Is XRP (Ripple) A Good Investment For The Future?

Table of Contents

Understanding XRP and its Technology

What is XRP and how does it work?

XRP is a cryptocurrency designed to facilitate fast and inexpensive cross-border payments. Unlike Bitcoin or Ethereum, which rely on complex mining processes, XRP uses a unique consensus mechanism that allows for incredibly quick transaction times – typically just a few seconds. This speed, coupled with exceptionally low transaction fees, makes XRP an attractive alternative for institutions seeking efficient international money transfers.

- Speed: XRP transactions are significantly faster than many other cryptocurrencies.

- Low Fees: The cost of sending XRP is minimal compared to traditional banking systems or other digital assets.

- RippleNet: This network connects banks and financial institutions, enabling them to utilize XRP for seamless cross-border payments. Its adoption by major players is a key factor impacting XRP's value.

- Scalability: XRP's technology is designed for high transaction volume, a critical factor for widespread adoption in the financial sector.

Ripple's Legal Battles and Their Impact on XRP Price

The ongoing SEC (Securities and Exchange Commission) lawsuit against Ripple Labs casts a significant shadow over XRP's future. The SEC alleges that XRP is an unregistered security, a claim that Ripple vehemently denies. The uncertainty surrounding the legal battle has created considerable price volatility for XRP.

- Uncertainty: The unpredictable nature of the lawsuit significantly impacts investor confidence. A positive outcome could lead to a surge in price, while a negative ruling could cause a dramatic drop.

- Price Volatility: The lawsuit is a major contributing factor to XRP's volatile price fluctuations.

- Potential Outcomes: A favorable ruling could legitimize XRP in the eyes of regulators, potentially boosting its adoption and price. Conversely, an unfavorable ruling could severely hamper its growth.

- Regulatory Landscape: The outcome of the lawsuit will have far-reaching implications for the broader cryptocurrency regulatory landscape, particularly regarding how digital assets are classified.

Analyzing the Market Potential of XRP

Adoption by Financial Institutions

Ripple has actively pursued partnerships with numerous major banks and financial institutions globally. This institutional adoption is a significant factor driving XRP's potential. The integration of XRP into existing financial systems could unlock massive growth opportunities.

- Strategic Partnerships: Ripple's collaborations with leading banks demonstrate its commitment to bridging the gap between traditional finance and cryptocurrency.

- Global Reach: The potential for widespread adoption of XRP for cross-border transactions could significantly increase its market capitalization.

- Increased Liquidity: Increased institutional usage generally improves liquidity, reducing price volatility in the long term.

XRP's Competition and Market Position

XRP faces competition from other cryptocurrencies focusing on payments, such as Stellar Lumens (XLM) and Litecoin (LTC). While XRP boasts speed and low fees, its success depends on overcoming the regulatory hurdles and maintaining its competitive edge.

- Competitive Landscape: The cryptocurrency payment space is becoming increasingly crowded.

- Strengths and Weaknesses: XRP's strengths lie in its speed, low transaction costs, and institutional partnerships, while its weaknesses are largely linked to regulatory uncertainty.

- Market Share Analysis: Careful monitoring of XRP's market share and growth relative to its competitors is crucial for investors.

Risk Assessment for Investing in XRP

Volatility and Price Fluctuations

Cryptocurrencies, including XRP, are notoriously volatile. Their prices can fluctuate dramatically in short periods due to various factors, including market sentiment, regulatory news, and technological developments.

- High Risk Investment: XRP carries a significantly higher risk profile than many traditional investments.

- Price Fluctuation Drivers: Factors like news related to the SEC lawsuit, broader market trends, and adoption rates heavily influence XRP's price.

- Risk Management: Diversifying your investment portfolio and only investing what you can afford to lose is crucial when dealing with volatile assets like XRP.

Regulatory Uncertainty and Legal Risks

The ongoing SEC lawsuit highlights the regulatory uncertainty surrounding XRP and the broader cryptocurrency market. Navigating this landscape requires careful attention to legal and compliance issues.

- Regulatory Risks: Changes in regulatory frameworks can significantly impact the value and legality of XRP.

- Legal Implications: The outcome of the SEC lawsuit will significantly affect XRP's future trajectory.

- Due Diligence: Thorough research into regulatory frameworks and legal implications is paramount before investing in XRP.

Conclusion

Investing in XRP presents a complex equation of potential and risk. While its speed, low fees, and potential for widespread institutional adoption are compelling arguments, the significant legal uncertainty and inherent volatility of the cryptocurrency market cannot be ignored. XRP's future is inextricably linked to the outcome of the SEC lawsuit and the broader adoption of cryptocurrencies within the traditional financial system.

To determine whether XRP aligns with your investment goals, you must carefully weigh its potential rewards against the considerable risks involved. Remember to conduct thorough research, diversify your portfolio, and consider consulting a financial advisor before making any investment decisions. Ultimately, whether XRP is a good investment for your future depends on careful consideration of its potential and the inherent risks involved.

