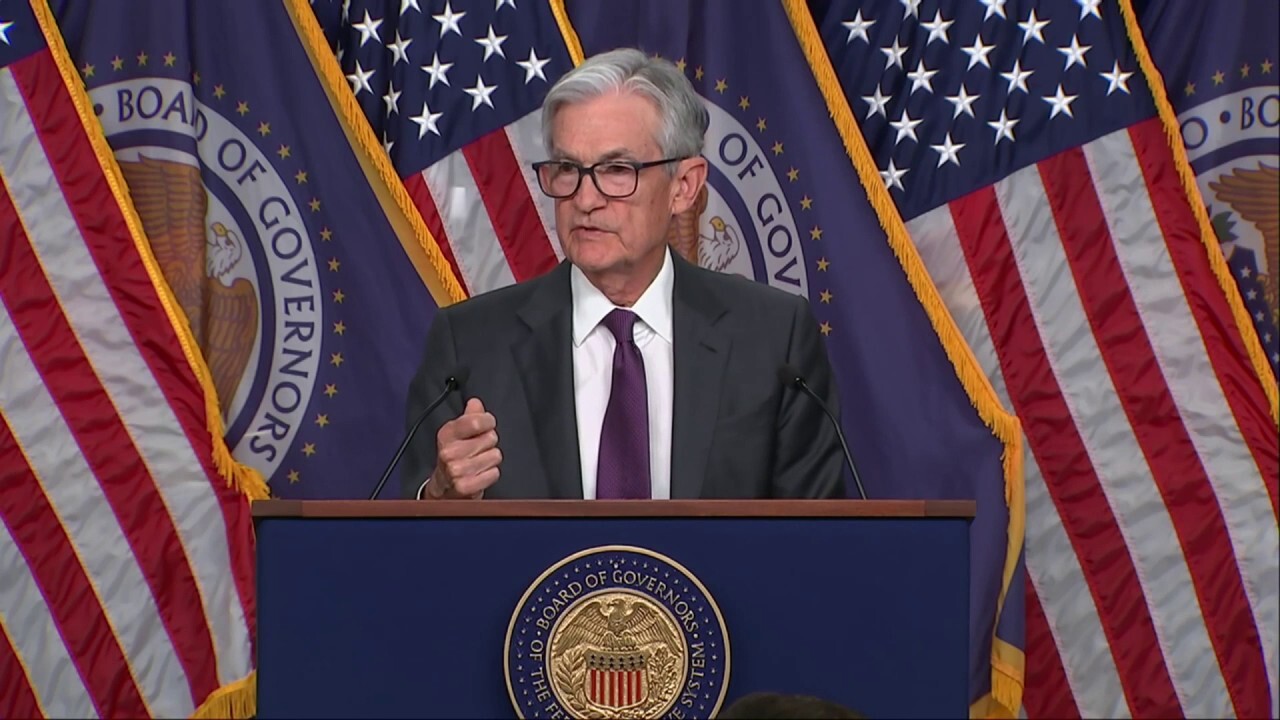

Jerome Powell On Tariffs: A Threat To Fed Goals?

Table of Contents

Tariffs and Inflation: A Balancing Act for the Fed

Tariffs, essentially taxes on imported goods, create a complex challenge for the Federal Reserve. They directly and indirectly influence inflation, forcing the Fed to navigate a delicate balancing act.

The Direct Impact of Tariffs on Consumer Prices

Tariffs immediately increase the cost of imported goods, directly translating into higher prices for consumers. This is a fundamental principle of economics: increased supply costs lead to increased prices.

- Examples: Tariffs on steel and aluminum increased the cost of various manufactured goods, from cars to appliances. Increased tariffs on goods from China led to higher prices for consumer electronics and clothing.

- Data: Inflation rates often show a spike following the implementation of significant tariffs, illustrating the direct impact on consumer prices. Analyzing inflation data before and after tariff implementation clearly shows this correlation.

Indirect Impacts of Tariffs on Supply Chains

The impact of tariffs extends far beyond simple price increases. They disrupt global supply chains, creating shortages and further fueling inflation. Businesses reliant on imported components face increased costs and potential production delays.

- Examples: Tariffs on intermediate goods can disrupt the production of finished products, leading to shortages and higher prices. The complexity of global supply chains means that the impact of tariffs can be felt across multiple industries.

- Ripple Effects: A tariff on a specific component can trigger price increases across a range of downstream products, leading to a widespread inflationary effect across numerous sectors.

