Is Palantir's High Stock Price Justified? Examining Past Performance And Future Prospects

Table of Contents

Palantir's Past Performance: A Detailed Look

Palantir's journey has been marked by significant growth, strategic shifts, and consistent scrutiny. Understanding its past performance is crucial to assessing its current valuation.

Revenue Growth and Profitability: Palantir's revenue growth has been impressive, though its path to consistent profitability has been less straightforward. While the company has shown year-on-year revenue increases, achieving sustained profitability has remained a key challenge.

- Key Financial Metrics: Analyzing Palantir's YoY revenue growth, net income, and EBITDA reveals a complex picture. While revenue growth has been positive, net income has fluctuated, highlighting the company's investment in growth initiatives.

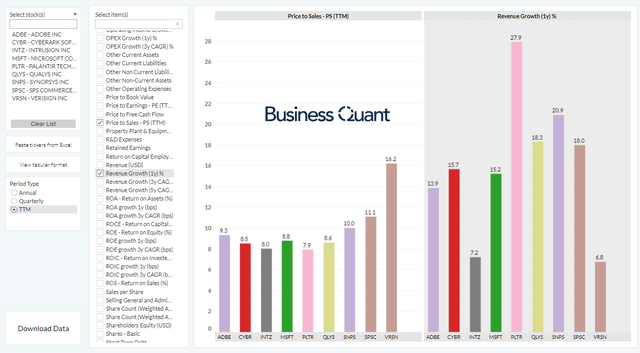

- Industry Comparison: Compared to competitors in the big data analytics market, such as Databricks and Snowflake, Palantir's profitability margins have lagged, though its focus on high-value, bespoke solutions differentiates its business model.

- Government vs. Commercial: A significant portion of Palantir's revenue historically stemmed from government contracts. However, the company's strategic focus on expanding its commercial client base is increasingly contributing to its revenue streams.

Government Contracts and Commercial Expansion: Government contracts have played a vital role in Palantir's early success, providing substantial revenue and establishing its reputation for delivering complex data analytics solutions. However, the company's future growth hinges on successful penetration of the commercial market.

- Revenue Breakdown: While the exact percentage fluctuates, a substantial portion of Palantir's revenue continues to originate from government contracts. Analyzing this breakdown is critical in assessing future revenue stability and diversification.

- Key Government Contracts: High-profile contracts with intelligence agencies and other government bodies demonstrate Palantir's ability to secure large, complex projects. However, reliance on such contracts can expose the company to geopolitical risks and potential budget cuts.

- Commercial Market Challenges: Competition in the commercial market is fierce. Palantir's success in attracting and retaining commercial clients will be key to its long-term growth and justification of its current stock price.

Technological Innovation and Competitive Advantage: Palantir's core strength lies in its proprietary technology, particularly its Foundry platform. This platform enables organizations to integrate and analyze vast datasets, offering powerful insights.

- Foundry Platform Capabilities: The Foundry platform's capabilities include data integration, visualization, and advanced analytics. Its scalability and adaptability to diverse data sources represent a significant competitive advantage.

- Competitive Landscape: While facing competition from established players and emerging startups, Palantir's focus on high-value, customized solutions distinguishes its offering. Its unique approach to data integration and analytics provides a defensible moat.

- Future Technological Advancements: Palantir's continued investment in research and development, specifically in areas like AI and machine learning, suggests a commitment to technological leadership, which is critical for maintaining its competitive edge.

Future Prospects and Growth Potential

Palantir's future growth hinges on several crucial factors, including market trends and its ability to effectively execute its strategic initiatives.

Market Opportunities and Growth Strategies: The global big data analytics market is expanding rapidly, presenting significant growth opportunities for Palantir. The increasing adoption of AI and machine learning further fuels this market expansion.

- Market Size Projections: Industry analysts predict substantial growth in the big data analytics market. Palantir's ability to capitalize on this growth will be a major determinant of its future success.

- Target Markets: Palantir's target markets span various sectors, including healthcare, finance, and manufacturing, demonstrating its ambitions for broad market penetration.

