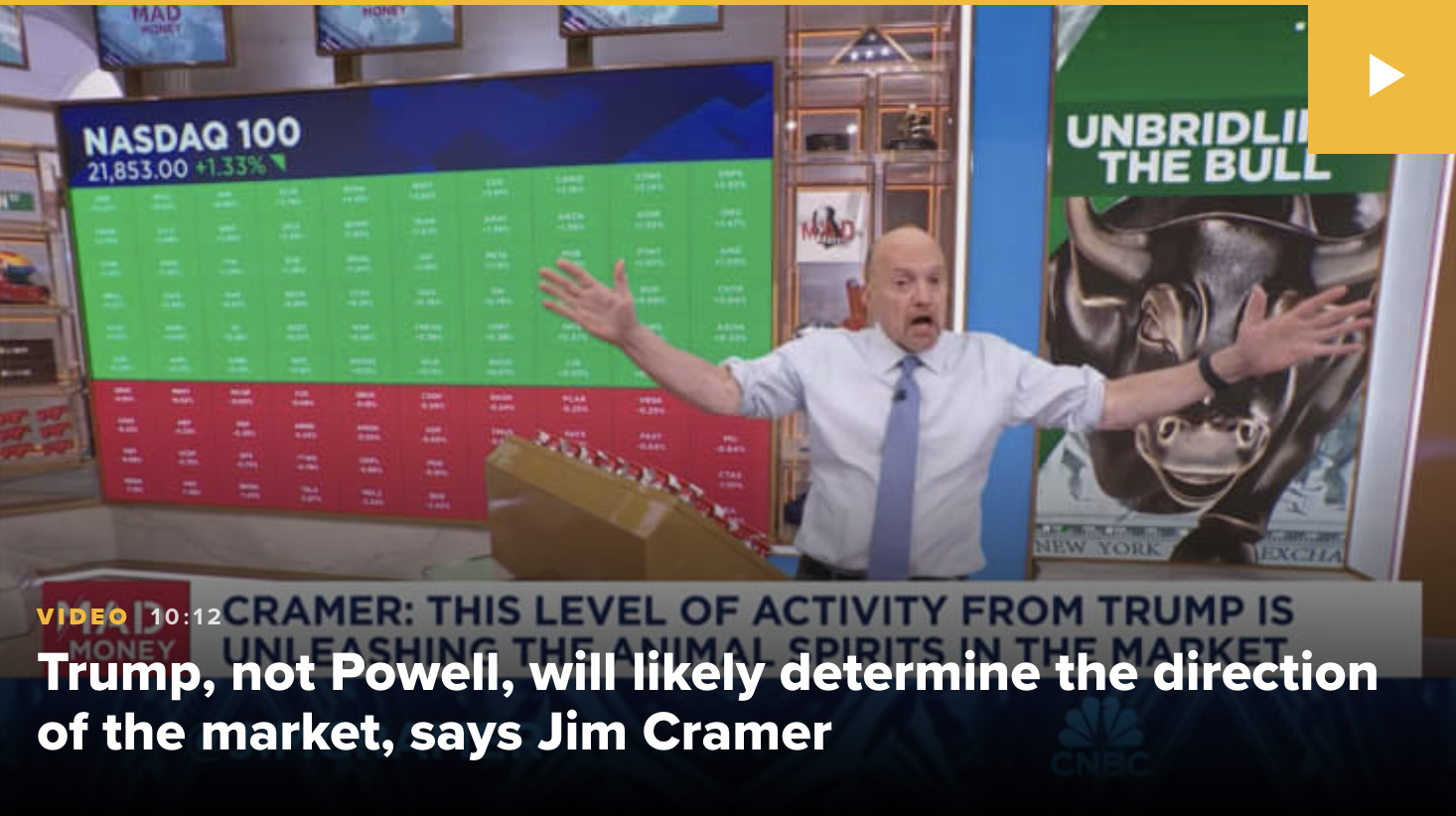

Jim Cramer On CoreWeave (CRWV): A Contrarian View On AI Infrastructure's Future

Table of Contents

Cramer's Stance on CoreWeave (CRWV) and its Implications

Pinpointing Jim Cramer's exact and consistent stance on CoreWeave (CRWV) across all his appearances is difficult, as his opinions often evolve with market shifts. However, by analyzing his various commentary on similar companies and the broader AI infrastructure sector, we can infer his likely perspective. While specific quotes directly referencing CRWV may be limited in readily available transcripts, his broader commentary on cloud computing, GPU-accelerated computing, and the competitive landscape of AI infrastructure provides valuable insight.

His reasoning likely stems from his assessment of the risks and rewards within the rapidly evolving AI market. He may express caution due to the volatility inherent in a burgeoning sector, emphasizing the need for careful due diligence. Conversely, the immense potential of AI could also lead him to advocate for exposure to companies like CoreWeave.

- Specific quotes from Cramer regarding CRWV (if available): [Insert any found quotes here, properly cited].

- Cramer's overall market sentiment: [Describe the general market outlook expressed by Cramer during his commentary on related topics].

- Financial metrics or market trends Cramer referenced: [Mention any specific metrics, like revenue growth projections or market capitalization, that might have influenced Cramer's perspective].

CoreWeave (CRWV): A Deep Dive into the Company and its Business Model

CoreWeave (CRWV) is a leading provider of cloud-based GPU computing infrastructure, specifically targeting the high-performance computing (HPC) demands of the burgeoning AI industry. Their business model centers around offering scalable and cost-effective access to powerful graphics processing units (GPUs), crucial for training and deploying complex AI models. This positions them directly within the heart of the AI infrastructure ecosystem.

CoreWeave’s competitive advantage lies in its ability to provide clients with on-demand access to a massive pool of GPUs, often leveraging repurposed gaming hardware to offer a more cost-effective solution than traditional cloud providers. However, it also faces challenges, including competition from established cloud giants like AWS, Google Cloud, and Microsoft Azure, each actively expanding their AI infrastructure offerings.