The Fed's Response to Tariff-Induced Inflation

The Fed's primary tool to combat inflation is adjusting interest rates. When inflation rises due to tariffs or other factors, the Fed typically raises interest rates to cool down the economy and curb spending. However, this presents a trade-off.

- Past Actions: The Fed has historically responded to inflationary pressures by raising interest rates. The timing and magnitude of these increases depend on the severity and persistence of inflation.

- Balancing Act: Raising interest rates to combat tariff-induced inflation risks slowing economic growth and potentially triggering a recession. The Fed must carefully balance inflation control with maintaining economic expansion.

Tariffs and Economic Growth: Slower Pace, Uncertain Future

Tariffs significantly impact economic growth, creating uncertainty and dampening both consumer and business confidence.

Reduced Consumer Spending and Business Investment

Higher prices caused by tariffs reduce consumer purchasing power, leading to decreased consumer spending. This decrease in demand, coupled with increased uncertainty about future costs, discourages business investment.

- Data: Consumer confidence indices often fall during periods of high tariffs, reflecting consumer concerns about rising prices and economic instability. Similarly, business investment tends to decline due to the uncertainty created by trade disputes and tariffs.

- Impact: Reduced consumer spending and business investment inevitably lead to a slowdown in overall economic growth.

Impact on Global Trade and Economic Interdependence

Tariffs harm global trade flows and disrupt the intricate web of economic interdependence between nations. Retaliatory tariffs from other countries further exacerbate the negative effects.

- Examples: Trade wars, often initiated by imposing tariffs, have historically led to significant disruptions in global trade and economic slowdown in affected countries. The interconnected nature of the global economy means that disruptions in one region can quickly spread.

- Global Slowdown: The uncertainty and reduced trade caused by tariffs can significantly contribute to a global economic slowdown, impacting multiple countries simultaneously.

The Fed's Balancing Act: Growth vs. Inflation

The Fed faces a considerable challenge in stimulating economic growth while simultaneously managing inflation exacerbated by tariffs. Its monetary policy tools must carefully navigate this trade-off.

- Monetary Policy Tools: The Fed might use a variety of tools beyond interest rate adjustments, such as quantitative easing or forward guidance, to try and stimulate economic growth while keeping inflation in check.

- Trade-offs: There are significant trade-offs between economic growth and inflation control. The Fed's decisions involve making difficult choices with potential short-term and long-term consequences.

Jerome Powell's Stance and Public Statements on Tariffs

Chairman Jerome Powell's public statements offer valuable insight into the Fed's perspective on the economic effects of tariffs.

Analyzing Key Speeches and Testimony

Powell's speeches and testimony before Congress consistently highlight the negative economic consequences of tariffs. He frequently underscores the uncertainty and risks they pose to the U.S. economy.

- Key Quotes: Careful analysis of Powell's public statements reveals his concerns about the inflationary and growth-dampening effects of tariffs, often expressed in nuanced yet clear terms. These statements provide valuable context for understanding the Fed's policy response.

- Tone and Emphasis: His public communication often emphasizes the challenges faced by the Fed in managing monetary policy amidst the uncertainty created by trade disputes.

The Fed's Communication Strategy Amidst Trade Uncertainty

Effective communication is crucial for the Fed during times of heightened trade uncertainty. Clear and consistent messaging helps manage market expectations and maintain confidence.

- Communication Strategies: The Fed utilizes various channels, including press conferences, policy statements, and economic forecasts, to communicate its policy decisions and expectations to the public and financial markets.

- Importance of Messaging: Transparent and consistent communication is vital to maintain market confidence and ensure effective monetary policy implementation.

Conclusion

Tariffs pose a significant challenge to the Federal Reserve's ability to achieve its dual mandate of price stability and maximum employment. The complexities of managing monetary policy in the face of external shocks like trade wars are substantial. Jerome Powell's statements consistently highlight the detrimental effects of tariffs on inflation, economic growth, and overall economic stability. The Fed must carefully navigate the trade-offs involved in maintaining price stability while fostering economic growth in the face of tariff-induced uncertainty.

Call to Action: Understanding the ongoing impact of tariffs on the U.S. economy and the Federal Reserve's response is crucial for navigating the current economic climate. Stay informed about Jerome Powell's statements and the Fed's monetary policy decisions to better understand the implications of tariffs on your financial well-being. Continue researching the implications of Jerome Powell on Tariffs to make informed decisions about your investments and financial planning.

