Is A Real Estate Investment A Safe Bet? Weighing The Risks And Rewards

Table of Contents

The Allure of Real Estate Investment: Potential Rewards

Real estate investment offers several compelling advantages that attract many investors. Let's delve into the key potential rewards.

Passive Income Generation

Rental property investment provides a significant avenue for generating passive income. This steady stream of cash flow can supplement your existing income and contribute to long-term financial security.

- Rental yields: The rental yield, calculated as annual rental income divided by the property value, indicates the potential return on your investment. Higher yields generally mean greater returns.

- Potential for rent increases: Annual rent increases, aligned with market rates, can boost your passive income streams over time. This helps offset inflation and improves your overall return.

- Tax advantages: Real estate offers several tax advantages, such as depreciation deductions and various other expenses that are often tax-deductible, potentially reducing your overall tax burden. Consult with a tax professional for specifics. This is a crucial aspect of any successful rental income strategy.

Appreciation in Property Value

A key attraction of real estate is the potential for long-term appreciation in property value. This growth can significantly enhance your investment returns over time.

- Market trends: Analyzing local and national real estate market trends is crucial. Strong market growth in your chosen area indicates greater potential for appreciation.

- Location, location, location: The location of your property significantly influences its value. Properties in desirable areas with high demand tend to appreciate more rapidly.

- Property type: Residential properties, commercial properties, and even specialized properties like multi-family units all have different appreciation potentials. Understanding the nuances of each is important in choosing the right real estate investment strategy.

- Impact of inflation: Real estate often acts as a hedge against inflation. As inflation rises, so too do property values, protecting your investment's purchasing power.

Leverage and Equity Building

Leveraging mortgage financing is a common strategy in real estate investment. This allows you to amplify your returns with a relatively smaller initial investment.

- Mortgage interest deductions: Mortgage interest payments are often tax-deductible, reducing your tax liability.

- Building equity over time: As you make mortgage payments, you gradually build equity in the property, increasing your ownership stake.

- Using equity for future investments: The accumulated equity can be used as collateral for future real estate investments or other ventures. This allows for strategic growth and diversification of your portfolio.

Navigating the Risks of Real Estate Investment

While the rewards are substantial, real estate investment also carries inherent risks. Understanding these risks is critical to making informed decisions.

Market Volatility

The real estate market is susceptible to economic fluctuations. Downturns can significantly impact property values, creating losses for investors.

- Recessions: During economic recessions, property values can decline, potentially leading to negative equity.

- Interest rate hikes: Increases in interest rates can make borrowing more expensive, affecting both purchase prices and rental yields.

- Local market conditions: Local factors, such as oversupply or decreased demand, can significantly influence property values.

- Supply and demand: The interplay of supply and demand dictates market prices. An oversupply can lead to decreased prices, while high demand drives prices up.

Unexpected Expenses

Property ownership often involves unexpected expenses that can significantly impact profitability.

- Repairs and maintenance: Unexpected repairs, such as plumbing issues or roof damage, can quickly deplete your cash flow.

- Vacancy periods: Periods when your rental property is vacant result in lost rental income.

- Property taxes and insurance: These recurring costs can add up significantly over time. Budgeting appropriately is essential for successful real estate investment.

Liquidity Concerns

Unlike some investments, real estate is not highly liquid. Selling a property can take time and effort.

- Time to sell: Finding a buyer and completing the transaction can take several months.

- Market conditions: Market conditions significantly influence selling prices. A slow market can lead to protracted selling periods.

- Transaction costs: Selling a property involves various transaction costs, including realtor fees, closing costs, and legal fees.

Tenant Management Challenges

Managing rental properties and tenants can be time-consuming and challenging.

- Finding reliable tenants: Screening tenants to ensure reliability and timely rent payments is crucial.

- Dealing with tenant issues: Addressing tenant complaints, maintenance requests, and potential lease violations requires time and effort.

- Property damage: Tenant-caused property damage can result in significant repair costs. Thorough tenant screening and a well-defined lease agreement are critical.

Conclusion

Real estate investment offers the potential for significant rewards, including passive income generation, property appreciation, and leveraging mortgage financing to build wealth. However, it's crucial to recognize and mitigate the risks associated with market volatility, unexpected expenses, liquidity concerns, and tenant management challenges.

Weighing the risks and rewards requires thorough research, due diligence, and professional advice from real estate agents, financial advisors, and tax professionals. Diversifying your investment portfolio is also a prudent strategy to reduce overall risk.

Ultimately, whether a real estate investment is a 'safe bet' depends on your individual circumstances and preparedness. By thoroughly understanding the potential rewards and risks outlined above, you can make an informed decision about whether real estate investment aligns with your financial goals. Consider consulting with a financial advisor to determine if real estate investment is the right choice for your unique financial situation.

