Investor Briefing: QNB Corp At The Virtual Banking Conference (March 6th)

Table of Contents

QNB Corp made a significant appearance at the Virtual Banking Conference on March 6th, presenting its latest financial performance and outlining its strategic vision for the future. This investor briefing summarizes the key takeaways from the presentation, providing valuable insights for current and prospective investors interested in QNB's growth trajectory and investment opportunities within the evolving banking landscape. This report will cover key performance indicators (KPIs), strategic initiatives, and the company's outlook for the coming quarters.

QNB Corp's Financial Performance: A Strong Quarter

Key Financial Highlights:

QNB Corp reported a strong financial performance for the quarter ending [Insert Date], exceeding expectations across several key metrics. This robust performance reflects the company's effective strategies and its resilience in a competitive market.

- Revenue Growth: Revenue increased by [Percentage]% year-on-year, reaching [Amount]. This growth was driven by [mention specific factors, e.g., strong loan growth, increased fee income, successful cross-selling initiatives].

- Net Income: Net income reached [Amount], representing a [Percentage]% increase compared to the same period last year. This signifies improved profitability and efficient operational management.

- Profit Margin: The company maintained a healthy profit margin of [Percentage]%, demonstrating strong cost control and efficient resource allocation.

- Return on Equity (ROE): ROE stood at [Percentage]%, showcasing the effectiveness of capital deployment and value creation for shareholders.

- Earnings Per Share (EPS): EPS increased to [Amount], indicating improved profitability per share.

Analysis of Key Performance Indicators (KPIs):

Analyzing QNB Corp's KPIs reveals a positive trend across its core business segments.

- Loan Growth: Loan growth exhibited a healthy [Percentage]% increase, reflecting strong demand for credit and effective lending strategies. This growth was particularly strong in [mention specific loan segments, e.g., commercial lending, retail banking].

- Deposit Growth: Deposit growth remained robust, increasing by [Percentage]%, demonstrating strong customer confidence and efficient deposit mobilization strategies. This was achieved through [Mention strategies, e.g., attractive interest rates, innovative deposit products].

- Customer Acquisition Costs: QNB Corp successfully managed its customer acquisition costs, keeping them at [Amount], demonstrating efficient marketing and customer acquisition strategies. [Mention specific initiatives that contributed to cost reduction].

[Include charts and graphs visualizing the above KPIs for better understanding.]

Strategic Initiatives and Future Outlook: Driving Growth and Innovation

Digital Transformation and Fintech Adoption:

QNB Corp is heavily investing in digital banking technologies to enhance customer experience and operational efficiency. This includes:

- Mobile Banking Enhancements: Significant improvements in the mobile banking app, including [mention specific features, e.g., enhanced security features, personalized financial management tools, seamless payment integrations].

- Fintech Partnerships: Collaborations with leading fintech companies to integrate innovative financial solutions and expand product offerings. This includes partnerships with [mention specific fintech partners, if applicable].

- Digital Transformation Strategy: A comprehensive digital transformation strategy is underway to optimize all internal processes and improve customer service through digital channels.

Expansion Plans and Market Diversification:

QNB Corp is actively pursuing market expansion and diversification strategies to drive future growth. This involves:

- Geographic Expansion: Exploration of new markets in [mention specific regions or countries] to leverage growth opportunities and expand its customer base.

- New Product Offerings: Introduction of innovative financial products and services catering to the evolving needs of its customer segments. [Mention specific examples].

- International Growth: The company is actively pursuing international growth opportunities, aiming to increase its presence in key global markets.

Sustainability and Corporate Social Responsibility (CSR):

QNB Corp demonstrates a strong commitment to ESG factors and is actively involved in various CSR initiatives:

- ESG Investing: QNB Corp is incorporating ESG considerations into its investment decisions, aligning with global sustainability goals.

- Sustainable Banking: The company is actively promoting sustainable banking practices and financing projects aligned with environmental and social goals.

- Community Engagement: Engagement in various community development programs, including [mention specific examples].

Q&A Session and Investor Sentiment:

The Q&A session following the presentation provided valuable insights into investor sentiment and concerns. Key questions revolved around [mention key topics discussed, e.g., future loan growth projections, the impact of rising interest rates, the competitive landscape]. Overall, investor sentiment towards QNB Corp's future prospects remained positive, reflecting confidence in the company's strategic direction and strong financial performance. However, some concerns were raised regarding [mention specific concerns and how QNB addressed them].

Conclusion:

QNB Corp's presentation at the Virtual Banking Conference provided a comprehensive overview of its strong financial performance, ambitious strategic initiatives, and promising future outlook. The company showcased its commitment to innovation, digital transformation, and sustainable growth, positioning itself for continued success in the dynamic banking sector. Strong performance indicators, coupled with strategic investments in digitalization and expansion, suggest a positive trajectory for QNB.

Call to Action: For further insights into QNB Corp's investment opportunities and to stay updated on future developments, visit the QNB Corp investor relations website. Learn more about QNB's financial performance and strategic initiatives and explore the opportunities available within this exciting growth story. Discover more about the future of QNB Corp.

