Is Palantir A Buy After A 30% Price Decline?

Table of Contents

Analyzing Palantir's Recent Performance and the 30% Decline

Understanding the Reasons Behind the Price Drop

Several factors likely contributed to Palantir's recent price decline. The overall market sentiment has played a significant role, with a broader tech sell-off impacting many growth stocks, including PLTR. Let's break down the key contributing factors:

- Increased Interest Rates: Rising interest rates make growth stocks, often valued on future earnings, less attractive to investors.

- Concerns About Slowing Revenue Growth: Some analysts express concerns about the pace of Palantir's revenue growth in certain sectors, leading to a reassessment of the company's future prospects.

- Competition from Established Players: Palantir faces competition from established players in the data analytics market, adding to investor uncertainty.

- Market Corrections: The broader market experienced corrections which dragged down growth stocks like Palantir.

Examining Palantir's Financials

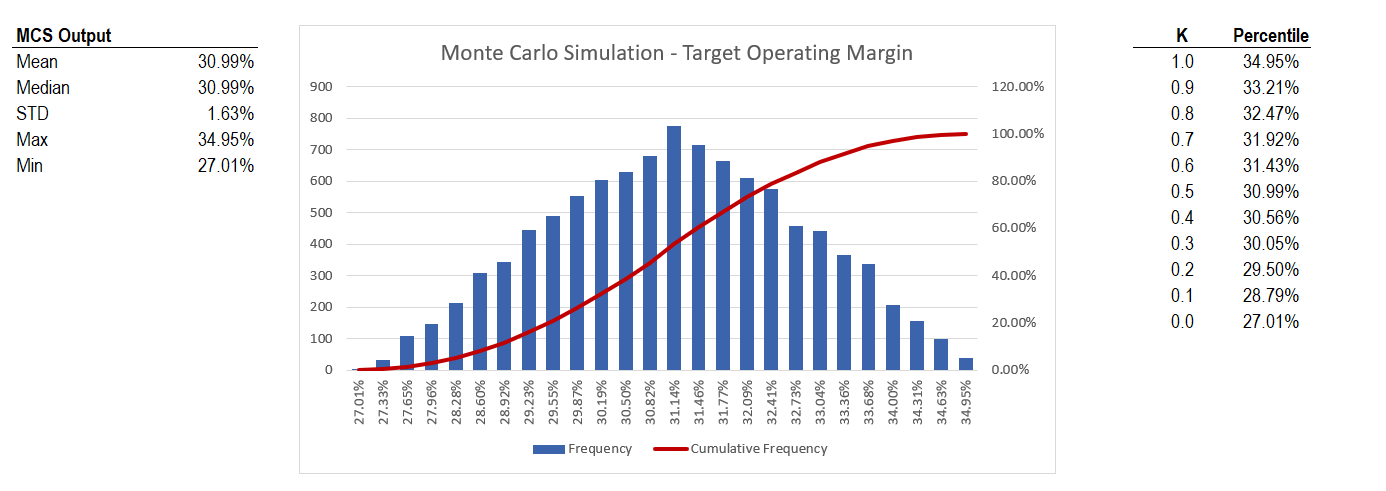

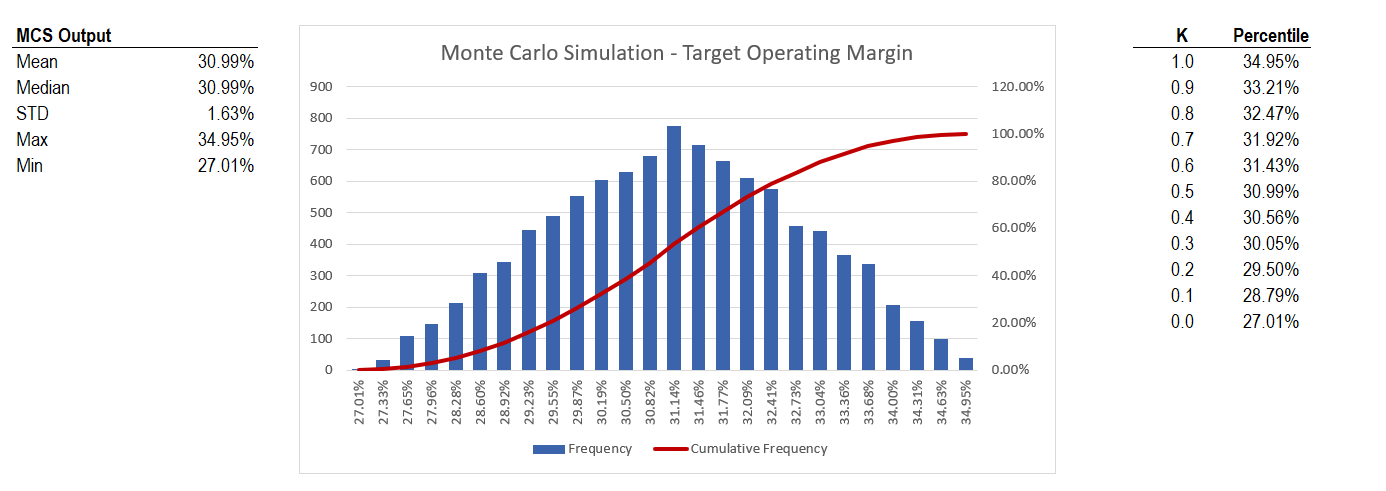

Analyzing Palantir's financial health is crucial for any investment decision. While revenue growth has been impressive, profitability remains a key focus for investors. Examining key metrics such as revenue growth rate, operating margins, and free cash flow is essential to assess the company's financial health and its ability to sustain growth. A detailed analysis of Palantir's debt levels and overall financial strength provides a complete picture of its financial standing. (Note: Specific financial data and charts would be included here in a real-world article).

Assessing Palantir's Long-Term Growth Potential

Despite recent challenges, Palantir's long-term growth potential remains substantial. The company operates in the rapidly expanding government and commercial data analytics markets. Key catalysts for future growth include:

- New Product Launches: Palantir continues to innovate and release new products, expanding its capabilities and market reach.

- Strategic Partnerships: Strategic partnerships can open new markets and accelerate growth.

- Government Contracts: Continued success in securing government contracts provides a stable revenue stream and strengthens its financial position.

Evaluating the Risks Associated with Investing in Palantir

High Volatility and Market Sentiment

Palantir stock is notoriously volatile, making it a higher-risk investment. Market sentiment significantly influences the PLTR stock price, leading to rapid price fluctuations that can be difficult to predict.

Competition and Market Share

The data analytics market is highly competitive. Palantir needs to maintain its competitive edge to secure and grow its market share. Established players and new entrants pose a constant threat.

