Is The Stock Market Overvalued? BofA Offers Reassurance To Investors

Table of Contents

Introduction: The question on many investors' minds is: is the stock market overvalued? Recent market volatility, fueled by factors like inflation and interest rate hikes, has intensified this concern. Many fear an impending market correction or even a crash. However, Bank of America (BofA), a prominent financial institution, has recently offered a more optimistic perspective, providing some reassurance to those worried about their investments. This article will delve into BofA's analysis, exploring key valuation metrics and examining whether the current market conditions truly warrant the widespread anxiety. We'll also consider counterarguments and offer practical strategies for navigating this potentially complex market environment.

BofA's Valuation Analysis and Key Findings

BofA employs a multifaceted approach to assess market valuation, utilizing several key metrics to paint a comprehensive picture. Their methodology incorporates both short-term and long-term perspectives, considering factors beyond simple price-to-earnings ratios (P/E).

BofA's analysis typically incorporates the following:

- Price-to-Earnings Ratio (P/E): This classic metric compares a company's stock price to its earnings per share. A high P/E ratio might suggest overvaluation, while a low P/E might indicate undervaluation. BofA considers this in conjunction with other metrics.

- Shiller PE Ratio (CAPE): Also known as the cyclically adjusted price-to-earnings ratio, this metric smooths out earnings fluctuations over a 10-year period, providing a more stable measure of valuation. It's often considered a more robust indicator of long-term market valuation than the standard P/E ratio.

- Other Valuation Metrics: BofA's analysis often includes other relevant metrics, such as dividend yield, price-to-book ratio, and growth rates, to build a holistic view of market valuation.

BofA's Conclusions: While specific reports vary, BofA's overall assessment often suggests that while the market isn't drastically undervalued, neither is it wildly overvalued. Their analysis often points to certain sectors being more expensive than others, and they might emphasize the importance of selective investing rather than broad market predictions. They typically temper their conclusions with warnings about potential downside risks.

Bullet Points:

- Key metric 1: Shiller PE Ratio: BofA's findings often show the CAPE ratio hovering around historical averages, indicating a market that is not exceptionally overpriced compared to its long-term historical performance.

- Key metric 2: Price-to-Sales Ratio: This metric considers the relationship between a company’s market capitalization and its revenue. BofA's analysis may suggest certain sectors have elevated price-to-sales ratios, signifying potential overvaluation in specific areas of the market.

- Key metric 3: Interest Rate Sensitivity: BofA frequently highlights the impact of interest rate changes on market valuations. Rising interest rates tend to negatively impact stock valuations, a factor considered heavily in their assessments.

Counterarguments and Alternative Perspectives

While BofA's perspective offers reassurance to some, it's crucial to consider alternative viewpoints. Several financial institutions and analysts hold differing opinions on market valuation.

- Argument 1: Some analysts argue that current valuations are inflated due to sustained low-interest rate policies in the past, leading to excessive investment in the stock market. They believe a correction is overdue. Source: [cite a relevant research report or analyst opinion].

- Argument 2: Factors like persistent inflation and geopolitical instability can significantly impact market valuation. Unexpected events can trigger volatility and potentially lead to a market downturn.

- Argument 3: A bearish outlook emphasizes the potential for significant economic slowdown impacting company earnings, thereby justifying a lower market valuation than currently observed.

Investor Strategies in a Potentially Overvalued Market

Even with BofA's relatively optimistic stance, a prudent investor should consider strategies to mitigate risk:

Bullet Points:

- Strategy 1: Diversify your portfolio: Spread your investments across different asset classes (stocks, bonds, real estate, etc.) to reduce the impact of a potential market downturn in any single sector.

- Strategy 2: Focus on value investing: Seek out companies with strong fundamentals and undervalued stock prices. Thorough due diligence is crucial to identify these opportunities.

- Strategy 3: Consider defensive sectors: Invest in sectors less sensitive to economic fluctuations, such as consumer staples and healthcare. These are often seen as safer bets during times of uncertainty.

Long-Term Outlook and Future Market Predictions (based on BofA's insights)

BofA's long-term outlook frequently reflects a degree of cautious optimism. They typically acknowledge potential risks but don't usually predict a catastrophic market crash. Their predictions often emphasize the importance of selective stock picking and diversification rather than blanket market timing.

Bullet Points:

- BofA's predicted market growth/decline: While specific numerical predictions vary, BofA generally projects moderate growth over the long term, but with potential short-term corrections.

- Factors influencing BofA's long-term outlook: Factors like economic growth, inflation rates, and geopolitical stability heavily influence BofA's predictions.

- Potential risks and opportunities: BofA often highlights emerging technologies and sectors as potential opportunities, while cautioning about the risks associated with high inflation and potential interest rate increases.

Conclusion

This article explored BofA's analysis of the question: is the stock market overvalued? While concerns about overvaluation persist, BofA's assessment offers a degree of reassurance, highlighting the importance of considering various valuation metrics and adopting a diversified investment strategy. However, it's crucial to consider counterarguments and remain aware of potential market risks. The key takeaway is that informed decision-making involves understanding different perspectives and developing a risk management plan tailored to your individual financial goals.

Call to Action: Stay informed about market trends by following reputable financial news sources and consulting with a financial advisor to determine the best investment strategy for your unique circumstances. Continue to research the topic of stock market overvaluation and refine your understanding of the various factors at play to make consistently informed decisions about your investments.

