Is A US XRP ETF Imminent? Latest XRP Price Predictions

Table of Contents

SEC's Stance on XRP and ETF Applications

The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) casts a long shadow over the possibility of an XRP ETF in the US. The SEC's stance on XRP, and indeed on cryptocurrencies in general, is a key determinant of whether such an ETF will ever see the light of day.

-

The Ripple vs. SEC lawsuit: This landmark case revolves around the SEC's classification of XRP as an unregistered security. The outcome will significantly impact not only XRP's future but also the regulatory landscape for other cryptocurrencies. A favorable ruling for Ripple could pave the way for XRP ETF approval, while an unfavorable outcome could significantly delay or even prevent it.

-

SEC's History with Crypto ETFs: The SEC has historically been cautious regarding cryptocurrency ETF approvals, citing concerns about market manipulation, investor protection, and the overall volatility of the crypto market. Their past decisions provide valuable insights into their current thinking.

-

Implications of a Ruling: A positive ruling could trigger a surge in XRP adoption and price, making an ETF application much more likely. Conversely, a negative ruling would likely dampen investor enthusiasm and delay any ETF aspirations for the foreseeable future.

-

Key Arguments in the Ripple Case:

- The SEC argues XRP was sold as an unregistered security.

- Ripple contends XRP is a decentralized digital asset, not a security.

- The definition of a "security" under US law remains a point of contention.

-

Impact on Other Cryptocurrencies: The Ripple case sets a precedent that could influence how the SEC regulates other cryptocurrencies, potentially impacting the likelihood of ETFs for other digital assets.

-

SEC's Evolving Approach: The SEC's approach to crypto regulation is constantly evolving. Recent statements and actions from the agency offer clues about their potential future decisions regarding XRP and other cryptocurrencies.

Factors Influencing XRP Price Predictions

XRP's price is a complex interplay of various factors, making accurate predictions challenging. Several key elements influence market sentiment and, subsequently, price fluctuations.

-

Market Sentiment: Investor confidence and overall market sentiment toward XRP play a crucial role. Positive news, such as partnerships or technological advancements, can boost sentiment, while regulatory uncertainty or negative news can dampen it.

-

Ripple's Partnerships and Technological Advancements: Ripple's ongoing partnerships with financial institutions and its continuous technological improvements contribute to XRP's long-term potential. These factors can significantly impact investor confidence and price.

-

Broader Cryptocurrency Market Trends: The overall cryptocurrency market significantly impacts XRP's price. A bull market in Bitcoin often correlates with positive price action in XRP, while a bear market tends to drag XRP's price down.

-

Key Technological Developments Driving XRP Adoption:

- Improvements in RippleNet, its payment processing network.

- Integration with new financial institutions globally.

- Development of new use cases for XRP beyond payments.

-

Influence of Major Institutional Investors: The participation of large institutional investors can significantly influence XRP's price. Their involvement signals confidence in the asset and can attract further investment.

-

Correlation Between Bitcoin's Price and XRP's Price: XRP often shows a strong correlation with Bitcoin's price movements. Understanding Bitcoin's price trends can help predict potential XRP price movements.

Bullish XRP Price Predictions

Several analysts and experts hold bullish XRP price predictions, often tying them to potential ETF approval.

-

Specific Price Targets and Timelines: Some analysts predict XRP could reach $5 or even higher if a US XRP ETF is approved. Timelines vary, but many believe significant price increases could happen within a year of approval.

-

Underlying Assumptions Driving Bullish Predictions: These predictions are largely based on the assumption that ETF approval would significantly increase liquidity and institutional investment in XRP.

-

Potential Impact of ETF Approval on Price: ETF approval is seen as a major catalyst that could unlock significant value and drive substantial price appreciation.

Bearish XRP Price Predictions

Conversely, some analysts maintain a bearish outlook, citing regulatory uncertainties and other potential headwinds.

-

Specific Price Targets and Timelines: Bearish predictions often suggest XRP might remain range-bound or even experience further price declines if the SEC continues its crackdown on cryptocurrencies or if the Ripple case results in an unfavorable outcome.

-

Underlying Assumptions Driving Bearish Predictions: These predictions are often based on the potential for continued regulatory uncertainty and the possibility of a protracted legal battle.

