Is Uber Stock Recession Resistant? Analyzing The Investment

Table of Contents

Uber's Demand Elasticity During Recessions

Examining Historical Data

Analyzing Uber's performance during previous economic slowdowns is crucial to understanding its recession resistance. While precise figures correlating Uber's ridership directly to specific recessions are difficult to isolate due to the company's relatively recent IPO, we can examine broader trends. We can look at periods of general economic weakness and compare Uber's performance to that of other transportation sectors. For instance, comparing Uber's growth rate during periods of high unemployment to periods of low unemployment offers insights into its sensitivity to economic cycles. This involves examining financial reports and publicly available data on ridership trends. Charts depicting ridership and revenue growth during different economic phases would further illustrate these trends.

- Did ridership decline significantly? While ridership might decline during a recession, the extent of the decline is key. A small decrease compared to overall economic contraction suggests resilience. Qualitative data from rider surveys and Uber's internal reports might offer additional context.

- How did Uber adapt its pricing strategies during these periods? Uber's dynamic pricing model is designed to adjust to fluctuations in demand. During recessions, analyzing how Uber adjusted pricing to balance rider affordability and driver earnings is essential. Were discounts offered? Did surge pricing become less frequent?

- Did the shift in demand impact profitability? The key question is whether reduced ridership significantly outweighed any cost-cutting measures. Examining profit margins during past economic downturns provides critical insight.

- Comparison with other transportation modes (public transit, personal vehicles) during recessions. Comparing Uber's performance to other transportation alternatives offers a valuable benchmark for assessing its relative resilience. Public transport typically experiences increased ridership during economic downturns, while personal vehicle usage may remain relatively stable.

Uber's services, while convenient, are often considered discretionary spending. Analyzing how consumers shift from using Uber to other, potentially cheaper options during economic downturns is crucial in determining its true recession-resistance.

Uber's Cost-Cutting Measures and Operational Efficiency

Analyzing Operational Expenses

Uber's ability to manage operational costs significantly impacts its resilience during economic downturns. Analyzing its past performance reveals its ability to adapt and cut expenses when needed.

- Examples of cost-cutting strategies implemented by Uber in the past. These may include reducing marketing expenditures, streamlining operations, or negotiating better deals with suppliers.

- Efficiency improvements through technology and automation. Uber has heavily invested in technology. Analyzing how these investments lead to greater efficiency and cost savings is crucial.

- Impact of driver compensation adjustments on profitability. Driver compensation is a major expense. Examining how Uber adjusts driver pay during economic slowdowns, while maintaining sufficient driver supply, is crucial.

- Analysis of Uber's fixed vs. variable costs. Understanding the proportion of fixed and variable costs helps determine the company's ability to reduce expenses during a downturn.

Technological advancements, such as autonomous vehicle technology (though still in its early stages for widespread adoption), hold significant potential for reducing operational expenses in the long term and enhancing Uber's recession resistance.

The Impact of Competition on Uber's Recession Resistance

Competitive Landscape Analysis

The ride-sharing market is competitive. Analyzing how this competition impacts Uber's resilience during economic downturns is vital.

- Analysis of key competitors (Lyft, taxis, public transportation). Understanding the competitive strategies of rivals during economic downturns is crucial. Aggressive pricing by competitors could impact Uber's market share and profitability.

- Market share analysis during economic downturns. How has Uber's market share changed during past economic slowdowns? Has its dominance been challenged?

- Impact of competitive pricing strategies on Uber's profitability. Price wars during recessions could significantly reduce profitability for all players in the market.

- Discuss the potential for increased competition during tough economic times. Recessions can create opportunities for new entrants or encourage existing players to intensify competition.

Increased competition during a recession could lead to a consolidation within the ride-sharing industry, potentially benefiting the strongest players.

Uber's Diversification and Future Growth Potential

Beyond Ridesharing

Uber's diversification into other areas, such as Uber Eats and freight services, contributes to its overall resilience.

- The contribution of these other segments to overall revenue and profitability. Analyzing the relative contribution of each segment during economic downturns provides a clearer picture of the company's overall resilience.

- How diversification helps mitigate risks during economic downturns. If one segment (e.g., ridesharing) suffers, others might perform better, providing a buffer against overall financial losses.

- Growth potential of each segment and their resilience to recessions. Evaluating the growth potential and recession resistance of each segment is important. For example, food delivery might experience different demand patterns than ridesharing.

- Future investment plans and their impact on recession-resistance. Uber's investments in autonomous vehicles, etc., could enhance long-term resilience.

Future growth opportunities in emerging markets and new services could significantly enhance Uber's long-term resilience and improve its chances of being considered a strong Uber stock recession-resistant investment.

Conclusion: Is Uber Stock a Recession-Proof Investment?

Our analysis reveals that Uber's resilience during economic downturns is multifaceted. While its demand elasticity might expose it to some degree of vulnerability, its cost-cutting capabilities, diversification strategies, and technological advancements contribute to its potential resilience. Whether Uber stock is truly "recession-proof" is debatable, as no investment is entirely immune to economic headwinds. However, its ability to adapt and adjust to changing market conditions suggests a degree of resilience higher than some other discretionary spending sectors. The key factors influencing Uber's performance during economic downturns remain its demand elasticity, its ability to control costs, the intensity of competition, and the success of its diversification efforts.