Featured Posts

-

Atp Indian Wells Drapers Breakthrough Masters 1000 Win

May 25, 2025

Atp Indian Wells Drapers Breakthrough Masters 1000 Win

May 25, 2025 -

Investigation Into Long Term Toxic Chemical Presence After Ohio Train Derailment

May 25, 2025

Investigation Into Long Term Toxic Chemical Presence After Ohio Train Derailment

May 25, 2025 -

Novo Ferrari 296 Speciale Motor Hibrido De 880 Cv Apresentado

May 25, 2025

Novo Ferrari 296 Speciale Motor Hibrido De 880 Cv Apresentado

May 25, 2025 -

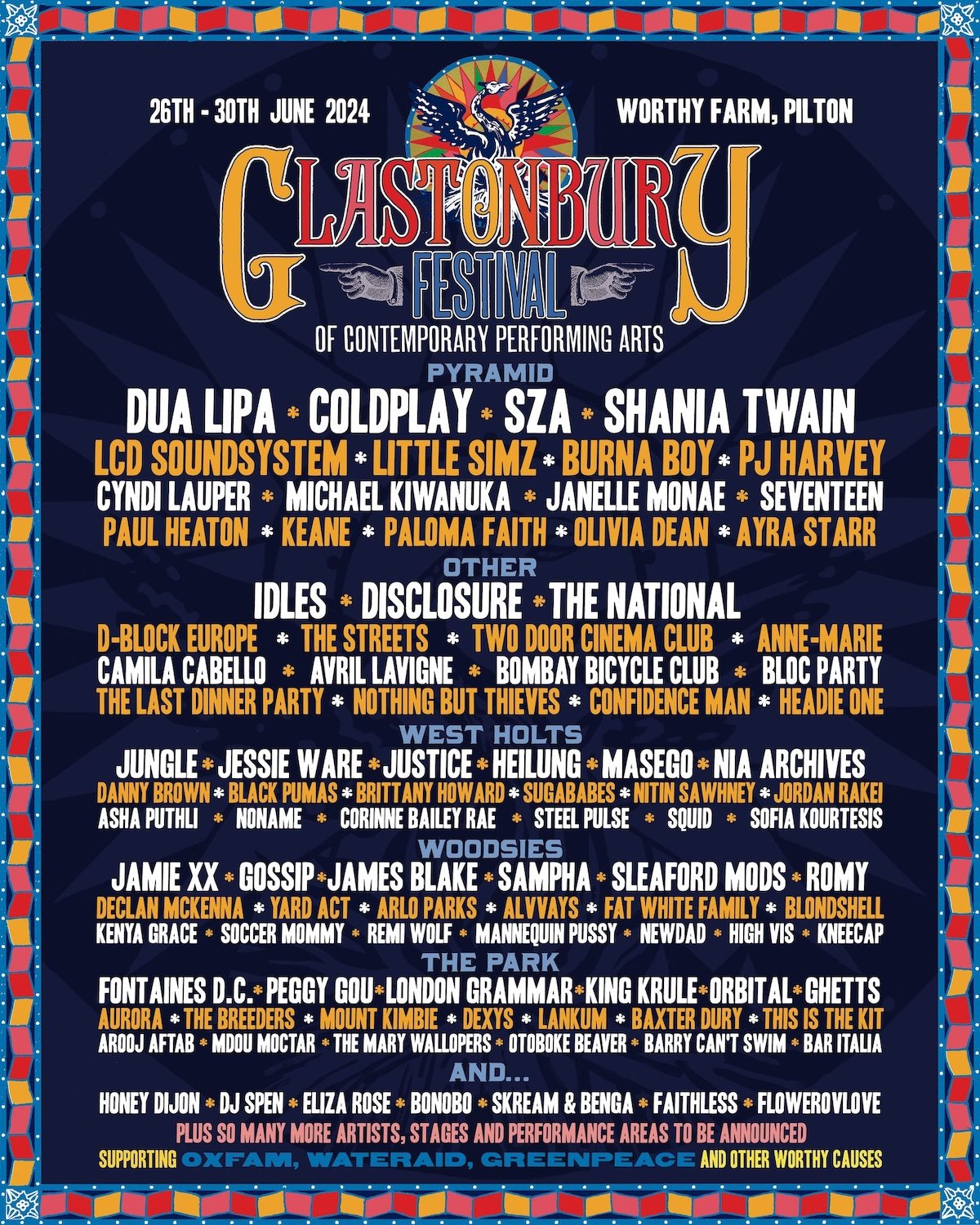

Leaked Glastonbury 2025 Lineup Confirmed Acts And How To Buy Tickets

May 25, 2025

Leaked Glastonbury 2025 Lineup Confirmed Acts And How To Buy Tickets

May 25, 2025 -

Informasi Lengkap Porsche Indonesia Classic Art Week 2025

May 25, 2025

Informasi Lengkap Porsche Indonesia Classic Art Week 2025

May 25, 2025

Latest Posts

-

Nationwide Tennis Participation Surges Over 25 Million Players Projected By August 2024

May 25, 2025

Nationwide Tennis Participation Surges Over 25 Million Players Projected By August 2024

May 25, 2025 -

Zheng Qinwens Historic Win First Victory Over Sabalenka Sends Her To Italian Open Semis

May 25, 2025

Zheng Qinwens Historic Win First Victory Over Sabalenka Sends Her To Italian Open Semis

May 25, 2025 -

Russell And The Typhoons Exploring Their Iconic Songs And Lasting Influence

May 25, 2025

Russell And The Typhoons Exploring Their Iconic Songs And Lasting Influence

May 25, 2025 -

Did Claire Williams Wrong George Russell Examining The Evidence

May 25, 2025

Did Claire Williams Wrong George Russell Examining The Evidence

May 25, 2025 -

Zheng Qinwen Upsets Sabalenka Reaches Italian Open Semifinals

May 25, 2025

Zheng Qinwen Upsets Sabalenka Reaches Italian Open Semifinals

May 25, 2025