Featured Posts

-

Emergency Services Respond To M56 Car Overturn Casualty On Motorway

May 25, 2025

Emergency Services Respond To M56 Car Overturn Casualty On Motorway

May 25, 2025 -

Europe And Bangladesh A Focus On Economic Growth Through Collaboration

May 25, 2025

Europe And Bangladesh A Focus On Economic Growth Through Collaboration

May 25, 2025 -

Cac 40 Index Finishes Week Lower But Weekly Trend Remains Stable

May 25, 2025

Cac 40 Index Finishes Week Lower But Weekly Trend Remains Stable

May 25, 2025 -

Canadian Screen Awards Kiefer Sutherlands Tribute To His Father

May 25, 2025

Canadian Screen Awards Kiefer Sutherlands Tribute To His Father

May 25, 2025 -

Conchita Wurst And Jj Eurovision Village Concert Esc 2025

May 25, 2025

Conchita Wurst And Jj Eurovision Village Concert Esc 2025

May 25, 2025

Latest Posts

-

The Cinematic Glasgow Comparing Martin Compstons Thriller To Los Angeless Film Noir

May 25, 2025

The Cinematic Glasgow Comparing Martin Compstons Thriller To Los Angeless Film Noir

May 25, 2025 -

The Best British Pop Films Of All Time A Critics Choice

May 25, 2025

The Best British Pop Films Of All Time A Critics Choice

May 25, 2025 -

10 Must See British Pop Films From Classics To Modern Hits

May 25, 2025

10 Must See British Pop Films From Classics To Modern Hits

May 25, 2025 -

10 Great British Pop Films A Definitive List

May 25, 2025

10 Great British Pop Films A Definitive List

May 25, 2025 -

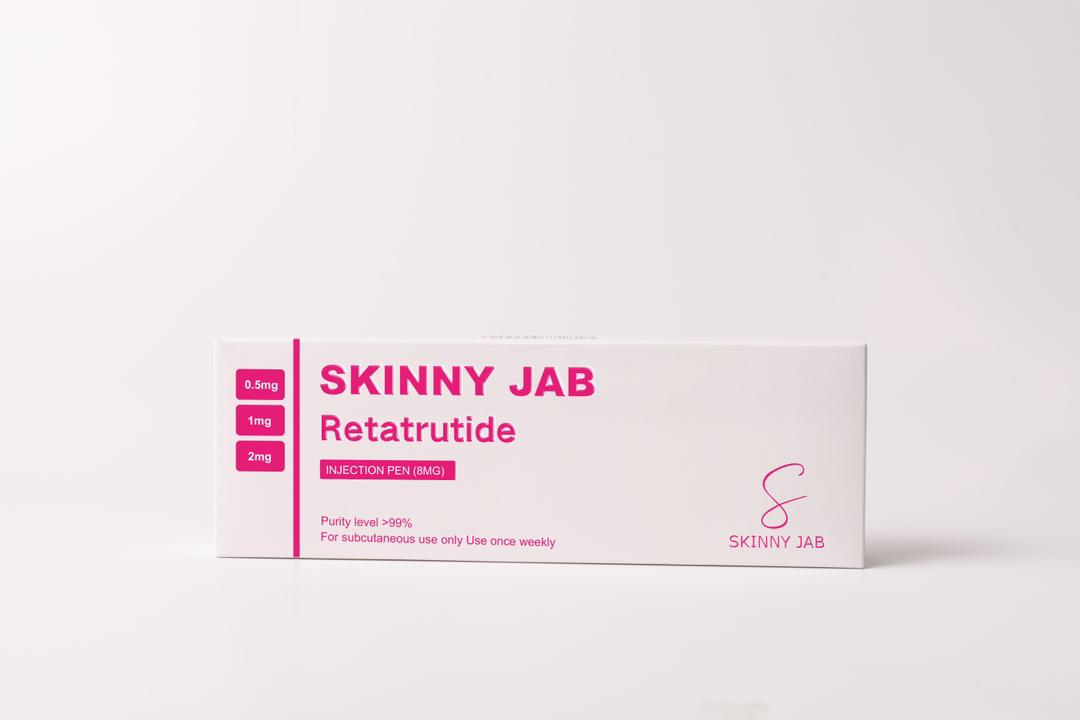

Review Of Todays Top Streaming And Tv The Skinny Jab Revolution Black 47 And Roosters

May 25, 2025

Review Of Todays Top Streaming And Tv The Skinny Jab Revolution Black 47 And Roosters

May 25, 2025