Is XRP's 400% 3-Month Rally A Buying Opportunity?

Table of Contents

Analyzing XRP's Recent Price Surge

The dramatic increase in XRP's price necessitates a thorough examination of both technical and fundamental factors.

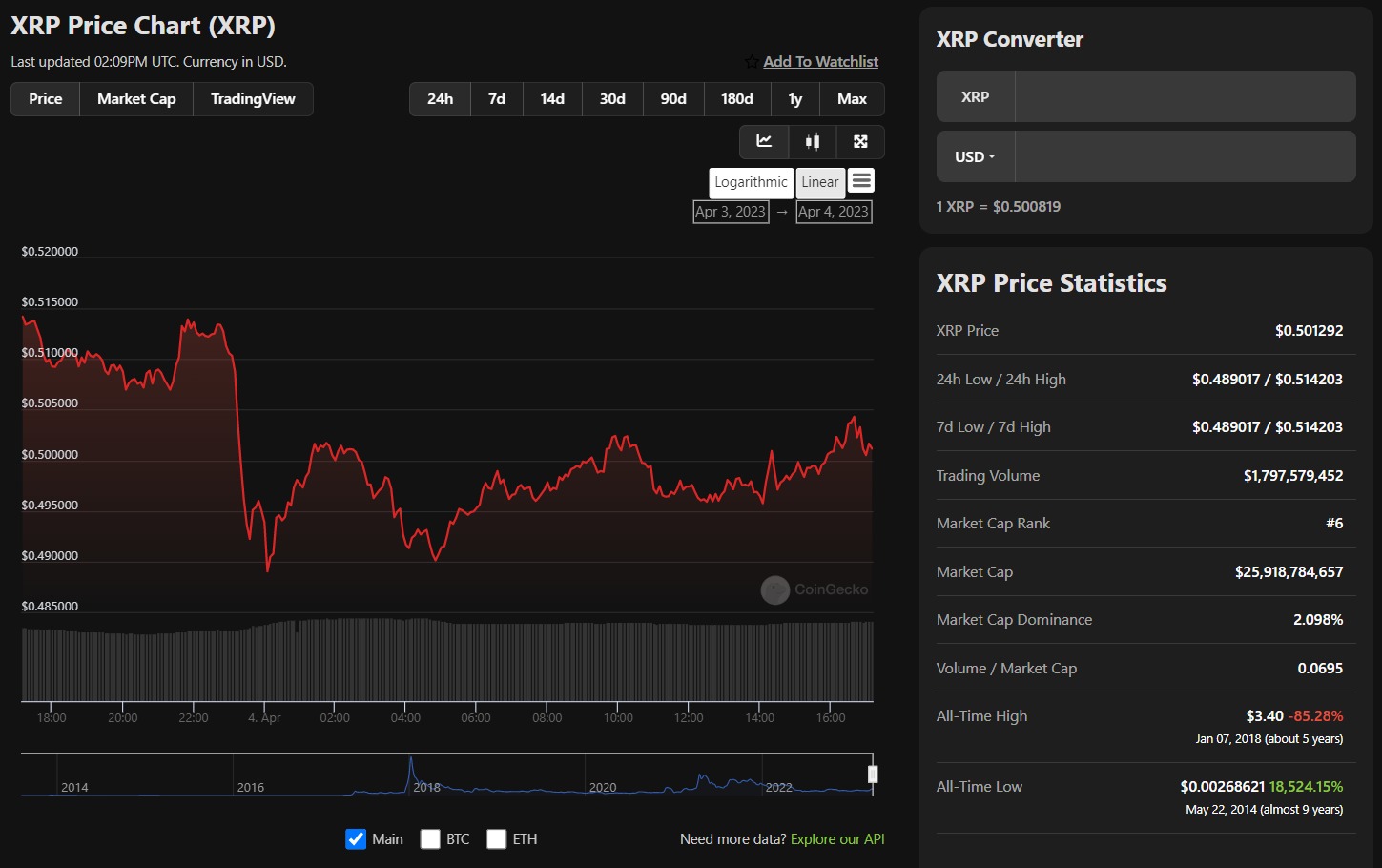

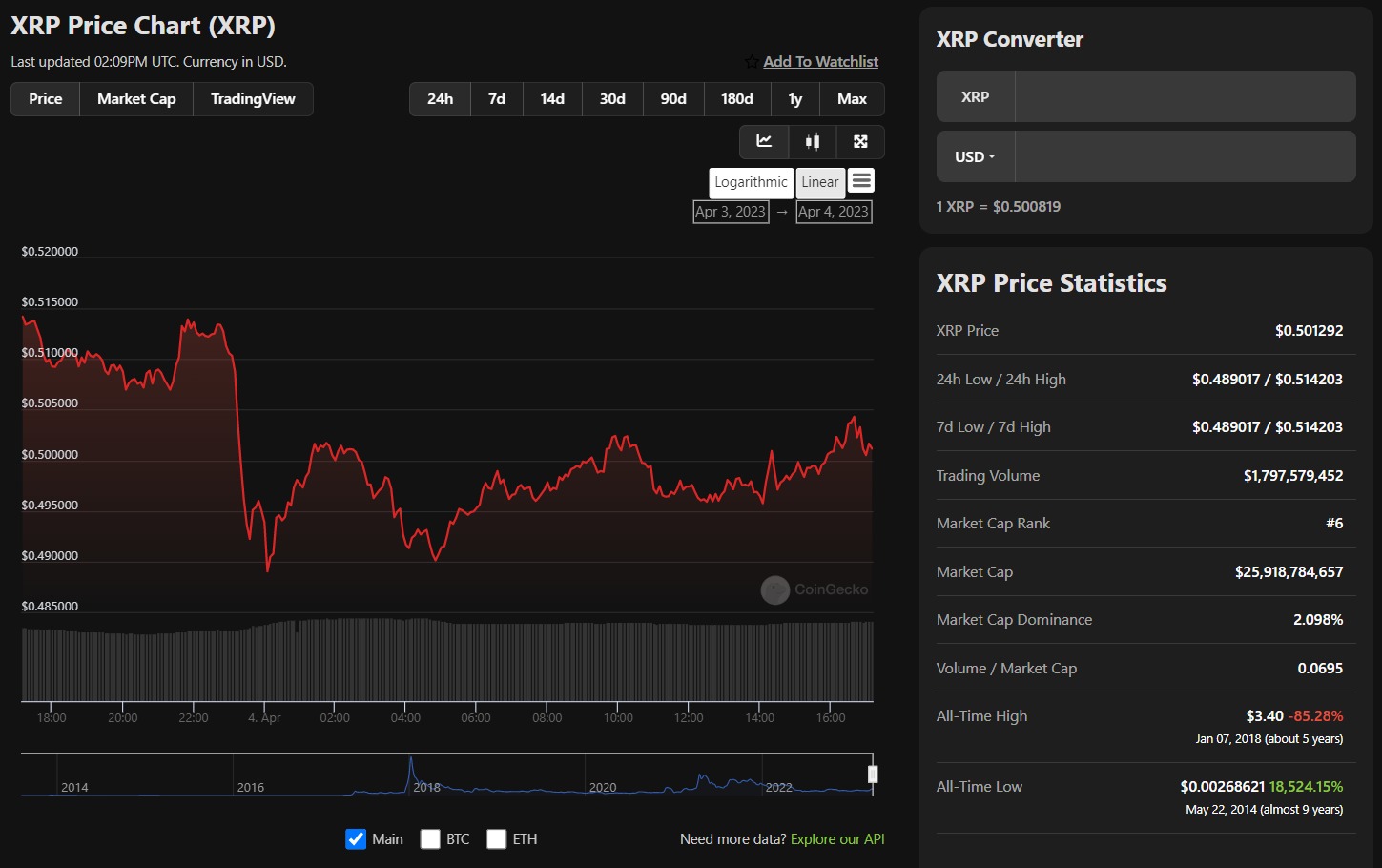

Technical Analysis of XRP's Chart

Analyzing XRP's chart reveals a steep upward trajectory. We see significant increases in trading volume accompanying these price rises, suggesting strong buying pressure. However, identifying support and resistance levels is crucial. While current support levels appear strong, potential resistance levels could hinder further price increases. Observing key indicators like the Relative Strength Index (RSI) and Moving Averages (MAs) can provide further insight into the potential for continued growth or an upcoming correction. (Insert chart showing XRP price action, support/resistance levels, and relevant indicators here.) Understanding these technical aspects is crucial for any XRP investment strategy.

- Key Support Levels: (Identify specific price points from the chart)

- Key Resistance Levels: (Identify specific price points from the chart)

- Trading Volume Analysis: (Explain observations from trading volume data)

- RSI & MA Indicators: (Explain the readings and their implications)

Fundamental Factors Influencing XRP's Price

Beyond technical analysis, several fundamental factors contribute to XRP's price movement:

- Ripple Lawsuit: The ongoing legal battle between Ripple and the SEC has significantly impacted XRP's price. Positive developments in the case often lead to price increases, while negative news can trigger sell-offs. A positive outcome could dramatically boost XRP's value.

- Institutional Adoption: Increasing adoption of XRP by financial institutions for cross-border payments is a key bullish factor. Its speed and low transaction costs make it attractive for global transactions.

- Cryptocurrency Market Trends: XRP's price is also influenced by the overall cryptocurrency market. A bullish market generally benefits XRP, while a bearish market can lead to significant price drops.

- Regulatory Landscape: Regulatory clarity or uncertainty surrounding XRP significantly impacts its price. Favorable regulations could drive adoption and price appreciation, whereas stricter regulations could hinder growth.

Assessing the Risks Associated with Investing in XRP

Despite the recent surge, investing in XRP carries significant risks:

Volatility and Price Fluctuations

Cryptocurrencies are inherently volatile, and XRP is no exception. Its price can fluctuate dramatically in short periods, leading to substantial gains or losses. Investors need a high-risk tolerance to navigate these price swings.

