Is Palantir Stock A Buy Right Now? A Comprehensive Analysis

Table of Contents

Palantir's Financial Performance and Valuation

Understanding Palantir's financial health is crucial for assessing the viability of Palantir stock. Analyzing key financial metrics provides a clearer picture of the company's performance and future potential.

-

Revenue Growth: Palantir has demonstrated consistent year-over-year revenue growth, although the rate of growth has fluctuated. Analyzing the trends in revenue growth, particularly the breakdown between government and commercial contracts, is critical. A consistent upward trajectory indicates a healthy and expanding business.

-

Profitability: While Palantir has shown progress toward profitability, it hasn't consistently achieved positive net income. Examining operating margins and the path to profitability is vital. Investors should analyze whether the company's spending on research and development is yielding sufficient returns.

-

Debt Levels: Palantir's debt-to-equity ratio should be carefully considered. High levels of debt can indicate financial risk and potentially limit the company's flexibility. Conversely, a manageable debt level suggests financial stability.

-

Cash Flow: Strong free cash flow generation is a positive indicator. A healthy cash flow allows Palantir to reinvest in its business, acquire other companies, and potentially return capital to shareholders.

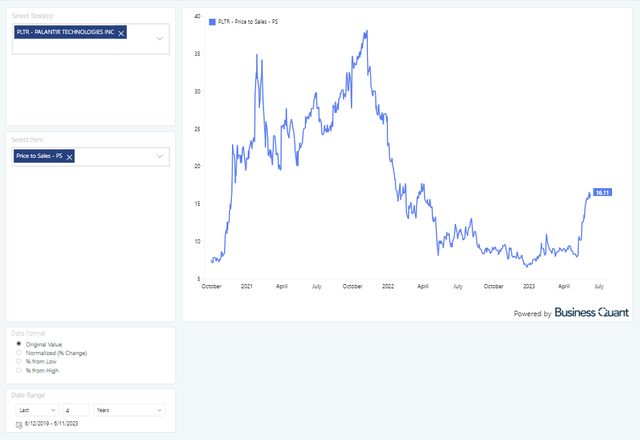

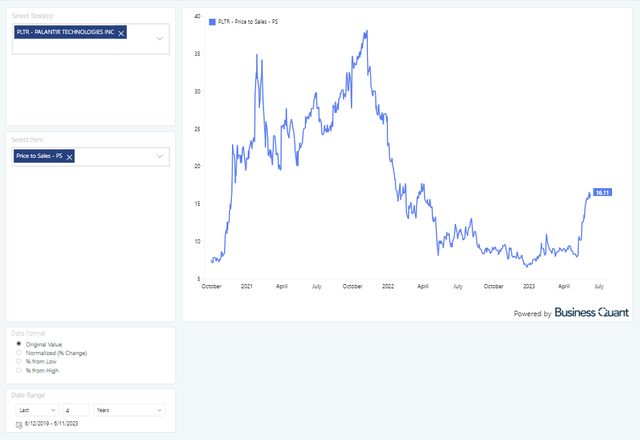

To evaluate Palantir's valuation, comparing its Price-to-Earnings (P/E) ratio and Price-to-Sales (P/S) ratio to those of its competitors provides context. A high valuation might suggest the market anticipates significant future growth, but also carries higher risk.

The Competitive Landscape and Market Position

Palantir operates in a competitive landscape, facing established players and emerging startups in the big data analytics and government contracting sectors. Key competitors include companies like Microsoft, Amazon Web Services (AWS), and Google Cloud.

-

Competitive Advantages: Palantir's proprietary technology, particularly its Gotham platform for government clients and Foundry for commercial clients, provides a significant competitive edge. Its strong relationships with government agencies also contribute to its market position.

-

Customer Relationships: The strength and longevity of Palantir's customer relationships, especially its government contracts, are crucial for its continued success. Long-term contracts provide revenue predictability, but reliance on a few major clients introduces risk.

-

Competitive Threats: The increasing competition from large cloud providers and the emergence of new analytics companies pose ongoing challenges. Palantir must continually innovate and adapt to maintain its competitive advantage.

Growth Prospects and Future Potential

Palantir's future growth depends on its ability to expand into new markets and leverage technological advancements.

-

Commercial Sector Growth: Palantir's strategy to increase its presence in the commercial sector is key to its long-term growth. Success in this area will diversify its revenue streams and reduce reliance on government contracts.

-

AI and Machine Learning: The integration of AI and machine learning into Palantir's platforms is crucial for enhancing its offerings and maintaining a competitive edge. This technological advancement offers opportunities for new product development and improved analytical capabilities.

-

Government Contracts: The sustainability of Palantir's government contracts is essential. Maintaining strong relationships and adapting to changing government priorities are critical for continued revenue generation in this sector.

Risks and Challenges Facing Palantir

Investing in Palantir stock involves inherent risks.

-

Government Contract Risk: Reliance on government contracts exposes Palantir to the risk of budget cuts, changes in government priorities, and potential delays in contract renewals.

-

Competition: Intense competition from established tech giants and agile startups poses a significant threat to Palantir's market share and profitability.

-

Regulatory Changes: Changes in data privacy regulations and government policies could significantly impact Palantir's operations and ability to secure new contracts.

-

Client Concentration: Palantir's revenue is concentrated among a relatively small number of clients. The loss of a major client could severely impact its financial performance.

Conclusion

Determining whether Palantir stock is a buy right now requires careful consideration of its financial performance, competitive position, growth prospects, and inherent risks. While Palantir shows potential for growth, especially in the commercial sector, its reliance on government contracts and the competitive landscape present significant challenges. Based on the analysis presented, a cautious approach might be warranted. While the long-term potential of Palantir is promising, the risks associated with PLTR stock necessitate a thorough understanding of the company's financials and the market before making any investment decisions. This analysis suggests a "hold" or cautious "buy" approach depending on individual risk tolerance, but it’s crucial to conduct your own thorough research before investing in Palantir stock. Consider your own risk tolerance and financial goals before making any investment decisions related to Palantir shares.

Featured Posts

-

Barbashevs Ot Goal Ties Series Knights Defeat Wild 4 3

May 09, 2025

Barbashevs Ot Goal Ties Series Knights Defeat Wild 4 3

May 09, 2025 -

Prisao No Reino Unido Mulher Clama Ser A Desaparecida Madeleine Mc Cann

May 09, 2025

Prisao No Reino Unido Mulher Clama Ser A Desaparecida Madeleine Mc Cann

May 09, 2025 -

Hurun Global Rich List 2025 Elon Musks Net Worth Drops Over 100 Billion But He Remains Richest

May 09, 2025

Hurun Global Rich List 2025 Elon Musks Net Worth Drops Over 100 Billion But He Remains Richest

May 09, 2025 -

I Meiosi Ton Xionion Sta Imalaia Sto Xamilotero Simeio Ton Teleytaion 23 Eton

May 09, 2025

I Meiosi Ton Xionion Sta Imalaia Sto Xamilotero Simeio Ton Teleytaion 23 Eton

May 09, 2025 -

Examining Apples Ai A Path To Innovation Or Decline

May 09, 2025

Examining Apples Ai A Path To Innovation Or Decline

May 09, 2025