Job Market Shock: TD Forecasts 100,000 Job Losses Due To Recession

Table of Contents

TD's Recessionary Forecast: A Deeper Dive

TD's forecast of 100,000 job losses is not a casual prediction. It’s based on a comprehensive analysis of key economic indicators, including inflation rates, consumer confidence, housing market trends, and business investment. The bank's economists used econometric modeling and historical data to project the severity and sectoral impact of the anticipated recession.

The sectoral impact is expected to be uneven. Sectors heavily reliant on consumer spending, such as retail and hospitality, are projected to be particularly vulnerable. Manufacturing job losses and construction job losses are also anticipated, reflecting the slowdown in investment and overall economic activity.

- Specific Sectoral Projections (Illustrative): While precise numbers per sector are not publicly released, projections suggest that retail could experience a loss of X jobs, construction Y, and manufacturing Z (replace X, Y, and Z with hypothetical numbers if available from the original source).

- Geographic Disparities: Provinces heavily reliant on resource extraction or specific manufacturing sectors might face disproportionately higher job losses. For example, provinces like Alberta could experience greater impact due to fluctuations in the energy sector.

- Comparison to Past Recessions: TD's forecast suggests that this recession, if it materializes, could be more severe than previous ones, resulting in a higher number of job losses compared to past economic downturns.

Impact on the Canadian Economy: Beyond Job Losses

The impact of 100,000 job losses extends far beyond individual hardship. The broader Canadian economy faces significant challenges. Reduced consumer spending, a direct consequence of increased unemployment, will further dampen economic growth, leading to decreased GDP growth. This ripple effect will impact numerous industries, potentially leading to a prolonged period of economic instability.

- Impact on Inflation: While job losses might initially ease inflationary pressures due to reduced demand, the overall economic slowdown could create uncertainty and potentially prolong inflationary challenges.

- Impact on Government Revenue and Spending: Reduced economic activity will likely lead to lower government tax revenues, making it challenging to fund social programs and support those affected by job losses. Increased government spending on social safety nets will likely offset some of these revenue shortfalls.

- Impact on the Housing Market: A significant drop in employment could lead to a decline in housing prices, potentially triggering a downward spiral in the real estate market and impacting the overall financial stability of many Canadians.

Strategies for Individuals Facing Job Market Uncertainty

The prospect of widespread job losses necessitates proactive strategies to enhance job security. Individuals should focus on improving their skill sets, expanding their professional network, and strengthening their financial preparedness.

-

Upskilling and Reskilling: Investing in upskilling and reskilling is crucial. Identify in-demand skills and pursue relevant training programs. This could involve online courses, certifications, or post-secondary education.

-

Networking: Actively expand your professional network by attending industry events, joining professional organizations, and utilizing platforms like LinkedIn. Strong networking can increase your visibility to potential employers.

-

Diversifying Skills: Develop skills that are transferable across multiple industries, making you more resilient to economic downturns. This adaptability increases your employment opportunities.

-

Financial Planning: Build an emergency fund to cover living expenses for several months. Review your budget and identify areas for cost savings.

-

Resume and LinkedIn Profile Updates: Ensure your resume and LinkedIn profile are updated and highlight your key skills and accomplishments. Tailor your applications to the specific requirements of each job opening.

-

Career Counseling and Training Resources: Utilize government programs like Employment Insurance (EI) and career counseling services to receive support during your job search. Explore free online resources for career development and training.

-

Importance of Emergency Funds: Building a strong emergency fund is crucial to weather financial storms. Aim for 3-6 months of living expenses in savings.

Government Response and Policy Implications

The severity of the predicted job losses requires a coordinated government response. Government policy needs to focus on mitigating the impact of the recession and providing support to individuals and businesses.

- Fiscal Stimulus: The government might consider fiscal stimulus measures, such as tax cuts or infrastructure spending, to boost economic activity and create jobs.

- Employment Support Programs: Expanding existing employment programs or creating new ones is crucial to provide financial assistance and job training to the unemployed.

- Analysis of Past Government Responses: Examining the effectiveness of past government responses to similar economic downturns provides insights into what works and what doesn't.

- Discussion of Potential Policy Solutions: Analyzing potential policy solutions requires considering their impact on various aspects of the economy, potential unintended consequences, and effectiveness in stimulating growth and reducing unemployment.

- Challenges in Implementing Effective Policies: Implementing effective policies can be challenging, and factors such as political considerations, timing, and budgetary constraints play a significant role.

