Investing In XRP (Ripple) Under $3: Risks And Rewards

Table of Contents

The Potential Rewards of Investing in XRP Below $3

Historical Price Performance and Future Projections

XRP's price has experienced considerable volatility. Analyzing past price fluctuations is key to understanding its potential. While past performance doesn't guarantee future results, studying trends can inform investment strategies. Several factors could drive future growth, including:

- Resolution of the SEC Lawsuit: A positive outcome in Ripple's legal battle with the SEC could significantly boost XRP's price.

- Increased Institutional Adoption: Growing partnerships with financial institutions using RippleNet for cross-border payments could fuel demand.

- Technological Advancements: Continuous improvements to XRP's technology, enhancing speed and efficiency, could attract more users.

Reputable analysts offer varying XRP price predictions. Some predict a substantial increase in value if positive legal and adoption developments materialize. Understanding these projections, alongside understanding the inherent risks, is vital for any XRP investment strategy. Researching credible sources for "XRP price prediction" and "XRP investment potential" is highly recommended.

Growing Adoption in the Payment Industry

Ripple's primary focus is on facilitating seamless cross-border payments through its RippleNet network. This network leverages XRP's speed and efficiency for faster and cheaper transactions. The growing adoption of RippleNet by financial institutions is a significant bullish factor:

- On-Demand Liquidity (ODL): This innovative solution allows financial institutions to settle payments instantly using XRP, reducing reliance on correspondent banks.

- Strategic Partnerships: Ripple has forged partnerships with numerous banks and payment providers globally, expanding its reach and potential market. The continued expansion of these partnerships could directly impact the "XRP investment potential."

The increasing utilization of RippleNet and ODL, keywords often associated with "cross-border payments," suggests growing adoption and potential demand for XRP.

Technological Advantages and Scalability

XRP's technology offers several advantages crucial for large-scale transactions:

- Speed: XRP transactions are significantly faster than many other cryptocurrencies, making it suitable for real-time payments.

- Low Transaction Fees: Compared to other cryptocurrencies, XRP boasts considerably lower transaction fees, making it cost-effective for high-volume payments.

- Energy Efficiency: XRP utilizes a unique consensus mechanism that consumes significantly less energy than Proof-of-Work cryptocurrencies, contributing to its sustainability.

These aspects of "XRP technology," especially "transaction speed" and "energy-efficient cryptocurrency," contribute to its appeal within the financial industry and strengthen its potential for future growth.

The Risks Associated with Investing in XRP Below $3

Regulatory Uncertainty and Legal Challenges

The ongoing legal battle between Ripple and the SEC poses significant regulatory uncertainty and risk to XRP.

- SEC Allegations: The SEC alleges that XRP is an unregistered security, impacting its regulatory status and potentially restricting its usage.

- Potential Outcomes: The outcome of the lawsuit could significantly impact XRP's price, with potential for both positive and negative consequences. Understanding the details of the "SEC lawsuit" and "Ripple legal battle" is crucial. This "regulatory risk" should be carefully assessed before investing.

Market Volatility and Price Fluctuations

The cryptocurrency market is inherently volatile, and XRP is no exception. Significant price drops can occur rapidly, leading to substantial losses:

- Market Sentiment: The price of XRP can be influenced by broader market trends, news events, and investor sentiment.

- Past Volatility: Historical data shows significant price swings, demonstrating the risk of investing in such a volatile asset. Careful consideration of "cryptocurrency volatility," "market risk," and "price fluctuations" is essential.

Competition from Other Cryptocurrencies

XRP faces competition from other cryptocurrencies offering similar functionalities:

- Alternative Payment Solutions: Several other cryptocurrencies are competing in the cross-border payments space.

- Market Share: The competitive landscape necessitates a thorough evaluation of XRP's position and future prospects relative to its competitors. Understanding "cryptocurrency competition" and the presence of various "altcoins" is crucial for risk assessment.

