Is The US Economy Slowing Down Because Of Biden? An Objective Look

Table of Contents

Inflation is hovering around 4%, a significant decrease from its peak but still above the Federal Reserve's target. GDP growth has also slowed. This begs the question: Is the US economy slowing down because of Biden? Understanding the factors influencing the current economic climate is crucial for informed civic engagement and effective policymaking. This article aims to provide an unbiased analysis of the various contributing factors, assessing the role of President Biden's policies alongside other significant influences.

H2: Biden's Economic Policies and Their Impact

The economic landscape under President Biden has been shaped by several key policy initiatives. Analyzing their impact requires considering both intended consequences and unintended side effects.

H3: American Rescue Plan (ARP)

The ARP, a massive economic stimulus package, aimed to mitigate the economic fallout from the COVID-19 pandemic.

- Positive Effects: The ARP spurred job creation and provided crucial relief to individuals and businesses. The Congressional Budget Office estimated that it prevented a deeper recession and significantly reduced unemployment. [Link to CBO report]

- Negative Effects: Critics argue that the substantial injection of funds into the economy contributed to inflationary pressures. The increased demand, coupled with supply chain disruptions, led to a surge in prices for goods and services. [Link to relevant economic analysis] Keywords: American Rescue Plan, economic stimulus, inflation, job growth, unemployment.

H3: Infrastructure Investment and Jobs Act

This bipartisan bill focuses on long-term investments in infrastructure, aiming to improve roads, bridges, public transit, and broadband access.

- Potential Long-Term Benefits: Proponents argue that the act will create millions of jobs, boost economic growth, and enhance the nation's competitiveness. Improved infrastructure can lower transportation costs, increase productivity, and attract investment. [Link to relevant government report]

- Challenges and Criticisms: The long-term economic impact remains to be seen. Concerns exist regarding potential cost overruns and the effectiveness of project implementation. [Link to analysis of potential challenges] Keywords: Infrastructure Investment, job creation, economic growth, long-term investment, infrastructure spending.

H3: Other Key Policies

Beyond the ARP and infrastructure bill, other Biden administration policies have economic implications:

- Tax Policies: Changes to tax rates and deductions can influence investment, consumer spending, and government revenue. [Link to relevant tax policy analysis]

- Climate Change Initiatives: Investments in clean energy and climate mitigation could stimulate innovation and create new jobs, while also impacting traditional energy sectors. [Link to climate policy analysis] Keywords: Tax policy, climate change policy, economic impact, fiscal policy.

H2: Global Factors Affecting the US Economy

While domestic policies play a role, several global factors significantly impact the US economy.

H3: Supply Chain Disruptions

The COVID-19 pandemic exposed vulnerabilities in global supply chains, leading to shortages of goods and contributing to inflation.

- Pandemic Impact: Factory closures, port congestion, and transportation bottlenecks disrupted the flow of goods worldwide. [Link to report on supply chain disruptions]

- Geopolitical Instability: Tensions and conflicts further exacerbate supply chain issues, increasing uncertainty and costs. [Link to analysis of geopolitical impact] Keywords: Supply chain disruptions, inflation, global economy, geopolitical risks, global supply chains.

H3: Global Inflation

Inflation is not solely a US phenomenon. Rising energy prices and commodity costs worldwide contribute to increased prices in the United States.

- Energy Prices: The war in Ukraine significantly impacted energy markets, driving up gasoline and natural gas prices globally. [Link to energy market analysis]

- Commodity Costs: Increases in the prices of raw materials, such as metals and agricultural products, add to inflationary pressures. [Link to commodity price index] Keywords: Global inflation, energy prices, commodity prices, economic slowdown, global economic outlook.

H3: The War in Ukraine

The war in Ukraine has had a significant ripple effect on the global economy, creating uncertainty and impacting energy markets.

