Japan's Central Bank Lowers Economic Growth Projection Due To Trade Tensions

Table of Contents

Weakening Global Demand Impacts Japanese Exports

Decreased global demand, largely fueled by ongoing trade wars and protectionist measures, is directly impacting Japan's export-oriented industries. This decline significantly affects Japan's GDP growth and overall economic health. The reduced appetite for Japanese goods in key markets is causing a ripple effect throughout the economy.

- Decline in automotive exports to the US and China: The ongoing trade friction between the US and China has significantly impacted Japanese car manufacturers, who export heavily to both markets. Reduced consumer spending and increased tariffs have led to a noticeable drop in sales.

- Reduced demand for electronics and machinery: Japanese companies renowned for their advanced electronics and machinery are also experiencing decreased orders from international clients. Uncertainty in the global market is making businesses hesitant to invest in new equipment and technology.

- Impact on small and medium-sized enterprises (SMEs) heavily reliant on exports: SMEs, forming the backbone of the Japanese economy, are particularly vulnerable to export slowdowns. Many lack the resources to diversify their markets or weather prolonged periods of reduced demand, threatening job security and economic stability.

Reports indicate a [insert percentage]% decline in exports during [insert period], with the technology and manufacturing sectors being the hardest hit. This weakening export performance is a major contributor to the downward revision of Japan's economic growth projection.

Supply Chain Disruptions and Increased Costs

Trade tensions and the resulting tariffs are causing significant disruptions to global supply chains, impacting Japanese businesses at every stage of production. This instability adds another layer of complexity to the already challenging economic environment.

- Increased costs for raw materials and components: Tariffs and trade barriers increase the cost of importing raw materials and components necessary for manufacturing, leading to higher production costs for Japanese companies.

- Delays in production and delivery schedules: Supply chain disruptions cause delays in receiving essential materials, impacting production schedules and potentially leading to missed deadlines and lost sales.

- Uncertainty affecting investment decisions by businesses: The instability caused by trade tensions creates uncertainty, making businesses hesitant to commit to long-term investments, hindering future economic expansion.

These disruptions translate directly into higher production costs and potentially lower profits, contributing to the overall slowdown in Japan's economic growth and impacting investor confidence.

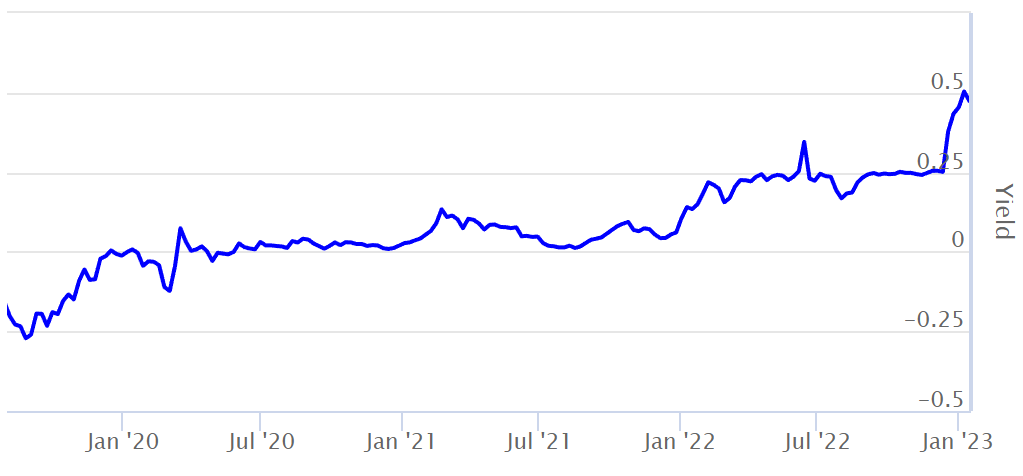

The BOJ's Response and Policy Implications

In response to the weakening economic outlook, the BOJ has revised its economic growth projection downward by [insert percentage points]. This reflects the bank's growing concerns about the impact of global trade tensions.

