Is Palantir Stock A Buy Before May 5th? Analyst Ratings And Future Outlook

Table of Contents

Analyzing Current Analyst Ratings for Palantir Stock

Understanding the sentiment of financial analysts is crucial before making any investment decision. Let's examine the current consensus regarding PLTR stock. While analyst ratings shouldn't be the sole determinant of your investment strategy, they offer valuable insight into market sentiment. Data compiled from sources like Bloomberg, Yahoo Finance, and others reveals a mixed outlook on Palantir stock.

- Average Price Target: (Insert current average price target from reputable sources). This represents the average price analysts predict PLTR will reach over the next 12 months.

- Highest Price Target: (Insert current highest price target from reputable sources).

- Lowest Price Target: (Insert current lowest price target from reputable sources).

- Number of Buy Ratings: (Insert current number of buy ratings from reputable sources). Analysts issuing buy ratings generally believe PLTR stock is undervalued and poised for growth. Their arguments often center on (insert common arguments from buy ratings, e.g., strong government contract pipeline, expansion into new markets, etc.).

- Number of Hold Ratings: (Insert current number of hold ratings from reputable sources). Analysts suggesting a "hold" often see Palantir stock as fairly valued, recommending neither buying nor selling at its current price.

- Number of Sell Ratings: (Insert current number of sell ratings from reputable sources). Sell ratings generally indicate a negative outlook, often citing concerns over (insert common arguments from sell ratings, e.g., high valuation, dependence on government contracts, intense competition, etc.).