- Energy Crisis: The disruption of energy supplies from Russia has led to higher energy costs globally, influencing inflation and economic growth. [Link to analysis of the war's economic impact]

- Global Uncertainty: The ongoing conflict contributes to overall economic uncertainty, making it difficult to predict future economic trends. [Link to economic forecast considering the war] Keywords: War in Ukraine, energy crisis, global economic uncertainty, geopolitical instability.

H2: Other Contributing Factors

Several other factors contribute to the current economic situation:

H3: The Pandemic's Lingering Effects

The COVID-19 pandemic continues to influence the economy, even as restrictions ease.

- Labor Market: Labor shortages persist in several sectors, impacting productivity and wages. [Link to labor market data]

- Consumer Behavior: Changes in consumer spending patterns continue to shape economic activity. [Link to consumer spending data] Keywords: COVID-19 pandemic, labor market, consumer behavior, economic recovery, labor shortages.

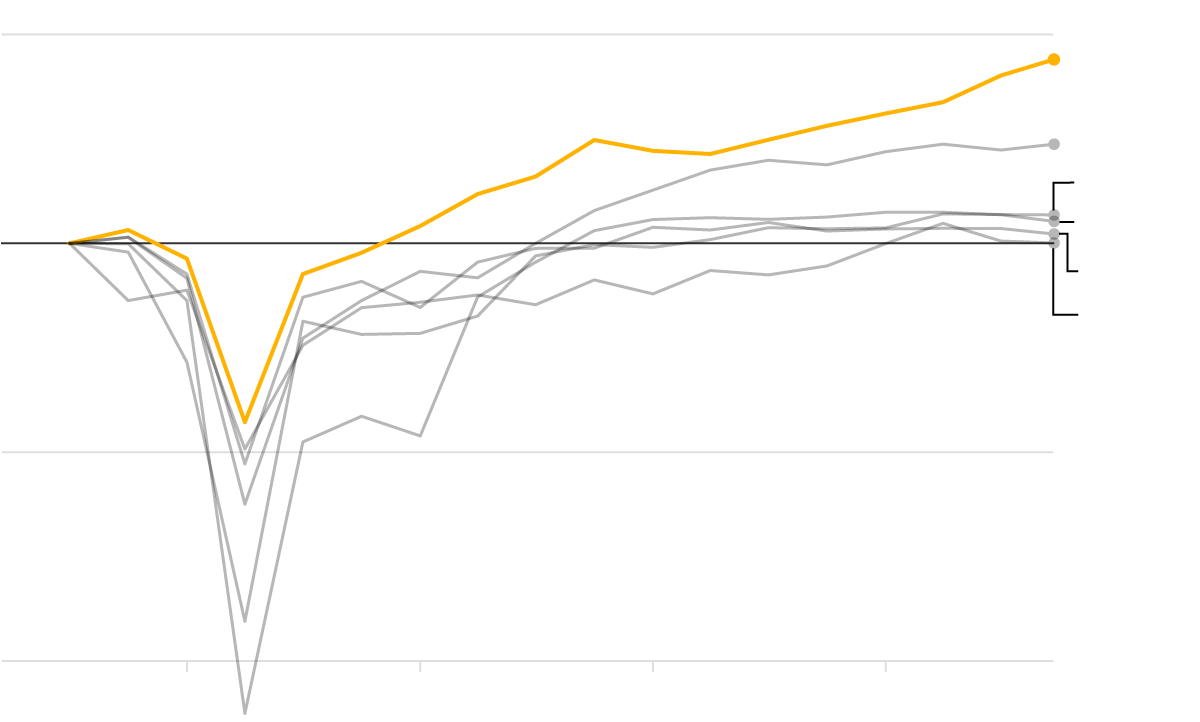

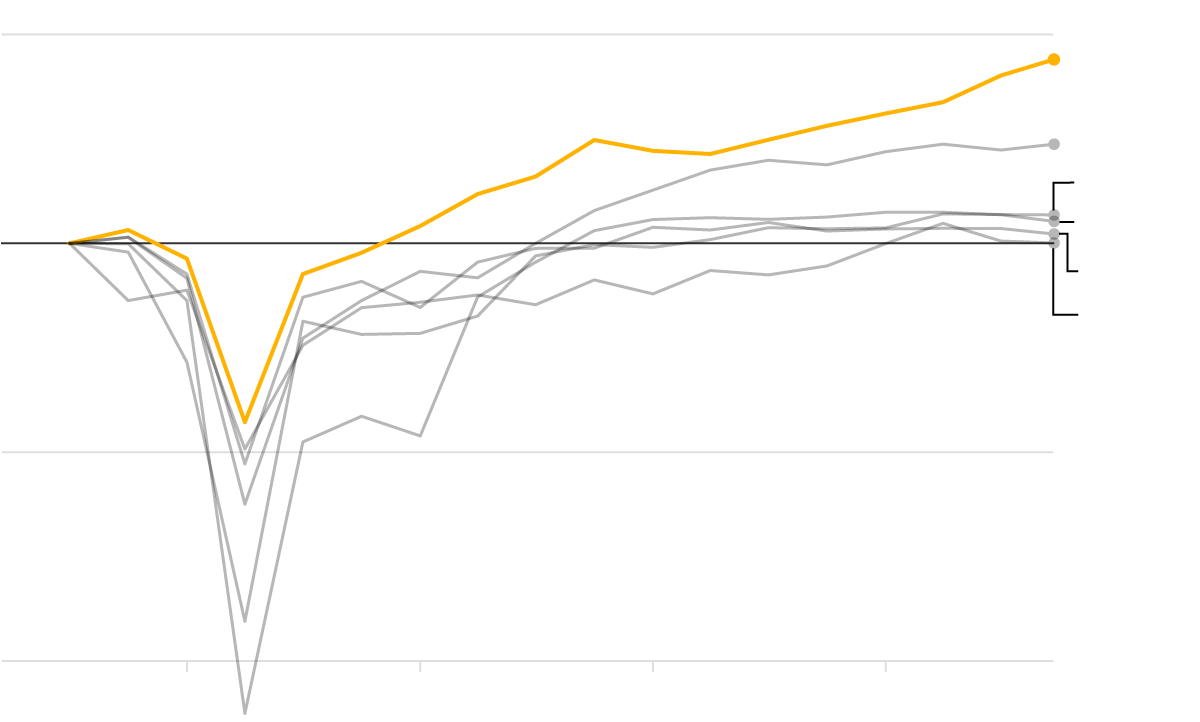

H3: Interest Rate Hikes

The Federal Reserve has implemented interest rate hikes to combat inflation.

- Inflation Control: Higher interest rates aim to cool down the economy by reducing borrowing and spending. [Link to Federal Reserve statements]

- Economic Growth: However, interest rate increases can also slow economic growth and potentially lead to a recession. [Link to analysis of interest rate impact] Keywords: Interest rate hikes, Federal Reserve, inflation control, economic growth, monetary policy.

Conclusion:

The current state of the US economy is a complex interplay of domestic policies, global events, and lingering effects from the pandemic. While President Biden's policies have undoubtedly played a role, attributing the economic slowdown solely to his administration would be an oversimplification. Global inflation, supply chain disruptions, and the war in Ukraine have also exerted significant influence. This analysis offers a balanced perspective, highlighting the various factors at play. Continue researching the topic using credible sources to form your own informed opinion on the question: Is the US economy slowing down because of Biden? Explore further resources on Biden's economic policies and the impact of global events on the US economy to gain a deeper understanding of this multifaceted issue.

