Is The Bank Of Canada Making A Mistake? Rosenberg Weighs In

Table of Contents

Rosenberg's Critique of the Bank of Canada's Interest Rate Policy

Rosenberg believes the Bank of Canada's current interest rate policy is overly aggressive and risks tipping the Canadian economy into a significant recession. He argues that the Bank is overcorrecting in its efforts to combat inflation, potentially causing more harm than good.

-

Potential for Overcorrection Leading to Recession: Rosenberg fears that the rapid pace of interest rate increases will stifle economic growth, leading to job losses and a sharp downturn. He points to historical precedents where aggressive monetary tightening has inadvertently triggered recessions.

-

Impact on Housing Market and Consumer Spending: The higher interest rates are significantly impacting the already vulnerable Canadian housing market, leading to decreased affordability and potentially triggering a price crash. This, in turn, affects consumer spending, a crucial driver of the Canadian economy.

-

Analysis of Inflation Data and its Interpretation: Rosenberg argues that the Bank of Canada's interpretation of inflation data is overly pessimistic and that some factors contributing to inflation are transitory. He suggests a more nuanced approach to assessing inflation pressures is needed.

-

Comparison to Other Central Banks' Strategies: Rosenberg contrasts the Bank of Canada's approach with that of other central banks globally, highlighting different strategies employed in response to similar inflationary pressures. He suggests a more measured approach might be more effective.

"The Bank of Canada is playing with fire," Rosenberg stated recently, highlighting the potential for severe economic consequences from its current path. (Source needed – replace with actual quote and source).

The Bank of Canada's Defense and Justification

The Bank of Canada maintains that its interest rate hikes are necessary to bring inflation back to its target level of 2%. They argue that current inflation rates remain unacceptably high and require decisive action.

-

Addressing Inflation Targets and Their Progress: The Bank emphasizes its commitment to achieving the 2% inflation target and points to recent data showing a gradual decline in inflation as evidence of the effectiveness of its strategy.

-

Economic Indicators Supporting Their Decisions: The Bank cites various economic indicators, including GDP growth, unemployment rates, and consumer confidence, to support its assertion that the economy can withstand the current interest rate increases. They emphasize the need to act decisively now to avoid long-term damage.

-

Long-Term Economic Outlook and Considerations: The Bank of Canada presents a long-term economic outlook that considers the potential risks associated with both high inflation and overly aggressive monetary tightening. They aim to strike a balance between these competing risks.

(Include links to official Bank of Canada publications and statements supporting their position here.)

Analyzing the Discrepancies: Rosenberg vs. the Bank of Canada

The key discrepancy lies in the interpretation of economic data and the assessment of risks. Rosenberg emphasizes the potential for a severe recession, prioritizing the preservation of economic growth. The Bank of Canada, conversely, prioritizes bringing inflation under control, even at the risk of a mild slowdown. This difference in risk tolerance drives their diverging approaches. Further analysis of leading economic indicators and expert opinions is needed to fully assess the credibility of both arguments.

The Potential Economic Consequences

The future trajectory of the Canadian economy hinges on the accuracy of both forecasts. Three potential scenarios emerge:

-

Scenario 1: Success in Curbing Inflation Without Severe Recession: The Bank of Canada's strategy proves effective, inflation returns to target, and economic growth slows moderately without entering a recession.

-

Scenario 2: Prolonged Recession Due to Overly Aggressive Rate Hikes: Rosenberg's concerns prove accurate, interest rate increases trigger a deep and prolonged recession, causing significant job losses and economic hardship.

-

Scenario 3: Inflation Remaining Stubbornly High Despite Interest Rate Increases: Inflation remains stubbornly high despite the interest rate increases, requiring further monetary tightening, potentially leading to a recessionary scenario similar to Scenario 2.

These scenarios will have a significant impact on various sectors of the Canadian economy, including employment, business investment, and consumer confidence. A deep recession would cause widespread hardship, while persistent inflation erodes purchasing power.

Conclusion: Is the Bank of Canada on the Right Track? A Call to Action

The debate surrounding the Bank of Canada's monetary policy reveals a fundamental disagreement on risk tolerance and economic forecasting. While the Bank emphasizes the necessity of controlling inflation, Rosenberg warns of the potential for an overly aggressive approach to trigger a recession. Whether the Bank of Canada is making a mistake remains to be seen, and the coming months will offer crucial insights.

Stay informed about the Bank of Canada's decisions and their impact on the Canadian economy. Continue researching the Bank of Canada's monetary policy, follow Rosenberg's analysis, and form your own informed opinion on this crucial issue. Understanding the Bank of Canada's actions and their potential consequences is essential for navigating the current economic climate.

Featured Posts

-

Update Search Continues For Missing British Paralympian In Las Vegas

Apr 29, 2025

Update Search Continues For Missing British Paralympian In Las Vegas

Apr 29, 2025 -

Chinas Huawei Unveils New Ai Chip Taking On Nvidia

Apr 29, 2025

Chinas Huawei Unveils New Ai Chip Taking On Nvidia

Apr 29, 2025 -

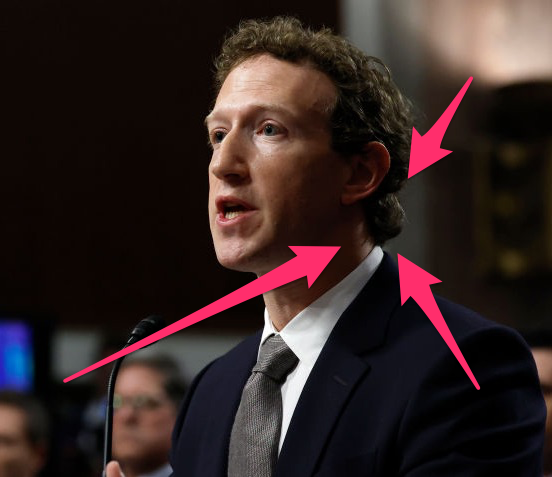

Zuckerbergs New Chapter Navigating The Trump Presidency

Apr 29, 2025

Zuckerbergs New Chapter Navigating The Trump Presidency

Apr 29, 2025 -

Making February 20 2025 A Happy Day

Apr 29, 2025

Making February 20 2025 A Happy Day

Apr 29, 2025 -

Mhairi Blacks Stance Misogynys Impact On Women And Girls Safety

Apr 29, 2025

Mhairi Blacks Stance Misogynys Impact On Women And Girls Safety

Apr 29, 2025