Is XRP A Commodity? SEC Decision And The Future Of XRP

Table of Contents

The SEC's Case Against Ripple Labs and XRP

The Securities and Exchange Commission (SEC) filed a lawsuit against Ripple Labs in 2020, alleging that XRP is an unregistered security. The SEC argued that Ripple's sales and distribution of XRP constituted the offering and sale of investment contracts, violating federal securities laws. This case hinged on the interpretation of the Howey Test, a legal framework used to determine whether an investment constitutes a security.

- The "Howey Test" and its application to XRP: The Howey Test considers whether an investment involves an investment of money in a common enterprise with a reasonable expectation of profits derived from the efforts of others. The SEC argued that XRP investors reasonably expected profits based on Ripple's efforts in developing and promoting the cryptocurrency.

- The role of Ripple's sales and distribution of XRP: The SEC pointed to Ripple's large-scale sales of XRP to institutional investors and the general public as evidence of a securities offering. They highlighted the significant profits Ripple made from these sales.

- The SEC's definition of an "investment contract": The SEC argued that XRP satisfied the definition of an investment contract under the Howey Test, emphasizing the reliance on Ripple's efforts for potential profits.

- Ripple's counterarguments regarding XRP's decentralized nature and market functionality: Ripple countered that XRP functions as a decentralized digital asset, similar to Bitcoin or Ether, and that its value is determined by market forces, not Ripple's actions. They argued that XRP's use in cross-border payments demonstrates its utility beyond mere investment.

The Judge's Ruling and its Implications

The judge's ruling in the Ripple case was a partial victory for Ripple. The court determined that XRP sales on public exchanges did not constitute the offer and sale of unregistered securities. However, the court ruled that certain direct sales of XRP by Ripple to institutional investors were indeed unregistered securities offerings.

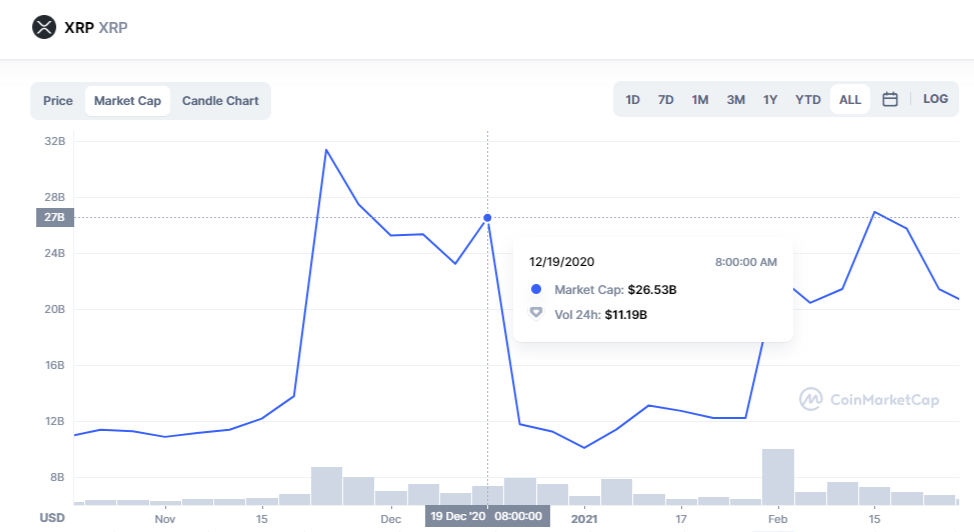

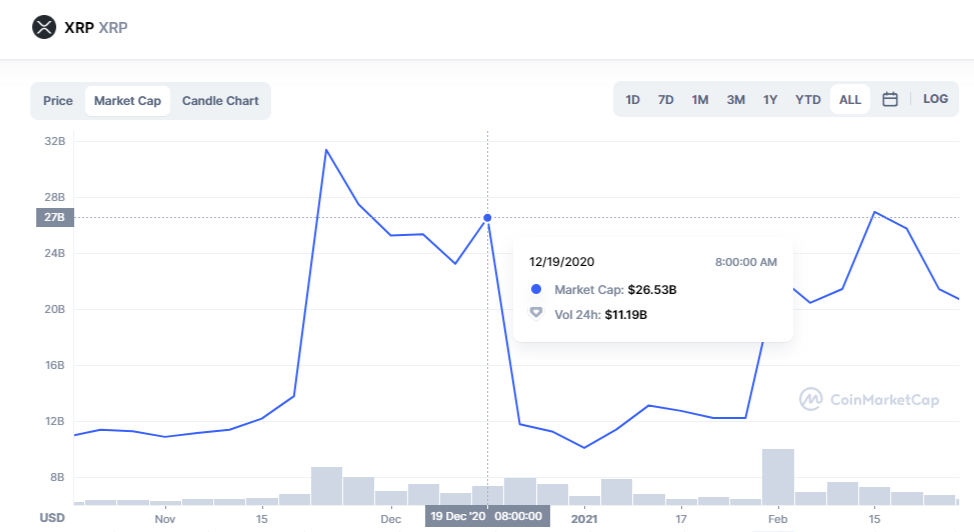

- Impact on XRP price and trading volume following the ruling: The ruling caused significant volatility in the XRP market. The price initially surged, reflecting the positive aspects of the decision, but then experienced fluctuations as the full implications became apparent.

- Analysis of the legal precedent set by the decision: The decision set a crucial precedent for how the SEC might approach the classification of other cryptocurrencies. It highlighted the importance of distinguishing between direct sales by a company and the trading of a digital asset on decentralized exchanges.

