Investor Concerns Weigh On Apple Stock Before Q2 Report

Table of Contents

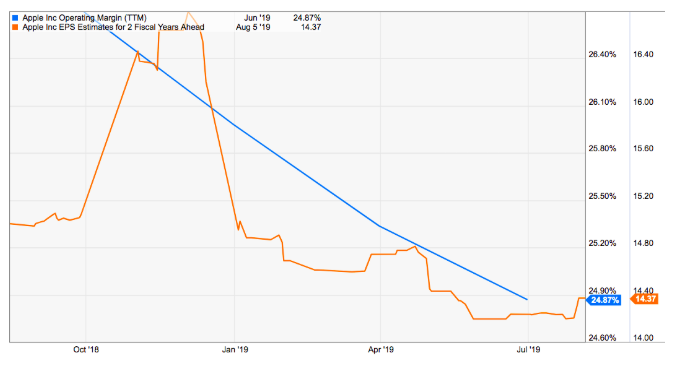

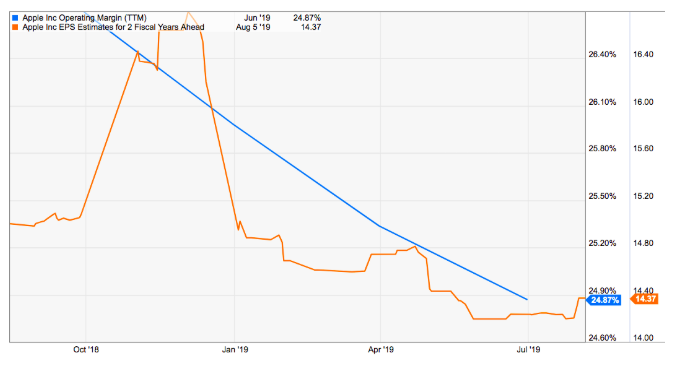

Slowing iPhone Sales and Supply Chain Issues

Recent reports indicate a slowdown in iPhone demand, particularly in crucial markets like China. This, coupled with persistent supply chain disruptions, casts a shadow over Apple's revenue projections for the Q2 report. The impact of these challenges on Apple stock is a primary concern for investors.

- Declining iPhone sales in key markets: Weakening consumer spending, particularly in China, a major market for Apple, has led to concerns about decreased iPhone sales volumes. This directly affects Apple revenue and profitability.

- Impact of global inflation on consumer spending: Rising inflation globally is squeezing consumer budgets, making expensive electronics like iPhones a less prioritized purchase for many. This decreased consumer spending is a major driver of the slowdown.

- Potential delays in new product launches: Any delays in launching new iPhone models or other key products could further exacerbate the impact of slowing demand and negatively affect Apple's stock price.

- Ongoing challenges in securing critical components: The ongoing global chip shortage and disruptions in the supply chain continue to pose significant challenges to Apple's production capabilities, potentially leading to lower-than-expected iPhone output.

Macroeconomic Headwinds and Inflationary Pressures

The broader macroeconomic environment presents significant headwinds for Apple. Rising inflation, interest rate hikes by central banks, and the looming threat of a global recession are all factors impacting consumer spending and investor sentiment toward tech stocks like Apple. The resulting market volatility is a major concern for investors assessing the Apple stock price.

- Impact of rising interest rates on consumer borrowing: Higher interest rates increase borrowing costs, potentially impacting consumer purchasing power and reducing demand for non-essential electronics such as iPhones.

- Reduced consumer discretionary spending due to inflation: Inflation erodes purchasing power, leading consumers to cut back on discretionary spending, including electronics. This impacts Apple's sales across its product lines.

- Potential for a global economic slowdown: A global economic slowdown would further dampen consumer demand and negatively impact Apple's financial performance, influencing the Apple stock price trajectory.

- Investor risk aversion in the current economic climate: In times of economic uncertainty, investors tend to become more risk-averse, potentially leading to a sell-off in even strong tech stocks like Apple.