- High Volatility: Emphasize the potential for sharp price drops.

- Risk Tolerance: Stress the importance of only investing what you can afford to lose.

Regulatory Uncertainty

The regulatory landscape surrounding XRP remains uncertain. The SEC's lawsuit casts a long shadow, and future regulatory actions could significantly impact XRP's price and even its legality in certain jurisdictions. This uncertainty presents a major risk for investors.

- SEC Lawsuit Outcome: Discuss the various potential outcomes and their impacts.

- Future Regulatory Actions: Highlight the possibility of further regulations.

Market Sentiment and Speculation

XRP's price is heavily influenced by market sentiment and speculation. Periods of hype can lead to rapid price increases, often followed by sharp corrections. Investing based solely on hype is extremely risky.

- FOMO (Fear Of Missing Out): Warn against making impulsive investment decisions driven by fear of missing out.

- Market Manipulation: Acknowledge the possibility of market manipulation influencing price.

Comparing XRP to Other Cryptocurrencies

To gain a better perspective on XRP's potential, let's compare it to other leading cryptocurrencies:

XRP vs. Bitcoin (BTC)

Bitcoin, the largest cryptocurrency by market capitalization, boasts a more established track record and wider adoption. While XRP offers faster transaction speeds and lower fees, Bitcoin's dominance and established position provide greater stability, albeit with lower potential for exponential growth.

- Market Capitalization: Compare the market caps of XRP and BTC.

- Use Cases: Highlight the differences in their functionalities and target markets.

XRP vs. Ethereum (ETH)

Ethereum, known for its smart contract capabilities, provides a different type of value proposition compared to XRP. While both play roles in the decentralized finance (DeFi) space, Ethereum's broader ecosystem and smart contract functionality create distinct investment opportunities and risks.

- Technological Differences: Explain the differences in their underlying technologies.

- Market Positions: Compare their current market positions and potential future growth.

Developing an Informed Investment Strategy

Investing in XRP, or any cryptocurrency, requires a well-defined strategy:

Diversification and Risk Management

Diversifying your investment portfolio across different asset classes, including both cryptocurrencies and traditional investments, is crucial to manage risk. Don't put all your eggs in one basket.

- Asset Allocation: Emphasize the benefits of spreading investments across various assets.

- Risk Tolerance Assessment: Encourage readers to evaluate their own risk profiles.

Setting Realistic Investment Goals

Setting realistic expectations is crucial. While XRP's potential is significant, it’s essential to avoid unrealistic expectations of overnight riches. A long-term investment approach with a clear understanding of potential risks and rewards is recommended.

- Long-Term Perspective: Advocate for a long-term investment strategy rather than short-term speculation.

- Realistic ROI Expectations: Discuss the importance of setting realistic return on investment goals.

Due Diligence and Research

Thorough research is paramount before investing in XRP. Understand the technology, the risks, and the market dynamics. Consult reliable sources, analyze market trends, and seek advice from qualified financial professionals if needed.

- Reliable Information Sources: Suggest reputable websites and publications for cryptocurrency news and analysis.

- Seek Professional Advice: Encourage readers to seek advice from financial professionals before making investment decisions.

Conclusion: Is XRP's 400% 3-Month Rally a Buying Opportunity? – A Summary and Call to Action

XRP's 400% 3-month rally presents a compelling case, but it's crucial to analyze the situation carefully. While the price surge is impressive, fueled by factors such as positive developments in the Ripple lawsuit and increasing institutional adoption, significant risks remain, including the inherent volatility of cryptocurrencies and ongoing regulatory uncertainty. Comparing XRP to other cryptocurrencies like Bitcoin and Ethereum reveals both its unique strengths and limitations. Developing a well-informed investment strategy involving diversification, risk management, and thorough research is essential.

While XRP's 400% 3-month rally is impressive, remember to carefully analyze the market before making any investment decisions. Conduct your own research and consider your risk tolerance to determine if XRP fits your individual investment strategy. Don't invest more than you can afford to lose, and remember that past performance is not indicative of future results.

Featured Posts

-

Remembering Priscilla Pointer A Century On Stage And Screen

May 01, 2025

Remembering Priscilla Pointer A Century On Stage And Screen

May 01, 2025 -

Kycklingnuggets Med Majsflingor Krispiga And Goda Med Asiatisk Kalsallad

May 01, 2025

Kycklingnuggets Med Majsflingor Krispiga And Goda Med Asiatisk Kalsallad

May 01, 2025 -

Mastering Corrections And Clarifications A Practical Approach

May 01, 2025

Mastering Corrections And Clarifications A Practical Approach

May 01, 2025 -

Tiesa Apie X Failus Aktoriai Ir Uzkulisiai

May 01, 2025

Tiesa Apie X Failus Aktoriai Ir Uzkulisiai

May 01, 2025 -

Amy Irving Mourns The Passing Of Dallas And Carrie Star

May 01, 2025

Amy Irving Mourns The Passing Of Dallas And Carrie Star

May 01, 2025