Investing In This Country: Opportunities And Challenges

Table of Contents

2. Economic Growth and Stability: A Foundation for Investment

2.1. GDP Growth and Projections: Vietnam boasts a consistently strong GDP growth rate, averaging over 6% annually in recent years. This robust growth is fueled by a thriving manufacturing sector, significant foreign direct investment (FDI), and a government committed to economic reform. The World Bank projects continued growth, positioning Vietnam as one of the fastest-growing economies in the ASEAN region. Contributing factors include:

- Strong export performance: Vietnam's exports, particularly in textiles, electronics, and footwear, have consistently increased, driving economic expansion.

- Government initiatives: The Vietnamese government has implemented numerous reforms to improve the business environment, attract FDI, and foster innovation. These include tax incentives, streamlined regulations, and infrastructure development projects.

- A burgeoning technology sector: Vietnam's tech sector is experiencing rapid growth, with a rising number of startups and tech companies attracting significant investment.

Keywords: economic growth, GDP growth, Vietnam economy, economic stability, Vietnam GDP, foreign direct investment.

2.2. Political and Regulatory Environment: Vietnam maintains a relatively stable political environment, providing a predictable framework for investors. While a communist state, the government has actively pursued economic liberalization, resulting in a more open and investor-friendly regulatory framework. Recent policy changes aimed at improving the ease of doing business include:

- Simplified business registration processes.

- Reduced bureaucratic hurdles for foreign investors.

- Increased transparency and accountability in government operations.

However, navigating the regulatory landscape requires careful attention to detail and adherence to local laws and regulations.

Keywords: political stability, regulatory framework, ease of doing business, Vietnam investment regulations, foreign investment policy, Vietnam business environment.

2.3. Inflation and Currency Risk: Vietnam's inflation rate has generally been low and stable, though susceptible to global economic fluctuations. Currency fluctuations are a factor to consider, as the Vietnamese Dong (VND) is subject to exchange rate volatility. To mitigate currency risk, investors should consider:

- Hedging strategies, such as forward contracts or currency options.

- Diversifying investments across different sectors and currencies.

- Closely monitoring macroeconomic indicators and exchange rate trends.

Keywords: inflation, currency risk, exchange rate, hedging strategies, Vietnam currency, Vietnam Dong.

2. Lucrative Investment Sectors: Identifying High-Growth Opportunities

2.1. Real Estate Investment: Vietnam's real estate market presents attractive opportunities, particularly in major cities like Ho Chi Minh City and Hanoi. Strong population growth and urbanization are driving demand for residential, commercial, and industrial properties. Government incentives and tax breaks are also available for certain projects.

Keywords: real estate investment, Vietnam real estate, property investment, real estate market trends, Vietnam property market.

2.2. Technology and Innovation: Vietnam’s technology sector is a rapidly expanding area, attracting significant investment in areas such as software development, e-commerce, and fintech. The young, tech-savvy population provides a fertile ground for innovation and entrepreneurship. Venture capital and private equity firms are actively seeking opportunities in this dynamic sector.

Keywords: Vietnam tech sector, technology investment, innovation, venture capital, private equity, Vietnam startups.

2.3. Infrastructure Development: Massive infrastructure development projects are underway across Vietnam, creating substantial investment opportunities in transportation, energy, and telecommunications. The government is actively promoting public-private partnerships (PPPs) to accelerate development.

Keywords: infrastructure investment, Vietnam infrastructure, public-private partnerships, PPP, Vietnam infrastructure development.