- Key offerings and technologies: High-performance GPU cloud computing, scalable infrastructure, specialized software tools for AI workloads.

- Competitive advantages: Cost-effective GPU access, scalable infrastructure, focus on the AI market niche.

- Potential risks and challenges: Intense competition, dependence on GPU technology advancements, potential for economic downturns impacting demand.

Analyzing the Contrarian Perspective: Is Cramer Right About CoreWeave (CRWV)?

Whether Cramer's perspective on CoreWeave (CRWV) is ultimately "right" is a complex question. While his skepticism regarding the risks of investing in volatile growth sectors is understandable, ignoring the significant potential of the AI infrastructure market would be equally unwise. The counterargument rests on the massive growth expected in AI, making CoreWeave a potentially lucrative investment despite the risks.

Independent analysis suggests significant potential for CoreWeave, driven by increasing demand for GPU-accelerated computing and the company's innovative approach to providing cost-effective solutions. However, the competitive landscape remains a considerable risk.

- Potential risks of investing in CRWV: Market volatility, intense competition from established players, potential for technological disruption.

- Potential rewards of investing in CRWV: High growth potential in the rapidly expanding AI market, first-mover advantage in certain niches, potential for strategic partnerships.

- Alternative perspectives: Some analysts might view CRWV as an overvalued growth stock, while others may see it as a promising long-term investment in the AI revolution.

The Broader Context: AI Infrastructure and Future Growth Potential

The AI infrastructure market is poised for explosive growth. The increasing adoption of AI across diverse sectors, combined with advancements in machine learning and deep learning algorithms, fuels this demand. This creates a fertile ground for companies like CoreWeave (CRWV) to flourish.

CoreWeave plays a vital role in providing the computational horsepower necessary to train and deploy cutting-edge AI models. Its contribution to the broader ecosystem is essential for the continued advancement and accessibility of AI technologies.

