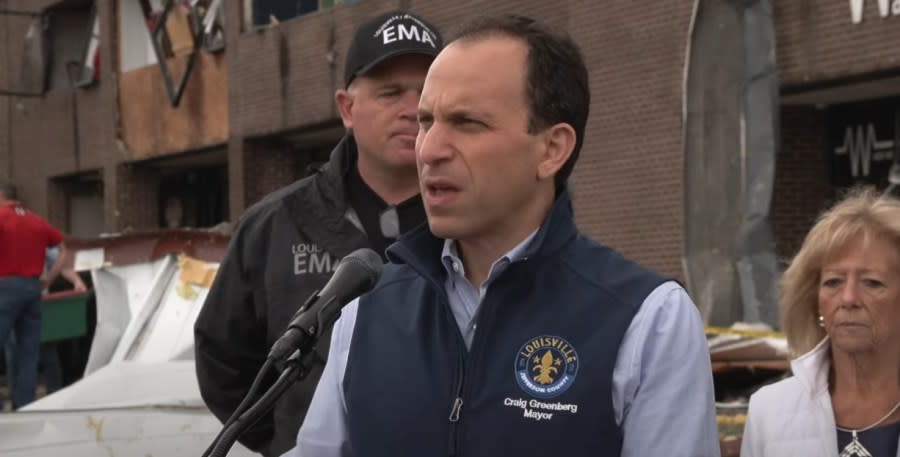

Kentucky Storm Damage Assessments: Delays And Reasons Explained

Table of Contents

The Complexity of Kentucky Storm Damage Assessments

The assessment process following a major storm in Kentucky is inherently complex, involving multiple factors that contribute to delays. Understanding these complexities is the first step in managing your expectations and ensuring a smoother claims process.

Extensive Damage and High Volume of Claims

Severe storms often cause widespread devastation, overwhelming assessors and insurance companies with a massive influx of claims.

- Widespread devastation from severe storms overwhelms assessors and insurance companies. A single storm can impact thousands of properties across a wide geographical area, stretching resources thin.

- Prioritization of the most urgent cases leads to longer wait times for others. Assessors often prioritize properties with the most significant damage or those posing immediate safety risks, leading to delays for those with less severe, but still substantial, damage.

- The sheer number of claims filed after a major storm requires significant time to process. The sheer volume necessitates a systematic approach, which inherently takes time.

The logistical challenges are considerable. Assessing damage across a vast area, particularly in rural parts of Kentucky with less accessible roads, requires careful planning and coordination. Limited personnel and resources further exacerbate these challenges, leading to inevitable delays in property damage assessment.

Detailed Documentation Requirements

Insurance companies in Kentucky require comprehensive documentation to validate claims and ensure accurate payouts for storm damage. This documentation process, while necessary, can contribute to delays.

- Insurance companies require comprehensive documentation of damage. This includes detailed descriptions of the damage, photographs from multiple angles, and supporting documentation like receipts for repairs or previous assessments.

- Gathering evidence, such as photographs, videos, and receipts, takes time. The more thorough your documentation, the stronger your claim will be, but gathering this evidence requires effort and time.

- Accurate record-keeping is crucial for a smooth and swift claim processing. Missing or incomplete documentation will likely result in delays as the insurance company requests additional information.

The types of documentation needed vary depending on the extent of the damage and your insurance policy. While documenting damage yourself can be helpful, engaging a professional assessor can provide more comprehensive documentation and speed up the process significantly. Understanding the difference and choosing the right approach can drastically impact your assessment timeline.

Factors Contributing to Kentucky Storm Damage Assessment Delays

Beyond the inherent complexities, several external factors can further contribute to delays in Kentucky storm damage assessments.

Severe Weather Impact on Accessibility

The aftermath of a storm can make accessing damaged properties incredibly difficult.

- Roads and infrastructure damage can hinder access to affected properties. Flooding, downed trees, and power lines can create significant obstacles for assessors.

- Safety concerns for assessors in hazardous areas contribute to delays. Assessors may need to wait until areas are deemed safe before conducting assessments, prioritizing safety over speed.

- Power outages and communication disruptions impede assessment efforts. Loss of power and cell service can significantly hamper communication and assessment activities.