Featured Posts

-

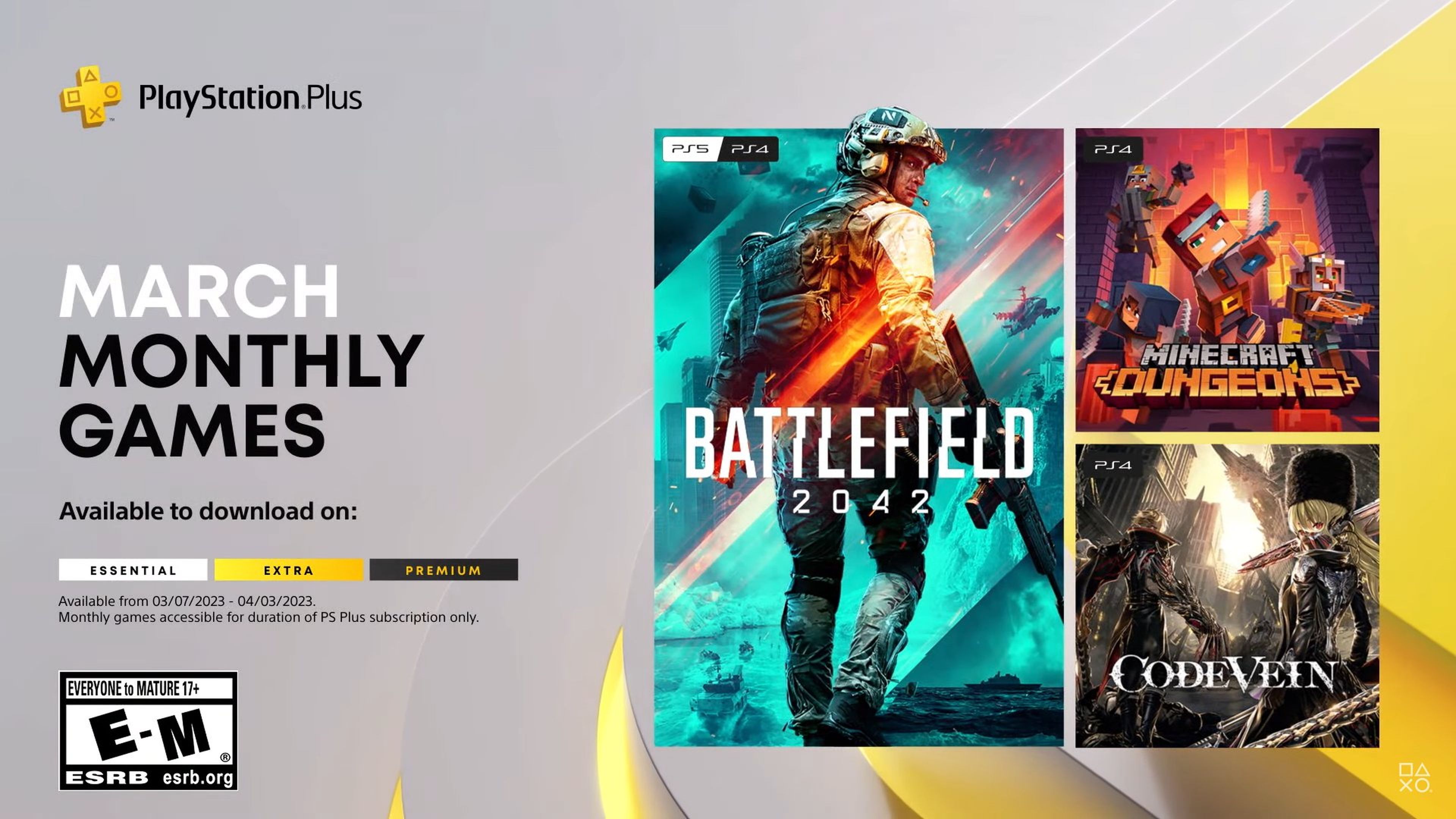

New Ps Plus Premium And Extra Games March 2024 Lineup

May 08, 2025

New Ps Plus Premium And Extra Games March 2024 Lineup

May 08, 2025 -

Dwp Warning Urgent Call Regarding 12 Benefits And Bank Accounts

May 08, 2025

Dwp Warning Urgent Call Regarding 12 Benefits And Bank Accounts

May 08, 2025 -

Superman Minecraft 5 Minute Preview Thailand Theater Teaser

May 08, 2025

Superman Minecraft 5 Minute Preview Thailand Theater Teaser

May 08, 2025 -

Chetvrtfinale Lige Shampiona Seged Eliminisao Pariz

May 08, 2025

Chetvrtfinale Lige Shampiona Seged Eliminisao Pariz

May 08, 2025 -

Hetimi I Uefa S Ndaj Arsenalit Per Ndeshjen Kunder Psg Cfare Ndodhi

May 08, 2025

Hetimi I Uefa S Ndaj Arsenalit Per Ndeshjen Kunder Psg Cfare Ndodhi

May 08, 2025

Latest Posts

-

Universal Credit Overpayment Reclaiming Money From The Dwp

May 08, 2025

Universal Credit Overpayment Reclaiming Money From The Dwp

May 08, 2025 -

Dwp Universal Credit Refunds How To Claim Historical Payments

May 08, 2025

Dwp Universal Credit Refunds How To Claim Historical Payments

May 08, 2025 -

Jayson Tatum Injury His Status For The Celtics Vs Nets Game

May 08, 2025

Jayson Tatum Injury His Status For The Celtics Vs Nets Game

May 08, 2025 -

Celtics Vs Nets Jayson Tatum Playing Status And Injury Update

May 08, 2025

Celtics Vs Nets Jayson Tatum Playing Status And Injury Update

May 08, 2025 -

Will Jayson Tatum Suit Up Tonight Celtics Vs Nets Injury Report Analysis

May 08, 2025

Will Jayson Tatum Suit Up Tonight Celtics Vs Nets Injury Report Analysis

May 08, 2025