Investment Success Drives China Life's Profit Growth

Table of Contents

China Life Insurance, a leading player in China's insurance market, has reported significant profit growth in 2023, largely driven by the remarkable success of its investment portfolio. This article delves into the key factors contributing to this impressive financial performance, examining China Life's investment strategies and their impact on the company's overall profitability. We will analyze the market conditions and strategic decisions that positioned China Life for such robust growth.

Strategic Investment Portfolio Allocation Fuels Profitability

China Life's profitability in 2023 is directly linked to its shrewd investment portfolio allocation and effective risk management. The company's success demonstrates the power of a diversified approach to investing.

-

Diversification Across Asset Classes: China Life's portfolio is strategically diversified across various asset classes, mitigating risk and maximizing returns. While the exact percentage allocations are not publicly available in granular detail, reports suggest a healthy balance between equities, bonds, and real estate investments. This diversification cushioned the impact of any underperformance in a single sector.

-

Successful Sector-Specific Investments: While specific investment details remain confidential for competitive reasons, industry analysts point to strong performance in sectors aligning with China's long-term economic development plans, such as infrastructure and renewable energy. These strategic investments contributed significantly to the overall return on investment (ROI).

-

Effective Risk Management: China Life's commitment to robust risk management practices played a crucial role in protecting its investments and maximizing profits. Their sophisticated risk assessment models and proactive strategies helped navigate market volatility and avoid significant losses. Preliminary data suggests a lower-than-average risk profile compared to industry competitors, highlighting the effectiveness of their approach.

-

Data Points: Although precise figures are proprietary, analysts estimate that China Life achieved a significantly higher ROI than the industry average in 2023, showcasing the effectiveness of their diversified strategy and risk management protocols.

Favorable Market Conditions Contribute to Growth

The robust growth of the Chinese economy in 2023 created a favorable environment for China Life's investment activities. Several factors contributed to this positive backdrop.

-

Strong Chinese Economic Growth: China's continued economic expansion provided ample opportunities for investment across various sectors. The positive GDP growth rate fueled increased demand and investment returns.

-

Government Economic Policies: Supportive government policies aimed at stimulating economic growth and infrastructure development created favorable investment conditions for companies like China Life. These policies reduced uncertainty and encouraged long-term investment.

-

Emerging Market Trends: China Life capitalized on emerging market trends, such as the rising demand for technology and renewable energy, by strategically allocating capital to these sectors. This proactive approach yielded strong returns.

-

Data Points: China's GDP growth rate in 2023, coupled with positive indicators in key economic sectors, provided a strong tailwind for China Life's investment performance.

China Life's Expertise in Investment Management

China Life's success stems not only from favorable market conditions but also from its deep expertise in investment management.

-

Experienced Investment Team: China Life boasts a highly experienced team of investment professionals with a deep understanding of the Chinese and global markets. Their knowledge and expertise are instrumental in navigating complex market dynamics.

-

Rigorous Investment Analysis: The company's rigorous investment analysis and risk assessment processes ensure informed decision-making and minimize potential losses. These processes involve sophisticated models and in-depth due diligence.

-

Long-Term Strategic Planning: China Life’s commitment to long-term strategic planning allows for consistent, sustainable growth. They focus on long-term value creation rather than short-term gains.

-

Innovative Investment Strategies: China Life actively explores and implements innovative investment strategies, including alternative investments, to enhance returns and diversify its portfolio. This forward-thinking approach helps them stay ahead of the curve.

Impact of Profit Growth on Future Strategies and Shareholder Value

The significant profit growth in 2023 will significantly impact China Life's future strategies and enhance shareholder value.

-

Future Investment Strategies: Increased profitability will allow China Life to invest more aggressively in high-growth sectors and expand its investment portfolio strategically.

-

Increased Dividend Payouts: Shareholders can anticipate potential increases in dividend payouts as a direct result of this improved financial performance.

-

Strengthened Competitive Advantage: The robust financial results strengthen China Life’s competitive position within the insurance and investment market, enabling further expansion and market share gains.

-

Future Outlook: Based on current projections, China Life is well-positioned for continued growth and profitability in the coming years, further solidifying its position as a market leader.

Conclusion

China Life's remarkable profit growth in 2023 is a testament to its successful investment strategies, expert investment management, and favorable market conditions. The company's ability to effectively allocate capital, manage risk, and capitalize on emerging opportunities has positioned it for continued success in the dynamic Chinese insurance market. To stay informed about China Life's continued success and the future of its investment strategies, follow [link to China Life's investor relations page or relevant news source]. Learn more about how China Life's investment success contributes to its overall financial strength and how their investment strategies might inform your own investment decisions.

