Is Riot Platforms Stock (RIOT) A Buy Near Its 52-Week Low?

Table of Contents

- Analyzing Riot Platforms' Recent Performance and Current Valuation

- Review of RIOT's 52-Week Low and Recent Price Movements:

- Assessing Riot Platforms' Financial Health:

- Factors Influencing RIOT Stock's Future Potential

- Bitcoin Price Predictions and Their Impact on RIOT:

- Regulatory Landscape and Its Effect on Cryptocurrency Mining Stocks:

- Competition and Market Share within the Bitcoin Mining Industry:

- Risk Assessment for Investing in RIOT Stock

- Volatility and Price Fluctuations:

- Dependence on Bitcoin Price:

- Regulatory Uncertainty:

- Conclusion: Is Riot Platforms Stock (RIOT) Right for Your Portfolio?

Analyzing Riot Platforms' Recent Performance and Current Valuation

Review of RIOT's 52-Week Low and Recent Price Movements:

Riot Platforms, a leading Bitcoin mining company, has seen its stock price fluctuate dramatically over the past year. The recent decline can be attributed to several factors:

- Bitcoin Price Fluctuations: The price of Bitcoin (BTC) is intrinsically linked to the profitability of Bitcoin mining companies. A downturn in Bitcoin's price directly impacts RIOT's revenue and stock valuation.

- General Market Downturn: The broader macroeconomic environment and concerns about inflation have negatively impacted investor sentiment across various sectors, including cryptocurrency mining.

- Regulatory Concerns: Uncertainty surrounding the regulatory landscape for cryptocurrency in the US and globally adds to the volatility of Bitcoin mining stocks like RIOT.

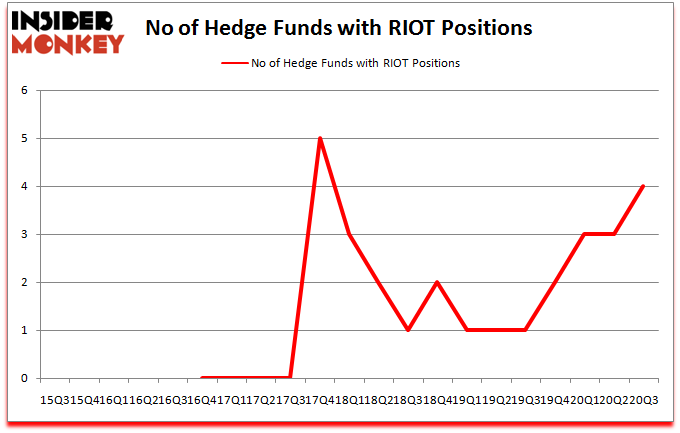

[Insert chart showing RIOT's price performance over the past year here]

Key financial metrics to consider include:

- P/E Ratio: [Insert current P/E ratio and compare to historical data and competitors]

- Market Capitalization: [Insert current market capitalization and compare to historical data and competitors]

Assessing Riot Platforms' Financial Health:

Analyzing Riot Platforms' financial health is crucial for evaluating its investment potential. Key aspects to consider include:

- Revenue: [Insert data on RIOT's revenue, highlighting growth or decline trends]

- Profitability: [Analyze RIOT's profit margins and profitability ratios, comparing to previous periods and competitors]

- Debt Levels: [Discuss RIOT's debt burden and its impact on the company's financial stability]

- Operational Efficiency: [Analyze metrics like mining costs per Bitcoin, hash rate, and energy consumption]

Key Financial Data (Illustrative):

- Q[Quarter] 2023 Revenue: $[Amount]

- Q[Quarter] 2023 Net Income/Loss: $[Amount]

- Total Debt: $[Amount]

- Hash Rate: [Amount] TH/s

Factors Influencing RIOT Stock's Future Potential

Bitcoin Price Predictions and Their Impact on RIOT:

The correlation between Bitcoin's price and RIOT's stock price is undeniable. Positive Bitcoin price predictions generally translate into increased RIOT stock valuation, and vice versa.

- Bullish Bitcoin Forecasts: [Mention some bullish predictions and their potential impact on RIOT's price]

- Bearish Bitcoin Forecasts: [Mention some bearish predictions and their potential impact on RIOT's price]

- Bitcoin Halving: The Bitcoin halving event, which reduces the rate of new Bitcoin creation, typically leads to increased scarcity and potentially higher prices in the long term. This could positively impact RIOT's profitability.

Regulatory Landscape and Its Effect on Cryptocurrency Mining Stocks:

The regulatory environment for cryptocurrency mining is constantly evolving. Changes in regulations can significantly impact the profitability and viability of Bitcoin mining operations.

- US Regulatory Landscape: [Discuss current and potential future US regulations impacting cryptocurrency mining]

- International Regulations: [Discuss the regulatory landscape in other key regions for Bitcoin mining]

- Environmental Regulations: [Discuss the impact of environmental regulations on energy consumption and Bitcoin mining operations]

Competition and Market Share within the Bitcoin Mining Industry:

Riot Platforms operates in a competitive market. Understanding its competitive position is vital.

- Key Competitors: [List and briefly describe RIOT's main competitors]

- Market Share: [Discuss RIOT's market share and its position relative to competitors]

- Competitive Advantages: [Analyze RIOT's advantages, such as access to low-cost energy, advanced mining technology, or strategic partnerships]

Risk Assessment for Investing in RIOT Stock

Investing in RIOT stock involves significant risks:

Volatility and Price Fluctuations:

RIOT stock is highly volatile, meaning its price can fluctuate dramatically in short periods. This inherent volatility presents considerable risk to investors.

Dependence on Bitcoin Price:

RIOT's profitability is heavily dependent on the price of Bitcoin. A sustained decline in Bitcoin's price can severely impact RIOT's financial performance and stock price.

Regulatory Uncertainty:

Changes in regulations could negatively affect RIOT's operations and profitability. This regulatory uncertainty constitutes a significant risk.

Key Risks Summarized:

- High Price Volatility

- Direct Dependence on Bitcoin Price

- Regulatory Uncertainty

- Competition within the Bitcoin Mining Industry

Conclusion: Is Riot Platforms Stock (RIOT) Right for Your Portfolio?

Investing in Riot Platforms stock near its 52-week low presents both potential rewards and significant risks. While the current low price might seem attractive, the inherent volatility and dependence on Bitcoin's price must be carefully considered. The regulatory landscape also adds a layer of uncertainty. Based on the analysis, whether RIOT is a buy, hold, or sell depends heavily on your individual risk tolerance and investment strategy. Before making any investment decisions regarding Riot Platforms stock (RIOT), conduct your own thorough due diligence and consider seeking advice from a qualified financial advisor. Remember to always carefully evaluate your risk tolerance before investing in volatile assets like Bitcoin mining stocks.

Colorado Buffaloes Game Preview Texas Tech Matchup Following Toppins 21 Points

Colorado Buffaloes Game Preview Texas Tech Matchup Following Toppins 21 Points

The Truth About Daisy May Coopers Transformation Weight Loss Fillers And More

The Truth About Daisy May Coopers Transformation Weight Loss Fillers And More

Credible Evidence Of Toxic Office Culture The Case Of Former Uk Mp Rupert Lowe

Credible Evidence Of Toxic Office Culture The Case Of Former Uk Mp Rupert Lowe

Samoas Miss Pacific Islands 2025 Win A Nation Celebrates

Samoas Miss Pacific Islands 2025 Win A Nation Celebrates

Revised Economic Forecast Bank Of Japan Responds To Trade War Challenges

Revised Economic Forecast Bank Of Japan Responds To Trade War Challenges