- Short-term and long-term implications for Ripple and the broader cryptocurrency market: The short-term impact included significant price swings and legal uncertainty. Long-term, the ruling may influence regulatory frameworks for cryptocurrencies globally and could affect future investment and development in the space.

- Uncertainty and clarification provided by the ruling: While the ruling offered some clarity, significant uncertainty remains regarding the regulatory landscape for XRP and other digital assets. The potential for appeals and further legal challenges adds to the uncertainty.

Arguments for XRP as a Commodity

Several arguments support the classification of XRP as a commodity. These arguments primarily focus on XRP's decentralized nature and its utility beyond investment.

- Comparison with other cryptocurrencies classified as commodities (e.g., Bitcoin, Ether): Proponents argue that XRP's functionality is similar to other cryptocurrencies widely considered commodities, like Bitcoin and Ether. These cryptocurrencies are primarily used as mediums of exchange and stores of value.

- Focus on XRP's utility as a bridge currency for cross-border payments: XRP's utility in facilitating faster and cheaper cross-border transactions provides a practical use case independent of investment speculation.

- Decentralization and lack of centralized control as supporting arguments: The decentralized nature of the XRP Ledger, with its distributed consensus mechanism, further supports the argument that it's a commodity rather than a security.

- Emphasis on the community and its role in shaping XRP's development: The large and active XRP community plays a vital role in the ecosystem's development and governance, further contributing to its decentralized nature.

Arguments Against XRP as a Commodity

Conversely, arguments exist against classifying XRP as a commodity. These arguments primarily center on Ripple's involvement in XRP's initial distribution and ongoing development.

- The concentration of XRP holdings by Ripple: Ripple initially held a significant portion of the total XRP supply, raising concerns about centralized control and potential manipulation of the market.

- Ripple's influence over XRP's development and ecosystem: Ripple's influence over the development and evolution of the XRP Ledger and its ecosystem could be seen as evidence of centralized control, a key argument against commodity status.

- Arguments related to the potential for profit based on Ripple's actions: The SEC argued that investors could reasonably expect profits based on Ripple's efforts to promote and develop the XRP ecosystem.

- The potential for future regulatory scrutiny: Even if currently classified differently in one jurisdiction, the potential for future regulatory scrutiny and reclassification remains a significant concern.

The Future of XRP: Regulatory Uncertainty and Market Outlook

The future of XRP remains clouded by regulatory uncertainty. The SEC's decision, while providing some clarity, leaves many unanswered questions.

- Potential impact of other regulatory decisions and actions globally: Regulatory actions in other jurisdictions will significantly impact the global adoption and usage of XRP.

- The influence of future court rulings or appeals: The possibility of appeals or further legal challenges could significantly alter the current landscape.

- The long-term prospects for XRP adoption and usage: The long-term success of XRP hinges on its ability to overcome regulatory hurdles and establish itself as a viable solution for cross-border payments and other use cases.

- The role of technological advancements and market adoption on XRP’s future: Technological advancements within the XRP Ledger and broader adoption by financial institutions could significantly influence its future.

Conclusion: Is XRP a Commodity? The Verdict and What's Next

The question, "Is XRP a commodity?", remains a complex one. While the court ruling offered partial clarity, significant uncertainty persists. The arguments for and against XRP's classification as a commodity highlight the intricate interplay between technological innovation, decentralized networks, and existing regulatory frameworks. The SEC's decision has set a significant precedent, yet the ongoing debate underscores the need for clearer regulatory guidelines within the cryptocurrency space. Stay informed on the evolving debate surrounding "Is XRP a commodity?" by following further legal developments and market analysis.

Featured Posts

-

Three Year Data Breach Costs T Mobile 16 Million In Fines

May 07, 2025

Three Year Data Breach Costs T Mobile 16 Million In Fines

May 07, 2025 -

Nhl Referee Technology The Apple Watch Advantage

May 07, 2025

Nhl Referee Technology The Apple Watch Advantage

May 07, 2025 -

Notre Dame To Host Wnba Preseason Game Las Vegas Aces Vs Dallas Wings

May 07, 2025

Notre Dame To Host Wnba Preseason Game Las Vegas Aces Vs Dallas Wings

May 07, 2025 -

Warriors Vs Trail Blazers Game Time Tv Schedule And Streaming Options April 11th

May 07, 2025

Warriors Vs Trail Blazers Game Time Tv Schedule And Streaming Options April 11th

May 07, 2025 -

Tuesdays High Stakes Meeting What To Expect From The Carney Trump Encounter

May 07, 2025

Tuesdays High Stakes Meeting What To Expect From The Carney Trump Encounter

May 07, 2025

Latest Posts

-

Por Que Este Betis Es Ya Historico Un Repaso A Sus Logros

May 08, 2025

Por Que Este Betis Es Ya Historico Un Repaso A Sus Logros

May 08, 2025 -

Exploring The Unique Double Performance Records Of The Former Okc Thunder

May 08, 2025

Exploring The Unique Double Performance Records Of The Former Okc Thunder

May 08, 2025 -

Este Betis Historico Analisis De Una Temporada Excepcional

May 08, 2025

Este Betis Historico Analisis De Una Temporada Excepcional

May 08, 2025 -

El Betis Una Historia Forjada En Verde Y Blanco

May 08, 2025

El Betis Una Historia Forjada En Verde Y Blanco

May 08, 2025 -

Nba Playoffs Alex Carusos Historic Performance In Thunders Game 1

May 08, 2025

Nba Playoffs Alex Carusos Historic Performance In Thunders Game 1

May 08, 2025