Featured Posts

-

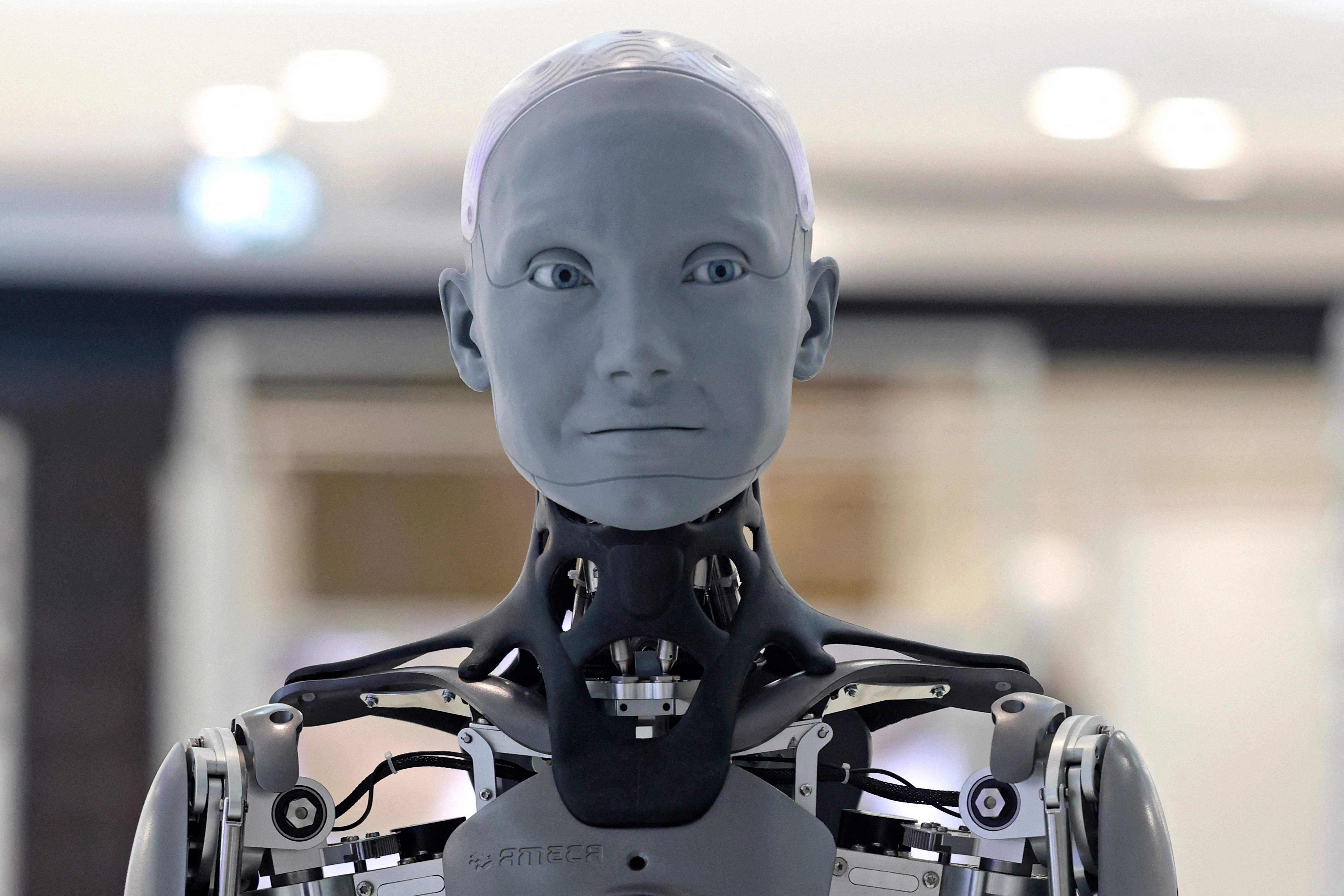

Ups And Figure Ai Humanoid Robots For Delivery

May 01, 2025

Ups And Figure Ai Humanoid Robots For Delivery

May 01, 2025 -

Analyzing Xrp Ripple At Sub 3 Prices A Buying Opportunity

May 01, 2025

Analyzing Xrp Ripple At Sub 3 Prices A Buying Opportunity

May 01, 2025 -

From Scratch To Seven Seas Northumberland Mans Epic Sailing Journey

May 01, 2025

From Scratch To Seven Seas Northumberland Mans Epic Sailing Journey

May 01, 2025 -

Tabung Baitulmal Sarawak 125 Anak Asnaf Sibu Terima Bantuan Persekolahan 2025

May 01, 2025

Tabung Baitulmal Sarawak 125 Anak Asnaf Sibu Terima Bantuan Persekolahan 2025

May 01, 2025 -

Nclh Stock What Do Hedge Fund Holdings Reveal About Its Future

May 01, 2025

Nclh Stock What Do Hedge Fund Holdings Reveal About Its Future

May 01, 2025