JM Financial: Invest In Baazar Style Retail For ₹400

Table of Contents

Understanding the Baazar-Style Retail Investment Opportunity

Baazar-style retail refers to the dynamic, informal retail landscape prevalent across India's numerous towns and cities. It encompasses a diverse range of businesses, from small neighborhood shops and street vendors to larger, more organized marketplaces. These businesses cater to the everyday needs of a vast consumer base, offering a diverse range of products and services.

What makes this sector so attractive for investors? Several key factors contribute to its appeal:

- High consumer demand in emerging markets: India's burgeoning middle class fuels consistent demand for goods and services across a wide spectrum.

- Low capital investment requirements compared to traditional retail: Starting a baazar-style retail business often requires significantly less capital than setting up a large-scale, modern retail outlet.

- Potential for high profit margins: Operating costs are generally lower, leading to the potential for higher profit margins compared to more established retail models.

- Opportunities for diversification and expansion: The sector's diverse nature offers ample opportunities for diversification and expansion into various product categories and geographical locations.

JM Financial's Investment Platform and Process

JM Financial provides a streamlined platform for investors to access the baazar-style retail sector. Their process is designed to be user-friendly, even for first-time investors.

- Account Opening: Opening an investment account with JM Financial is a straightforward process, typically involving online registration and KYC verification.

- Fund Allocation: Once your account is activated, you can easily allocate funds towards baazar-style retail investment options. JM Financial offers various investment vehicles tailored to different risk appetites and investment goals.

- Risk Factors: Like any investment, baazar-style retail carries inherent risks. These include market volatility, changes in consumer preferences, and the potential for business failures. JM Financial provides detailed information on these risks as part of its investment disclosures.

- Reputation and Credibility: JM Financial is a reputable and established financial services company with a long track record in the Indian market. Their expertise and commitment to transparency provide investors with a degree of confidence.

Key features of JM Financial's investment platform:

- Easy online investment process.

- Minimum investment amount: ₹400.

- Transparent fee structure.

- Access to investment tools and resources.

- Risk assessment and mitigation strategies.

Potential Returns and Risks of Baazar-Style Retail Investments

Investing in baazar-style retail offers the potential for significant returns, driven by the robust growth of the Indian retail market. However, it's crucial to acknowledge the associated risks.

- Potential High Returns: Successful baazar-style retail businesses can generate substantial profits, particularly those catering to underserved markets or offering unique products or services.

- Associated Risks: Market volatility, changing consumer preferences, competition, and economic downturns can all impact the performance of baazar-style retail investments. Business failures are also a possibility.

- Due Diligence is Key: Thorough due diligence is essential before investing in any baazar-style retail venture. This includes researching the business model, management team, market conditions, and financial projections.

Factors to Consider:

- Historical return data (if available from similar investments).

- Factors influencing returns (market trends, consumer behaviour).

- Risk mitigation strategies (diversification, risk assessment).

- Importance of professional financial advice.

