Iron Ore Price Drop: China's Steel Output Restrictions Explained

Table of Contents

China's Steel Production Restrictions: A Deep Dive

China's recent clampdown on steel production is the primary driver behind the current iron ore price drop. Several factors have converged to necessitate these stringent measures.

- Environmental Concerns: China's commitment to reducing carbon emissions and improving environmental sustainability has led to stricter regulations on industrial activities, including steel production, which is a significant contributor to air pollution. These efforts align with the country's ambitious climate change targets.

- Overcapacity Curbing: For years, China's steel industry suffered from significant overcapacity. To create a more efficient and sustainable sector, the government has implemented policies aimed at reducing excess capacity and promoting consolidation within the industry. This involves shutting down inefficient or polluting steel mills.

- Real Estate Slowdown: The slowdown in China's real estate market has significantly impacted steel demand. As construction activity has decreased, so has the need for steel as a key building material. This reduced demand ripples throughout the entire supply chain, affecting iron ore consumption.

The restrictions implemented by the Chinese government are multifaceted:

- Steel Production Quotas: Specific production quotas have been imposed on steel mills, limiting their output and directly impacting iron ore demand.

- Stricter Environmental Regulations: Increased scrutiny of environmental compliance has led to production shutdowns and limitations for steel mills failing to meet stricter emission standards. This translates to steel capacity cuts and reduced iron ore consumption.

- Limitations on New Steel Plant Construction: New steel plant construction has been heavily restricted, further hindering the growth of steel production capacity and consequently, iron ore demand.

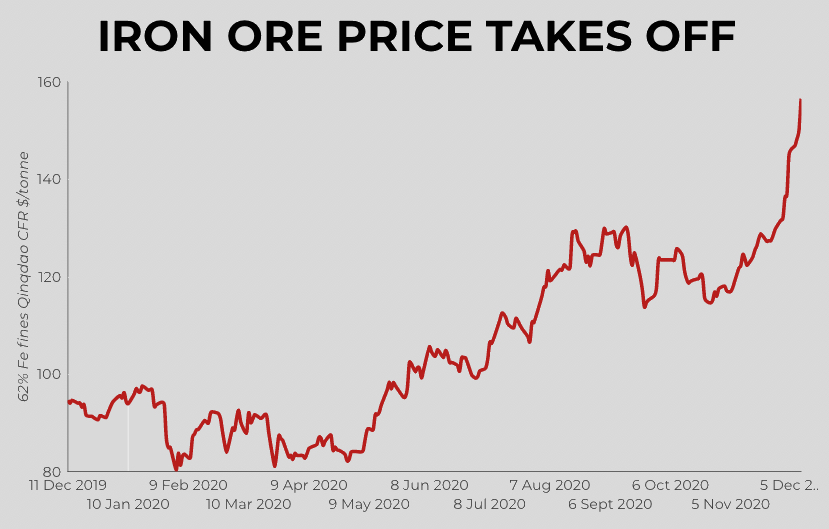

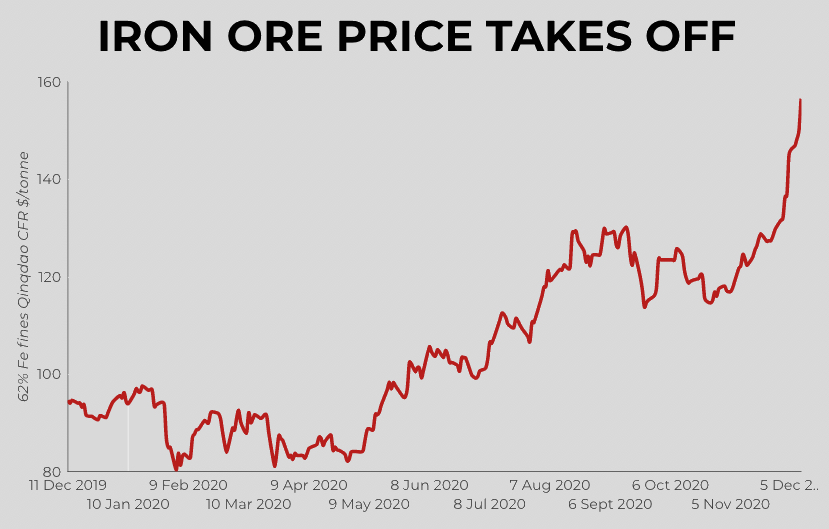

Data from the National Bureau of Statistics of China reveals a significant reduction in steel production in recent months, directly correlating with the decline in iron ore prices. These steel production quotas and environmental regulations have significantly reduced the overall demand for steelmaking raw materials.

