Is Jim Cramer Right About CoreWeave (CRWV)? A Deep Dive Into The AI Infrastructure Landscape

Table of Contents

CoreWeave's Business Model: Powering the AI Revolution

CoreWeave's Infrastructure as a Service (IaaS) Offering

CoreWeave specializes in providing high-performance computing (HPC) resources tailored specifically for the demanding workloads of artificial intelligence. Their infrastructure leverages the power of NVIDIA GPUs, offering clients scalable and cost-effective access to this crucial technology. This cloud-based infrastructure is designed to support the needs of a diverse customer base, ranging from ambitious AI startups to large established enterprises. Key features driving CoreWeave's success include:

- Unparalleled Scalability: Quickly scale resources up or down to meet fluctuating demands, ensuring optimal performance and cost efficiency.

- NVIDIA GPU Optimization: Direct access to the latest NVIDIA GPUs, maximizing performance for AI training and inference.

- Robust Cloud Infrastructure: Built on a reliable and secure cloud platform, ensuring high availability and data security.

- Competitive Pricing: Offers flexible pricing models to cater to the budgets of various clients.

CoreWeave's Competitive Advantages in the AI Infrastructure Market

While major cloud providers like AWS, Azure, and GCP also offer AI infrastructure solutions, CoreWeave differentiates itself through several key advantages:

- GPU Specialization: CoreWeave's focus on GPU-accelerated computing gives it a specialized edge over general-purpose cloud providers.

- Strategic Partnerships: Collaborations with leading technology companies further strengthen its market position and provide access to cutting-edge technology.

- Agile and Customer-Centric Approach: CoreWeave’s responsiveness to client needs and ability to adapt quickly to market changes gives them a competitive edge.

- Optimized Pricing: A competitive pricing strategy allows them to attract a broad customer base, particularly price-sensitive AI startups.

Financial Performance and Growth Trajectory of CRWV

CoreWeave's financial performance, while relatively young as a publicly traded company, reflects strong growth in revenue. While profitability is still a key focus, the company's rapid expansion in the booming AI sector suggests a positive trajectory. Analyzing investor sentiment and stock performance is crucial; while the stock price can be volatile, long-term growth potential is a significant factor for consideration. Examining key financial metrics, including revenue growth, expense management, and debt levels, provides a clearer picture of the company’s financial health.

The AI Infrastructure Landscape: A Booming Market for CRWV

The Explosive Growth of the AI Market

The AI infrastructure market is experiencing explosive growth, fueled by the increasing adoption of AI across various industries. The rise of large language models (LLMs) and the growing demand for sophisticated AI applications are driving the need for powerful computing resources. This demand translates directly into increased revenue opportunities for companies like CoreWeave:

- Market Size and Projections: Analysts predict substantial growth in the AI infrastructure market over the next decade.

- Key Market Drivers: The widespread adoption of AI, the development of increasingly complex AI models, and the emergence of new AI applications are all contributing to this growth.

- Demand for Specialized Computing: The need for specialized hardware like high-performance GPUs is a critical factor driving this market expansion.

Key Players and Competitive Analysis in the AI Infrastructure Space

The AI infrastructure space is becoming increasingly competitive. While major cloud providers remain significant players, specialized companies like CoreWeave are carving out niches with their expertise and tailored solutions. Analyzing the competitive landscape requires understanding each player's strengths, weaknesses, and market share. Technology advancements and market share fluctuations will significantly impact the future of the AI infrastructure space.