Dependence on Government Contracts

A significant portion of Palantir's revenue comes from government contracts. This reliance presents a risk if government spending patterns change or if the company fails to secure new contracts.

Considering the Potential Upside of a Palantir Investment

Growth Potential in the Data Analytics Market

The data analytics market is experiencing explosive growth, and Palantir is well-positioned to benefit from this trend. Its innovative technologies offer solutions for complex data challenges across various industries.

Potential for Increased Profitability

While Palantir is not yet consistently profitable, it has demonstrated a clear path towards profitability. Achieving sustained profitability would significantly boost investor confidence and the PLTR stock price.

Valuation Compared to Competitors

Comparing Palantir's valuation to its competitors can help determine if the current price represents a buying opportunity. A thorough comparative analysis should be conducted to assess its relative value and growth potential.

Conclusion: Should You Buy Palantir Stock After the 30% Drop?

Whether Palantir is a buy after its 30% price decline is a complex question. The potential for significant upside exists, driven by growth in the data analytics market and Palantir's innovative technologies. However, the high volatility, intense competition, and reliance on government contracts present substantial risks. Ultimately, whether Palantir is a buy after its 30% price decline depends on your individual risk tolerance and investment strategy. Conduct thorough research and consider consulting a financial advisor before making any investment decisions regarding Palantir stock or PLTR. Carefully weigh the potential rewards against the risks before deciding if a Palantir investment is right for you.

Featured Posts

-

Harassment Charges Polish National And Accomplice Deny Targeting Mc Cann Home

May 09, 2025

Harassment Charges Polish National And Accomplice Deny Targeting Mc Cann Home

May 09, 2025 -

Is Palantir Stock A Good Buy Before May 5th A Detailed Look

May 09, 2025

Is Palantir Stock A Good Buy Before May 5th A Detailed Look

May 09, 2025 -

Young Thug Addresses Infidelity In New Music Snippet

May 09, 2025

Young Thug Addresses Infidelity In New Music Snippet

May 09, 2025 -

Family Support For Dakota Johnson At Materialist Film Premiere

May 09, 2025

Family Support For Dakota Johnson At Materialist Film Premiere

May 09, 2025 -

Treiler Materialists Dakota Johnson Pedro Pascal Kai Chris Evans Se Romantiki Komenti

May 09, 2025

Treiler Materialists Dakota Johnson Pedro Pascal Kai Chris Evans Se Romantiki Komenti

May 09, 2025