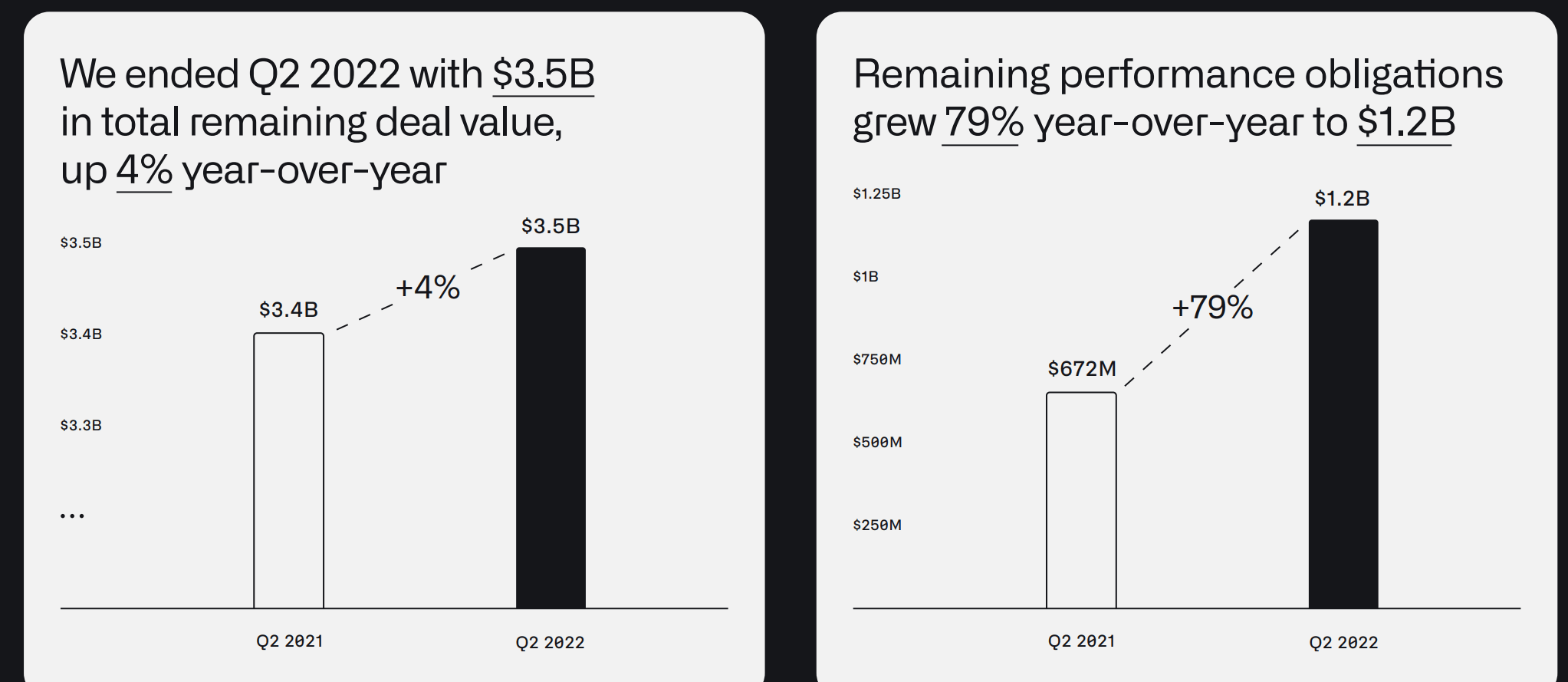

Palantir's Recent Performance and Key Financials

Examining Palantir's recent financial performance is crucial for evaluating its investment potential. Factors like revenue growth, profitability, and contract wins significantly impact PLTR's stock price.

- Revenue Growth (YoY, QoQ): (Insert recent YoY and QoQ revenue growth figures). Sustained revenue growth demonstrates the company's ability to expand its market reach and secure new contracts.

- Profitability (Margins, Net Income): (Insert recent data on profit margins and net income). Profitability is a key indicator of a company's financial health and long-term sustainability.

- Key Contract Wins and Their Impact: (Discuss significant contract wins and their projected impact on revenue and profitability). Large government and commercial contracts are crucial drivers of Palantir's growth.

- Cash Flow Situation: (Insert data on cash flow, highlighting any trends). A strong cash flow position allows for reinvestment in growth initiatives and debt reduction.

- Debt Levels: (Insert data on debt levels and any significant changes). High debt levels can increase financial risk and negatively affect the stock price.

Future Outlook and Potential Catalysts for Palantir Stock

Several factors could influence Palantir's stock price before and after May 5th. Analyzing potential catalysts and risks is vital for assessing the investment outlook.

- Expected Earnings Release Details (May 5th): (Discuss expectations for the May 5th earnings report and its potential impact on the stock price). Earnings reports often cause significant short-term volatility in stock prices.

- New Product/Service Announcements: (Highlight any anticipated product launches or service enhancements). New offerings can attract new clients and drive revenue growth.

- Market Expansion Plans: (Discuss Palantir's plans to expand into new markets or sectors). Successful expansion can significantly enhance revenue streams.

- Competitive Landscape Analysis: (Analyze Palantir's competitive position within the data analytics market). Intense competition can pressure margins and limit growth.

- Potential Regulatory Risks: (Discuss any regulatory hurdles or potential changes impacting Palantir's business). Regulatory changes can pose significant challenges to the company's operations.

Considering the Risks: Why Palantir Stock Might Not Be a Buy

While Palantir offers significant potential, it's crucial to acknowledge potential downsides.

- Valuation Concerns: (Discuss whether Palantir's current valuation is justified based on its financials and growth prospects). Overvaluation can lead to stock price declines.

- Dependence on Government Contracts: (Analyze the risks associated with relying heavily on government contracts). Changes in government spending can negatively impact revenue.

- Competition from Established Tech Giants: (Discuss competition from larger, more established tech companies). Competition from established players can limit Palantir's market share.

- Potential for Slower-than-Expected Growth: (Discuss the risk of the company failing to meet growth expectations). Disappointing growth can lead to a decline in investor confidence and stock price.

Conclusion: Is Palantir Stock a Buy Before May 5th? Your Final Verdict

Based on the analysis of analyst ratings, recent financial performance, future prospects, and potential risks, (Insert your recommendation: Buy, Hold, or Sell). Our recommendation is primarily based on (briefly summarize the key factors that led to your recommendation). However, it's crucial to remember that this is not financial advice. Investing in the stock market involves inherent risks, and the price of Palantir stock could fluctuate significantly. Conduct your own thorough due diligence and consider seeking professional financial advice before making any investment decisions. Is Palantir stock a good investment for you? That's a question only you can answer after careful consideration. Share your thoughts on the Palantir stock outlook in the comments below! Continue following for further updates on Palantir stock and related investment analysis.