- Market size projections for AI infrastructure: [Insert market size projections from reputable sources, properly cited].

- Key technological advancements driving market growth: Advancements in GPU technology, improved deep learning algorithms, increased data availability.

- Major players in the AI infrastructure space: AWS, Google Cloud, Microsoft Azure, NVIDIA, CoreWeave, etc.

Conclusion: Jim Cramer, CoreWeave (CRWV), and Your Investment Strategy

Jim Cramer's perspective on CoreWeave (CRWV), while not explicitly defined in readily available sources, likely reflects a cautious optimism, balancing the risks inherent in the AI market with the significant potential for growth. This article presented counterarguments, highlighting the potential rewards alongside the challenges. Investing in CoreWeave (CRWV) or any AI infrastructure company requires thorough due diligence. The potential for high returns comes with considerable risk.

To make informed investment decisions, learn more about CoreWeave (CRWV) by consulting financial reports, analyst reviews, and independent market research. Assess the risks and rewards of investing in CRWV carefully, considering your overall investment strategy and risk tolerance. Consider CoreWeave (CRWV) as part of a diversified portfolio only after careful consideration of all available information.

Featured Posts

-

Appraisal On Antiques Roadshow Results In Jail Sentences

May 22, 2025

Appraisal On Antiques Roadshow Results In Jail Sentences

May 22, 2025 -

Pelatih Liverpool Yang Pernah Raih Gelar Liga Inggris Sejarah Dan Strategi

May 22, 2025

Pelatih Liverpool Yang Pernah Raih Gelar Liga Inggris Sejarah Dan Strategi

May 22, 2025 -

Get Ready For Spring Streaming Jellystone And Pinata Smashling On Teletoon

May 22, 2025

Get Ready For Spring Streaming Jellystone And Pinata Smashling On Teletoon

May 22, 2025 -

Analyzing The Bruins Offseason Espns Perspective On Franchise Altering Changes

May 22, 2025

Analyzing The Bruins Offseason Espns Perspective On Franchise Altering Changes

May 22, 2025 -

Noumatrouff Mulhouse Echo Du Hellfest

May 22, 2025

Noumatrouff Mulhouse Echo Du Hellfest

May 22, 2025

Latest Posts

-

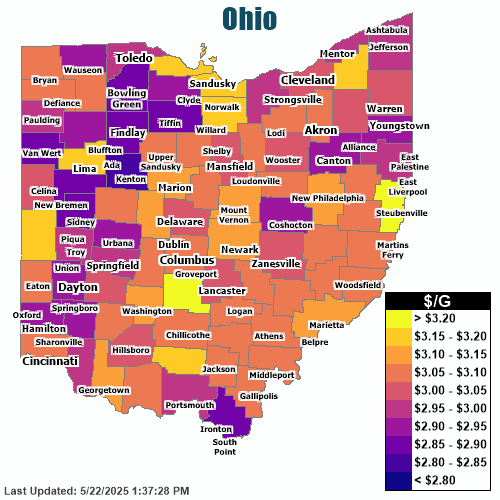

Wide Gas Price Range In Columbus 2 83 3 31 Gallon

May 22, 2025

Wide Gas Price Range In Columbus 2 83 3 31 Gallon

May 22, 2025 -

Solve Nyt Wordle 1368 March 18 Hints And The Answer

May 22, 2025

Solve Nyt Wordle 1368 March 18 Hints And The Answer

May 22, 2025 -

Columbus Gas Station Prices Vary By 48 Cents

May 22, 2025

Columbus Gas Station Prices Vary By 48 Cents

May 22, 2025 -

Wordle 367 March 17th Hints Clues And Answer

May 22, 2025

Wordle 367 March 17th Hints Clues And Answer

May 22, 2025 -

Columbus Gas Prices 2 83 To 3 31 Per Gallon

May 22, 2025

Columbus Gas Prices 2 83 To 3 31 Per Gallon

May 22, 2025