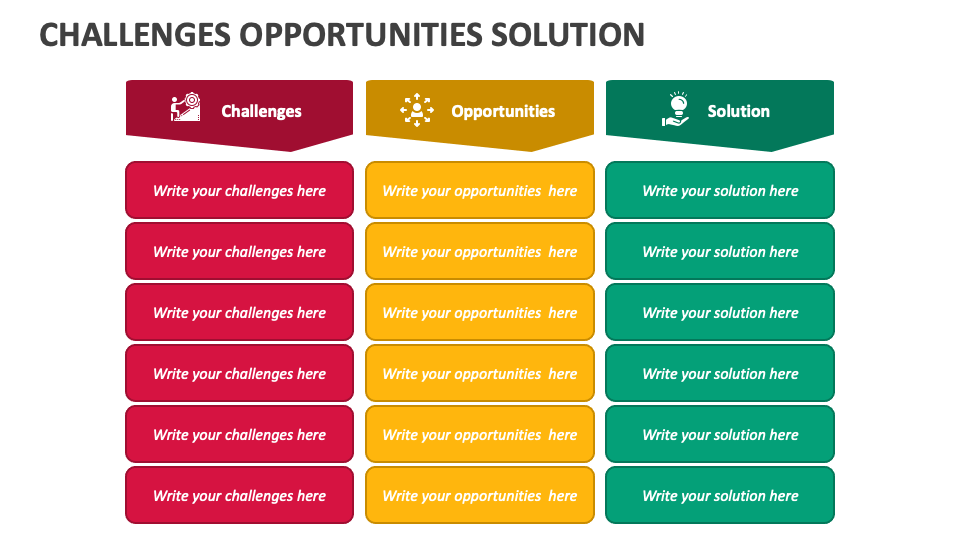

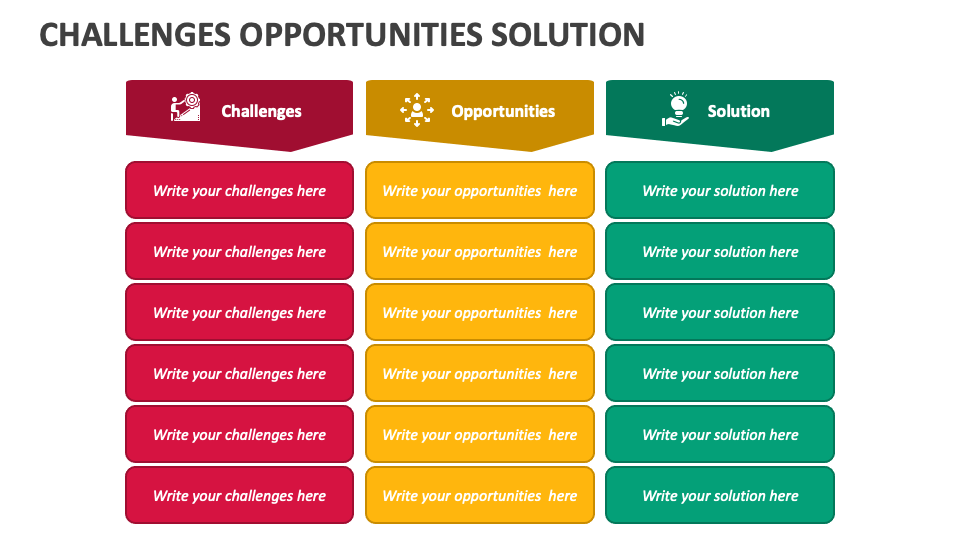

2.3. Challenges and Risks in Investing in Vietnam

2.1. Bureaucracy and Corruption: While improvements have been made, navigating bureaucratic processes can still be challenging, and corruption remains a concern in some areas. To mitigate these risks, investors should:

- Conduct thorough due diligence.

- Engage experienced local partners.

- Maintain transparent and well-documented business practices.

Keywords: bureaucracy, corruption, risk mitigation, due diligence, Vietnam business challenges.

2.2. Geopolitical Risks: Vietnam’s geopolitical position presents some risks, including regional tensions and global economic uncertainty. Staying informed about these factors and their potential impact is crucial for informed investment decisions.

Keywords: geopolitical risk, Vietnam geopolitical landscape, political risk, Vietnam political environment.

2.3. Labor Market and Skills Gaps: While Vietnam has a large and relatively young workforce, skills gaps exist in certain sectors. Companies need to invest in training and development to address these challenges.

Keywords: labor market, skills gap, human capital, Vietnam workforce.

3. Conclusion: Making Informed Investment Decisions in Vietnam

Investing in Vietnam offers significant potential for substantial returns, driven by strong economic growth, a favorable investment climate, and numerous lucrative investment sectors. However, understanding and mitigating the associated challenges, such as bureaucratic hurdles and potential geopolitical risks, is crucial for success. Thorough due diligence, careful risk assessment, and leveraging the expertise of local partners are essential for navigating the Vietnamese market effectively. Unlock the potential of investing in Vietnam by conducting thorough research and leveraging the insights in this article. Start planning your investment strategy today!