- Specific percentage point reduction in the growth forecast: The BOJ has lowered its forecast for [insert year] GDP growth from [previous forecast]% to [revised forecast]%, clearly indicating the severity of the situation.

- Potential adjustments to monetary policy in response to the weakened outlook: The BOJ might consider further monetary easing measures, such as lowering interest rates or expanding its quantitative easing program, to stimulate economic activity.

- Discussion of the BOJ's concerns about inflation and deflationary pressures: The BOJ is concerned that the economic slowdown could lead to deflationary pressures, which could further hamper economic growth.

These actions have significant implications for businesses and consumers in Japan, affecting investment decisions, borrowing costs, and overall consumer confidence. The BOJ's response will be crucial in mitigating the negative effects of the slowing economy.

Potential for Further Downgrades

The possibility of further revisions to Japan's economic growth forecast remains high, heavily dependent on the evolution of global trade tensions.

- Escalation of trade disputes: A further escalation of trade disputes could lead to a more significant downward revision of the growth forecast, potentially triggering more drastic policy responses from the BOJ.

- De-escalation or resolution: Conversely, a de-escalation or resolution of trade disputes could lead to an upward revision, boosting investor confidence and stimulating economic growth.

- Potential implications for the Japanese Yen and the global economy: Changes in Japan's economic outlook will impact the value of the Japanese Yen and could have wider repercussions for the global economy, given Japan's significant role in international trade.

Impact on Domestic Consumption and Investment

The slowdown in exports is not limited to the export sector; it has a significant ripple effect on domestic consumption and investment within Japan.

- Decreased consumer confidence: Reduced export performance can lead to job losses and wage stagnation, impacting consumer confidence and spending.

- Reduced business investment due to uncertainty: Uncertainty about the future economic outlook discourages businesses from investing in expansion or new projects, slowing down capital formation.

- Potential impact on employment levels: Reduced economic activity can lead to job losses, particularly in export-oriented sectors and related industries, increasing unemployment and potentially leading to social unrest.

These factors contribute to a further slowdown in Japan's economy, creating a vicious cycle of reduced demand, lower investment, and weaker growth.

Conclusion

The downward revision of Japan's economic growth projection by the BOJ highlights the substantial impact of global trade tensions on the Japanese economy. Weakening export demand, supply chain disruptions, and pervasive uncertainty are all contributing to this slowdown. The potential for further downgrades remains, directly tied to the resolution of ongoing trade disputes. Closely monitoring Japan's economic growth and the BOJ's policy responses is crucial for understanding the future trajectory of this vital global economy. Stay informed about further developments concerning Japan's economic growth to make informed financial and investment decisions.

Featured Posts

-

Reform Uk Internal Conflict Understanding The Fierce Row

May 02, 2025

Reform Uk Internal Conflict Understanding The Fierce Row

May 02, 2025 -

Heartbreak In The Community Remembering A 10 Year Old Taken Too Soon

May 02, 2025

Heartbreak In The Community Remembering A 10 Year Old Taken Too Soon

May 02, 2025 -

Zasto Se Udala Prica O Prvoj Ljubavi Zdravka Colica

May 02, 2025

Zasto Se Udala Prica O Prvoj Ljubavi Zdravka Colica

May 02, 2025 -

Finom Es Egeszseges Fedezze Fel A Mecsek Baromfi Kft Kme Vedjegyes Baromfihusokat

May 02, 2025

Finom Es Egeszseges Fedezze Fel A Mecsek Baromfi Kft Kme Vedjegyes Baromfihusokat

May 02, 2025 -

Did Christina Aguilera Go Too Far With Photo Editing A Look At The Latest Photos

May 02, 2025

Did Christina Aguilera Go Too Far With Photo Editing A Look At The Latest Photos

May 02, 2025