Is Now The Time To Ignore The Stock Market? Jeanine Pirro Weighs In

Table of Contents

Jeanine Pirro's Perspective on Current Market Conditions

While Jeanine Pirro isn't known for providing specific financial investment advice, we can infer her likely perspective based on her generally conservative viewpoints. Her commentary often reflects a belief in fiscal responsibility and limited government intervention. Therefore, we can speculate on how she might view the current situation.

-

Her potential assessment of current inflation rates: She would likely express concern about high inflation rates, viewing them as a consequence of government spending and potentially advocating for fiscal restraint to curb inflation. This concern could translate to a cautious approach to stock market investments.

-

Her likely opinion on government policies and their impact on the market: She'd probably criticize government policies that she perceives as contributing to market instability, emphasizing the importance of sound fiscal policy and deregulation to foster a healthy market environment. She might argue that excessive government intervention creates uncertainty and volatility.

-

Her probable views on the long-term prospects of the economy: Her outlook would likely depend on the success of government policies in addressing inflation and promoting economic growth. A belief in the resilience of the American economy might lead her to suggest a long-term investment horizon, despite short-term market fluctuations.

-

Mention any specific investments or strategies she might favor (if publicly known): While not explicitly stated, her general conservative stance might lead one to speculate that she may favor investments in established companies with a strong track record, perhaps favoring dividend-paying stocks or real estate as more stable investments.

Analyzing Market Volatility and its Impact on Investors

The current market volatility is undeniably significant. Factors such as persistent inflation, geopolitical instability (like the ongoing war in Ukraine), and aggressive interest rate hikes by the Federal Reserve contribute to the uncertainty. This volatility creates a challenging environment for investors.

-

Explain the causes of current market volatility: The interplay of high inflation, geopolitical risks, and rising interest rates creates a perfect storm of uncertainty, leading investors to question the direction of the market and seek safer havens for their investments. Supply chain disruptions and energy price fluctuations also play a significant role.

-

Describe the psychological impact of volatility on investor behavior: Market volatility triggers a range of emotional responses, from fear and panic selling to greed and FOMO (fear of missing out). These emotional responses can lead to rash investment decisions that may not align with long-term financial goals.

-

Explore the risks associated with ignoring the stock market completely: Completely ignoring the stock market means missing out on potential growth opportunities. While a bear market can be frightening, history shows that markets generally recover and grow over the long term. Ignoring the market entirely could mean missing substantial returns in the future.

Alternative Investment Strategies to Consider

For investors considering reducing their exposure to stock market volatility, several alternatives exist:

-

Real estate investment: Real estate can offer a hedge against inflation and provide rental income. However, it requires a significant capital investment and involves management responsibilities.

-

Bonds and fixed-income securities: Bonds offer a more stable, lower-risk investment compared to stocks. However, their returns might not keep pace with inflation during periods of high inflation.

-

Precious metals (gold, silver): Precious metals are often seen as a safe haven during times of economic uncertainty. Their value can fluctuate, but they can offer a degree of protection against inflation.

-

Diversification strategies beyond stocks: Diversification across different asset classes is crucial for managing risk. Including bonds, real estate, and alternative investments in your portfolio can reduce your reliance on the stock market's performance.

When Ignoring the Stock Market Might Be a Suitable Approach

While generally not advisable, there are circumstances where temporarily stepping away from the stock market might be a reasonable choice:

-

High personal debt levels: If you have high-interest debt, it's crucial to prioritize paying it down before investing additional funds.

-

Immediate need for funds: If you anticipate needing funds in the short term, it's wise to keep those funds in readily accessible accounts, rather than tied up in the stock market.

-

Low risk tolerance: If you have a low risk tolerance and find the market's volatility too stressful, it might be better to focus on low-risk investments.

-

Lack of financial knowledge or expertise: If you lack the knowledge or expertise to navigate the complexities of the stock market, consulting with a financial advisor is recommended before making any decisions.

Conclusion

Jeanine Pirro's likely perspective, coupled with an analysis of current market volatility and alternative investment options, highlights the complexities of today's financial landscape. The decision of whether to ignore the stock market is highly personal and hinges on individual circumstances and risk tolerance. While some might find it prudent to reduce their exposure to market volatility, completely ignoring the market entails risks. Reiterating, it is important to remember that the potential benefits of long-term investment in a diversified portfolio should not be dismissed.

Call to Action: While Jeanine Pirro's perspective can provide valuable context, the ultimate decision rests with you. Conduct thorough research, consult a financial advisor, and carefully consider your financial goals before making any investment decisions. Learn more about navigating market volatility and developing a sound investment strategy—don't ignore the power of informed decision-making in your financial future. Don't ignore the stock market without a clear understanding of your personal circumstances and the potential consequences.

Featured Posts

-

4 Randall Flagg Theories A New Look At Stephen Kings Universe

May 09, 2025

4 Randall Flagg Theories A New Look At Stephen Kings Universe

May 09, 2025 -

A And E Records Accessed Nottingham Families Demand Answers After Stabbing Tragedy

May 09, 2025

A And E Records Accessed Nottingham Families Demand Answers After Stabbing Tragedy

May 09, 2025 -

Dieu Tra Loi Khai Bao Mau Bao Hanh Tre Tai Tien Giang

May 09, 2025

Dieu Tra Loi Khai Bao Mau Bao Hanh Tre Tai Tien Giang

May 09, 2025 -

Record Fentanyl Bust Pam Bondi Details Largest Us Seizure

May 09, 2025

Record Fentanyl Bust Pam Bondi Details Largest Us Seizure

May 09, 2025 -

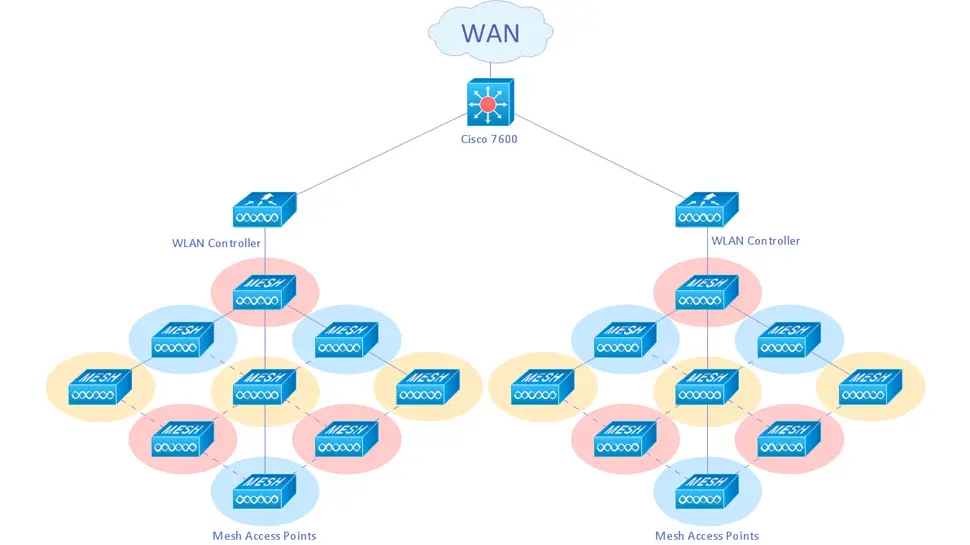

Wireless Mesh Networks Market 9 8 Cagr Projected Growth

May 09, 2025

Wireless Mesh Networks Market 9 8 Cagr Projected Growth

May 09, 2025