Is The XRP 400% Price Jump A Bubble? Expert Opinion And Investment Strategies

Table of Contents

Analyzing the XRP Price Surge: Factors Contributing to the Jump

The dramatic increase in XRP's price isn't solely attributable to one factor. Instead, it's a confluence of events and market sentiment that has driven this significant jump. Keywords: XRP price increase, XRP price drivers, Ripple lawsuit, SEC lawsuit, XRP adoption, XRP technology, Ripple partnerships

-

Positive Ripple Lawsuit Developments: The ongoing legal battle between Ripple Labs and the SEC has significantly impacted XRP's price. Positive developments in the case, such as favorable court rulings or settlements, often trigger price increases due to reduced regulatory uncertainty. Recent rulings have been interpreted positively by some, leading to increased investor confidence.

-

Increased Institutional Adoption and Interest: Growing interest from institutional investors and financial institutions is a key driver. Larger players entering the market can inject significant liquidity and drive demand, pushing prices upwards. This increased institutional interest reflects a growing belief in XRP's potential use cases.

-

Growing Use of XRP in Cross-Border Payments: XRP's core technology and its intended use in facilitating faster and cheaper cross-border payments continues to gain traction. Increased adoption by financial institutions for this purpose fuels demand and positively impacts its price. Successful partnerships and integrations in this space are crucial catalysts.

-

Speculative Trading and FOMO (Fear of Missing Out): The rapid price increase itself can create a self-fulfilling prophecy. Speculative trading, fueled by FOMO, can further accelerate the price surge, even in the absence of fundamental changes. This speculative element introduces a high degree of volatility.

-

General Positive Sentiment in the Broader Crypto Market: The overall crypto market sentiment plays a significant role. A bull market in cryptocurrencies generally lifts all boats, leading to increased demand and higher prices across the board, including for XRP.