Heightened Competition in the Tech Sector

Apple faces increasingly fierce competition in the tech sector. Samsung and Google, with their robust Android ecosystems and competitive pricing strategies, are aggressively challenging Apple's market share, particularly in the smartphone market. This competition requires Apple to continually innovate to maintain its leading position.

- Increasing market share of Android devices: The continued growth of Android devices globally directly impacts Apple's market share and its ability to maintain its premium pricing strategy.

- Competitive pricing strategies employed by rivals: Competitors are increasingly offering comparable smartphones at lower price points, putting pressure on Apple's pricing power.

- The emergence of innovative technologies from competitors: Competitors are constantly innovating, introducing new features and technologies that could challenge Apple's technological leadership.

- Apple's need for continuous innovation to maintain its edge: To counteract competitive pressures, Apple needs to consistently deliver innovative products and services to maintain its premium brand image and customer loyalty.

Impact on Apple Services Revenue

While hardware sales face headwinds, Apple's services segment, encompassing iCloud, the App Store, and other subscription services, offers some potential mitigation. The growth of subscription revenue is critical to Apple's overall financial health and provides a degree of diversification from its dependence on hardware sales. This diversification lessens investor concern to some extent, but not completely.

Conclusion

This article examined the key investor concerns weighing on Apple stock before the release of the Q2 earnings report. Slowing iPhone sales, macroeconomic uncertainty, and intensifying competition create a complex picture for investors, making the upcoming report crucial for understanding Apple's future trajectory. The impact of these investor concerns on the Apple stock price will be a key focus in the coming weeks.

Call to Action: Stay tuned for our in-depth analysis of Apple's Q2 report and learn how these investor concerns ultimately impacted Apple stock and its future performance. Continue to follow our coverage on Apple stock and other significant market movements to make informed investment decisions. Monitor the impact of these investor concerns on Apple stock prices and plan your investment strategy accordingly.

Featured Posts

-

Dazi E Mercati L Unione Europea Di Fronte Alla Crisi Delle Borse

May 25, 2025

Dazi E Mercati L Unione Europea Di Fronte Alla Crisi Delle Borse

May 25, 2025 -

Frank Sinatras Wives Exploring His Four Marriages And Love Life

May 25, 2025

Frank Sinatras Wives Exploring His Four Marriages And Love Life

May 25, 2025 -

10 Let Evrovideniya Chto Stalo S Triumfatorami

May 25, 2025

10 Let Evrovideniya Chto Stalo S Triumfatorami

May 25, 2025 -

Untapped Potential Why News Corp Could Be Significantly Undervalued

May 25, 2025

Untapped Potential Why News Corp Could Be Significantly Undervalued

May 25, 2025 -

Escape To The Country Balancing Rural Life With Modern Comforts

May 25, 2025

Escape To The Country Balancing Rural Life With Modern Comforts

May 25, 2025

Latest Posts

-

Turning Poop Into Prose An Ai Powered Podcast Revolution

May 25, 2025

Turning Poop Into Prose An Ai Powered Podcast Revolution

May 25, 2025 -

Investigating The Connections Presidential Seals Luxury Goods And Exclusive Afterparties

May 25, 2025

Investigating The Connections Presidential Seals Luxury Goods And Exclusive Afterparties

May 25, 2025 -

The I O And Io Battleground How Google And Open Ai Are Shaping The Future Of Tech

May 25, 2025

The I O And Io Battleground How Google And Open Ai Are Shaping The Future Of Tech

May 25, 2025 -

The Symbolism Of Power Presidential Seals Expensive Watches And Elite Gatherings

May 25, 2025

The Symbolism Of Power Presidential Seals Expensive Watches And Elite Gatherings

May 25, 2025 -

The Trump Factor Influencing Republican Negotiations

May 25, 2025

The Trump Factor Influencing Republican Negotiations

May 25, 2025