Featured Posts

-

Portland Trail Blazers Play In Tournament Hope Or Hopeless

Apr 30, 2025

Portland Trail Blazers Play In Tournament Hope Or Hopeless

Apr 30, 2025 -

The Growing Market For Wildfire Betting A Societal Reflection

Apr 30, 2025

The Growing Market For Wildfire Betting A Societal Reflection

Apr 30, 2025 -

44 Year Old Channing Tatum Reportedly Dating 25 Year Old Inka Williams

Apr 30, 2025

44 Year Old Channing Tatum Reportedly Dating 25 Year Old Inka Williams

Apr 30, 2025 -

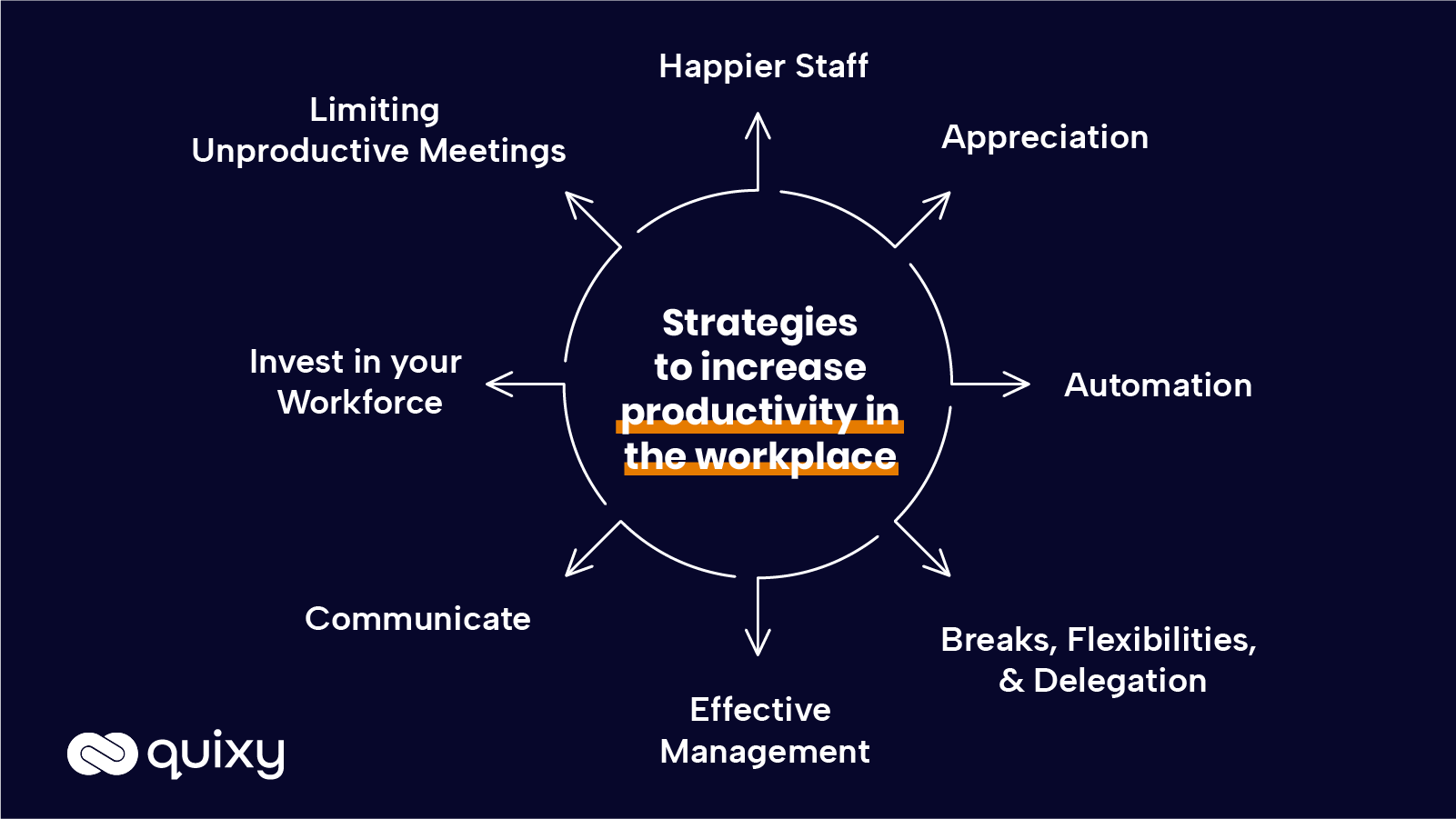

Effective Middle Management A Foundation For A Productive Workplace

Apr 30, 2025

Effective Middle Management A Foundation For A Productive Workplace

Apr 30, 2025 -

Kinopoisk Darit Soski S Ovechkinym V Chest Rekorda N Kh L

Apr 30, 2025

Kinopoisk Darit Soski S Ovechkinym V Chest Rekorda N Kh L

Apr 30, 2025