Featured Posts

-

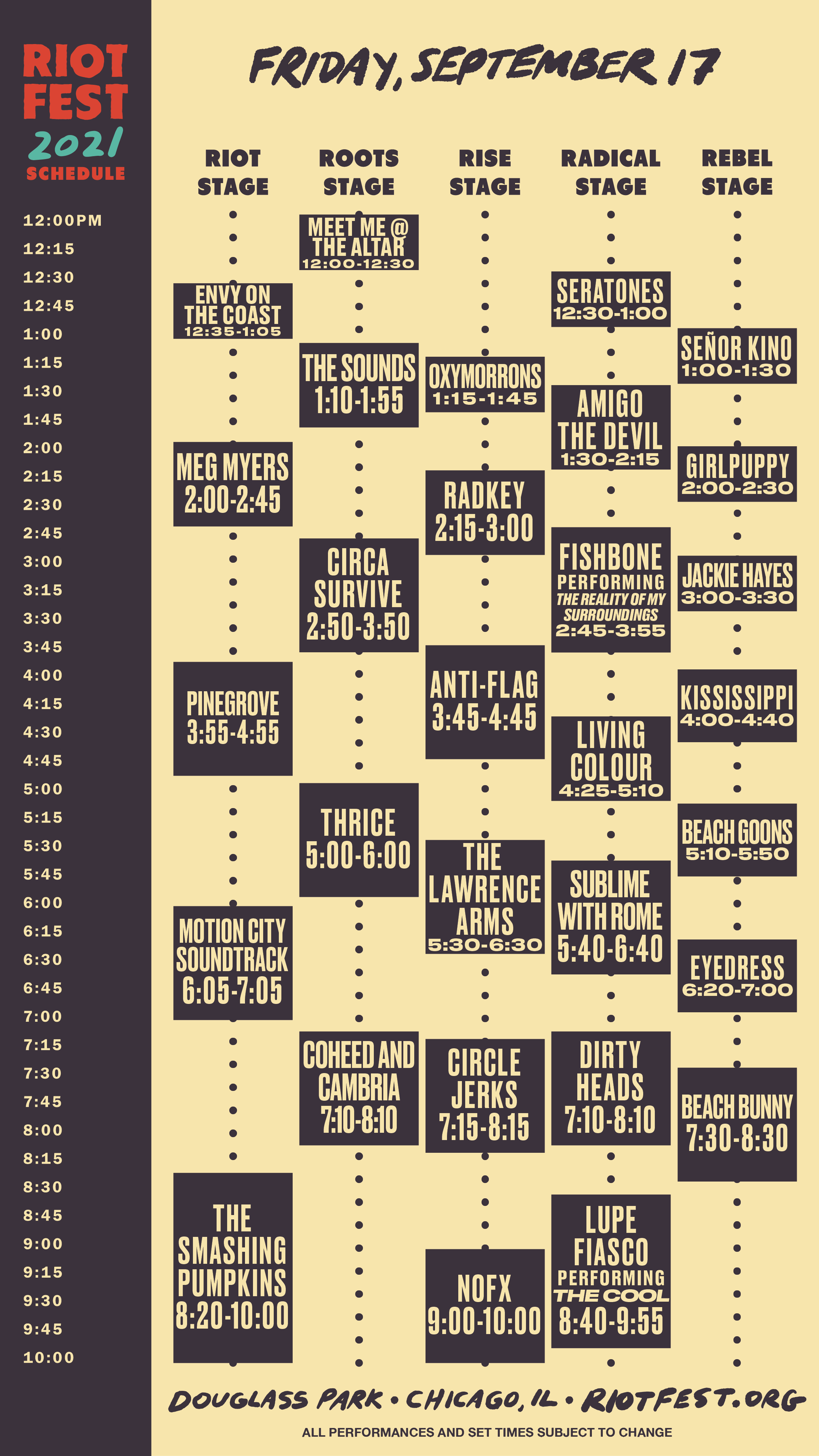

Riot Fest 2025 Lineup Revealed Green Day Weezer Lead The Charge

May 02, 2025

Riot Fest 2025 Lineup Revealed Green Day Weezer Lead The Charge

May 02, 2025 -

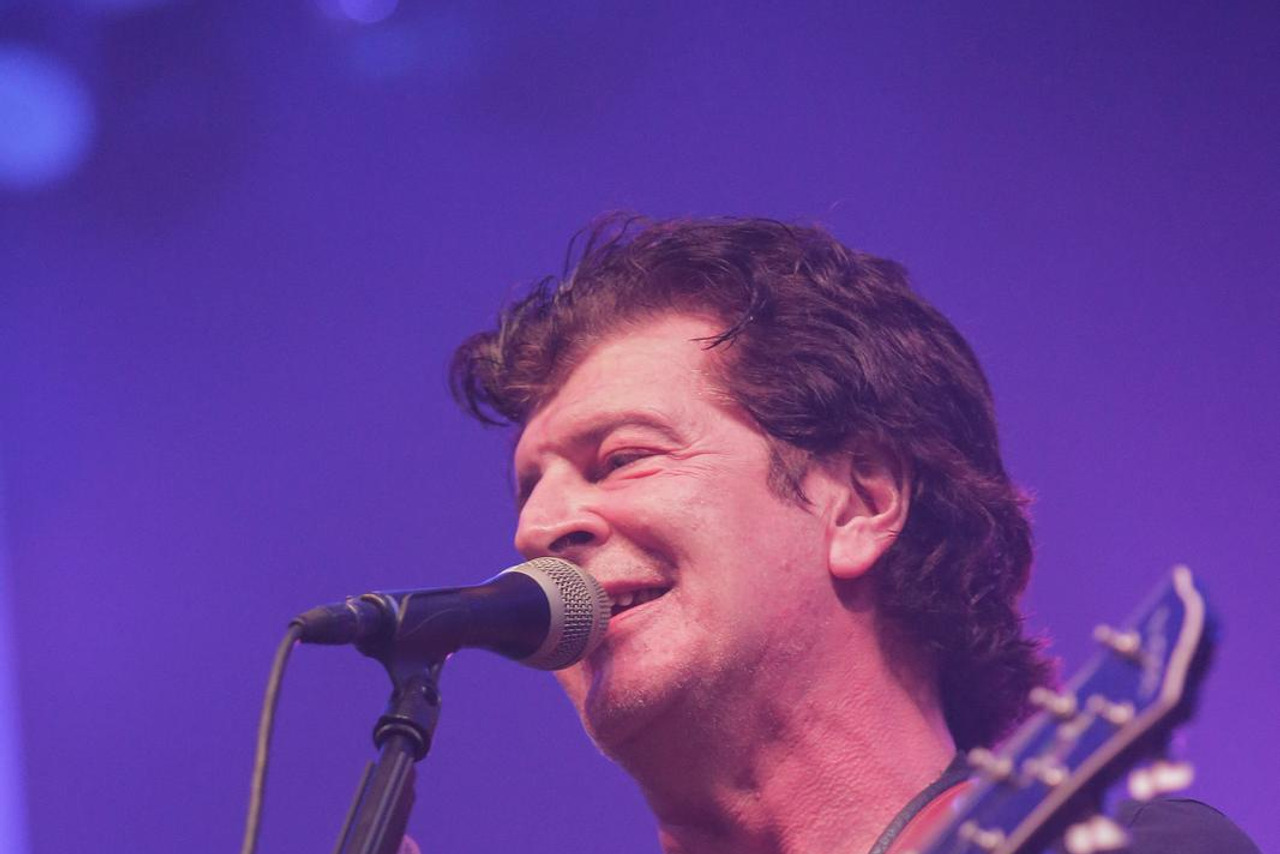

Kad Sam Se Vratio Inspiracija I Prica Iza Coliceve Pjesme

May 02, 2025

Kad Sam Se Vratio Inspiracija I Prica Iza Coliceve Pjesme

May 02, 2025 -

Utahs Keller Second Missouri Native To Reach 500 Nhl Points

May 02, 2025

Utahs Keller Second Missouri Native To Reach 500 Nhl Points

May 02, 2025 -

15 April 2025 Daily Lotto Winning Numbers

May 02, 2025

15 April 2025 Daily Lotto Winning Numbers

May 02, 2025 -

Six Nations Englands Last Minute Try Secures Win Over France

May 02, 2025

Six Nations Englands Last Minute Try Secures Win Over France

May 02, 2025