The Ripple Effect on Iron Ore Demand

The reduced steel production in China has had a direct and immediate impact on global iron ore demand. China accounts for a vast majority of global iron ore consumption, making its reduced appetite for the commodity a significant factor in the global iron ore market.

- Impact on Iron Ore Prices: Decreased demand from China translates directly into a significant drop in iron ore prices. The supply remains relatively stable, but the demand has plummeted leading to a surplus in the market.

- Effect on Major Iron Ore Producers: Major iron ore producers like Australia and Brazil are experiencing a substantial impact on their revenues and export volumes due to reduced demand from China. This situation has led to increased competition amongst these producers and potential adjustments to their production levels. This situation affects not only the price but also the entire iron ore supply chain.

The relationship between reduced steel production and decreased iron ore demand is undeniably strong, making China's policies a crucial factor in understanding the current state of the global iron ore market.

Alternative Explanations for the Price Drop

While China's steel output restrictions are the primary driver of the iron ore price drop, other factors also contribute:

- Global Economic Slowdown: The global economic slowdown, particularly in developed economies, has reduced overall demand for steel and, consequently, iron ore.

- Increased Iron Ore Supply from Other Sources: Increased iron ore production from countries other than Australia and Brazil could add to the supply, potentially putting downward pressure on prices.

However, compared to the impact of China's steel output restrictions, these other factors play a secondary role in the current market situation. The sheer scale of China's steel production and its dominance in the iron ore market make its policies the most significant influence on the current price drop. Analyzing commodity market trends reveals this dynamic clearly.

Forecasting Future Iron Ore Prices

Predicting the future trajectory of iron ore prices is challenging, but several factors should be considered:

- Continued Steel Output Restrictions in China: If China maintains its current policies, the downward pressure on iron ore prices could persist.

- Potential Policy Changes in China: Any changes in China's economic policies, particularly those related to environmental regulations or infrastructure spending, could significantly impact steel production and, subsequently, iron ore demand.

- Global Economic Recovery: A robust global economic recovery could increase demand for steel and, in turn, for iron ore, potentially mitigating the price drop.

Expert opinions and market analyses provide varying forecasts, but the consensus points toward a continued period of price volatility. The future of iron ore will largely depend on China's economic policies and the pace of global economic recovery. Keeping an eye on the iron ore price forecast and Chinese economic policy is crucial for navigating this uncertainty.

Conclusion: Navigating the Shifting Sands of the Iron Ore Market

In conclusion, China's steel output restrictions are the primary driver of the recent iron ore price drop. This has created significant ripple effects throughout the global iron ore market, impacting major producers and causing considerable price volatility. The future of iron ore prices remains uncertain, contingent on a complex interplay of factors, including continued Chinese policies, potential policy shifts, and global economic conditions. To stay abreast of this dynamic market and understand the implications of iron ore price trends, stay informed by subscribing to our updates and following reputable news sources specializing in iron ore market analysis. Understanding these iron ore price drop factors is crucial for informed decision-making in this volatile market.

Featured Posts

-

Elon Musks Net Worth Below 300 Billion After Tesla Slump And Tariff Issues

May 10, 2025

Elon Musks Net Worth Below 300 Billion After Tesla Slump And Tariff Issues

May 10, 2025 -

U S China Trade Talks A Focus On De Escalation And Future Relations

May 10, 2025

U S China Trade Talks A Focus On De Escalation And Future Relations

May 10, 2025 -

Tramway Dijon Concertation Sur Le Projet De 3e Ligne

May 10, 2025

Tramway Dijon Concertation Sur Le Projet De 3e Ligne

May 10, 2025 -

Draisaitl Hellebuyck And Kucherov 2023 Hart Trophy Finalists

May 10, 2025

Draisaitl Hellebuyck And Kucherov 2023 Hart Trophy Finalists

May 10, 2025 -

Pakistan Stock Exchange Portal Down Volatility And Geopolitical Tensions

May 10, 2025

Pakistan Stock Exchange Portal Down Volatility And Geopolitical Tensions

May 10, 2025