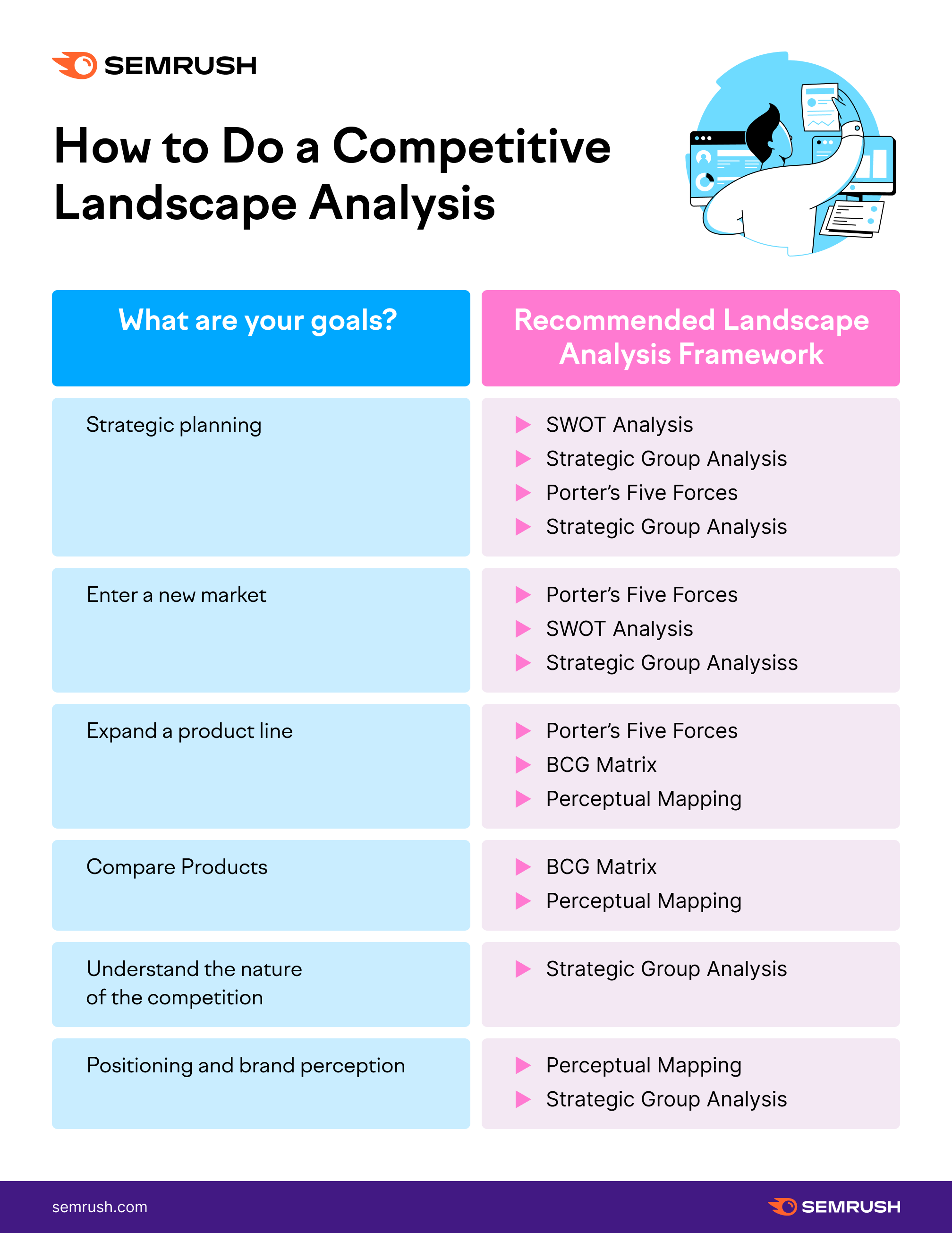

JM Financial vs. Other Investment Options

Compared to traditional investment avenues like fixed deposits or mutual funds, baazar-style retail investments through JM Financial offer a unique blend of accessibility, potential returns, and risk.

- Ease of Access: The ₹400 minimum investment makes it incredibly accessible, unlike many other investment options with higher entry barriers.

- Risk vs. Return: While the potential for high returns exists, it’s crucial to understand the higher risk compared to lower-return, less volatile options.

(Comparison Table - Insert a comparative table here showcasing JM Financial's Baazar-style retail investment against other options like Fixed Deposits, Mutual Funds, etc. Include columns for Minimum Investment, Risk Level, Potential Return, and Ease of Access.)

Choosing the right investment option depends on your individual risk tolerance, financial goals, and investment horizon. Consider consulting a financial advisor to determine the best strategy for your needs.

Conclusion: Start Investing in Baazar-Style Retail with JM Financial Today!

Investing in baazar-style retail through JM Financial presents a compelling opportunity to tap into the dynamism of the Indian retail market. The low entry barrier of ₹400 makes it accessible to a wider range of investors, while the potential for high returns is enticing. However, it's crucial to understand and manage the associated risks.

Remember to conduct thorough research, diversify your investments, and consider seeking professional financial advice before making any investment decisions. Ready to explore this exciting investment avenue? Visit the JM Financial website today to learn more about their baazar-style retail investment plan or contact a financial advisor to discuss your investment options. Invest in baazar-style retail and unlock the potential of this vibrant market segment with JM Financial's ₹400 investment plan.