Featured Posts

-

F1 News Clarksons Proposal Amidst Renewed Ferrari Disqualification Concerns

May 09, 2025

F1 News Clarksons Proposal Amidst Renewed Ferrari Disqualification Concerns

May 09, 2025 -

Wynne Evans Denies Wrongdoing Amidst Show Of Support

May 09, 2025

Wynne Evans Denies Wrongdoing Amidst Show Of Support

May 09, 2025 -

Wynne Evanss Go Compare Future Uncertain After Strictly Incident

May 09, 2025

Wynne Evanss Go Compare Future Uncertain After Strictly Incident

May 09, 2025 -

Joanna Page And Wynne Evans Bbc Show Clash A Detailed Look

May 09, 2025

Joanna Page And Wynne Evans Bbc Show Clash A Detailed Look

May 09, 2025 -

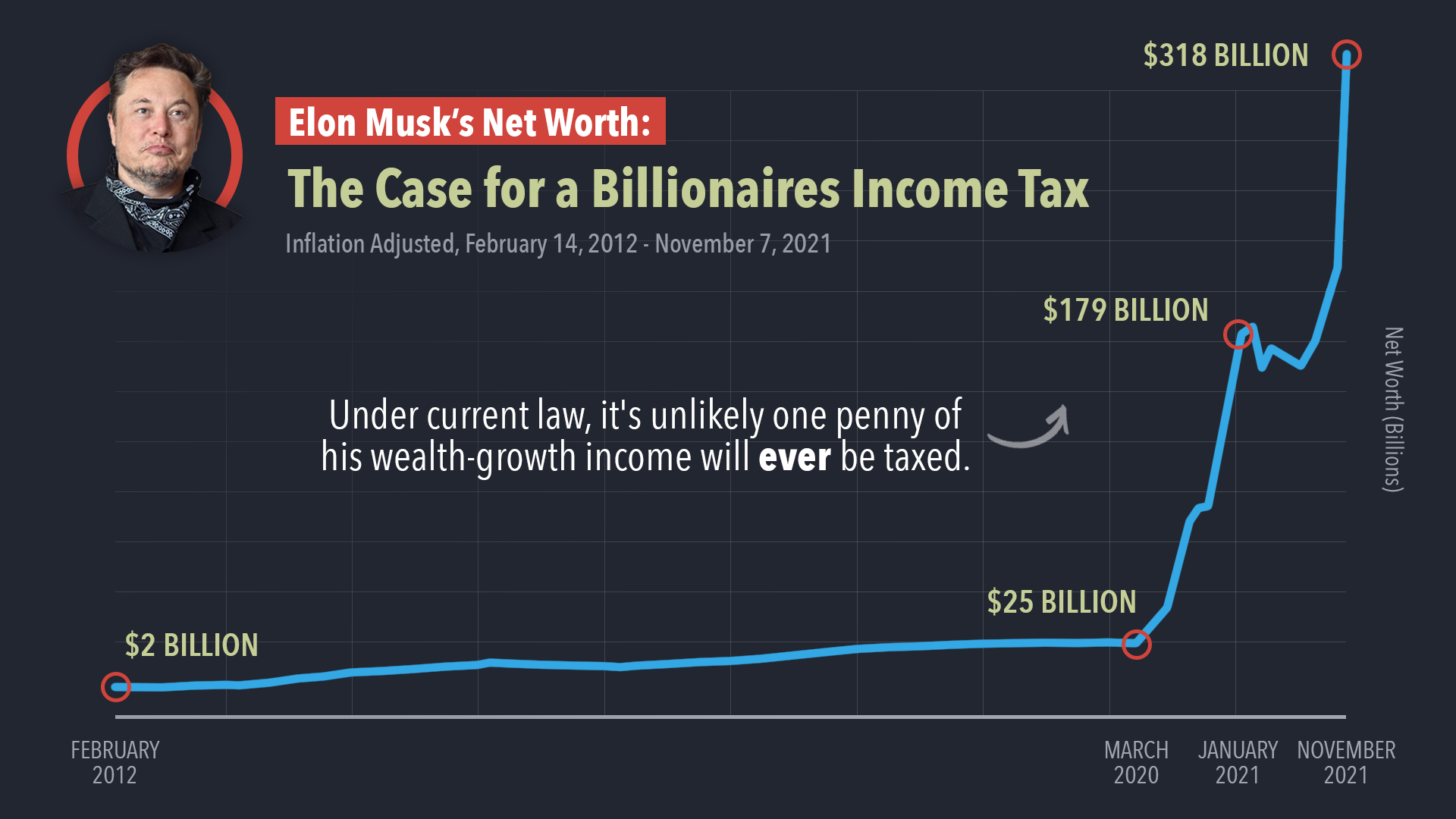

Elon Musk Wealth Explodes Teslas Rise And The Dogecoin Fallout

May 09, 2025

Elon Musk Wealth Explodes Teslas Rise And The Dogecoin Fallout

May 09, 2025