Is The XRP Derivatives Market Hindering Price Recovery?

Table of Contents

- The Mechanics of XRP Derivatives and Their Impact

- Analyzing Trading Volume and Open Interest in XRP Derivatives

- The Role of Institutional Investors in the XRP Derivatives Market

- Regulatory Uncertainty and its Effect on the XRP Derivatives Market

- Conclusion: Is the XRP Derivatives Market a Hindrance or a Help? A Call to Action

The Mechanics of XRP Derivatives and Their Impact

XRP derivatives are financial contracts whose value is derived from the price of XRP. These include futures contracts (agreements to buy or sell XRP at a future date), options (giving the holder the right, but not the obligation, to buy or sell XRP at a specific price), and swaps (exchanging cash flows based on XRP's price). Unlike spot trading, where XRP is bought and sold for immediate delivery, derivatives trading involves speculation on future price movements.

Short-selling, a common practice in derivatives trading, allows investors to profit from a decline in XRP's price. They borrow XRP, sell it at the current price, and hope to buy it back later at a lower price, pocketing the difference. Similarly, leveraged trading magnifies both profits and losses, amplifying the impact of price swings. This can lead to significant volatility.

- Increased short positions: A high concentration of short positions can exert downward pressure on XRP's price, as sellers attempt to cover their positions by buying back XRP at a lower price.

- Leveraged bets: The use of leverage in derivatives trading amplifies both upward and downward price movements, creating a more volatile market.

- Cascading liquidations: When leveraged positions suffer significant losses, margin calls trigger forced liquidations, which can lead to a cascading effect and further price declines. This can exacerbate existing market volatility and create a negative feedback loop.

