Investing In The Amundi Dow Jones Industrial Average UCITS ETF: NAV Analysis

Table of Contents

Understanding the Amundi Dow Jones Industrial Average UCITS ETF's Composition and Structure

The Amundi Dow Jones Industrial Average UCITS ETF (Ticker symbol will need to be added here if available - research needed) aims to replicate the performance of the iconic Dow Jones Industrial Average. This index comprises 30 blue-chip American companies, representing a significant slice of the US economy. Understanding its composition and structure is crucial for informed investment.

- Investment Objective: To track the performance of the Dow Jones Industrial Average as closely as possible. This means the ETF's price movements should mirror those of the index.

- Replication Method: The ETF likely uses a full replication strategy (this needs verification from the fund's prospectus). This means it holds all 30 constituent stocks in the same proportions as the index. A sampling replication might be used - it would need to be specified here.

- Expense Ratio: The expense ratio represents the annual cost of owning the ETF. (Research and insert the actual expense ratio here). This fee covers administrative and management expenses. A lower expense ratio is generally more favorable for investors.

- Trading Volume and Liquidity: High trading volume indicates ease of buying and selling the ETF. (Research and insert data on trading volume and liquidity here). This is important for ensuring you can easily enter and exit your position without significant price slippage.

Analyzing the Amundi Dow Jones Industrial Average UCITS ETF's NAV Performance

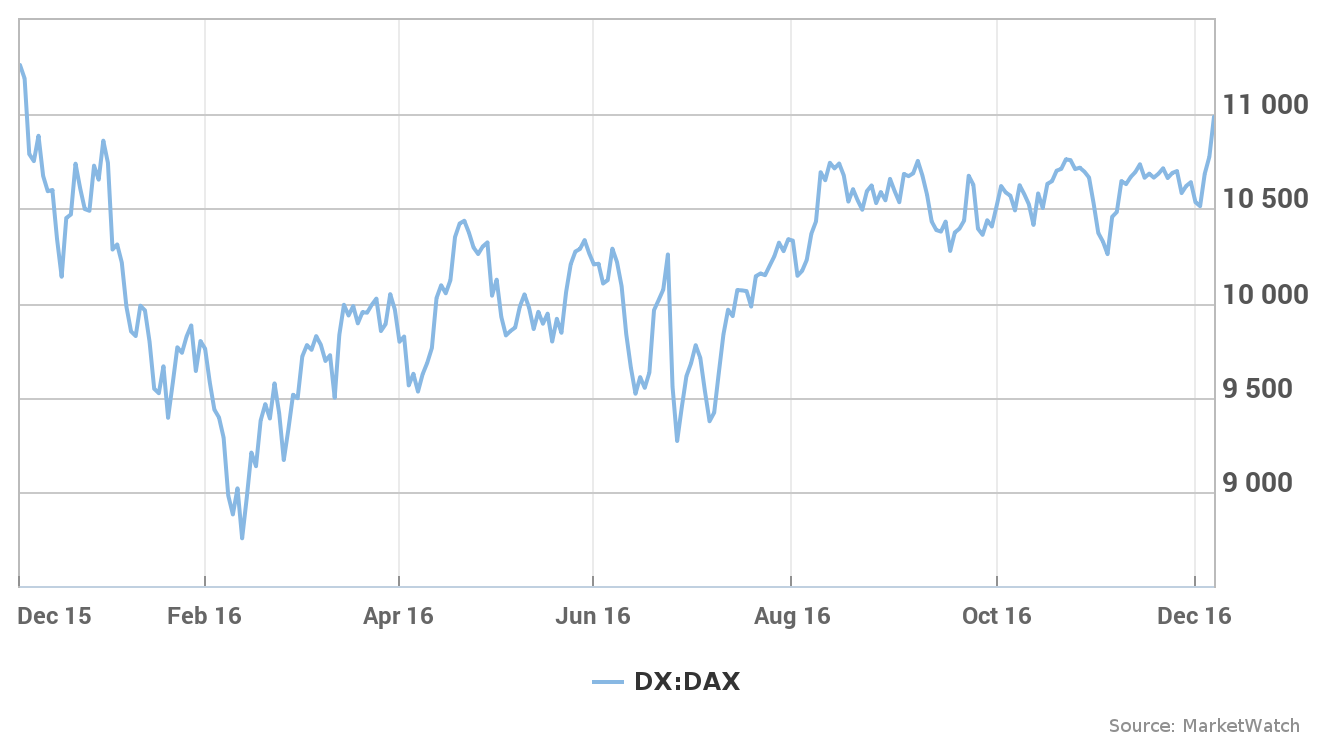

Analyzing the historical NAV performance of the Amundi Dow Jones Industrial Average UCITS ETF is crucial for understanding its past behavior and potential future returns. (Insert charts and graphs showing historical NAV data here. Different timeframes – short-term, medium-term, and long-term – should be shown.)

- NAV Trends: Examine the trends in NAV over various periods. Identify periods of strong growth, periods of decline, and any significant volatility. (Analyze and describe the trends visible in the charts/graphs).

- Benchmark Comparison: Compare the ETF's NAV performance to the Dow Jones Industrial Average's performance. (Calculate and display the tracking error). Any significant deviation indicates a tracking error.

- Influencing Factors: Factors influencing NAV fluctuations include:

- Market Trends: Broad market movements (bull or bear markets) directly impact the NAV.

- Economic Conditions: Economic growth or recession significantly influence the performance of the constituent companies and the overall index.

- Company Performance: Individual company performance within the index also affects the overall NAV.

Factors Affecting Amundi Dow Jones Industrial Average UCITS ETF NAV

Several factors influence the NAV fluctuations of the Amundi Dow Jones Industrial Average UCITS ETF:

- Market Volatility: Periods of high market volatility, such as during economic uncertainty or geopolitical events, lead to greater NAV fluctuations.