Featured Posts

-

Gaza Freedom Flotilla Sos Drone Attack Near Malta

May 03, 2025

Gaza Freedom Flotilla Sos Drone Attack Near Malta

May 03, 2025 -

East Coast Ev Drivers Enjoy Free Hpc Charging With Shell Recharge This Raya

May 03, 2025

East Coast Ev Drivers Enjoy Free Hpc Charging With Shell Recharge This Raya

May 03, 2025 -

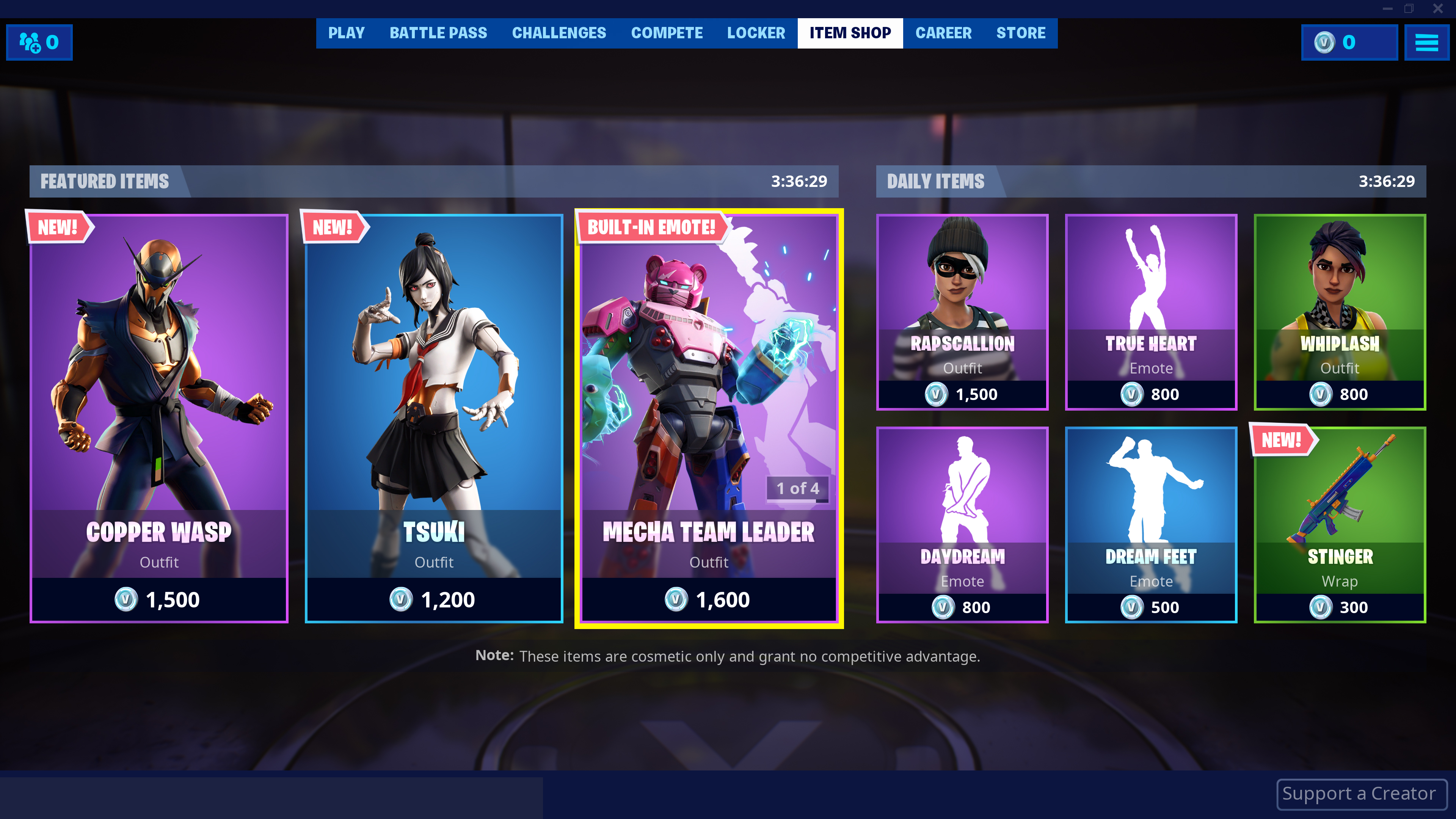

Enhanced Functionality Fortnite Item Shop Update

May 03, 2025

Enhanced Functionality Fortnite Item Shop Update

May 03, 2025 -

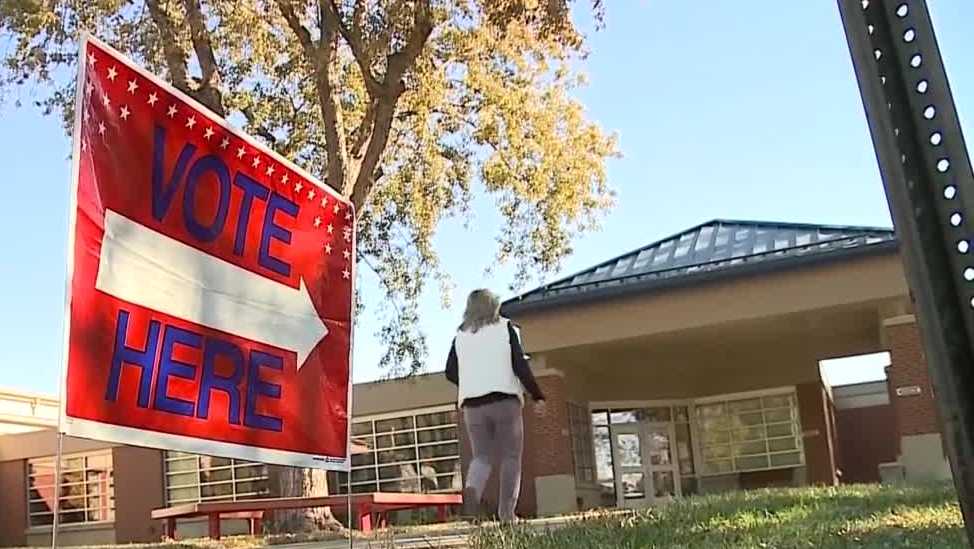

Nebraska Voter Id Campaign Honored With Prestigious National Award

May 03, 2025

Nebraska Voter Id Campaign Honored With Prestigious National Award

May 03, 2025 -

I Nea Ethniki Stratigiki P Syxikis Ygeias 2025 2028 Ti Allazei

May 03, 2025

I Nea Ethniki Stratigiki P Syxikis Ygeias 2025 2028 Ti Allazei

May 03, 2025