Analyzing Trading Volume and Open Interest in XRP Derivatives

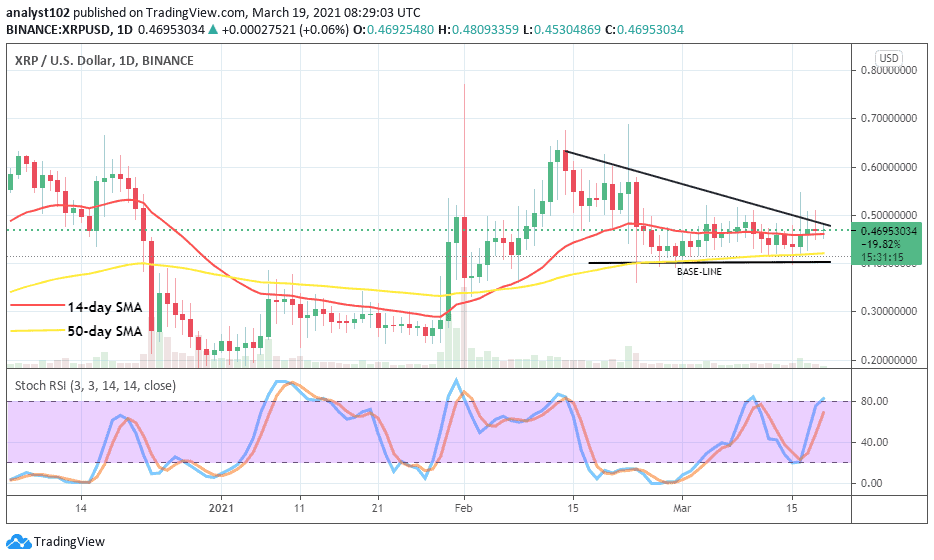

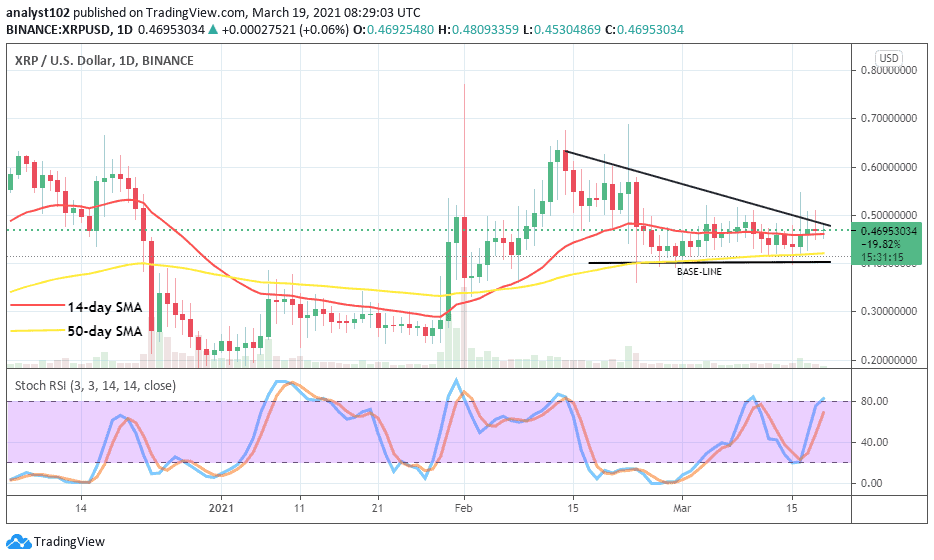

The XRP derivatives market has witnessed substantial growth in recent times. Analyzing trading volume and open interest—the total number of outstanding derivative contracts—provides valuable insights into market sentiment and potential price movements. (Insert chart depicting growth of XRP derivatives market volume and open interest here if available. Source should be clearly cited.)

- High open interest: A significantly high open interest indicates substantial market speculation and suggests potential for substantial price movements in either direction.

- Increased trading volume: Elevated trading volume often correlates with increased market volatility, indicating higher levels of investor activity and uncertainty.

- Correlation analysis: A detailed correlation analysis between derivatives market activity (volume and open interest) and XRP's spot price movements is crucial to understanding the relationship. A strong correlation would suggest a significant influence of the derivatives market on XRP's price.

The Role of Institutional Investors in the XRP Derivatives Market

Institutional investors, including hedge funds and other large financial entities, are increasingly active in the XRP derivatives market. Their trading strategies, often involving sophisticated hedging and speculative techniques, can significantly influence XRP's price.

- Hedging and speculation: Institutional investors might use derivatives to hedge against potential losses in their XRP holdings or to speculate on future price movements.

- Price manipulation potential: Large-scale institutional trades could potentially manipulate XRP's price, especially in less liquid markets. This potential for manipulation needs to be thoroughly examined.

- Impact on market sentiment: Institutional participation can significantly impact overall market sentiment, boosting confidence with significant investment, or conversely, causing concern with large-scale selling.

Regulatory Uncertainty and its Effect on the XRP Derivatives Market

The regulatory landscape surrounding XRP and its derivatives remains uncertain, particularly in the wake of the SEC lawsuit against Ripple Labs. This regulatory uncertainty significantly impacts investor confidence and trading activity.

- Ongoing legal battles: The ongoing legal battles and their outcome will significantly influence market sentiment and investor behavior. A favorable ruling could boost investor confidence and potentially lead to price appreciation.

- Impact of regulatory clarity: Regulatory clarity, or the lack thereof, directly influences the level of institutional participation in the XRP derivatives market. Clearer regulations would likely attract more institutional investors.

- Future regulatory changes: Potential future regulations impacting the derivatives market could significantly alter the landscape, creating both opportunities and challenges for investors.

Conclusion: Is the XRP Derivatives Market a Hindrance or a Help? A Call to Action

The relationship between the XRP derivatives market and its price performance is complex and multifaceted. While derivatives offer opportunities for hedging and speculation, their potential for increasing volatility and even price manipulation cannot be ignored. The growth of the market, coupled with regulatory uncertainty and institutional involvement, creates a dynamic and potentially volatile environment. Further research is crucial to establish a definitive conclusion regarding the extent of the derivatives market's influence.

To gain a deeper understanding of this evolving landscape, we encourage you to conduct further research into the XRP derivatives market, focusing on analyzing market data, staying abreast of regulatory developments, and tracking the participation of institutional investors. By closely monitoring these factors, investors can better navigate the complexities of the XRP derivatives market and make informed decisions about their investments.

8 Filmes Incriveis Com Isabela Merced Dina De The Last Of Us

8 Filmes Incriveis Com Isabela Merced Dina De The Last Of Us

Simone Biles Post Gymnastics Career A New Chapter

Simone Biles Post Gymnastics Career A New Chapter

Draymond Green On Le Bron James Randles Defense To Be Tested In Lakers Timberwolves Matchup

Draymond Green On Le Bron James Randles Defense To Be Tested In Lakers Timberwolves Matchup

The Apple Watch In Nhl Officiating Technology On The Ice

The Apple Watch In Nhl Officiating Technology On The Ice

Carney Meets Trump Anticipating The Results Of Tuesdays White House Talks

Carney Meets Trump Anticipating The Results Of Tuesdays White House Talks