- Dividend Payouts: Dividend payouts from the constituent companies affect the NAV. When companies distribute dividends, the NAV generally adjusts downwards, reflecting the distribution.

- Currency Fluctuations: (Only relevant if the ETF holds assets denominated in currencies other than the base currency. If applicable, describe the impact).

- Management Fees: The expense ratio, a form of management fee, slightly erodes the NAV over time.

Interpreting NAV and Making Informed Investment Decisions

Interpreting NAV data is essential for assessing the ETF's value and making informed investment decisions.

- NAV vs. Market Price: Compare the NAV to the ETF's market price. A difference between the two indicates a premium or discount.

- Premium and Discount: A premium means the market price is higher than the NAV, while a discount means the market price is lower. Understanding the reasons behind premiums and discounts is critical.

- Investment Strategy: Incorporate NAV analysis into your broader investment strategy. This involves considering your risk tolerance, investment timeframe, and overall financial goals. Use NAV data as one factor among many in your decision-making process.

Conclusion: Investing Wisely with the Amundi Dow Jones Industrial Average UCITS ETF: A NAV-Focused Approach

Understanding the NAV is crucial for successfully investing in the Amundi Dow Jones Industrial Average UCITS ETF. Our analysis highlights the importance of monitoring NAV trends, comparing performance against the benchmark index, and considering the factors influencing NAV fluctuations. By incorporating NAV analysis into your investment process, you can make more informed decisions. Conduct your own thorough research, considering your personal risk tolerance and financial goals before investing. Remember, utilizing a NAV-focused approach can significantly enhance your investment experience with the Amundi Dow Jones Industrial Average UCITS ETF and similar index funds.

Featured Posts

-

Stoxx Europe 600 Ve Dax 40 Endekslerinde Gerileme Avrupa Borsalari Duesueste 16 Nisan 2025

May 24, 2025

Stoxx Europe 600 Ve Dax 40 Endekslerinde Gerileme Avrupa Borsalari Duesueste 16 Nisan 2025

May 24, 2025 -

New Hot Wheels Ferrari Sets A Mamma Mia Moment For Collectors

May 24, 2025

New Hot Wheels Ferrari Sets A Mamma Mia Moment For Collectors

May 24, 2025 -

Frank Sinatra And His Wives Exploring His Four Marriages

May 24, 2025

Frank Sinatra And His Wives Exploring His Four Marriages

May 24, 2025 -

Glastonbury 2025 Lineup Olivia Rodrigo The 1975 And More Confirmed

May 24, 2025

Glastonbury 2025 Lineup Olivia Rodrigo The 1975 And More Confirmed

May 24, 2025 -

Bailed Teen Rearrested Shop Owners Fatal Stabbing

May 24, 2025

Bailed Teen Rearrested Shop Owners Fatal Stabbing

May 24, 2025

Latest Posts

-

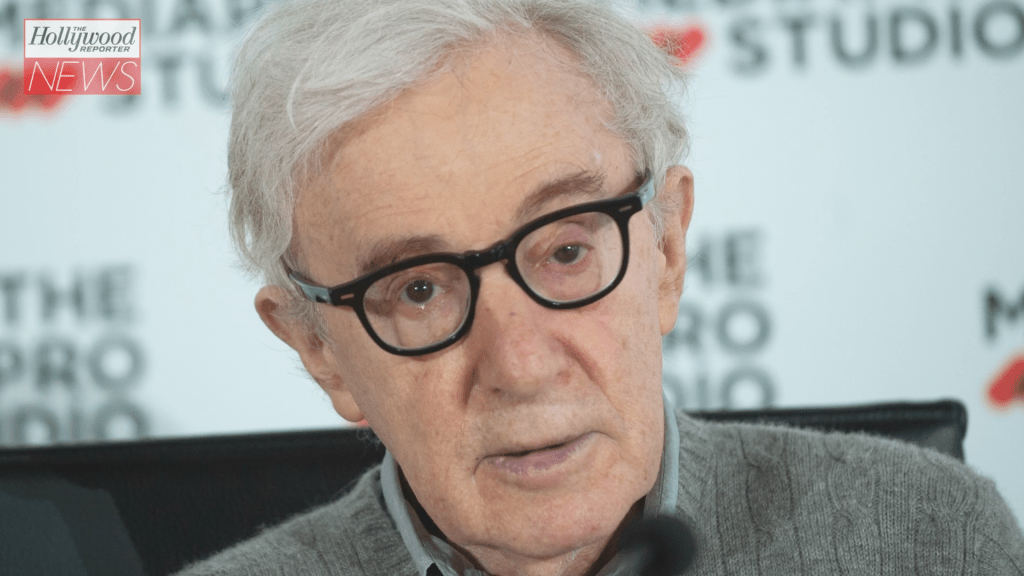

Public Figure Questions The Accusations Sean Penn And The Dylan Farrow Case

May 24, 2025

Public Figure Questions The Accusations Sean Penn And The Dylan Farrow Case

May 24, 2025 -

Mia Farrow On Trumps Venezuelan Deportation Lock Him Up

May 24, 2025

Mia Farrow On Trumps Venezuelan Deportation Lock Him Up

May 24, 2025 -

Woody Allen And Dylan Farrow Sean Penns Perspective On The Allegations

May 24, 2025

Woody Allen And Dylan Farrow Sean Penns Perspective On The Allegations

May 24, 2025 -

Actress Mia Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025

Actress Mia Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025 -

Sean Penns View On The Dylan Farrow Woody Allen Sexual Assault Case

May 24, 2025

Sean Penns View On The Dylan Farrow Woody Allen Sexual Assault Case

May 24, 2025