-

Potential Impact of Regulatory Uncertainty on Price: Ongoing regulatory uncertainty is a major headwind that could keep XRP's price suppressed.

The Likelihood of an XRP ETF Approval in the US

Assessing the likelihood of SEC approval for an XRP ETF is complex, requiring careful consideration of the current regulatory climate and several other factors.

-

Probability of SEC Approval: Given the SEC's historical stance and the ongoing Ripple case, the probability remains uncertain. However, a positive outcome in the Ripple case would significantly increase the likelihood.

-

Potential Timelines for Approval or Rejection: If approved, the timeline for an XRP ETF launch could range from several months to a year or more, depending on various factors. Rejection could lead to lengthy appeals processes.

-

Impact on the Broader Cryptocurrency Market: Approval or rejection of an XRP ETF would send shockwaves through the cryptocurrency market, influencing investor sentiment and potentially affecting other digital assets.

-

Comparison with Other Crypto ETF Approvals (or Rejections): Examining past decisions concerning other crypto ETFs offers valuable context and insights.

-

Potential Hurdles and Challenges to Approval: Regulatory hurdles, ongoing legal battles, and concerns about market manipulation continue to present significant challenges.

-

Analysis of Legal Precedents and Expert Opinions: Legal precedents and expert opinions on securities law play a crucial role in influencing the SEC’s decision-making process.

Conclusion

The question of whether a US XRP ETF is imminent remains a complex one, deeply intertwined with the SEC's ongoing legal battles and its fluctuating stance on cryptocurrencies. While optimistic predictions point to substantial price jumps upon approval, pessimistic viewpoints highlight the persistent regulatory uncertainties. Understanding these diverse perspectives and the driving forces behind them is essential for sound investment choices. Stay informed about the latest developments in the Ripple case and SEC rulings to make well-informed decisions about your XRP investment strategy. Continue researching the prospects of a US XRP ETF and stay updated on the newest XRP price predictions.

Featured Posts

-

Comparing Us Sales Data Ps 5 Vs Xbox Series X S

May 02, 2025

Comparing Us Sales Data Ps 5 Vs Xbox Series X S

May 02, 2025 -

A Look At Ongoing Nuclear Litigation Cases Challenges And Implications

May 02, 2025

A Look At Ongoing Nuclear Litigation Cases Challenges And Implications

May 02, 2025 -

This Country Your Ultimate Travel Guide

May 02, 2025

This Country Your Ultimate Travel Guide

May 02, 2025 -

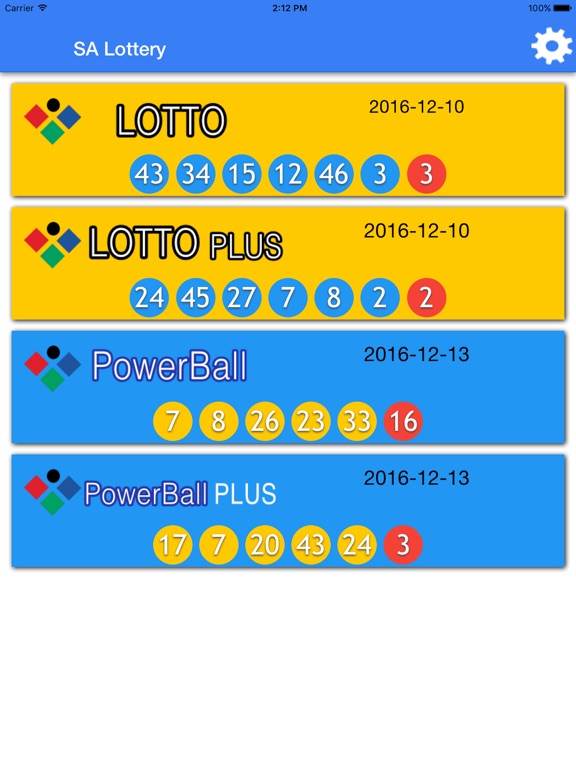

Latest Lotto Lotto Plus 1 And Lotto Plus 2 Draw Results

May 02, 2025

Latest Lotto Lotto Plus 1 And Lotto Plus 2 Draw Results

May 02, 2025 -

How To Prepare Your Pitch For Dragons Den

May 02, 2025

How To Prepare Your Pitch For Dragons Den

May 02, 2025