Is Uber Recession-Proof? Analyst Insights And Stock Performance

Table of Contents

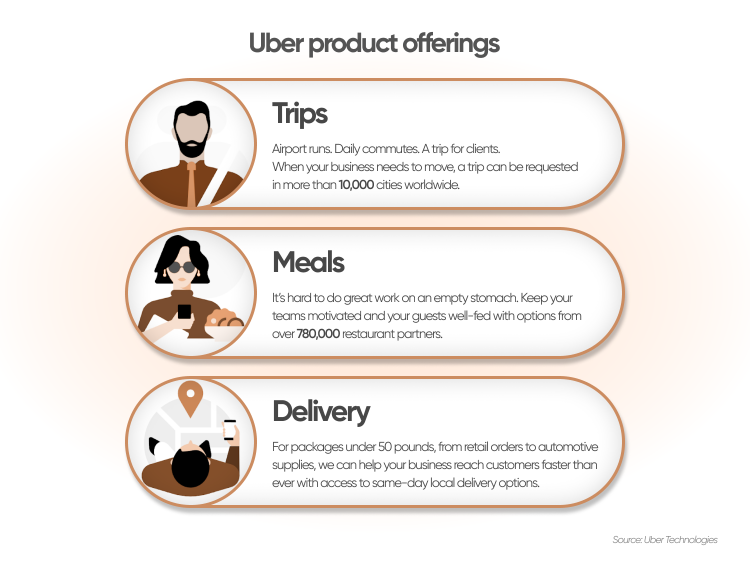

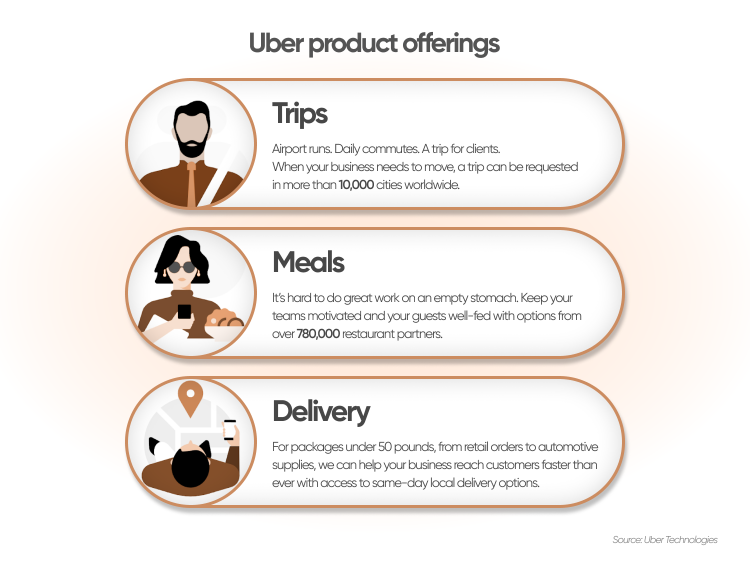

Uber's Business Model During Recessions

Examining Demand Elasticity: A key question regarding Uber's recession-proof nature lies in the elasticity of demand for its services. Ride-sharing, being a discretionary expense, is susceptible to decreased demand during economic downturns. People may opt for cheaper alternatives like public transport or carpooling when budgets tighten. Similarly, spending on food delivery, while often considered more essential than ride-sharing, can still be reduced during periods of financial strain.

- Increased reliance on public transportation during downturns: As disposable income shrinks, individuals may choose more affordable public transportation options, impacting Uber's ride-sharing revenue.

- Shift in consumer preferences toward cheaper alternatives: The emergence of budget ride-sharing services or increased use of personal vehicles can further decrease Uber's market share during a recession.

- Analysis of historical data showing Uber usage during previous economic slowdowns: Studying Uber's performance during previous recessions (like the 2008 financial crisis) provides crucial insights into its resilience. While data may be limited for Uber specifically due to its relatively recent IPO, broader trends in transportation and consumer spending provide valuable context.

Pricing Strategies and Cost-Cutting Measures: To navigate a recession, Uber employs dynamic pricing strategies, adjusting fares to reflect fluctuating demand. While this can boost revenue during peak periods, it might alienate price-sensitive customers during downturns. Further, Uber can implement cost-cutting measures such as operational streamlining and increased efficiency in its logistics and dispatch systems. However, managing driver wages and retention remains a crucial balancing act. Reducing driver compensation could negatively impact service quality and driver availability.

- Dynamic pricing adjustments to meet fluctuating demand: Uber's algorithm adjusts prices based on real-time demand, helping maximize revenue but potentially increasing costs for consumers.

- Efficiency improvements and operational streamlining: Optimizing routes, improving driver matching algorithms, and reducing administrative overhead are crucial cost-cutting strategies.