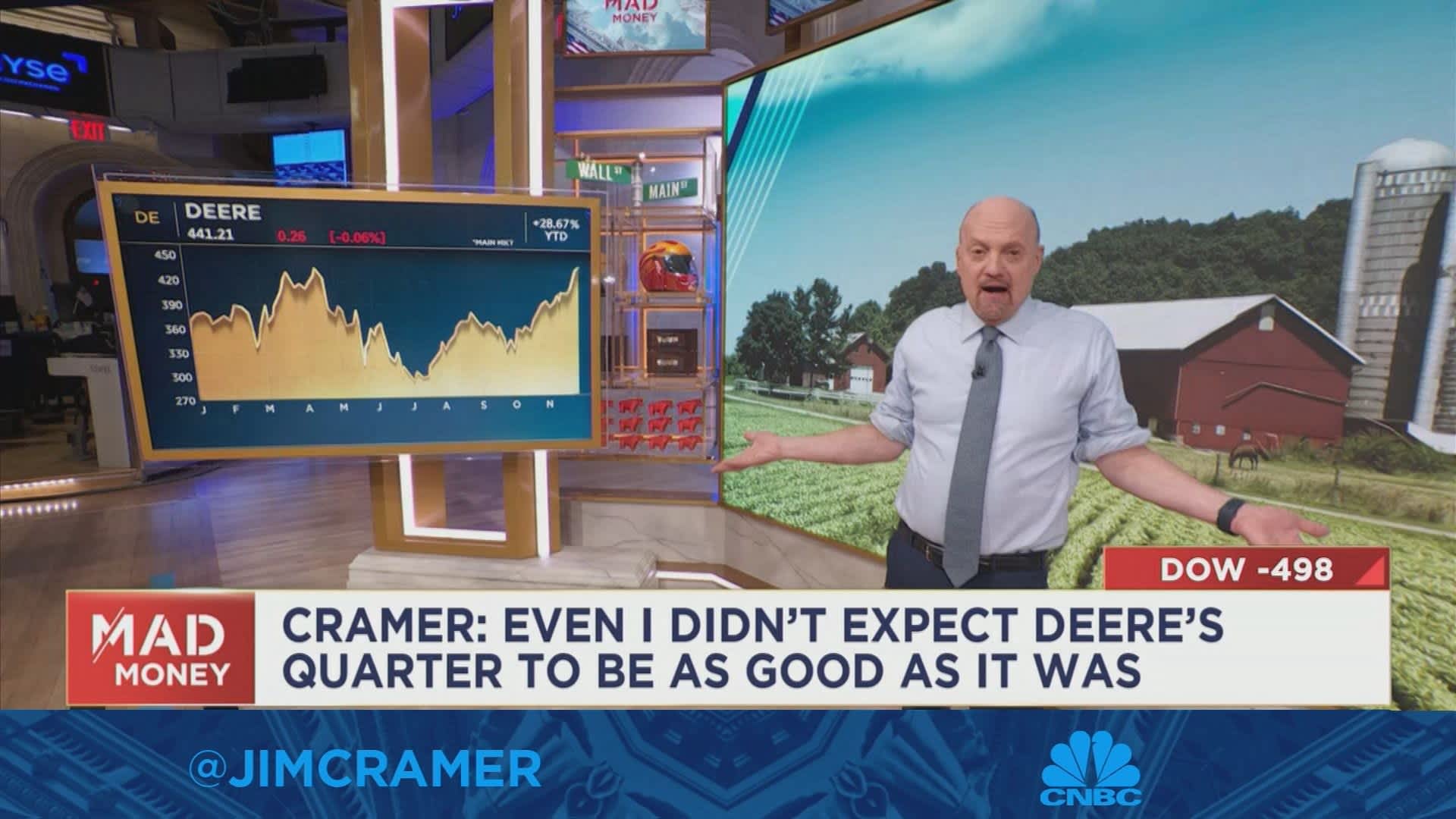

Analyzing Jim Cramer's CoreWeave (CRWV) Prediction

Jim Cramer's Stance on CoreWeave (CRWV):

A summary of Jim Cramer's public statements regarding CoreWeave and his prediction for its future performance is necessary here. Reference specific quotes and news articles detailing his viewpoints.

Evaluating the Validity of Cramer's Prediction

To evaluate Cramer's prediction, we must weigh the evidence gathered in the preceding sections. Consider the following:

- Strengths: CoreWeave's specialization in GPU-accelerated computing, its strong growth trajectory, and the overall booming AI market all support a positive outlook.

