Japanese Assets: Record Inflows Signal US Capital Flight

Table of Contents

Why Investors are Choosing Japanese Assets:

Several compelling reasons explain the recent surge in investment directed towards Japanese assets. Let's delve into the key factors:

Safe-Haven Appeal of the Japanese Yen:

The Japanese Yen (JPY) has long held a reputation as a safe-haven currency. During periods of global economic uncertainty and geopolitical instability, investors often flock to the Yen, seeking stability and preserving capital. This is particularly true given the relatively low volatility of the Yen compared to other major currencies.

- Geopolitical instability: Rising global tensions and unpredictable geopolitical events often lead investors to seek refuge in stable, low-risk assets. Japanese government bonds (JGBs), for instance, benefit immensely from this "flight to safety."

- Low-risk investment options: The Yen's stability makes Japanese government bonds and other low-risk assets incredibly attractive to risk-averse investors seeking to minimize potential losses. This contributes significantly to the increasing demand for Japanese assets.

Attractive Interest Rates and Yields:

While interest rates in many major economies remain low or even negative, Japan presents a comparatively attractive yield environment for certain asset classes. This discrepancy creates an incentive for global investors to allocate capital to Japanese assets.

- Interest rate differentials: Comparing Japanese interest rates with those in the US, Europe, or the UK reveals noticeable differences, making Japanese assets more appealing for yield-seeking investors.

- Bank of Japan's monetary policy: The Bank of Japan's monetary policies, while evolving, continue to influence investor sentiment towards Japanese assets and the overall attractiveness of the JPY. Analyzing these policies is critical for understanding the current investment climate.

Strong Japanese Corporate Performance:

Beyond the macroeconomic environment, the strong performance of Japanese corporations across various sectors is a major draw for foreign investors. Japanese companies are increasingly showcasing innovation and competitiveness on the global stage.

- Growth potential: Several leading Japanese companies across technology, automotive, and consumer goods sectors demonstrate robust growth potential, attracting significant investment.

- Innovation and technology: The appeal of Japanese innovation, particularly in technology sectors like robotics and electronics, is a major factor driving foreign direct investment (FDI) into Japanese equities.

The Implications of US Capital Flight:

The capital flight from the US is not an isolated event; it reflects broader concerns about the American economy and its future prospects. Understanding these implications is crucial for comprehending the global shift in investment flows.

Economic Weakness in the US:

Several factors contribute to the capital outflow from the US, raising concerns about its long-term economic health.

- Inflationary pressures: Persistent high inflation erodes purchasing power and reduces the attractiveness of US dollar-denominated assets.

- Recessionary fears: Growing concerns about a potential US recession further discourage investment and encourage capital flight to perceived safer havens.

- Political risk: Political instability and uncertainty can also contribute to investor apprehension and fuel the shift towards more stable economies.

Shifting Global Economic Landscape:

The capital shift from the US towards Japanese assets is part of a larger, evolving global economic landscape.

- Global capital flows: This trend underscores the increasing dynamism of global capital flows and the need for diversified investment strategies.

- Economic diversification: Investors are increasingly diversifying their portfolios to mitigate risks associated with investing heavily in any single economy.

- Geopolitical risks: The interplay of geopolitical factors and economic uncertainties is significantly influencing global capital flows.

Japanese Assets – A Growing Investment Destination?

The record inflows into Japanese assets are driven by a confluence of factors: the safe-haven appeal of the Japanese Yen, attractive interest rates and yields, and the strong performance of Japanese corporations. Conversely, capital flight from the US reflects concerns about economic weakness, inflationary pressures, and political risks. Japanese assets are increasingly seen as a stable and potentially lucrative investment opportunity, offering diversification and relative safety in uncertain times.

