Ivanhoe's Congo Copper Mine: Production Guidance Withdrawn

Table of Contents

Reasons Behind the Withdrawn Production Guidance

The withdrawal of production guidance for the Kamoa-Kakula copper mine signals a confluence of operational and logistical challenges. While Ivanhoe Mines hasn't explicitly detailed all contributing factors, several plausible explanations warrant consideration:

-

Operational Challenges: Unexpected geological conditions can significantly impact mining operations. Harder-than-anticipated rock formations or the discovery of unforeseen water ingress could necessitate adjustments to mining plans, impacting extraction rates and timelines. Equipment malfunctions and the need for unplanned maintenance also contribute to production slowdowns.

-

Infrastructure Limitations: The DRC's infrastructure presents ongoing hurdles. Inadequate power supply, unreliable transportation networks (both for transporting mined copper concentrate and for supplying necessary materials), and limited access to skilled labor all directly impact production capacity and efficiency. These limitations represent significant bottlenecks.

-

Logistical Issues: The transportation of copper concentrate from the mine to processing facilities and ultimately to international markets can be a complex and time-consuming process. Delays in this supply chain due to poor road conditions, bureaucratic hurdles, or port congestion can severely constrain production output and increase costs.

-

Workforce Issues: Skill shortages or labor disputes can disrupt operations significantly. Securing and retaining a skilled workforce in a remote location like the DRC poses ongoing challenges, and labor relations can be volatile, leading to costly delays.

-

Delays and Cost Overruns: The combination of the above factors inevitably leads to delays and cost overruns, forcing the company to reassess its production projections and withdraw its previous guidance.

-

External Factors: Political instability or changes in DRC mining regulations can also create uncertainty and impact production. Navigating the regulatory landscape in developing countries adds another layer of complexity to mining projects.

Impact on Copper Prices and Market Sentiment

The withdrawn production guidance from Kamoa-Kakula has immediate and potentially long-term implications for copper prices and market sentiment:

-

Copper Price Volatility: Reduced supply from one of the world's largest copper mines will almost certainly create upward pressure on copper prices, at least in the short term. This volatility could impact various industries relying on copper as a raw material.

-

Global Market Dynamics: Kamoa-Kakula's contribution to global copper supply is substantial. The reduction in output will tighten the global market and potentially exacerbate existing supply chain concerns. This could lead to further price increases and impact manufacturing sectors worldwide.

-

Investor Confidence: News of withdrawn guidance often negatively impacts investor confidence. This is especially true for companies operating in challenging geopolitical environments like the DRC. Investors may reconsider their positions or become hesitant about future investments in Ivanhoe Mines or other similar projects.

-

Market Analysis: Market analysts are closely monitoring the situation, adjusting their price forecasts and assessing the broader implications for the copper sector. The impact on investor confidence and future investment decisions will be a key area of analysis.

Ivanhoe Mines' Response and Future Outlook

Ivanhoe Mines has acknowledged the challenges and issued a statement outlining their plans to address the situation:

-

Company Statement: The official statement likely highlights the factors contributing to the withdrawn guidance and emphasizes the company's commitment to resolving the issues. This statement will shape market perceptions of the company's competence and transparency.

-

Revised Guidance and Future Plans: The company will likely provide a revised production timeline and guidance once the underlying challenges are addressed. Investors will keenly await this update to assess the potential long-term impact.

-

Exploration Updates: Ivanhoe Mines may also provide updates on exploration activities at Kamoa-Kakula, highlighting the potential for expanding resources and supporting future production growth.

-

Corporate Strategy: The incident could lead to a reassessment of Ivanhoe Mines’ operational strategies, emphasizing improved risk management, infrastructure development, and potentially technology adoption to mitigate future production disruptions.

Potential Mitigation Strategies

Ivanhoe Mines needs to implement comprehensive mitigation strategies to overcome the challenges and meet future production targets:

-

Risk Management: A robust risk management framework is essential, incorporating measures to anticipate and mitigate potential geological, logistical, and operational challenges.

-

Contingency Plans: Develop well-defined contingency plans to address unforeseen circumstances, enabling faster responses and minimizing downtime.

-

Investment in Infrastructure: Significant investment in upgrading power supply, transportation networks, and other crucial infrastructure is paramount to enhance operational efficiency.

-

Technological Advancements: Adopting advanced mining technologies can improve efficiency, optimize resource extraction, and minimize environmental impact.

