Is News Corp's Stock Price Misrepresenting Its True Value?

Table of Contents

Analyzing News Corp's Financial Performance

To understand the true value of News Corp stock, we must rigorously analyze its financial performance. This involves examining revenue streams, profitability, and overall financial health.

Revenue Streams and Growth Prospects

News Corp operates across diverse sectors, including newspapers, digital properties, book publishing, and more. Analyzing the growth and challenges in each segment is crucial for a complete News Corp valuation.

- Newspapers: While print advertising revenue continues to decline, News Corp has shown some success in digital subscriptions, although this segment faces intense competition.

- Digital Properties: Growth in this sector varies significantly across News Corp's portfolio. Some digital properties show robust growth, while others lag behind.

- Book Publishing: This segment generally exhibits more stability than digital news, but faces challenges from e-books and changing consumer preferences.

Market trends such as the shift to digital media, evolving reader habits, and the competitive landscape significantly impact News Corp's revenue streams. Any significant acquisitions or divestitures also influence its overall financial picture and thus the News Corp stock price. For example, a successful acquisition can boost revenue and earnings, impacting the News Corp valuation positively.

Profitability and Earnings

A comprehensive News Corp stock price analysis needs to consider key profitability metrics:

- Profit Margins: Analyzing year-over-year changes in profit margins reveals trends in operational efficiency and pricing power.

- Earnings Per Share (EPS): EPS growth indicates the profitability available to shareholders and is a crucial factor in News Corp valuation.

- Return on Equity (ROE): ROE demonstrates the effectiveness of management in using shareholder investments to generate profits.

Comparing these metrics year-over-year and against competitors in the media industry provides a benchmark for evaluating News Corp’s performance and potential for future growth. High operating costs and debt levels can significantly impact profitability, and thus, need careful consideration when assessing News Corp investment potential.

Debt and Financial Health

Analyzing News Corp's financial health is critical for assessing its long-term viability and the sustainability of its current stock price. Key metrics include:

- Debt-to-Equity Ratio: This ratio indicates the proportion of debt financing compared to equity, highlighting the company’s financial leverage.

- Interest Coverage Ratio: This metric shows the company's ability to meet its interest payment obligations.

- Credit Rating: A credit rating from agencies like Moody's or S&P provides an independent assessment of News Corp's creditworthiness.

A high debt level increases financial risk, potentially impacting the News Corp stock price negatively. Investors need to evaluate News Corp's ability to manage its debt and the potential impact of rising interest rates on its financial health.

Evaluating Intangible Assets and Future Potential

Beyond the financials, News Corp possesses valuable intangible assets that contribute significantly to its overall value. Analyzing these assets is crucial for a complete News Corp valuation.

Brand Value and Market Position

News Corp owns several powerful and well-recognized brands. These brands contribute significantly to the company's market position and ability to generate revenue. Assessing brand strength and recognition across different market segments is crucial. Analyzing News Corp's market share within various media sectors allows us to understand its competitive standing and future potential.

Digital Transformation and Innovation

News Corp's success in navigating the digital media landscape is critical for its future. Evaluating its digital initiatives, investments, and their success or failure directly impacts the News Corp stock price and overall valuation. This includes examining the effectiveness of their strategies to attract and retain digital subscribers.

- Successful digital transformation will likely lead to increased revenue and profitability.

- Failure to adapt could lead to further decline in revenue from traditional media sources.

Potential for Synergies and Acquisitions

Opportunities for synergy between News Corp's diverse business units or through strategic acquisitions significantly influence the company's long-term prospects. Identifying potential acquisition targets and assessing their strategic fit can provide insight into potential growth. Analyzing potential cost savings and revenue increases from synergies is critical for a comprehensive News Corp valuation.

Considering External Factors Impacting Valuation

Several external factors can influence News Corp's stock price, independently of its internal performance. Considering these factors is vital for a comprehensive News Corp investment analysis.

Macroeconomic Conditions

Broader economic factors such as inflation and interest rates significantly impact News Corp's operations and valuation. Rising interest rates increase borrowing costs, potentially reducing profitability. Inflation affects operating costs, impacting profit margins. Recessionary fears can lead to decreased advertising spending and reduced consumer demand, affecting News Corp’s revenue.

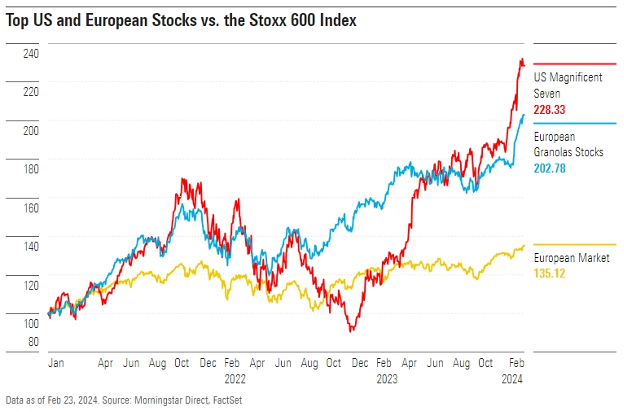

Industry Trends and Competition

The media industry faces significant challenges from declining print advertising revenue and the rise of digital media. Intense competition among media companies further complicates the situation. Analyzing the competitive landscape and its impact on profitability is critical. Identifying opportunities within the evolving media landscape is also crucial for evaluating News Corp’s future prospects.