To successfully navigate today's complex investment landscape, it's crucial to understand these trends and explore the potential benefits of incorporating Japanese assets into your portfolio. Consider conducting further research into specific investment opportunities in Japanese equities, bonds, and other asset classes. Diversify your investment portfolio by including Japanese assets to potentially mitigate risk and capitalize on growth opportunities. [Link to further resources/investment guides]

Featured Posts

-

Europes Premier Shopping 10 Cities To Explore

Apr 25, 2025

Europes Premier Shopping 10 Cities To Explore

Apr 25, 2025 -

Jack O Connells Casting What It Means For Godzilla X Kong 3

Apr 25, 2025

Jack O Connells Casting What It Means For Godzilla X Kong 3

Apr 25, 2025 -

The Impact Of Makeup On Skin Benefits Risks And Best Practices For Healthy Skin

Apr 25, 2025

The Impact Of Makeup On Skin Benefits Risks And Best Practices For Healthy Skin

Apr 25, 2025 -

Trumps Shift In Tone Triggers Gold Price Increase

Apr 25, 2025

Trumps Shift In Tone Triggers Gold Price Increase

Apr 25, 2025 -

Tariff Hikes Create Challenges For Montreal Guitar Production

Apr 25, 2025

Tariff Hikes Create Challenges For Montreal Guitar Production

Apr 25, 2025

Latest Posts

-

The Elizabeth Line Challenges And Opportunities For Wheelchair Accessibility

May 10, 2025

The Elizabeth Line Challenges And Opportunities For Wheelchair Accessibility

May 10, 2025 -

Wynne Evans Removed From Go Compare Ads Amidst Strictly Controversy

May 10, 2025

Wynne Evans Removed From Go Compare Ads Amidst Strictly Controversy

May 10, 2025 -

Strictly Scandal Leads To Wynne Evanss Go Compare Advert Departure

May 10, 2025

Strictly Scandal Leads To Wynne Evanss Go Compare Advert Departure

May 10, 2025 -

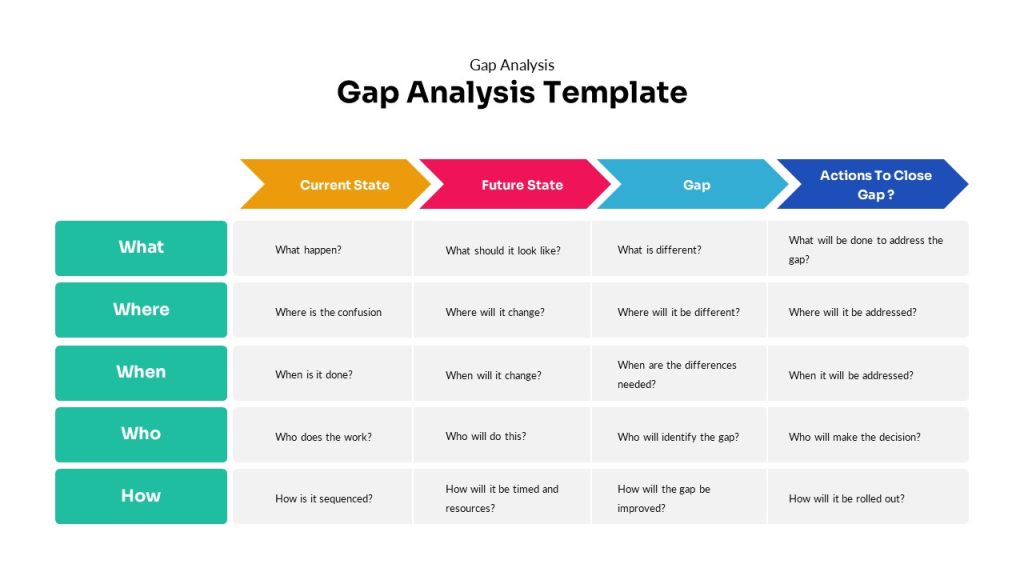

Elizabeth Line Gap Analysis And Solutions For Wheelchair Users

May 10, 2025

Elizabeth Line Gap Analysis And Solutions For Wheelchair Users

May 10, 2025 -

Accessibility Audit Wheelchair Access On The Elizabeth Line

May 10, 2025

Accessibility Audit Wheelchair Access On The Elizabeth Line

May 10, 2025