Is News Corp An Undervalued Asset? A Deep Dive Into Its Business Units

Table of Contents

News Corp, the media and information services giant founded by Rupert Murdoch, has a long and complex history. Recent market performance and strategic shifts have led many investors to question whether News Corp is currently an undervalued asset. This in-depth analysis will explore its diverse business units, examining their individual strengths and weaknesses to determine if the company's current market capitalization accurately reflects its true potential. We'll delve into the financials, assess the risks, and ultimately help you decide if News Corp stock is a smart investment for your portfolio.

News Corp's Diverse Portfolio: A Breakdown of Key Business Units

Keywords: News Corp segments, Dow Jones, Wall Street Journal, News Corp revenue, publishing, digital real estate, book publishing, News Corp subsidiaries

News Corp's revenue streams are diversified across several key segments, each contributing uniquely to its overall financial performance. Understanding these individual units is critical to evaluating the company's overall valuation.

-

News Media: This segment is arguably News Corp's most recognizable, anchored by the prestigious Wall Street Journal, a global leader in financial news, and complemented by UK titles like The Times and The Sunday Times. While print circulation remains a factor, the focus has shifted towards digital subscriptions, which offer recurring revenue and enhanced engagement opportunities. Advertising revenue in this sector is naturally subject to market fluctuations, but targeted digital content strategies present significant growth potential. The ability to provide high-quality, exclusive journalism remains a key competitive advantage in an increasingly fragmented media landscape.

-

Book Publishing: HarperCollins Publishers, a major player in the global book publishing industry, contributes significantly to News Corp's revenue. The success of HarperCollins rests on a diverse portfolio of best-selling titles, spanning various genres. The company's strategic adaptation to the rise of e-books and audiobooks has been crucial in maintaining profitability. While print books continue to be important, the digital market represents significant growth opportunities for expansion and reaching new audiences.

-

Digital Real Estate Services: REA Group, dominating the Australian real estate market, and Move, Inc., a prominent player in the US market (through Realtor.com), provide significant and steadily growing revenue streams for News Corp. These online platforms benefit from a recurring revenue model driven by subscriptions and advertising from real estate agents. The future growth prospects of these businesses are tied to the ongoing digitization of the real estate industry and the increasing reliance on online platforms for property searches and transactions. This provides a stable and potentially high-growth area within News Corp's portfolio, less susceptible to the volatility of the advertising-driven news market.

-

Other Businesses: While less prominent than the above segments, News Corp also holds smaller stakes in other ventures that contribute to the overall financial picture. These diverse holdings provide a level of diversification, mitigating some of the risks associated with reliance on any single business unit.

Financial Performance and Valuation Analysis

Keywords: News Corp financials, News Corp stock price, earnings per share, price-to-earnings ratio, dividend yield, market capitalization, News Corp debt

Analyzing News Corp's financial health is crucial for determining its potential as an undervalued asset. Several key metrics offer insight:

-

Revenue and Profitability: Examining News Corp's financial statements reveals trends in revenue growth, profit margins, and key performance indicators (KPIs). Consistently strong performance across business units would point towards a healthy and growing company.

-

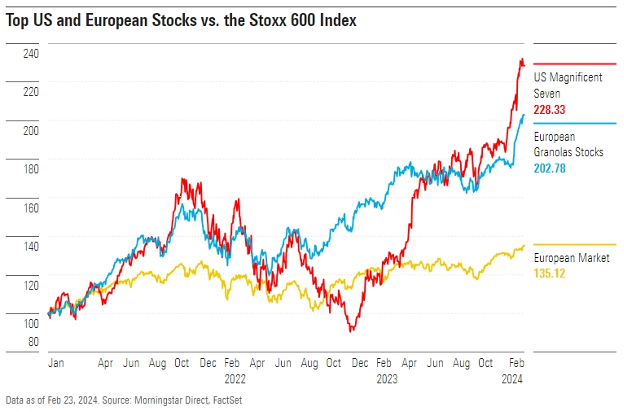

Valuation Metrics: Comparing News Corp's Price-to-Earnings ratio (P/E), Price-to-Book ratio (P/B), and dividend yield to its industry peers is essential. A lower P/E ratio, for instance, could suggest undervaluation compared to competitors with similar growth prospects.

-

Debt and Financial Health: A high level of debt can be a significant risk factor. Analyzing News Corp's debt levels and its ability to service that debt is crucial for assessing its overall financial health and stability.