Featured Posts

-

Herstel Van Vertrouwen De Uitdaging Voor Het College Van Omroepen En De Npo

May 15, 2025

Herstel Van Vertrouwen De Uitdaging Voor Het College Van Omroepen En De Npo

May 15, 2025 -

Npo Medewerkers Getuigen Over Angstcultuur Onder Leeflang

May 15, 2025

Npo Medewerkers Getuigen Over Angstcultuur Onder Leeflang

May 15, 2025 -

Kibris Isguecue Piyasasi Icin Yeni Dijital Veri Tabani Rehberi

May 15, 2025

Kibris Isguecue Piyasasi Icin Yeni Dijital Veri Tabani Rehberi

May 15, 2025 -

Tatar In Kibris Politikasi Ve Direkt Ucus Olasiligi

May 15, 2025

Tatar In Kibris Politikasi Ve Direkt Ucus Olasiligi

May 15, 2025 -

12 Milyon Avroluk Kktc Karari Tuerk Devletlerinin Rolue Ve Uzman Goeruesleri

May 15, 2025

12 Milyon Avroluk Kktc Karari Tuerk Devletlerinin Rolue Ve Uzman Goeruesleri

May 15, 2025

Latest Posts

-

Exploring The Countrys Top Business Hot Spots Opportunities And Challenges

May 15, 2025

Exploring The Countrys Top Business Hot Spots Opportunities And Challenges

May 15, 2025 -

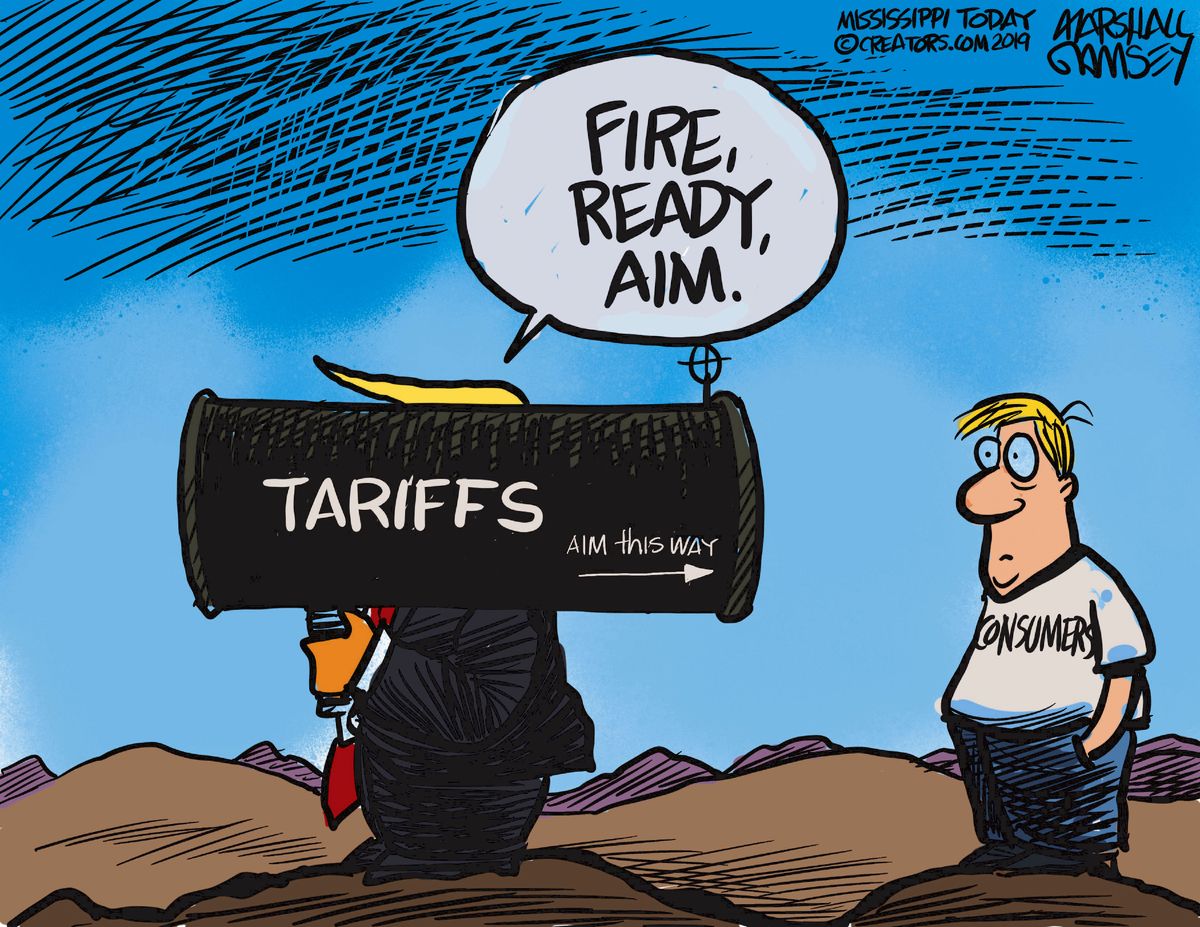

Trumps Tariffs A 16 Billion Hit To Californias Revenue

May 15, 2025

Trumps Tariffs A 16 Billion Hit To Californias Revenue

May 15, 2025 -

Understanding The Countrys New Business Landscape Key Locations And Trends

May 15, 2025

Understanding The Countrys New Business Landscape Key Locations And Trends

May 15, 2025 -

The China Factor Assessing Challenges For Bmw Porsche And Other Automakers

May 15, 2025

The China Factor Assessing Challenges For Bmw Porsche And Other Automakers

May 15, 2025 -

Rethinking Middle Management Their Crucial Contribution To Organizational Growth

May 15, 2025

Rethinking Middle Management Their Crucial Contribution To Organizational Growth

May 15, 2025