- Market Penetration Strategies: Palantir's strategic partnerships, product development, and aggressive sales efforts are designed to accelerate its market penetration and expansion.

Risks and Challenges: Despite its potential, Palantir faces several significant risks that could impact its future performance.

- Competition: The competitive landscape includes established tech giants and numerous agile startups, creating a challenging environment for maintaining market share.

- Regulatory Hurdles: Data privacy and security regulations pose significant challenges, requiring Palantir to ensure compliance across various jurisdictions.

- Economic Downturns: Government spending, a crucial revenue source for Palantir, is susceptible to economic fluctuations, potentially impacting future contracts.

- Dependence on Large Contracts: Palantir's business model involves securing large contracts, making it vulnerable to delays or cancellations.

Analyst Predictions and Valuation: Analyst opinions on Palantir's future stock price are diverse, reflecting the inherent uncertainty associated with high-growth technology companies.

- Analyst Ratings and Price Targets: The range of price targets provided by analysts reflects the varying perspectives on Palantir's growth potential and risk profile.

- Valuation Multiples: Comparing Palantir's valuation multiples to its peers helps determine whether its current valuation is justified relative to its growth prospects and profitability.

- Valuation Methodologies: Different valuation methodologies yield varying results, highlighting the complexity of assessing Palantir's intrinsic value.

Conclusion:

Is Palantir's high stock price justified? The answer is nuanced and depends on several intertwined factors. While Palantir has demonstrated impressive revenue growth and possesses a strong technological foundation, its path to sustained profitability remains a key concern. The company's future success hinges on its ability to successfully navigate the competitive landscape, manage regulatory risks, and capitalize on the expanding big data analytics market. The significant volatility inherent in its stock price reflects this inherent uncertainty. Therefore, a balanced perspective is critical. Continue your research into Palantir's stock price and make informed investment decisions based on your risk tolerance and investment goals. Thoroughly evaluating Palantir's financial performance, growth strategies, and competitive positioning is vital before making any investment decisions related to this complex and dynamic company.

Featured Posts

-

Saison Culturelle Onet Le Chateau Le Concert Final Avec Christophe Mali

May 07, 2025

Saison Culturelle Onet Le Chateau Le Concert Final Avec Christophe Mali

May 07, 2025 -

Ayesha Curry Putting Marriage First A Modern Family Dynamic

May 07, 2025

Ayesha Curry Putting Marriage First A Modern Family Dynamic

May 07, 2025 -

Watch Warriors Vs Trail Blazers Live Game Time And Streaming Details For April 11th

May 07, 2025

Watch Warriors Vs Trail Blazers Live Game Time And Streaming Details For April 11th

May 07, 2025 -

Analyse Du Potentiel De Lane Hutson Comme Defenseur Numero 1

May 07, 2025

Analyse Du Potentiel De Lane Hutson Comme Defenseur Numero 1

May 07, 2025 -

Talking Heads Donovan Mitchell And A Question For His Fans

May 07, 2025

Talking Heads Donovan Mitchell And A Question For His Fans

May 07, 2025

Latest Posts

-

Diego Luna On Andor Season 2 A Significant Departure For The Star Wars Franchise

May 08, 2025

Diego Luna On Andor Season 2 A Significant Departure For The Star Wars Franchise

May 08, 2025 -

Rogues Team A Look At Her Place In Marvel Comics

May 08, 2025

Rogues Team A Look At Her Place In Marvel Comics

May 08, 2025 -

Andor Season 2 Will It Surpass The First Season Diego Lunas Hints At Major Changes

May 08, 2025

Andor Season 2 Will It Surpass The First Season Diego Lunas Hints At Major Changes

May 08, 2025 -

Rogue One Recut Andor Directors Close Call With A Spoiler

May 08, 2025

Rogue One Recut Andor Directors Close Call With A Spoiler

May 08, 2025 -

Avengers Vs X Men Where Does Rogue Truly Belong

May 08, 2025

Avengers Vs X Men Where Does Rogue Truly Belong

May 08, 2025