Before making any investment decisions, conduct your own thorough research. Consider Uber stock as part of a diversified portfolio. Understanding the nuances of Uber stock recession-resistant analysis is crucial for making informed investment choices. Consult with a financial advisor for personalized guidance. [Link to relevant financial resource]

Featured Posts

-

Russias Failed Peace Overture Analyzing Putins Diplomatic Defeat

May 18, 2025

Russias Failed Peace Overture Analyzing Putins Diplomatic Defeat

May 18, 2025 -

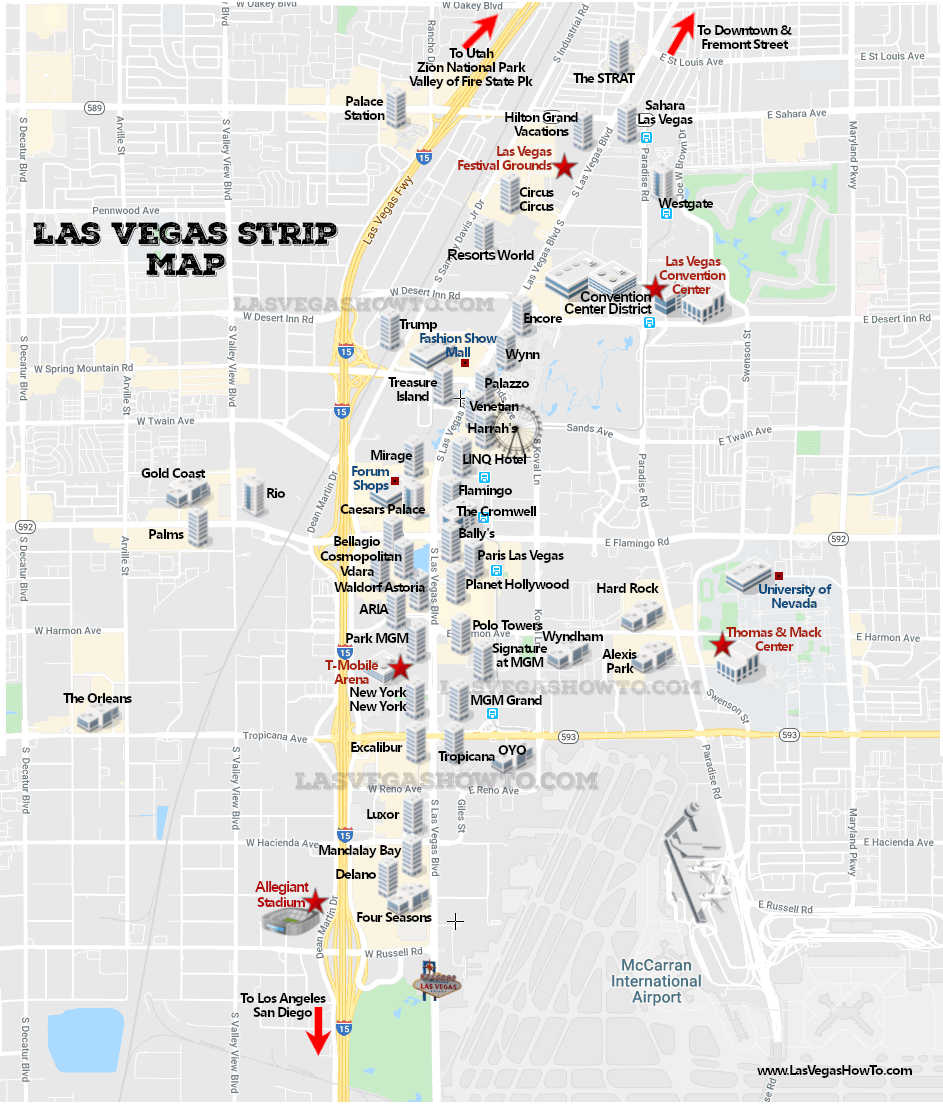

Las Vegas Strip Decline A Look At Off Strip Growth

May 18, 2025

Las Vegas Strip Decline A Look At Off Strip Growth

May 18, 2025 -

Worldwide Reddit Outage Leaves Thousands Of Users Affected

May 18, 2025

Worldwide Reddit Outage Leaves Thousands Of Users Affected

May 18, 2025 -

Mike Myers Three Word Reaction To Shrek Role

May 18, 2025

Mike Myers Three Word Reaction To Shrek Role

May 18, 2025 -

Exploring The Brooklyn Bridge Through Barbara Menschs Story

May 18, 2025

Exploring The Brooklyn Bridge Through Barbara Menschs Story

May 18, 2025

Latest Posts

-

Pertukaran Tahanan Israel Palestina 1 027 Nyawa Untuk Satu Tentara

May 18, 2025

Pertukaran Tahanan Israel Palestina 1 027 Nyawa Untuk Satu Tentara

May 18, 2025 -

Kisah Pertukaran 1 027 Tahanan Palestina Dengan Satu Tentara Israel Negosiasi 5 Tahun

May 18, 2025

Kisah Pertukaran 1 027 Tahanan Palestina Dengan Satu Tentara Israel Negosiasi 5 Tahun

May 18, 2025 -

Misir In Gazze Yoenetim Oenerisini Reddetmesi Boelge Icin Ne Anlama Geliyor

May 18, 2025

Misir In Gazze Yoenetim Oenerisini Reddetmesi Boelge Icin Ne Anlama Geliyor

May 18, 2025 -

Ucapan Selamat Ulang Tahun Untuk Jusuf Kalla Dari Gaza Mengharap Perdamaian Israel Palestina

May 18, 2025

Ucapan Selamat Ulang Tahun Untuk Jusuf Kalla Dari Gaza Mengharap Perdamaian Israel Palestina

May 18, 2025 -

3 Alasan Di Balik Keengganan Israel Mengirim Pejabat Senior Ke Pemakaman Paus Fransiskus

May 18, 2025

3 Alasan Di Balik Keengganan Israel Mengirim Pejabat Senior Ke Pemakaman Paus Fransiskus

May 18, 2025