Kentucky Storm Damage Assessments: Delays And Reasons Why

Table of Contents

The Sheer Volume of Claims After Major Storms

Following a major weather event like the 2021 tornadoes, the sheer number of insurance claims filed simultaneously creates a significant bottleneck in the assessment process.

Overwhelmed Insurance Adjusters and Appraisers

The influx of claims overwhelms the system. Imagine hundreds, even thousands, of homeowners needing assessments – all at once. This leads to a logistical nightmare for insurance companies.

- Increased demand: The demand for qualified insurance adjusters and independent appraisers skyrockets, resulting in significantly longer wait times for homeowners.

- Out-of-state adjusters: Insurance companies often bring in adjusters from other states, which introduces travel delays and further complicates the process.

- Claim backlogs: Processing the sheer volume of claims creates substantial backlogs, leading to further delays in scheduling assessments and disbursing payments.

Resource Constraints and Staffing Shortages

Insurance companies, despite their best efforts, often struggle to cope with the sudden surge in claims.

- Limited personnel: Many companies simply don't have the personnel to handle the massive influx of claims immediately.

- Resource limitations: The lack of sufficient resources, including adjusters, appraisers, and support staff, directly impacts processing times.

- Prioritization: Insurance companies often prioritize claims based on severity, meaning homeowners with less extensive damage may experience longer wait times.

Severe Weather Conditions Hindering Access

Severe weather itself can significantly impede the assessment process. The damage caused by the storm may make accessing properties difficult or dangerous.

Impassable Roads and Dangerous Conditions

The aftermath of a storm often leaves behind hazardous conditions that make it difficult or impossible for adjusters to reach damaged properties.

- Impassable roads: Flooding, debris, and downed power lines can render roads impassable, preventing access to affected areas.

- Safety concerns: The safety of adjusters is paramount. Insurance companies may prioritize properties accessible without significant risk.

- Delayed assessments: Assessments must often wait until conditions improve and access becomes safe.

Power Outages and Communication Issues

A lack of power and reliable communication further complicates the assessment process.

- Equipment limitations: Power outages prevent the use of essential equipment such as drones for aerial assessments or computers for data entry.

- Communication breakdowns: Difficulty contacting homeowners to schedule assessments delays the process.

- Infrastructure damage: Damage to cell towers and other communication infrastructure can significantly compound communication problems.

Complexity of Damage and Insurance Policy Coverage

Determining the extent of the damage and whether it's covered by insurance can be a protracted process, adding to the delays.

Determining the Extent of Damage

Assessing the full extent of damage, especially for complex structural issues, requires thorough investigation.

- Hidden damage: Significant damage might be hidden beneath superficial damage, requiring extensive inspections to uncover.

- Specialized expertise: Structural engineers or other specialists may be needed, adding to the time required for a complete assessment.

- Cause of damage: Establishing the precise cause of the damage is critical in determining insurance coverage, which can be time-consuming.

Navigating Insurance Policies and Exclusions

Insurance policies contain specific terms and conditions that dictate coverage. Understanding these is crucial.

- Policy interpretation: Homeowners must understand their policy terms and conditions to determine what is and isn't covered.

- Coverage disputes: Disputes over coverage are common and can significantly prolong the assessment process.

- Legal counsel: In some cases, legal counsel may be necessary to resolve complex coverage issues.

Conclusion: Understanding Delays in Kentucky Storm Damage Assessments

Delays in Kentucky storm damage assessments are often caused by a combination of factors: the sheer volume of claims following major storms, severe weather conditions that hinder access to damaged properties, and the inherent complexity of assessing damage and determining insurance coverage. Patience and proactive communication with your insurance provider are essential. To expedite the process, document damage thoroughly with photos and videos, contact your insurer promptly, and keep records of all communications. Consider contacting a reputable public adjuster or storm damage restoration specialist for assistance in navigating the complexities of Kentucky storm damage assessments. Understanding your insurance policy and seeking professional help when needed can significantly improve your chances of a timely and fair assessment. Don't hesitate to seek help with your Kentucky storm damage assessment; your peace of mind is worth it.

Featured Posts

-

Trump Faces Gop Headwinds On Tax Legislation

Apr 29, 2025

Trump Faces Gop Headwinds On Tax Legislation

Apr 29, 2025 -

Las Vegas Police Seek Publics Help In Finding Missing Paralympian Sam Ruddock

Apr 29, 2025

Las Vegas Police Seek Publics Help In Finding Missing Paralympian Sam Ruddock

Apr 29, 2025 -

Trump Administrations Funding Threat Harvards Response And Legal Challenges

Apr 29, 2025

Trump Administrations Funding Threat Harvards Response And Legal Challenges

Apr 29, 2025 -

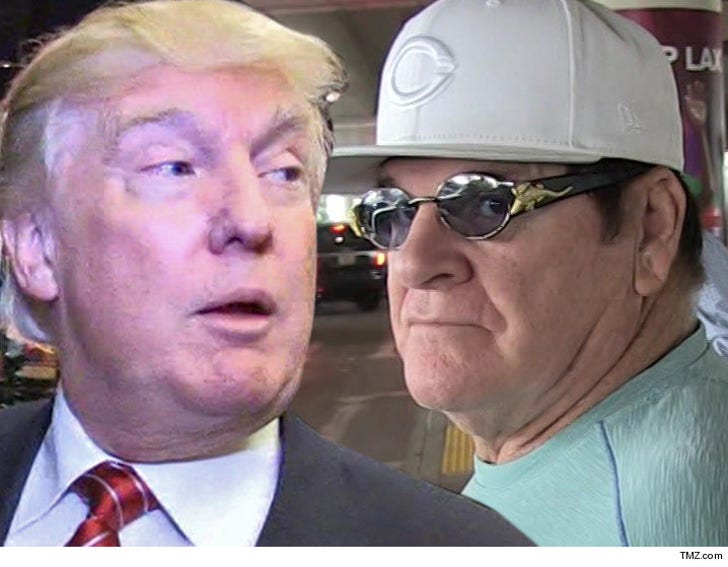

The Pete Rose Pardon Analyzing The Legal And Political Ramifications

Apr 29, 2025

The Pete Rose Pardon Analyzing The Legal And Political Ramifications

Apr 29, 2025 -

Bundesliga News Lask Mit Problemen Klagenfurt Im Freien Fall

Apr 29, 2025

Bundesliga News Lask Mit Problemen Klagenfurt Im Freien Fall

Apr 29, 2025