-

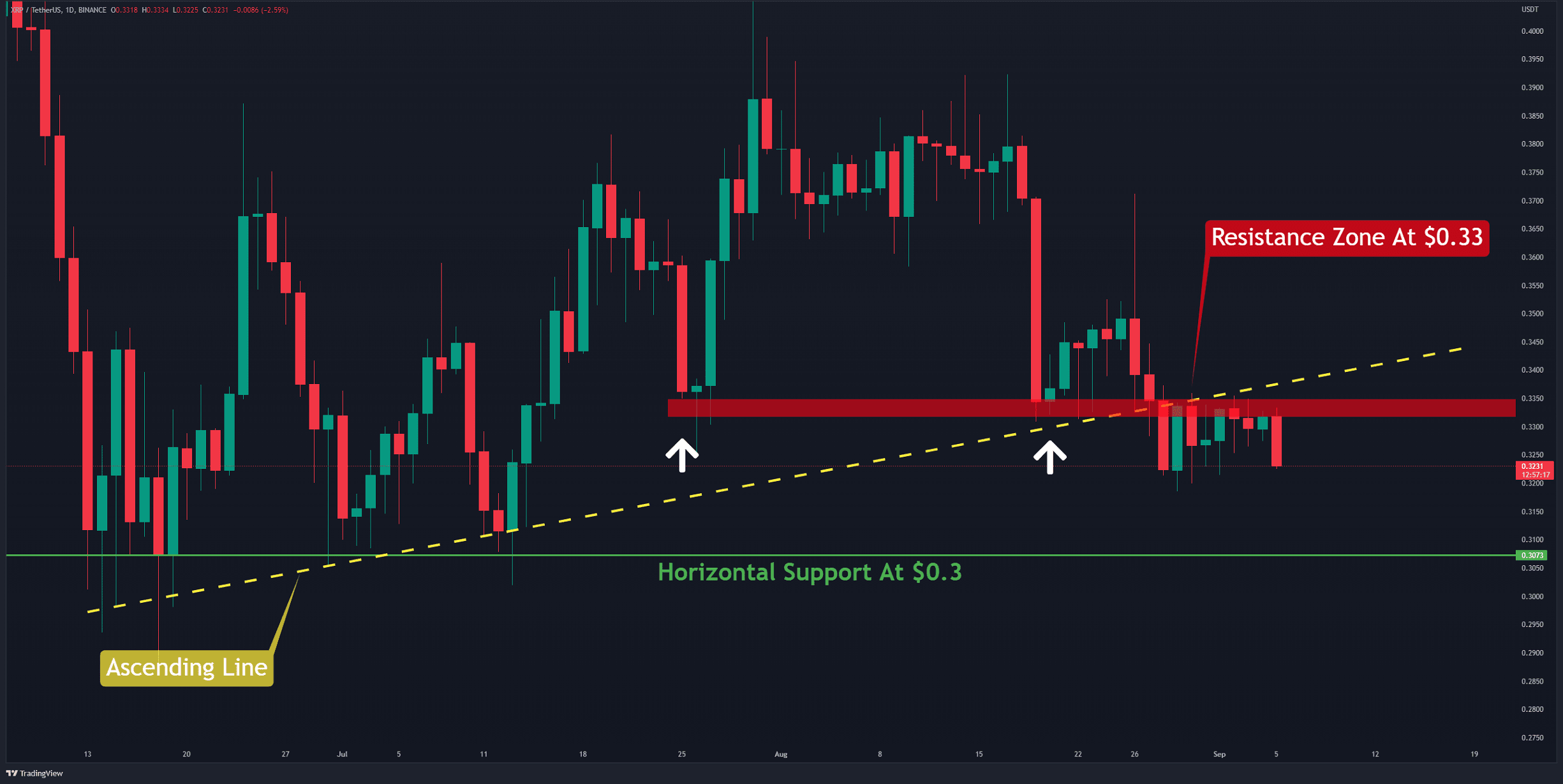

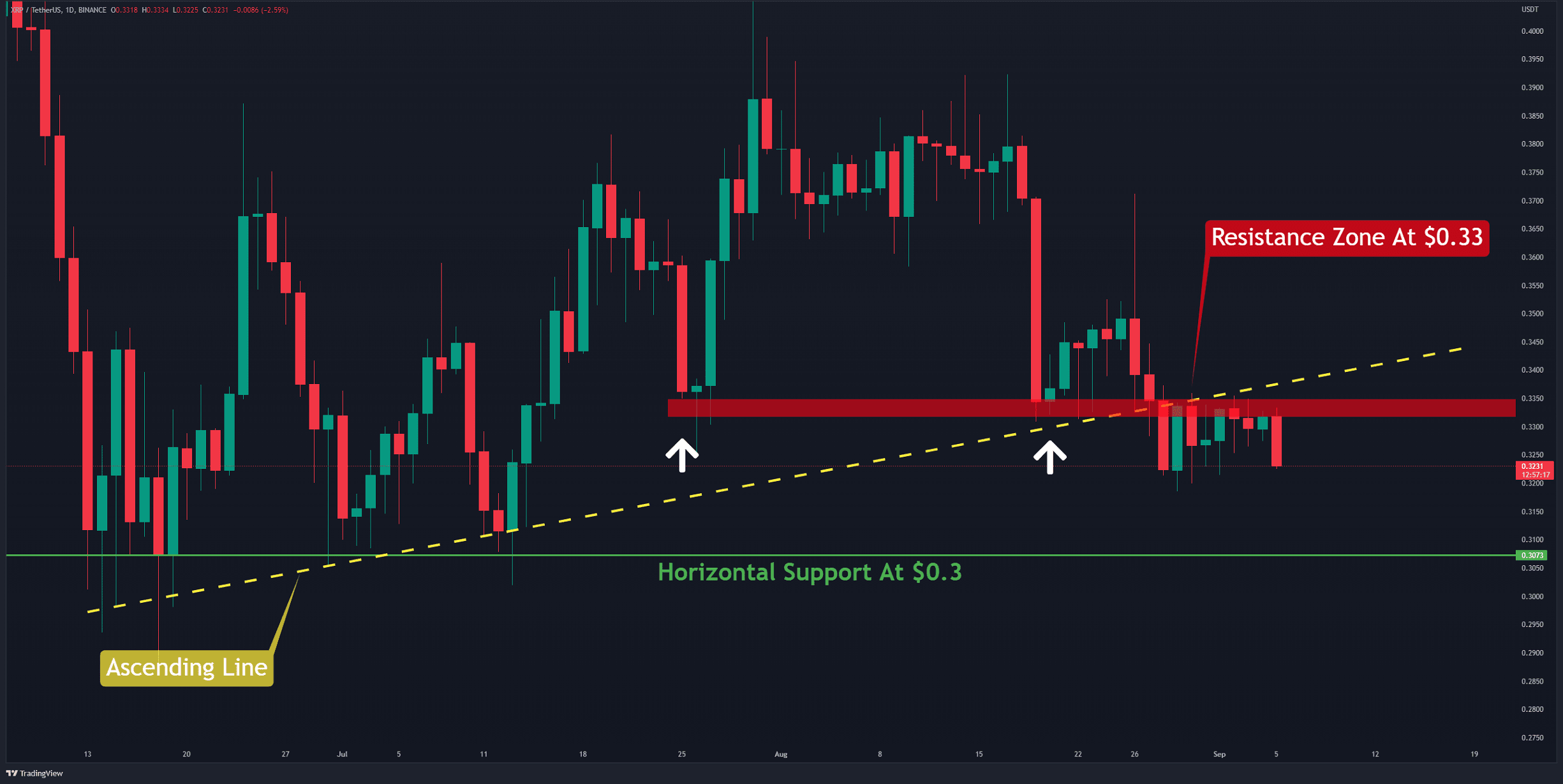

Technical Analysis Indicators: Technical indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) can signal potential price movements. While not definitive predictors, these indicators can provide valuable insights into short-term trends and potential momentum shifts. For instance, a high RSI might suggest an overbought condition, hinting at a potential correction.

Expert Opinions: Bullish vs. Bearish Predictions for XRP

The cryptocurrency community is divided on XRP's future price trajectory. Keywords: XRP price forecast, XRP analysts, cryptocurrency experts, market sentiment, XRP future

-

Bullish Predictions: Many analysts point to XRP's technological advantages, growing adoption in the payments sector, and potential positive outcomes in the Ripple lawsuit as reasons for a bullish outlook. Some forecast continued price appreciation, even surpassing previous all-time highs. These predictions often cite increasing institutional adoption and a growing belief in Ripple's long-term vision.

-

Bearish Predictions: Conversely, some experts express concerns about the regulatory uncertainty surrounding XRP, the ongoing legal battle, and the potential for a market correction. They argue that the recent price surge is unsustainable and warn of a potential bubble burst. These analysts often highlight the risks associated with highly volatile assets and the potential for a significant price drop.

-

Balanced Perspective: It's crucial to consider both bullish and bearish perspectives. No prediction is guaranteed, and the cryptocurrency market is inherently volatile. A balanced assessment of various viewpoints is essential for informed decision-making. It's vital to consult multiple sources and weigh their credibility before forming an opinion. For example, analyzing forecasts from established financial news outlets alongside opinions from individual crypto analysts offers a broader perspective.

Investment Strategies: Mitigating Risk and Maximizing Potential

Investing in XRP, like any cryptocurrency, involves significant risk. Keywords: XRP investment strategy, risk management, cryptocurrency portfolio, diversification, dollar-cost averaging, stop-loss orders

-

Dollar-Cost Averaging (DCA): DCA involves investing a fixed amount of money at regular intervals, regardless of price fluctuations. This strategy helps mitigate the risk of investing a large sum at a market peak. By averaging your purchase price over time, you reduce your exposure to short-term volatility.