-

Future Earnings Projections: Analyzing analyst forecasts for future earnings provides a forward-looking perspective on the company's potential. Positive growth projections suggest a more optimistic outlook for the stock price.

Risks and Challenges Facing News Corp

Keywords: News Corp risks, media industry challenges, competition, regulatory risks, economic downturn, digital disruption

Despite its strengths, News Corp faces several challenges:

-

Competition: The media and publishing industries are highly competitive, with both established players and new digital entrants vying for market share. Maintaining a competitive edge requires constant innovation and adaptation.

-

Regulatory Scrutiny: News Corp's operations are subject to regulatory scrutiny in various jurisdictions. Changes in media regulations can significantly impact its business model and profitability.

-

Economic Conditions: Economic downturns often lead to reduced advertising spending and decreased consumer spending on news and entertainment. News Corp's revenue is vulnerable to such fluctuations.

-

Digital Disruption: The ongoing shift to digital media poses a significant challenge to traditional media businesses. News Corp's ability to adapt to this disruption is key to its long-term success.

Addressing the Undervalued Asset Question

Keywords: News Corp investment, buy News Corp stock, News Corp outlook, long-term investment

Synthesizing the information above, the question of whether News Corp is an undervalued asset is complex. Its diversified portfolio and strong brands offer potential for growth, particularly in the digital real estate sector. However, the challenges posed by digital disruption and economic uncertainty cannot be ignored. A thorough assessment of its financial health, valuation relative to peers, and future growth prospects is crucial.

Conclusion

News Corp operates in a dynamic and competitive landscape. While facing significant challenges from digital disruption and economic uncertainty, its diverse portfolio of businesses and strategic initiatives offer potential for future growth. A thorough analysis of its financial performance, valuation, and risk factors is crucial for determining whether it truly represents an undervalued asset. Further research, including analyzing individual segment performance and future market trends, is essential before making any investment decisions. Consider the potential for long-term growth and diversification offered by News Corp before deciding whether it’s right for your portfolio. Is News Corp an undervalued asset for you? Conduct thorough due diligence before making any investment decisions related to News Corp stock.

Featured Posts

-

Prognoz Konchiti Vurst Potentsiyni Peremozhtsi Yevrobachennya 2025 Unian

May 25, 2025

Prognoz Konchiti Vurst Potentsiyni Peremozhtsi Yevrobachennya 2025 Unian

May 25, 2025 -

Is Kyle Walker Peters Heading To Elland Road Leeds Transfer Update

May 25, 2025

Is Kyle Walker Peters Heading To Elland Road Leeds Transfer Update

May 25, 2025 -

2024 Philips Annual General Meeting Financial Results And Future Plans

May 25, 2025

2024 Philips Annual General Meeting Financial Results And Future Plans

May 25, 2025 -

H Nonline Sk Tisice Prepustenych V Nemecku Reakcia Na Hospodarsky Pokles

May 25, 2025

H Nonline Sk Tisice Prepustenych V Nemecku Reakcia Na Hospodarsky Pokles

May 25, 2025 -

Finding Bbc Radio 1 Big Weekend 2025 Tickets A Practical Guide

May 25, 2025

Finding Bbc Radio 1 Big Weekend 2025 Tickets A Practical Guide

May 25, 2025

Latest Posts

-

Best Of Bangladesh In Europe 2nd Edition Driving Collaboration And Economic Growth

May 25, 2025

Best Of Bangladesh In Europe 2nd Edition Driving Collaboration And Economic Growth

May 25, 2025 -

Best Of Bangladesh In Europe 2nd Edition Focuses On Collaboration And Growth

May 25, 2025

Best Of Bangladesh In Europe 2nd Edition Focuses On Collaboration And Growth

May 25, 2025 -

Analyse Snelle Marktdraai Europese Aandelen Implicaties Voor Beleggers

May 25, 2025

Analyse Snelle Marktdraai Europese Aandelen Implicaties Voor Beleggers

May 25, 2025 -

De Toekomst Van Europese Aandelen Zal De Snelle Marktdraai Ten Opzichte Van Wall Street Aanhouden

May 25, 2025

De Toekomst Van Europese Aandelen Zal De Snelle Marktdraai Ten Opzichte Van Wall Street Aanhouden

May 25, 2025 -

Le Brest Urban Trail Benevoles Artistes Et Partenaires Au Coeur De La Course

May 25, 2025

Le Brest Urban Trail Benevoles Artistes Et Partenaires Au Coeur De La Course

May 25, 2025