Conclusion: Preparing for the Job Market Shock: Navigating the Recession

TD's forecast of 100,000 job losses due to a potential recession highlights the significant challenges facing the Canadian economy. The potential impact on individuals and businesses is substantial, requiring proactive strategies for mitigation. Understanding the sectoral impact, preparing for potential job losses through upskilling and networking, and advocating for effective government policies are crucial.

Don't be caught off guard by the potential job market shock. Take proactive steps today to secure your future and prepare for a possible recession. Stay informed about the latest economic forecasts, utilize the available resources to mitigate the risks, and remember that effective planning is your strongest ally during times of economic uncertainty.

Featured Posts

-

Hamas Faces Us Ceasefire Proposal In Gaza Conflict

May 28, 2025

Hamas Faces Us Ceasefire Proposal In Gaza Conflict

May 28, 2025 -

The Housing Permit Dip Understanding The Construction Markets Challenges

May 28, 2025

The Housing Permit Dip Understanding The Construction Markets Challenges

May 28, 2025 -

Increased Rainfall Amounts In Western Massachusetts Due To Climate Change

May 28, 2025

Increased Rainfall Amounts In Western Massachusetts Due To Climate Change

May 28, 2025 -

Pirates Skenes To Start On Opening Day

May 28, 2025

Pirates Skenes To Start On Opening Day

May 28, 2025 -

Understanding Erik Ten Hag 10 Insights Into His Bayer Leverkusen Role

May 28, 2025

Understanding Erik Ten Hag 10 Insights Into His Bayer Leverkusen Role

May 28, 2025

Latest Posts

-

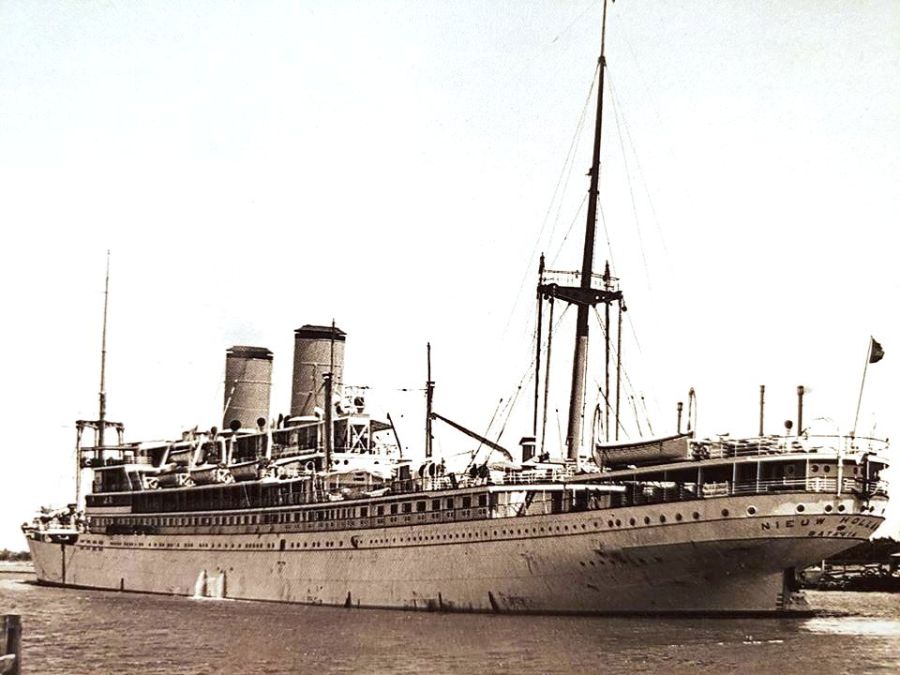

Fincantieri Secures New Cruise Ship Order From Tui Ag For Marella Cruises

May 29, 2025

Fincantieri Secures New Cruise Ship Order From Tui Ag For Marella Cruises

May 29, 2025 -

The Nieuw Statendams Impact On Invergordons Cruise Season

May 29, 2025

The Nieuw Statendams Impact On Invergordons Cruise Season

May 29, 2025 -

Nieuw Statendam Invergordons First Major Cruise Ship Of The Season

May 29, 2025

Nieuw Statendam Invergordons First Major Cruise Ship Of The Season

May 29, 2025 -

Easter Ross Port Of Invergordon Sees Arrival Of Nieuw Statendam

May 29, 2025

Easter Ross Port Of Invergordon Sees Arrival Of Nieuw Statendam

May 29, 2025 -

Invergordon Welcomes Nieuw Statendam Easter Ross Cruise Season Underway

May 29, 2025

Invergordon Welcomes Nieuw Statendam Easter Ross Cruise Season Underway

May 29, 2025