Is Ripple The Next Bitcoin? Understanding XRP's Potential.

Table of Contents

XRP vs. Bitcoin: Key Differences and Similarities

While both Bitcoin and XRP operate within the cryptocurrency space, their underlying technologies and market positions differ significantly. Understanding these differences is crucial to assessing XRP's potential.

Technological Differences:

- Consensus Mechanism: Bitcoin utilizes Proof-of-Work (PoW), a computationally intensive process requiring significant energy consumption. XRP, on the other hand, employs the Ripple Protocol Consensus Algorithm (RPCA), a more energy-efficient mechanism designed for faster transaction speeds.

- Transaction Speed and Scalability: Bitcoin's transaction speeds are relatively slow compared to XRP. XRP's network is designed for high scalability, handling thousands of transactions per second, making it suitable for large-scale applications.

- Energy Consumption: Bitcoin's PoW mechanism leads to substantial energy consumption, raising environmental concerns. XRP's RPCA significantly reduces energy usage, making it a more sustainable option.

- Focus: Bitcoin focuses on being a decentralized store of value and a medium of exchange. XRP, while also a digital asset, primarily targets institutional adoption and facilitating cross-border payments.

The core technological differences between Bitcoin and XRP stem from their design goals. Bitcoin prioritizes decentralization and security, even at the cost of speed and scalability. XRP, conversely, prioritizes speed, efficiency, and scalability, making it attractive to financial institutions seeking faster and cheaper cross-border payment solutions.

Market Capitalization and Adoption:

- Market Capitalization: Bitcoin maintains a significantly larger market capitalization than XRP, reflecting its established position as the leading cryptocurrency.

- Institutional Adoption: While Bitcoin enjoys widespread individual adoption, XRP has seen greater traction among financial institutions. Many banks use RippleNet, Ripple's payment network, leveraging XRP for international money transfers.

- Use Cases: Bitcoin is primarily used as a store of value and a speculative asset. XRP finds more practical applications in the financial industry, particularly in cross-border payments.

Bitcoin's dominance in market capitalization reflects years of establishment and widespread adoption. However, XRP's focus on institutional use cases presents a different growth trajectory, potentially appealing to a different segment of the market.

Regulatory Landscape:

- Regulatory Scrutiny: Both Bitcoin and XRP have faced regulatory scrutiny globally. Bitcoin's regulatory status varies across jurisdictions.

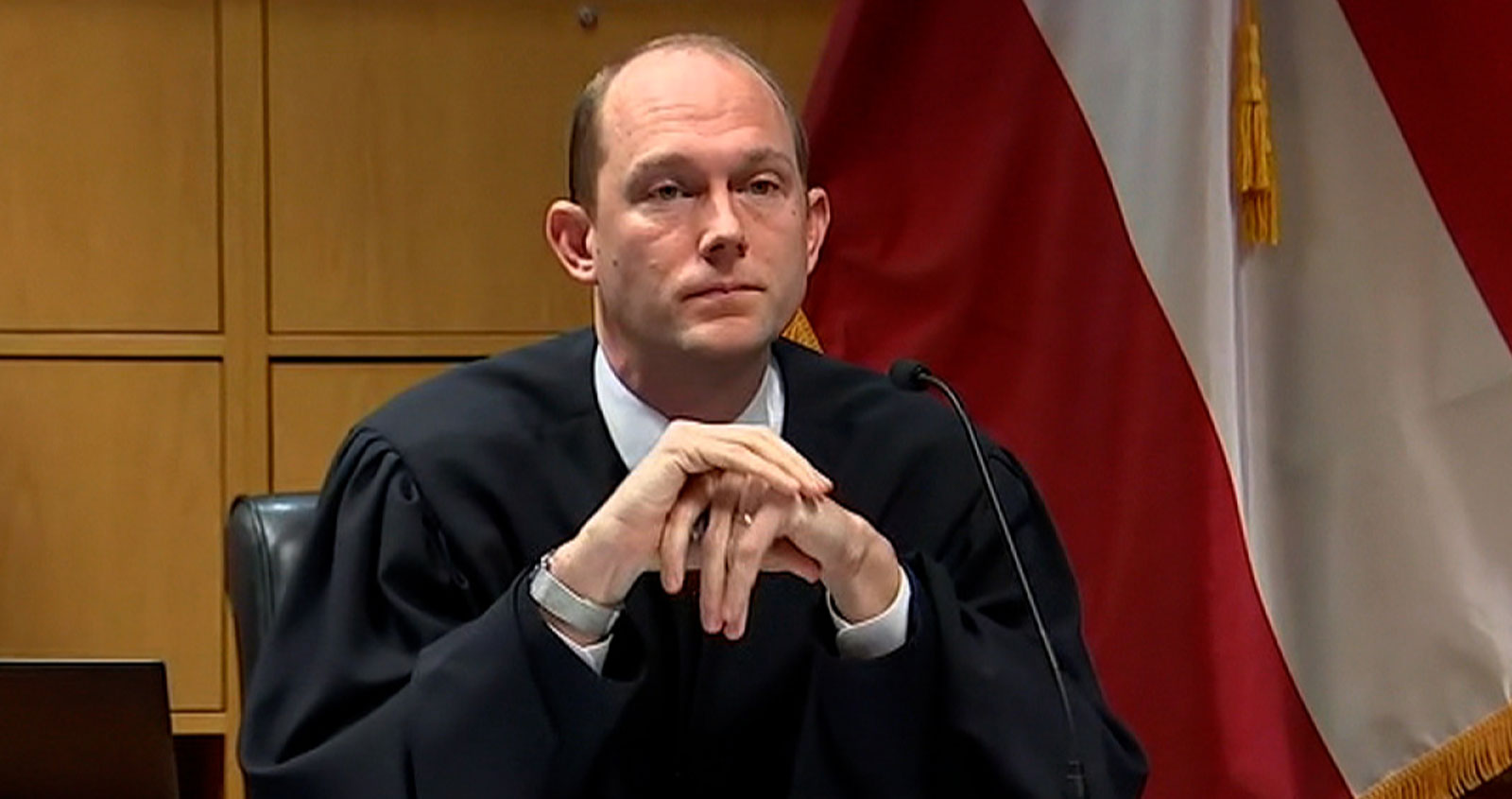

- SEC Lawsuit: XRP has faced a significant legal challenge from the Securities and Exchange Commission (SEC) in the US, impacting its price and adoption. This contrasts with Bitcoin, which has generally seen less direct regulatory conflict.