Featured Posts

-

Inquiry Into Nottingham Attacks Judge Taylors Appointment

May 09, 2025

Inquiry Into Nottingham Attacks Judge Taylors Appointment

May 09, 2025 -

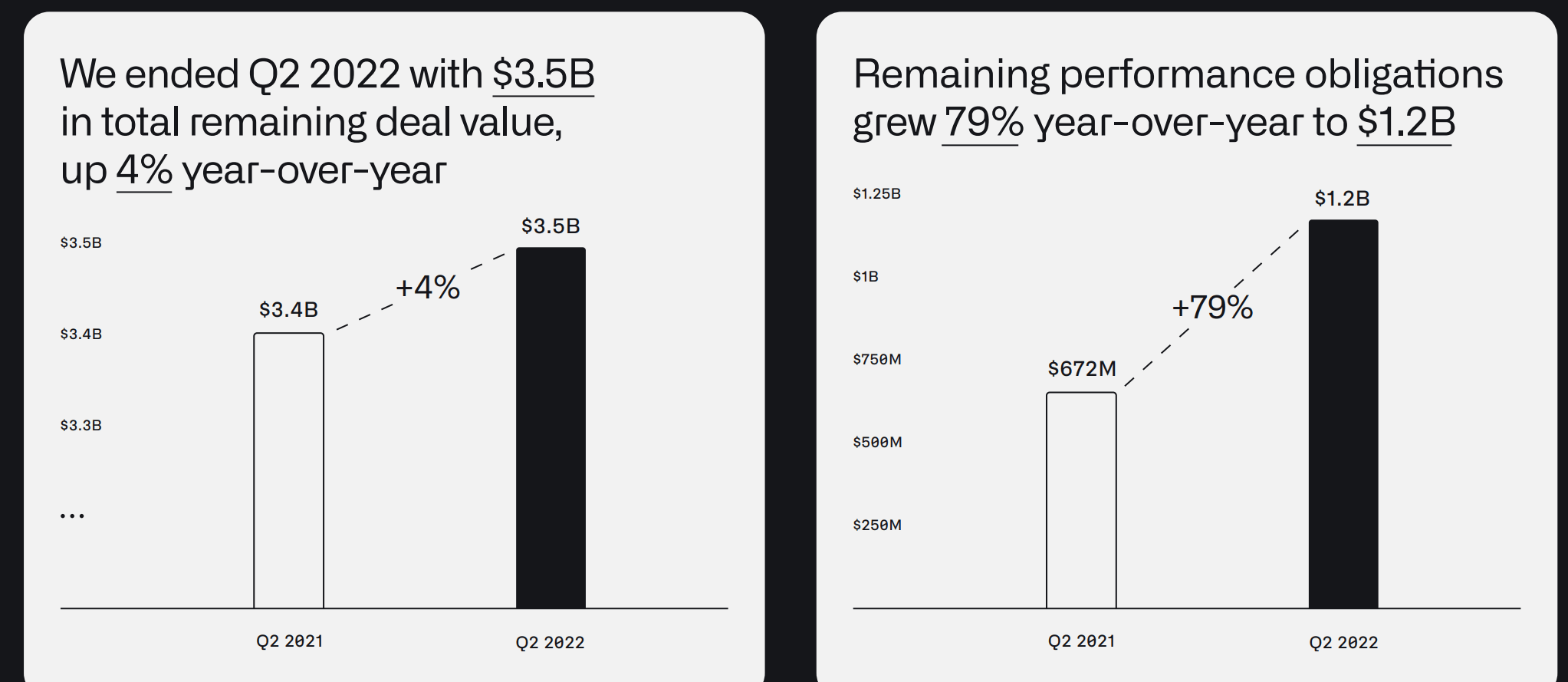

Policia Britanica Prende Mulher Que Se Diz Madeleine Mc Cann

May 09, 2025

Policia Britanica Prende Mulher Que Se Diz Madeleine Mc Cann

May 09, 2025 -

Ag Pam Bondi And The Epstein Client List What We Know

May 09, 2025

Ag Pam Bondi And The Epstein Client List What We Know

May 09, 2025 -

Aeroport Permi Zakrytie Iz Za Snegopada Do 4 00

May 09, 2025

Aeroport Permi Zakrytie Iz Za Snegopada Do 4 00

May 09, 2025 -

Investing In The Future Jazz Cash And K Trades Partnership For Democratized Stock Trading

May 09, 2025

Investing In The Future Jazz Cash And K Trades Partnership For Democratized Stock Trading

May 09, 2025