Conclusion

The withdrawal of production guidance for Ivanhoe Mines' Congo copper mine highlights the significant challenges inherent in large-scale mining operations in complex environments. While the reasons behind the decision remain partly unclear, the impact on copper prices and investor sentiment is undeniable. The company’s response and its ability to implement effective mitigation strategies will be crucial in determining the long-term outlook for Kamoa-Kakula and Ivanhoe Mines' position within the global copper market. The uncertainty surrounding the future production of this vital Congo copper mine underscores the need for careful monitoring of the situation. Stay informed about further developments concerning Ivanhoe Mines’ Congo copper mine operations by following Ivanhoe Mines' official announcements and industry news to stay updated on the evolving situation regarding Ivanhoe Mines Congo copper production and future guidance.

Featured Posts

-

South Korea Presidential Election Meet The Leading Candidates And Their Policies

May 28, 2025

South Korea Presidential Election Meet The Leading Candidates And Their Policies

May 28, 2025 -

Gyoekeres Atigazolas Az Arsenalhoz Golok Teljesitmenyelemzes

May 28, 2025

Gyoekeres Atigazolas Az Arsenalhoz Golok Teljesitmenyelemzes

May 28, 2025 -

Mundial De Atletismo En Pista Cubierta Nanjing 2023 La Seleccion Espanola

May 28, 2025

Mundial De Atletismo En Pista Cubierta Nanjing 2023 La Seleccion Espanola

May 28, 2025 -

Jadwal Kapal Pelni Km Lambelu Terbaru Hingga 25 Juni 2025 Nunukan Makassar

May 28, 2025

Jadwal Kapal Pelni Km Lambelu Terbaru Hingga 25 Juni 2025 Nunukan Makassar

May 28, 2025 -

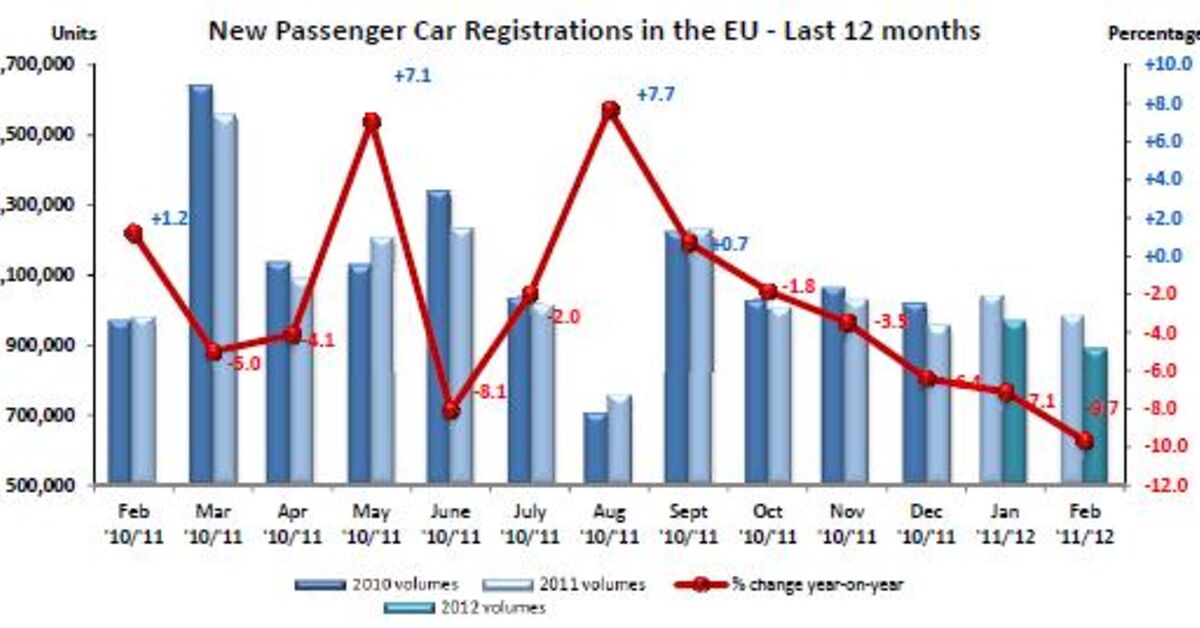

Weakening Economy Leads To Drop In European Car Sales Figures

May 28, 2025

Weakening Economy Leads To Drop In European Car Sales Figures

May 28, 2025