Is BigBear.ai Holdings, Inc. (NYSE: BBAI) A Top Penny Stock To Watch?

Table of Contents

BigBear.ai (BBAI) Business Model and Financial Performance

BigBear.ai's (BBAI) business model centers on providing advanced AI and data analytics solutions to both government and commercial clients. Understanding its revenue streams and financial health is crucial for assessing its investment potential.

Revenue Streams and Growth Prospects

BBAI generates revenue primarily through:

- Government Contracts: A significant portion of BBAI's revenue comes from contracts with various government agencies, focusing on national security and intelligence.

- Commercial Sales: The company is also expanding its commercial client base, offering AI-powered solutions across diverse sectors.

Analyzing BBAI's recent financial performance reveals:

- Year-over-Year Revenue Growth: [Insert data on year-over-year revenue growth here, ideally with a chart showing the trend]. This data point is key to evaluating the company's growth trajectory.

- Profitability: [Insert data on profit margins and profitability trends. Are they improving or declining? Include a chart if possible]. This shows the company's ability to generate profits from its operations.

- Debt Levels: [Insert data on BBAI's debt levels and debt-to-equity ratio. High debt levels can pose a significant risk]. Understanding the company's financial leverage is critical.

Keywords: "BBAI revenue," "BBAI financial performance," "revenue growth," "profitability," "financial statements."

Competitive Landscape and Market Position

The AI and big data market is highly competitive. Understanding BBAI's positioning within this landscape is essential.

Key Competitors and Market Share

BBAI faces stiff competition from established players and emerging startups. Key competitors include [List key competitors here, e.g., Palantir, CACI International, etc.]. Assessing BBAI's relative strengths and weaknesses requires analyzing:

- Market Share: [Insert data on BBAI's estimated market share, if available. This information might be difficult to find for a smaller player]. Even an estimate can be helpful in understanding its position.

- Competitive Advantages: BBAI's competitive advantages might include specialized expertise in certain AI applications, strong government relationships, or a unique technological approach.

- Competitive Disadvantages: Potential disadvantages could include limited resources compared to larger competitors, dependence on a small number of clients, or challenges in scaling operations.

Keywords: "BBAI competitors," "market share," "competitive advantage," "AI market," "big data market."

Risk Assessment and Investment Considerations

Investing in penny stocks like BBAI carries inherent risks. A thorough risk assessment is crucial before committing any capital.

Potential Risks and Challenges

Investing in BBAI involves several significant risks:

- Volatility of Penny Stocks: Penny stocks are notoriously volatile, meaning their prices can fluctuate dramatically in short periods.

- Dependence on Government Contracts: BBAI's significant reliance on government contracts exposes it to the risks of budget cuts, changing government priorities, and potential delays in contract awards.

- Technological Disruption Risks: Rapid advancements in AI technology could render BBAI's current offerings obsolete.

- Regulatory Risks: Changes in government regulations could impact BBAI's operations and profitability.

Valuation and Investment Strategy

Evaluating BBAI's current valuation requires analyzing:

- P/E Ratio: [Insert P/E ratio if available. Explain its significance and limitations in the context of a growth company.]

- Market Capitalization: [Insert market capitalization. Discuss its relevance in evaluating the company's size and potential.]

- Potential Return on Investment (ROI): Projecting ROI for BBAI is highly speculative due to the inherent volatility and uncertainty.

Potential investment strategies range from long-term holding (assuming sustained growth) to shorter-term trading (exploiting price fluctuations). However, any strategy should align with your personal risk tolerance.

Keywords: "BBAI risk," "penny stock risk," "investment risk," "volatility," "market risk," "BBAI valuation," "P/E ratio," "market capitalization," "investment strategy," "ROI."

Conclusion: Is BigBear.ai (BBAI) Right for Your Portfolio?

BigBear.ai (BBAI) presents a compelling opportunity in the rapidly growing AI and big data sectors. However, its status as a penny stock necessitates careful consideration of the inherent risks. While the potential for high returns exists, the volatility and challenges discussed above cannot be ignored.

Based on our analysis, BBAI might be suitable for investors with a high-risk tolerance and a long-term investment horizon. However, it's crucial to conduct thorough due diligence, including reviewing BBAI's financial statements, researching its competitive landscape, and understanding the potential risks before investing. Remember, no investment is without risk, and past performance is not indicative of future results.

Before investing in BigBear.ai (BBAI) or any other penny stock, conduct thorough research and seek professional financial advice. Remember, understanding the risks associated with BBAI penny stock investment is crucial for making informed decisions.

Featured Posts

-

Le Noumatrouff Et Le Hellfest Un Evenement Musical A Mulhouse

May 21, 2025

Le Noumatrouff Et Le Hellfest Un Evenement Musical A Mulhouse

May 21, 2025 -

The Goldbergs Character Profiles And Relationships

May 21, 2025

The Goldbergs Character Profiles And Relationships

May 21, 2025 -

Stijgende Huizenprijzen In Nederland Abn Amros Voorspellingen

May 21, 2025

Stijgende Huizenprijzen In Nederland Abn Amros Voorspellingen

May 21, 2025 -

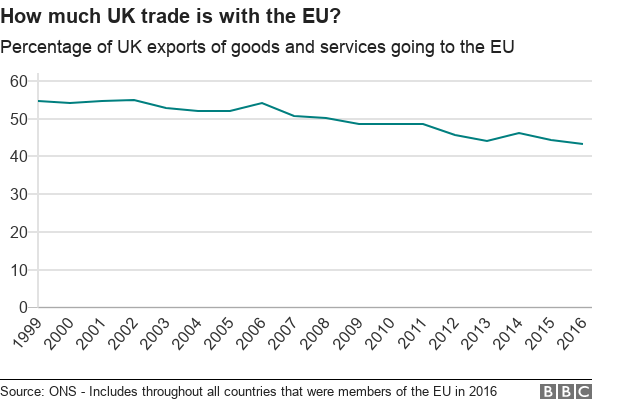

Brexits Impact Uk Luxury Goods Exports To The Eu

May 21, 2025

Brexits Impact Uk Luxury Goods Exports To The Eu

May 21, 2025 -

American Couple Arrested In Uk After Appearing On Bbc Antiques Roadshow

May 21, 2025

American Couple Arrested In Uk After Appearing On Bbc Antiques Roadshow

May 21, 2025

Latest Posts

-

Liverpools Win Expert Analysis From Slot And Enrique On Alisson And Luck

May 22, 2025

Liverpools Win Expert Analysis From Slot And Enrique On Alisson And Luck

May 22, 2025 -

Financial Times Bps Chief Executive Targets Valuation Doubling Rejects Us Listing

May 22, 2025

Financial Times Bps Chief Executive Targets Valuation Doubling Rejects Us Listing

May 22, 2025 -

Alissons Performance Slot And Enrique Offer Insights After Liverpool Win

May 22, 2025

Alissons Performance Slot And Enrique Offer Insights After Liverpool Win

May 22, 2025 -

Musics Reach Delving Into The Sound Perimeter Of Shared Emotion

May 22, 2025

Musics Reach Delving Into The Sound Perimeter Of Shared Emotion

May 22, 2025 -

Slot Concedes Liverpools Good Fortune Enrique Analyzes Alisson

May 22, 2025

Slot Concedes Liverpools Good Fortune Enrique Analyzes Alisson

May 22, 2025