Kentucky's diverse geography, with areas of rugged terrain and isolated communities, compounds these accessibility challenges. Subsequent storms or severe weather after the initial event can further complicate access and extend assessment times.

Insurance Company Backlogs and Processing Times

Even with swift assessment, the claims process itself can face delays within insurance companies.

- High demand on insurance adjusters leads to extended wait times. After major storms, adjusters are overwhelmed with a surge in claims, creating a backlog.

- Insurance companies may have limited staff to handle the influx of claims. Many insurance companies simply do not have the staffing capacity to handle a sudden massive increase in claims.

- Internal processing delays within insurance companies can prolong assessment timelines. Bureaucracy, internal reviews, and other processing steps within the insurance company contribute to overall delays.

Understanding your insurance policy and contacting your insurer promptly after the storm is crucial. Proactive communication and a clear understanding of the claims process can help mitigate some of these delays.

Fraudulent Claims and Investigations

To protect against fraudulent claims, insurance companies dedicate resources to thorough investigations.

- The potential for fraudulent claims necessitates thorough investigation. Insurance companies must investigate claims to ensure legitimacy, preventing abuse of the system.

- Insurance companies dedicate resources to verifying the legitimacy of each claim. This verification process, while necessary, adds time to the overall assessment timeline.

- Investigations can lead to significant delays in the assessment process. If suspicions of fraud arise, investigations can take significant time, impacting even legitimate claims.

This investigative process, while potentially frustrating for those with legitimate claims, is a necessary component of the system to ensure fair and equitable distribution of resources.

Conclusion

Delays in Kentucky storm damage assessments are often unavoidable due to the scale of damage, the detailed documentation requirements, and the logistical challenges of assessing widespread destruction. Furthermore, the involvement of insurance companies, their internal processes, and the necessity of preventing fraudulent claims all contribute to the overall timeline. Understanding the reasons behind these delays can help homeowners and business owners manage their expectations and better navigate the claims process.

If you’ve experienced storm damage in Kentucky and are facing assessment delays, don't hesitate to contact your insurance provider immediately and gather comprehensive documentation of your damages to expedite the process. Learn more about navigating the intricacies of Kentucky storm damage assessments and protect your interests.

Featured Posts

-

Celtics Defeat Cavaliers 4 Key Takeaways From Derrick Whites Stellar Performance

May 01, 2025

Celtics Defeat Cavaliers 4 Key Takeaways From Derrick Whites Stellar Performance

May 01, 2025 -

Little Tahiti Italy The Ultimate Beach Getaway

May 01, 2025

Little Tahiti Italy The Ultimate Beach Getaway

May 01, 2025 -

Seven Carnival Cruise Line Updates Revealed Next Month

May 01, 2025

Seven Carnival Cruise Line Updates Revealed Next Month

May 01, 2025 -

Garcias Homer Witts Rbi Double Power Royals Past Guardians

May 01, 2025

Garcias Homer Witts Rbi Double Power Royals Past Guardians

May 01, 2025 -

Michael Sheens 100 000 Donation 900 Peoples Debts Erased

May 01, 2025

Michael Sheens 100 000 Donation 900 Peoples Debts Erased

May 01, 2025

Latest Posts

-

Before The Cobbles Daisy Midgeleys Earlier Acting Roles

May 01, 2025

Before The Cobbles Daisy Midgeleys Earlier Acting Roles

May 01, 2025 -

Emotional Coronation Street Farewell Jordan And Fallons Thank You Message Brings Co Star To Tears

May 01, 2025

Emotional Coronation Street Farewell Jordan And Fallons Thank You Message Brings Co Star To Tears

May 01, 2025 -

Coronation Streets Jordan And Fallon Depart Leaving Co Star Emotional With Joint Thank You

May 01, 2025

Coronation Streets Jordan And Fallon Depart Leaving Co Star Emotional With Joint Thank You

May 01, 2025 -

Lack Of Police Accountability Campaigners Express Deep Worry Over Review

May 01, 2025

Lack Of Police Accountability Campaigners Express Deep Worry Over Review

May 01, 2025 -

Concerns Mount Over Police Accountability Review Process Campaigners Speak Out

May 01, 2025

Concerns Mount Over Police Accountability Review Process Campaigners Speak Out

May 01, 2025