-

Setting Realistic Profit Targets and Stop-Loss Orders: Defining profit targets helps you lock in gains and avoid greed-driven losses. Stop-loss orders automatically sell your XRP if the price falls below a predetermined level, limiting potential losses. Setting these parameters requires careful consideration of your risk tolerance and market conditions.

-

Diversification within a Cryptocurrency Portfolio: Never put all your eggs in one basket. Diversifying your investment across multiple cryptocurrencies reduces your overall risk. This means spreading your investment across different assets, mitigating the impact of any single asset's price decline.

-

Thorough Due Diligence: Before investing, conduct thorough research on XRP, its underlying technology, and the associated risks. Understand the fundamentals of the project, its potential use cases, and the legal landscape surrounding it. Independent verification of information is crucial.

-

Understanding the Risks Associated with Highly Volatile Assets: Cryptocurrencies are notoriously volatile. Their prices can fluctuate dramatically in short periods. Be prepared for significant price swings and only invest what you can afford to lose. This understanding is fundamental to responsible cryptocurrency investing.

Understanding the Ripple-SEC Lawsuit and its Impact on XRP

The Ripple-SEC lawsuit remains a significant factor influencing XRP's price. Keywords: Ripple lawsuit update, SEC vs Ripple, XRP legal battle, regulatory uncertainty

-

Current Status: The lawsuit's ongoing nature creates uncertainty in the market. Any development – a favorable ruling, a settlement, or an unfavorable outcome – can have a profound impact on XRP's price. Staying abreast of legal updates is crucial.

-

Potential Implications: A positive resolution could significantly boost XRP's price, while an unfavorable outcome could lead to a sharp decline. The ambiguity surrounding the legal outcome contributes to the asset's volatility.

-

Regulatory Uncertainty: The lawsuit highlights the regulatory uncertainty surrounding cryptocurrencies, particularly in the US. This uncertainty impacts investor confidence and can lead to price fluctuations. Understanding and evaluating the legal and regulatory environment is paramount.

Conclusion

The recent XRP 400% price jump is a complex event driven by a combination of factors, including positive lawsuit developments, increased institutional adoption, and speculative trading. Expert opinions are divided, with both bullish and bearish predictions. While the potential for substantial gains exists, the inherent volatility of the cryptocurrency market demands caution. A well-defined investment strategy that incorporates risk management techniques like dollar-cost averaging, stop-loss orders, and portfolio diversification is crucial. Remember, thorough due diligence and a realistic understanding of the risks involved are essential before investing in XRP or any other cryptocurrency. Conduct thorough research and carefully assess your risk tolerance before investing in XRP. Learn more about navigating the volatility of XRP and other cryptocurrencies by exploring further resources [link to relevant resources].

Featured Posts

-

Ia Da Meta Recursos E Comparacao Com O Chat Gpt

May 01, 2025

Ia Da Meta Recursos E Comparacao Com O Chat Gpt

May 01, 2025 -

Massale Stroomstoring Breda Oorzaak En Herstel

May 01, 2025

Massale Stroomstoring Breda Oorzaak En Herstel

May 01, 2025 -

Genc Futbolcular Icin Firsat Stuttgart Ta Atff Secmeleri

May 01, 2025

Genc Futbolcular Icin Firsat Stuttgart Ta Atff Secmeleri

May 01, 2025 -

Louisvilles Early 2025 Weather Crisis A Timeline Of Snow Tornadoes And Catastrophic Flooding

May 01, 2025

Louisvilles Early 2025 Weather Crisis A Timeline Of Snow Tornadoes And Catastrophic Flooding

May 01, 2025 -

Akhr Thdyth Trtyb Hdafy Aldwry Alinjlyzy Bed Hdf Haland Dd Twtnham

May 01, 2025

Akhr Thdyth Trtyb Hdafy Aldwry Alinjlyzy Bed Hdf Haland Dd Twtnham

May 01, 2025