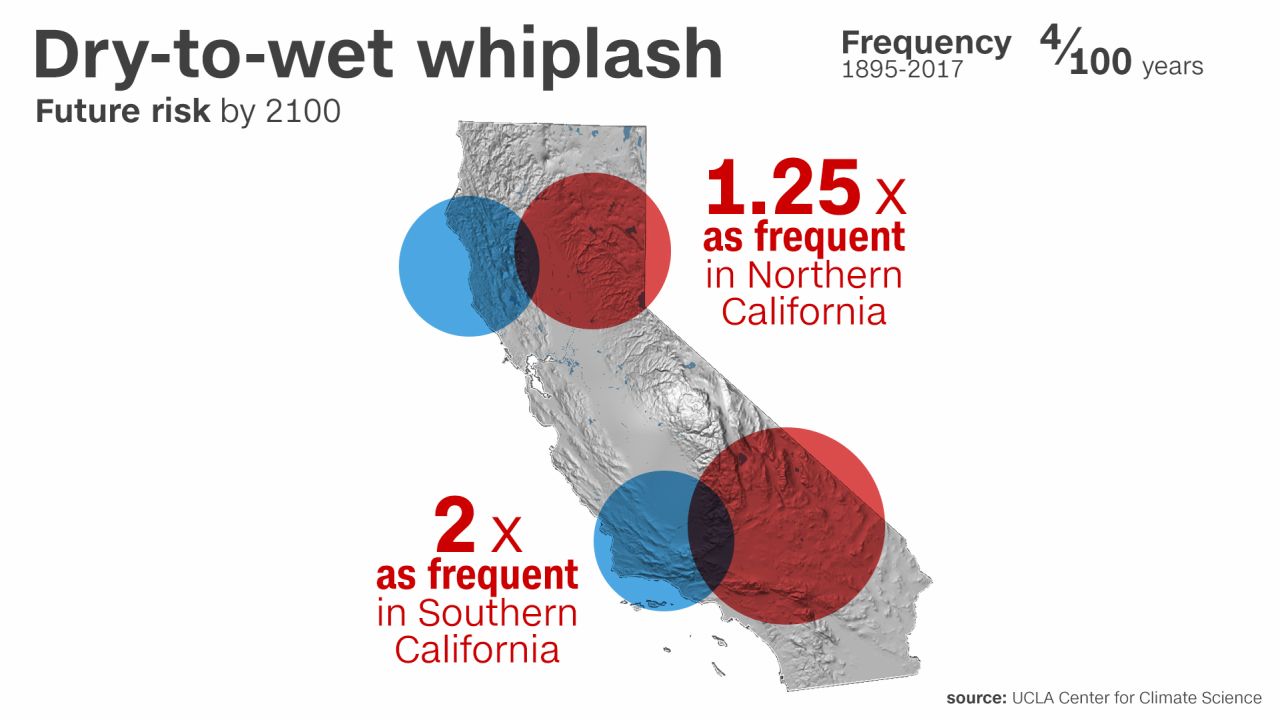

Understanding The Impacts Of Dangerous Climate Whiplash On Urban Areas

May 28, 2025

Understanding The Impacts Of Dangerous Climate Whiplash On Urban Areas

May 28, 2025 -

Hailee Steinfeld And Josh Allens Engagement Intimate Wedding Details Revealed

May 28, 2025

Hailee Steinfeld And Josh Allens Engagement Intimate Wedding Details Revealed

May 28, 2025 -

Jennifer Lopez To Host The 2025 American Music Awards Official Announcement

May 28, 2025

Jennifer Lopez To Host The 2025 American Music Awards Official Announcement

May 28, 2025 -

Housing Corporations Initiate Legal Proceedings Against Rent Freeze Policy

May 28, 2025

Housing Corporations Initiate Legal Proceedings Against Rent Freeze Policy

May 28, 2025