- Regulatory Uncertainty: The evolving regulatory landscape presents challenges and uncertainties for both cryptocurrencies, though the SEC lawsuit significantly impacts XRP's immediate future.

The regulatory landscape for cryptocurrencies remains fluid and complex. The SEC lawsuit against Ripple highlights the specific regulatory challenges facing XRP, which differs from the overall regulatory environment surrounding Bitcoin.

XRP's Potential Use Cases and Growth Drivers

XRP's potential for growth stems from its targeted use cases and growing adoption.

Cross-border Payments:

- RippleNet: RippleNet, Ripple's payment network, utilizes XRP to facilitate faster and cheaper international transactions.

- Partnerships: Ripple has partnered with numerous banks and financial institutions globally, integrating XRP into their cross-border payment systems.

- Efficiency: XRP's speed and scalability make it a compelling alternative to traditional cross-border payment methods, which can be slow, expensive, and opaque.

XRP's potential in cross-border payments is a significant driver of its growth, potentially disrupting the traditional financial system.

Institutional Adoption:

- Financial Institutions: A growing number of financial institutions are using RippleNet and XRP for their operations, indicating a rising level of confidence and trust.

- Reduced Costs: The cost-effectiveness of XRP for international transfers makes it an attractive option for institutions seeking to reduce their operational expenses.

- Improved Efficiency: The speed and efficiency of XRP transactions improve overall operational efficiency for these institutions.

The increasing institutional adoption of XRP signifies a potential shift towards wider mainstream acceptance.

Decentralized Finance (DeFi):

- DEXs: XRP's potential role in decentralized exchanges (DEXs) and other DeFi applications is growing.

- Liquidity: XRP's liquidity can contribute to the broader DeFi ecosystem.

- Future Potential: The integration of XRP into DeFi applications presents opportunities for future growth and expansion within the decentralized finance space.

While still nascent, XRP's involvement in the DeFi space offers promising avenues for future development and adoption.

Risks and Challenges Facing XRP

Despite its potential, XRP faces several challenges that could hinder its growth.

Centralization Concerns:

- Ripple Labs: Critics point to the centralized nature of Ripple Labs, the company behind XRP, suggesting potential conflicts of interest.

- Decentralization Debate: The level of decentralization in XRP's network is a subject of ongoing debate, with some arguing it is not truly decentralized.

- Price Influence: Concerns exist regarding Ripple Labs' potential influence on XRP's price and market manipulation.

The degree of decentralization in XRP is a key point of discussion and a potential risk factor for investors.

Regulatory Uncertainty:

- Ongoing Legal Challenges: The ongoing SEC lawsuit creates significant regulatory uncertainty surrounding XRP's future.

- Unfavorable Decisions: Unfavorable regulatory decisions could severely impact XRP's price and adoption.

- Global Regulatory Landscape: The varying regulatory landscapes across different countries present further challenges.

The regulatory uncertainty surrounding XRP presents a significant risk that investors must carefully consider.

Competition from Other Cryptocurrencies:

- Competing Cryptocurrencies: XRP faces competition from other cryptocurrencies targeting similar use cases in cross-border payments and DeFi.

- Technological Advancements: Advancements in other blockchain technologies could potentially render XRP less competitive.

- Market Share: Maintaining a competitive market share will require continuous innovation and adaptation.

The competitive landscape of the cryptocurrency market presents a constant challenge for XRP's continued growth.

Conclusion

XRP, while sharing some similarities with Bitcoin, has a distinct identity and potential. Its focus on institutional adoption and cross-border payments, coupled with its technological advantages, presents compelling arguments for its future growth. However, regulatory uncertainty and centralization concerns remain significant hurdles. Whether XRP will ultimately become "the next Bitcoin" remains uncertain; it's a complex equation with many variables. Further research and careful consideration of the risks and rewards are crucial before investing in XRP or any other cryptocurrency. Continue your research and learn more about Ripple and XRP to make informed decisions about its potential in your investment portfolio.

Featured Posts

-

Understanding The Dragons Den Process From Application To Pitch

May 01, 2025

Understanding The Dragons Den Process From Application To Pitch

May 01, 2025 -

Eskisehir De Tip Egitimi Ve Stres Yoenetimi Boksun Etkisi

May 01, 2025

Eskisehir De Tip Egitimi Ve Stres Yoenetimi Boksun Etkisi

May 01, 2025 -

Fourth Law Firm Agrees To Pro Bono Trump Work To Avoid Sanctions

May 01, 2025

Fourth Law Firm Agrees To Pro Bono Trump Work To Avoid Sanctions

May 01, 2025 -

Ofc U 19 Womens Championship 2025 Tonga Earns Qualification

May 01, 2025

Ofc U 19 Womens Championship 2025 Tonga Earns Qualification

May 01, 2025 -

Dragons Den Peter Jones Faces Backlash Viewer Reaction Explodes

May 01, 2025

Dragons Den Peter Jones Faces Backlash Viewer Reaction Explodes

May 01, 2025