- Weaknesses: The highly competitive landscape, potential for technological disruptions, and the inherent volatility of the stock market present significant risks.

- Opportunities: Expanding into new markets, developing innovative technologies, and forging strategic partnerships could further boost CoreWeave’s growth.

- Threats: Intense competition from established cloud providers and the emergence of new technologies pose challenges to CoreWeave's long-term success.

Conclusion: Is Investing in CoreWeave (CRWV) the Right Move?

Our analysis of CoreWeave reveals a company operating in a rapidly expanding market with a strong value proposition. However, the competitive landscape and inherent risks associated with investing in a relatively young technology company cannot be ignored. While Jim Cramer's prediction might hold some merit based on CoreWeave’s current position and growth potential, whether it's the right move for you depends entirely on your individual risk tolerance and investment strategy. Before making any investment decisions regarding CoreWeave (CRWV) or any other AI infrastructure company, conduct thorough due diligence and seek professional financial advice. Further research into CoreWeave's financial statements, industry reports, and competitive analysis will equip you to make a more informed decision about investing in CRWV and the broader AI infrastructure market.

Featured Posts

-

Voedselexport Naar Vs Keldert Abn Amro Analyseert Impact Heffingen

May 22, 2025

Voedselexport Naar Vs Keldert Abn Amro Analyseert Impact Heffingen

May 22, 2025 -

The Amazing World Of Gumball A New Streaming Home On Hulu And Disney

May 22, 2025

The Amazing World Of Gumball A New Streaming Home On Hulu And Disney

May 22, 2025 -

Across Australia On Foot A Britons Challenging Run

May 22, 2025

Across Australia On Foot A Britons Challenging Run

May 22, 2025 -

Brasserie Hell City L Adresse Incontournable Pour Le Hellfest

May 22, 2025

Brasserie Hell City L Adresse Incontournable Pour Le Hellfest

May 22, 2025 -

Kien Nghi Xay Dung Duong Cao Toc 4 Lan Xe Tu Dong Nai Den Binh Phuoc Qua Rung Ma Da

May 22, 2025

Kien Nghi Xay Dung Duong Cao Toc 4 Lan Xe Tu Dong Nai Den Binh Phuoc Qua Rung Ma Da

May 22, 2025

Latest Posts

-

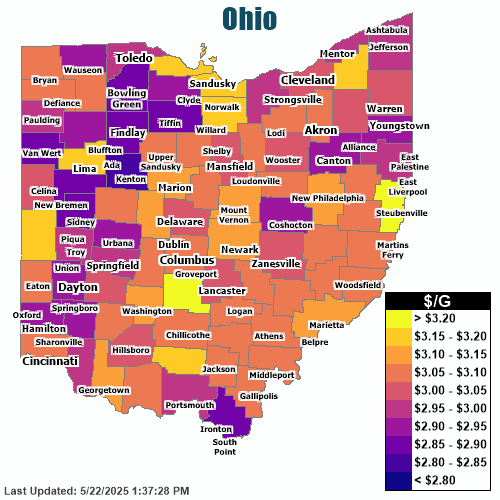

Wide Gas Price Range In Columbus 2 83 3 31 Gallon

May 22, 2025

Wide Gas Price Range In Columbus 2 83 3 31 Gallon

May 22, 2025 -

Solve Nyt Wordle 1368 March 18 Hints And The Answer

May 22, 2025

Solve Nyt Wordle 1368 March 18 Hints And The Answer

May 22, 2025 -

Columbus Gas Station Prices Vary By 48 Cents

May 22, 2025

Columbus Gas Station Prices Vary By 48 Cents

May 22, 2025 -

Wordle 367 March 17th Hints Clues And Answer

May 22, 2025

Wordle 367 March 17th Hints Clues And Answer

May 22, 2025 -

Columbus Gas Prices 2 83 To 3 31 Per Gallon

May 22, 2025

Columbus Gas Prices 2 83 To 3 31 Per Gallon

May 22, 2025