Conclusion

Investing in XRP (Ripple) under $3 presents both significant potential rewards and considerable risks. The potential for growth is fueled by its increasing adoption in the payments industry, technological advantages, and the possibility of a positive resolution in the SEC lawsuit. However, the inherent volatility of the cryptocurrency market, regulatory uncertainty, and competition from other cryptocurrencies pose substantial risks. Before investing in XRP, or any cryptocurrency, it's crucial to conduct thorough research, assess your own risk tolerance, and only invest what you can afford to lose. Investing in XRP (Ripple) under $3 can be lucrative, but it’s crucial to weigh the risks carefully. Learn more about XRP and its potential by exploring [link to relevant resource].

Featured Posts

-

Christina Aguileras Altered Image Analysis Of A Recent Photoshoot

May 02, 2025

Christina Aguileras Altered Image Analysis Of A Recent Photoshoot

May 02, 2025 -

Christina Aguileras New Look Sparks Debate Among Fans

May 02, 2025

Christina Aguileras New Look Sparks Debate Among Fans

May 02, 2025 -

Waarom Biedt Nrc Nu Gratis Toegang Tot The New York Times

May 02, 2025

Waarom Biedt Nrc Nu Gratis Toegang Tot The New York Times

May 02, 2025 -

Nrc Announces Resumption Of Warri Itakpe Rail Line

May 02, 2025

Nrc Announces Resumption Of Warri Itakpe Rail Line

May 02, 2025 -

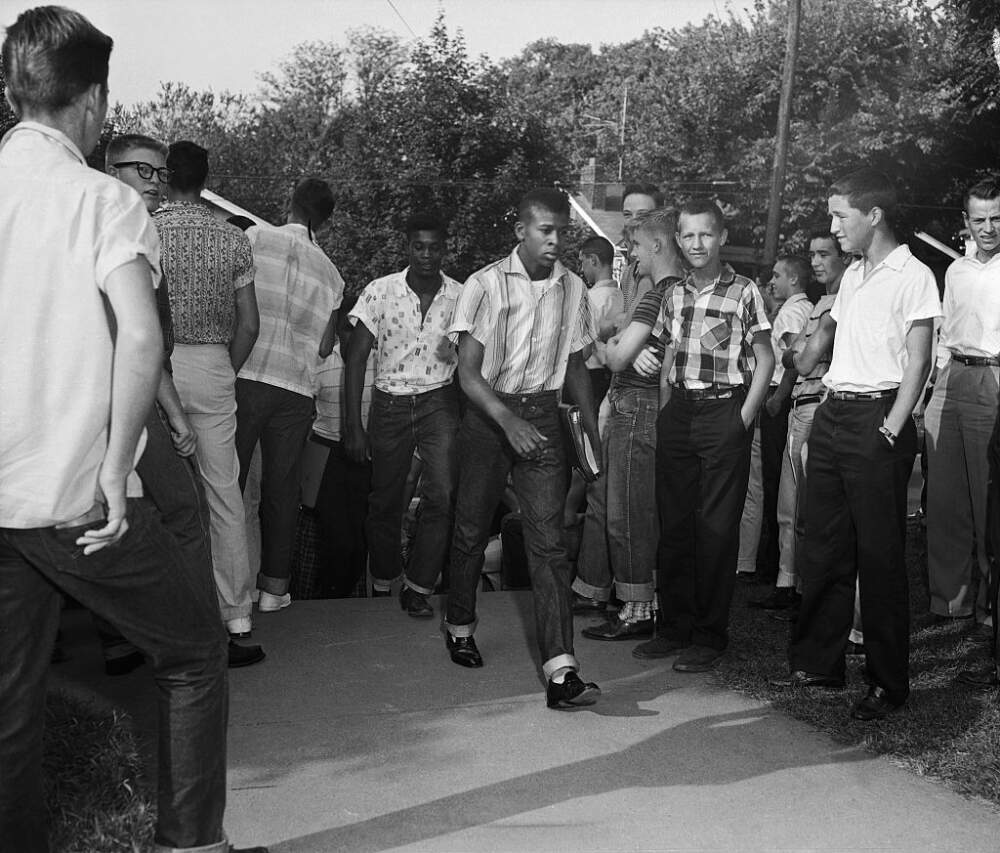

School Desegregation Order Terminated A Turning Point In Education

May 02, 2025

School Desegregation Order Terminated A Turning Point In Education

May 02, 2025