- Potential impact of driver wages and retention on profitability: Maintaining driver satisfaction and retention is crucial even during recessions, but balancing this with profitability presents a significant challenge.

Analyst Insights and Stock Performance

Wall Street's View on Uber's Recession Resilience: Analyst opinions on Uber's recession resilience are varied. While some highlight the potential for increased demand for food delivery during economic uncertainty, others remain cautious about the impact on ride-sharing. Factors influencing analyst sentiment include revenue growth, profitability margins, and market share relative to competitors.

- Review of recent analyst reports and ratings: Analyzing recent reports from major investment banks and financial analysts provides valuable insights into prevailing market sentiment.

- Discussion of factors influencing analyst sentiment (e.g., revenue growth, profitability, market share): Understanding the metrics that analysts focus on helps gauge their expectations for Uber's future performance.

- Comparison to competitor performance during previous recessions: Examining how other transportation network companies (TNCs) fared during past economic downturns provides a useful benchmark.

Historical Stock Performance During Economic Downturns: Analyzing Uber's stock performance during past economic slowdowns offers valuable insight into its resilience. Correlations between macroeconomic indicators (like GDP growth and unemployment rates) and Uber's stock price can help predict future trends.

- Historical chart illustrating Uber's stock price during previous recessions: Visualizing Uber's stock performance during past economic downturns clearly shows its price volatility.

- Correlation analysis between Uber's stock performance and macroeconomic indicators: This statistical analysis reveals the relationship between Uber's performance and broader economic trends.

- Key factors contributing to positive or negative stock performance during downturns: Identifying the factors that drove past performance helps anticipate future trends.

Factors Contributing to Uber's Resilience (or Vulnerability)

The Role of Uber Eats: The food delivery segment, Uber Eats, offers a potential buffer against economic downturns. While discretionary spending on ride-sharing might decrease, demand for food delivery tends to remain relatively stable even during recessions. However, increased competition within the food delivery market could affect Uber Eats’ profitability.

- Comparison of ride-sharing and food delivery demand during economic downturns: Analyzing the differences in demand elasticity between these two services provides valuable insights.

- Growth potential of food delivery amidst changing consumer behavior: Shifting consumer preferences toward convenience and home delivery could positively impact Uber Eats' performance.

- Impact of competition within the food delivery market: The presence of strong competitors like DoorDash and Grubhub poses a challenge to Uber Eats' market share.

Geographic Diversification and International Markets: Uber's global presence offers diversification benefits. Economic downturns rarely affect all regions simultaneously. Performance in strong economies can offset weakness in others. However, factors like currency fluctuations and geopolitical instability can impact international operations.

- Analysis of performance across different regions during economic hardship: Examining Uber's performance in different geographical markets reveals its resilience in diverse economic environments.

- Impact of currency fluctuations and geopolitical events: These factors can significantly influence Uber's profitability in international markets.

- Opportunities for growth in emerging markets: Expanding into rapidly growing economies presents significant opportunities for future growth and diversification.

Conclusion

Whether Uber is truly "recession-proof" remains a complex question. While its food delivery segment offers some resilience, the vulnerability of ride-sharing to economic downturns remains a significant factor. Analyst opinions are mixed, and historical stock performance suggests price volatility during economic uncertainty. However, its dynamic pricing strategies, cost-cutting measures, and geographical diversification offer potential buffers against economic hardship.

Continue your research into Uber's resilience and make informed decisions about investing in this ride-sharing and delivery giant. Stay informed about Uber's performance and the broader economic climate to make informed decisions regarding your investment strategy. Understanding the nuances of Uber's business model and the evolving economic landscape is key to assessing its long-term investment potential.

Featured Posts

-

Todays Nyt Connections Answers April 17th Puzzle 676

May 19, 2025

Todays Nyt Connections Answers April 17th Puzzle 676

May 19, 2025 -

Fairness And Access Rethinking College Admissions Standards And Diversity Initiatives

May 19, 2025

Fairness And Access Rethinking College Admissions Standards And Diversity Initiatives

May 19, 2025 -

I Istoria Kai I Paradosiaki Teleti Toy Ieroy Niptiros Sta Ierosolyma

May 19, 2025

I Istoria Kai I Paradosiaki Teleti Toy Ieroy Niptiros Sta Ierosolyma

May 19, 2025 -

The Trump Presidency And Aerospace Evaluating The Impact Of Major Deals

May 19, 2025

The Trump Presidency And Aerospace Evaluating The Impact Of Major Deals

May 19, 2025 -

Moze Li Se Marko Bosnjak Oporaviti Kladionice Daju Odgovor

May 19, 2025

Moze Li Se Marko Bosnjak Oporaviti Kladionice Daju Odgovor

May 19, 2025