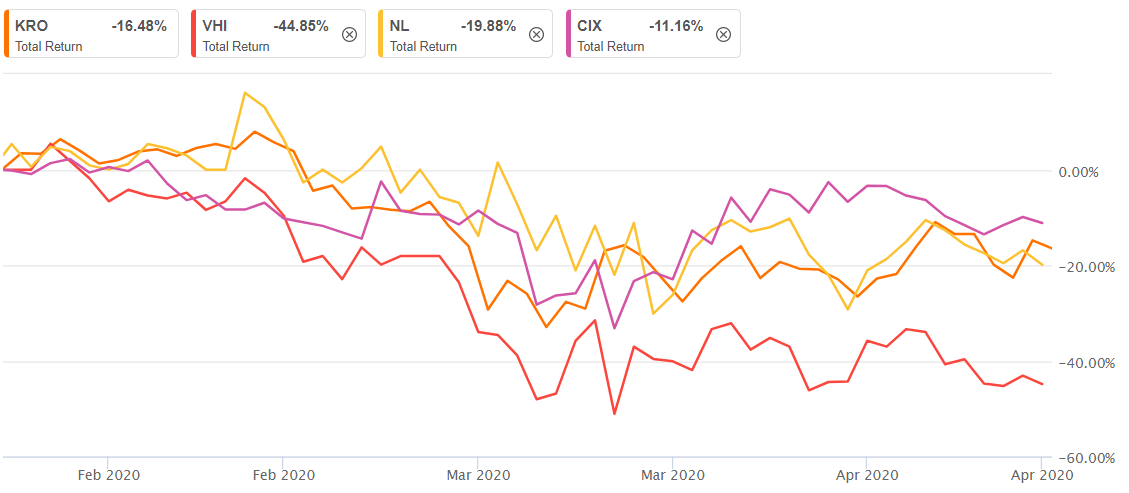

Market Sentiment and Investor Psychology

Market sentiment towards News Corp and the media sector as a whole can significantly influence its stock price. News events and investor perceptions can create volatility, regardless of the company's underlying fundamentals. It's important to determine whether investor sentiment is justified based on the available evidence. Analyzing investor sentiment towards the sector as a whole provides context for News Corp's stock performance.

Conclusion

Our analysis of News Corp's financial performance, intangible assets, and external factors provides a nuanced understanding of the company's current situation and future prospects. Whether the News Corp stock price accurately reflects its intrinsic value depends on a careful weighting of these diverse factors. While some indicators point towards undervaluation, others suggest caution. Determining whether News Corp stock is truly undervalued, fairly valued, or even overvalued requires ongoing monitoring and a thorough understanding of the evolving media landscape. Conduct your own due diligence and determine if News Corp stock aligns with your investment strategy and risk tolerance. Is News Corp's stock price truly reflecting its true value?

Featured Posts

-

Viktorina Roli Olega Basilashvili V Sovetskom Kino

May 25, 2025

Viktorina Roli Olega Basilashvili V Sovetskom Kino

May 25, 2025 -

Snl Afterparty Lady Gagas Romantic Arrival With Michael Polansky

May 25, 2025

Snl Afterparty Lady Gagas Romantic Arrival With Michael Polansky

May 25, 2025 -

West Ham United Bid For Kyle Walker Peters Transfer Offer Details

May 25, 2025

West Ham United Bid For Kyle Walker Peters Transfer Offer Details

May 25, 2025 -

Conchita Wurst And Jj Eurovision Village Concert Esc 2025

May 25, 2025

Conchita Wurst And Jj Eurovision Village Concert Esc 2025

May 25, 2025 -

News Corps Undervalued Assets A Comprehensive Analysis

May 25, 2025

News Corps Undervalued Assets A Comprehensive Analysis

May 25, 2025

Latest Posts

-

Analyse Snelle Marktdraai Europese Aandelen Implicaties Voor Beleggers

May 25, 2025

Analyse Snelle Marktdraai Europese Aandelen Implicaties Voor Beleggers

May 25, 2025 -

De Toekomst Van Europese Aandelen Zal De Snelle Marktdraai Ten Opzichte Van Wall Street Aanhouden

May 25, 2025

De Toekomst Van Europese Aandelen Zal De Snelle Marktdraai Ten Opzichte Van Wall Street Aanhouden

May 25, 2025 -

Le Brest Urban Trail Benevoles Artistes Et Partenaires Au Coeur De La Course

May 25, 2025

Le Brest Urban Trail Benevoles Artistes Et Partenaires Au Coeur De La Course

May 25, 2025 -

Brest Urban Trail Un Portrait Des Acteurs Cles

May 25, 2025

Brest Urban Trail Un Portrait Des Acteurs Cles

May 25, 2025 -

Krijgt De Snelle Marktdraai Van Europese Aandelen Ten Opzichte Van Wall Street Een Vervolg Analyse En Voorspelling

May 25, 2025

Krijgt De Snelle Marktdraai Van Europese Aandelen Ten Opzichte Van Wall Street Een Vervolg Analyse En Voorspelling

May 25, 2025